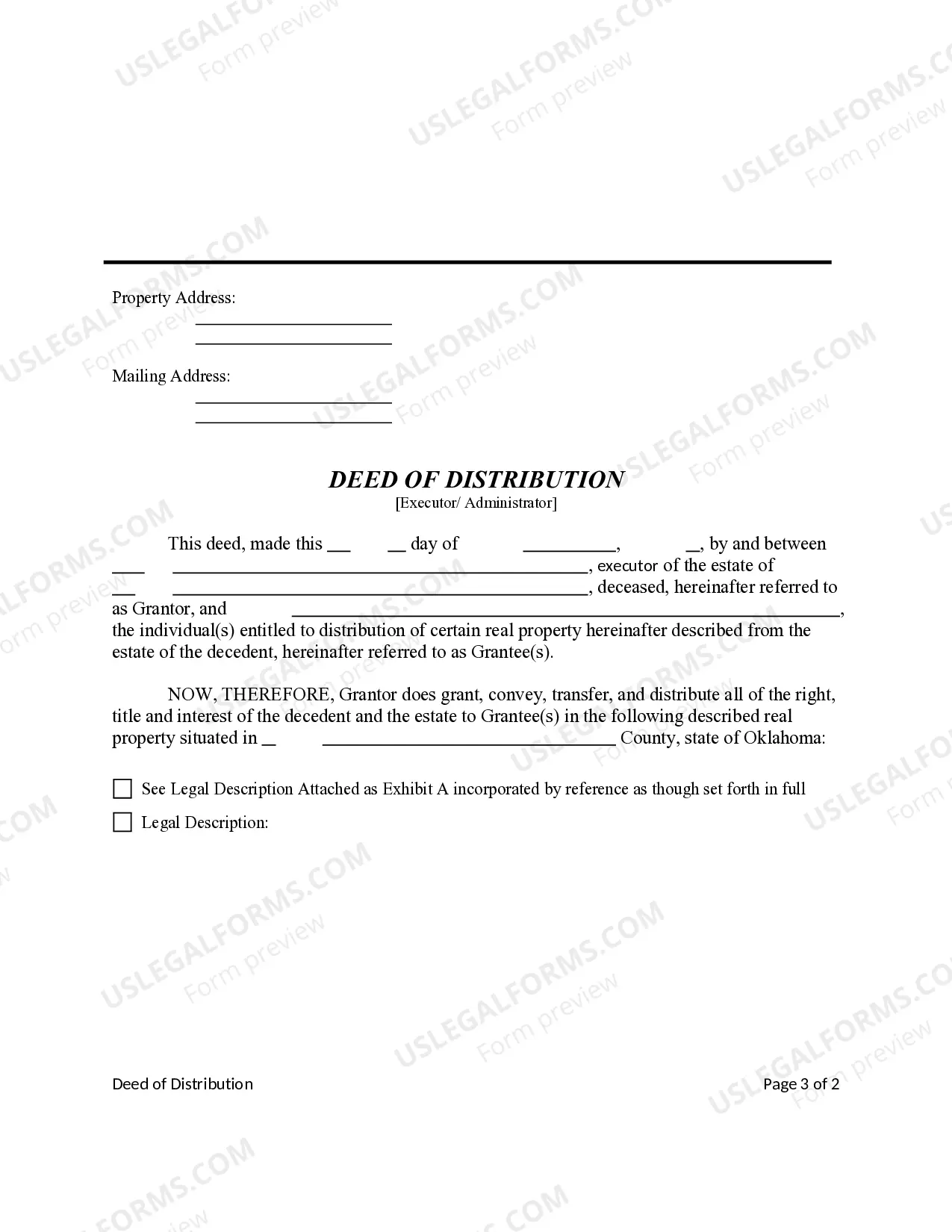

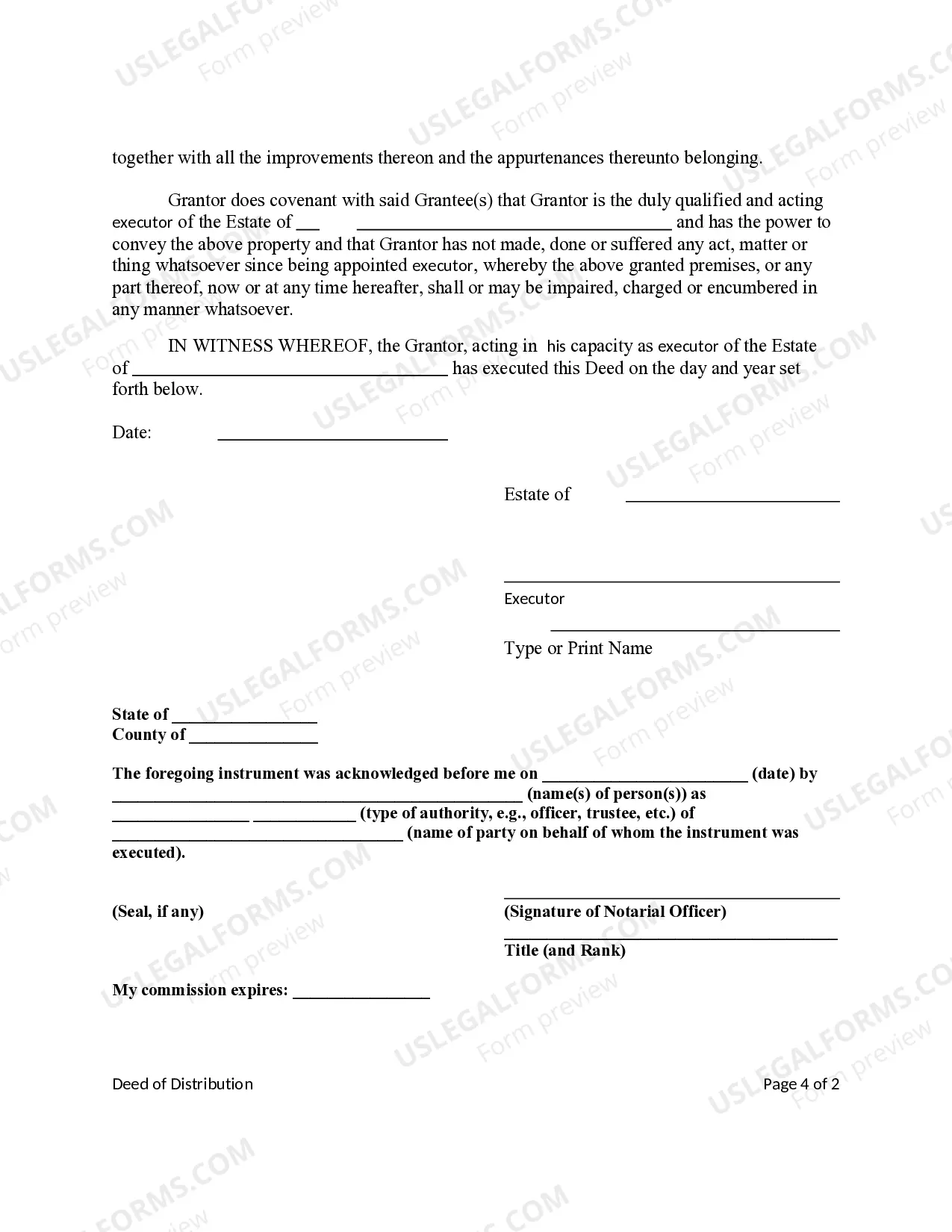

This form is a Deed of Distribution where the grantor is the individual appointed as administrator or executor of an estate and the grantee(s) is/are the individual(s) entitled to receive the property from the estate. Grantor conveys the described property to Grantee(s) and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving in grantors official capacity to encumber the property. This deed complies with all state statutory laws.

Deed Of Distribution Form

Description

How to fill out Deed Of Distribution Form?

How to obtain professional legal templates that adhere to your state regulations and prepare the Deed Of Distribution Form without consulting a lawyer.

Numerous services online offer templates to address various legal scenarios and formalities. However, it may require time to determine which of the provided samples fulfill both your requirements and legal criteria.

US Legal Forms is a trusted service that assists you in locating official documents created in compliance with the most current state law revisions, allowing you to economize on legal support.

If you do not have an account with US Legal Forms, follow the instructions below: Review the webpage you have accessed and verify if the form meets your requirements. To assist with this, utilize the form description and preview options if available. Search for another template in the header specifying your state, if necessary. Once you locate the appropriate document, click the Buy Now button. Select the most appropriate pricing plan, then Log In or create an account. Choose the payment method (by credit card or through PayPal). Decide on the file format for your Deed Of Distribution Form and click Download. The acquired templates remain yours; you can always access them in the My documents tab of your account. Join our platform and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not an ordinary online library.

- It's a compilation of over 85k authenticated templates for diverse business and personal circumstances.

- All documents are sorted by category and jurisdiction to expedite your search process.

- Moreover, it integrates with robust tools for PDF editing and electronic signatures, enabling users with a Premium subscription to seamlessly finalize their paperwork online.

- It requires minimal effort and time to acquire the necessary documents.

- If you already possess an account, Log In and confirm your subscription is active.

- Download the Deed Of Distribution Form by clicking the corresponding button next to the filename.

Form popularity

FAQ

Recording a deed in South Carolina requires several key components. First, you need to complete a valid deed, such as a deed of distribution form, ensuring that all pertinent information is included. Next, you must sign the deed in the presence of a notary and obtain their acknowledgment. Finally, submit the deed to the county clerk along with any applicable recording fees to complete the process.

To file a deed of distribution in South Carolina, first gather the necessary documents, including the deed of distribution form. Ensure that all interested parties sign the form, which validates the distribution according to the probate court's order. After obtaining signatures, you must file the completed deed with the appropriate county clerk's office. Lastly, consider using USLegalForms to access ready-made templates and streamline the filing process.

A quitclaim deed is often the most straightforward option for transferring property. This type of deed allows you to transfer your interest in a property quickly, without any warranties regarding the title. To effectively manage your estate, consider pairing it with a deed of distribution form, which clearly specifies how assets should be allocated after your passing. Always seek guidance from a professional to make the most informed choice.

A revocable living trust is one of the best options for avoiding probate. This type of trust allows you to retain control over your assets during your lifetime and facilitates the transfer of assets upon your death without going through probate. To establish this trust, you may want to utilize a deed of distribution form to outline the specific transfers. Consulting with a trust specialist can ensure that your estate plan meets your needs.

Joint ownership with rights of survivorship is an effective way to avoid probate. This form of ownership allows the surviving owner to inherit the property automatically upon the death of the other owner. Additionally, using a deed of distribution form can clarify the transfer of assets to avoid disputes. It’s essential to understand how ownership structures work, so consider discussing your situation with a legal expert.

To fill out a quit claim deed in South Carolina, start by identifying the current property owner and the new owner. Clearly describe the property and include any necessary details such as the county and property address. After filling it out, you must sign it in the presence of a notary public, making sure to understand how this deed works as it transfers any interest in the property without guaranteeing title.

The purpose of a deed of distribution in South Carolina is to legally transfer ownership of property from an estate to its rightful heirs. This document serves as proof that the designated heirs have received their share of the deceased's assets. In essence, it helps finalize the estate settlement process, making it essential for estate administration.

Filling out a South Carolina deed of distribution requires specific information, including the name of the deceased, the heirs, and a description of the property. Ensure that you include all pertinent details accurately, as any mistakes can delay the transfer process. You can find templates and guidance on completing this deed on USLegalForms, which offers resources to help you.

To transfer a property deed from a deceased relative in South Carolina, begin by obtaining the death certificate and the will, if available. The next step involves filing the will in probate court and completing the deed of distribution form to move ownership to the heirs or new owners. This form is essential in ensuring that the transfer is recognized legally.

Yes, a personal representative can sell property in South Carolina, but they must follow legal procedures. After being appointed by the probate court, the representative is responsible for managing the estate's assets. This includes selling property as necessary, and using a deed of distribution form is essential to properly transfer ownership post-sale.