Any Transfer Death With You

Description

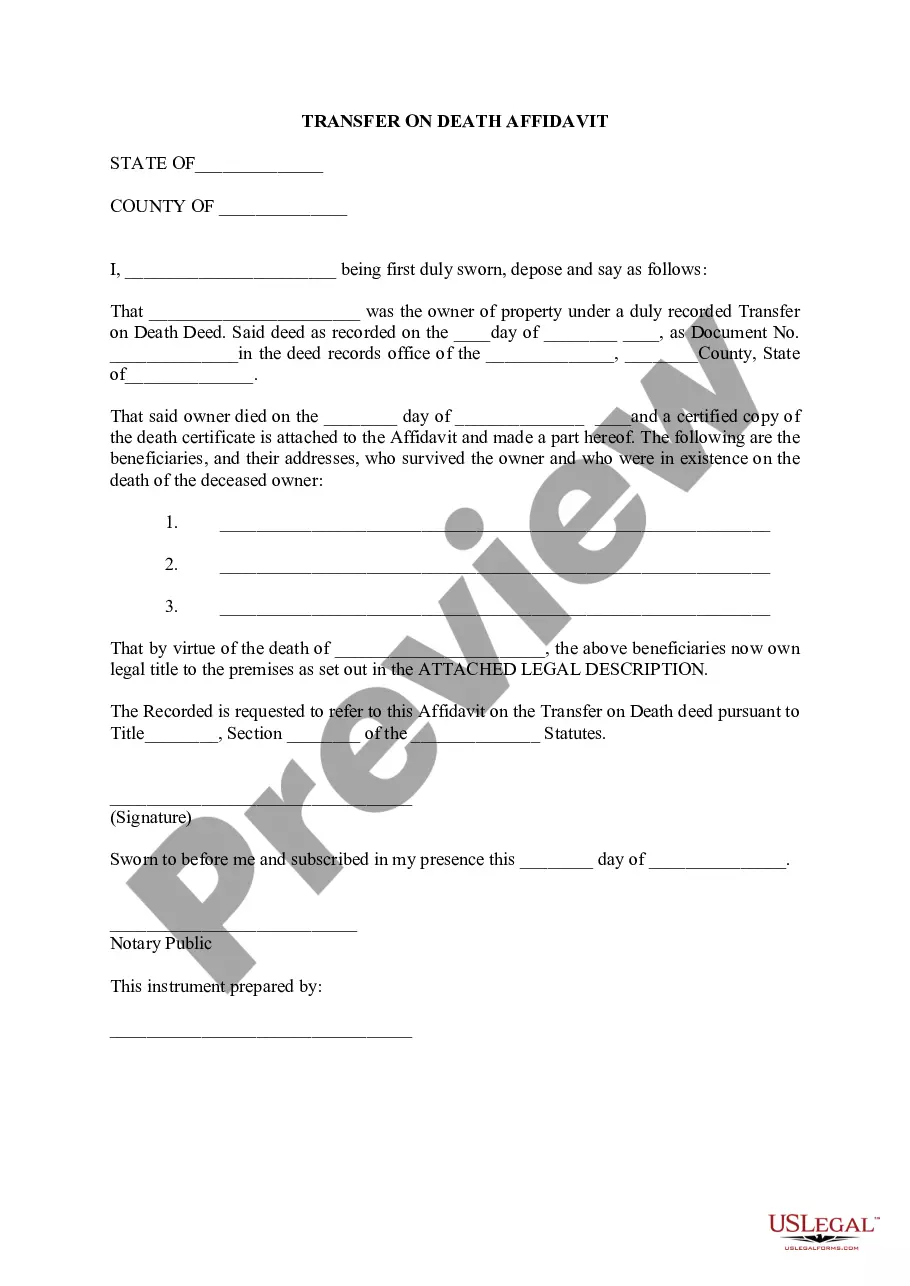

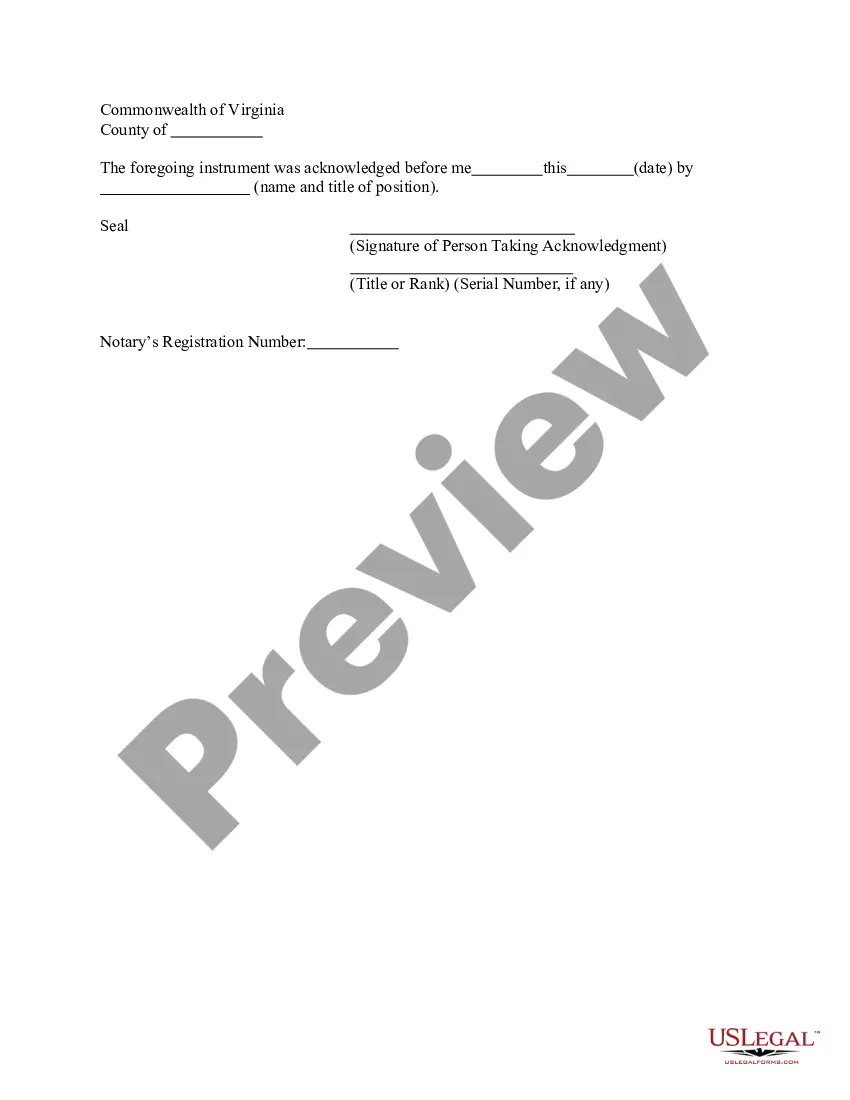

How to fill out Oklahoma Transfer On Death Deed?

- Log in to your US Legal Forms account if you are a returning user and check your subscription status.

- For first-time users, explore the Preview mode and form descriptions to find the legal document that meets your specific needs and complies with your local laws.

- If necessary, utilize the Search option to find alternative templates, ensuring you select the most suitable one.

- Proceed to purchase your document by clicking the Buy Now button and selecting the appropriate subscription plan.

- Complete your payment using either your credit card or PayPal account to finalize your subscription.

- Download your chosen form to your device and access it at any time through the My Forms section of your profile.

In conclusion, obtaining forms related to any transfer death with you has never been easier with US Legal Forms. Their extensive collection and expert assistance empower you to confidently handle legal documentation.

Start your journey towards hassle-free legal forms now by visiting US Legal Forms and discover how easy it is to access the documents you need!

Form popularity

FAQ

Generally, there is no strict deadline for transferring property after someone's death. However, it is advisable to initiate the process as soon as possible to avoid any potential complications or disputes. Using a transfer on death deed can simplify this process significantly. After the passing of the property owner, beneficiaries can transfer ownership swiftly, helping to settle the estate effectively, especially with the support of US Legal Forms.

While it is possible to create a transfer on death deed without an attorney, consulting with one can help ensure that the document meets state requirements and accurately reflects your wishes. An attorney can also provide valuable insights into the specific legal implications for your situation. If you prefer to handle this process yourself, US Legal Forms has user-friendly templates and resources to guide you through. This allows you to feel confident in managing any transfer death with you.

A transfer on death operates by designating a beneficiary who will automatically inherit the property upon the owner's death. This method bypasses the probate process, allowing for a smoother transition of ownership. Essentially, the property remains under the owner’s control during their lifetime. Once the owner passes away, the named beneficiary can claim the property easily, ensuring peace of mind for all involved.

To transfer property after death, you typically file a transfer on death deed, also known as a TOD deed. This legal document allows you to designate beneficiaries who will receive your property without going through probate. By using this method, you can ensure that your wishes are fulfilled while also simplifying the process for your loved ones. US Legal Forms offers comprehensive resources to help you create and file a TOD deed effectively.

Transfer on death deeds can simplify asset transfers, but they are not without disadvantages. Any transfer death with you can lead to tax implications for beneficiaries or potential disputes if your intentions are unclear. Moreover, this deed does not account for debts owed at the time of death, which could affect the distribution. It's wise to consult with an expert to understand the implications fully.

When your dad dies without a will, state laws determine how assets are distributed. Any transfer death with you might complicate matters, especially if assets were not designated to anyone specifically. The court will usually appoint an administrator to sort things out, which can be lengthy and costly. Seeking guidance through platforms like USLegalForms can help your family navigate these complexities.

Transfer on death, or TOD, means that ownership of an asset automatically transfers to a designated beneficiary upon your death. It can simplify the distribution of your estate by bypassing probate. Any transfer death with you streamlines the process, making it easier for your loved ones during a difficult time.

While having a will is important, a transfer on death may still provide additional benefits. Any transfer death with you can allow for a smoother asset transition without going through probate, even if you have a will. However, ensure that your will and TOD align with your intentions to avoid any conflicts or confusion in the future.

One notable downside of a transfer on death is that it can inadvertently create family tensions. Any transfer death with you does not allow for changes after your passing, potentially leaving some heirs unhappy. Furthermore, if you don't update the account or deed as your life circumstances change, your wishes may not be honored. Regular reviews are essential.

Creating a transfer on death account can be beneficial, especially for avoiding probate. However, any transfer death with you should be approached with caution. You may need to consider your overall estate plan and consult with a professional to determine if this strategy aligns with your goals. Remember, not all assets are suitable for this type of transfer.