Notice Of Default Form Withdrawal

Description

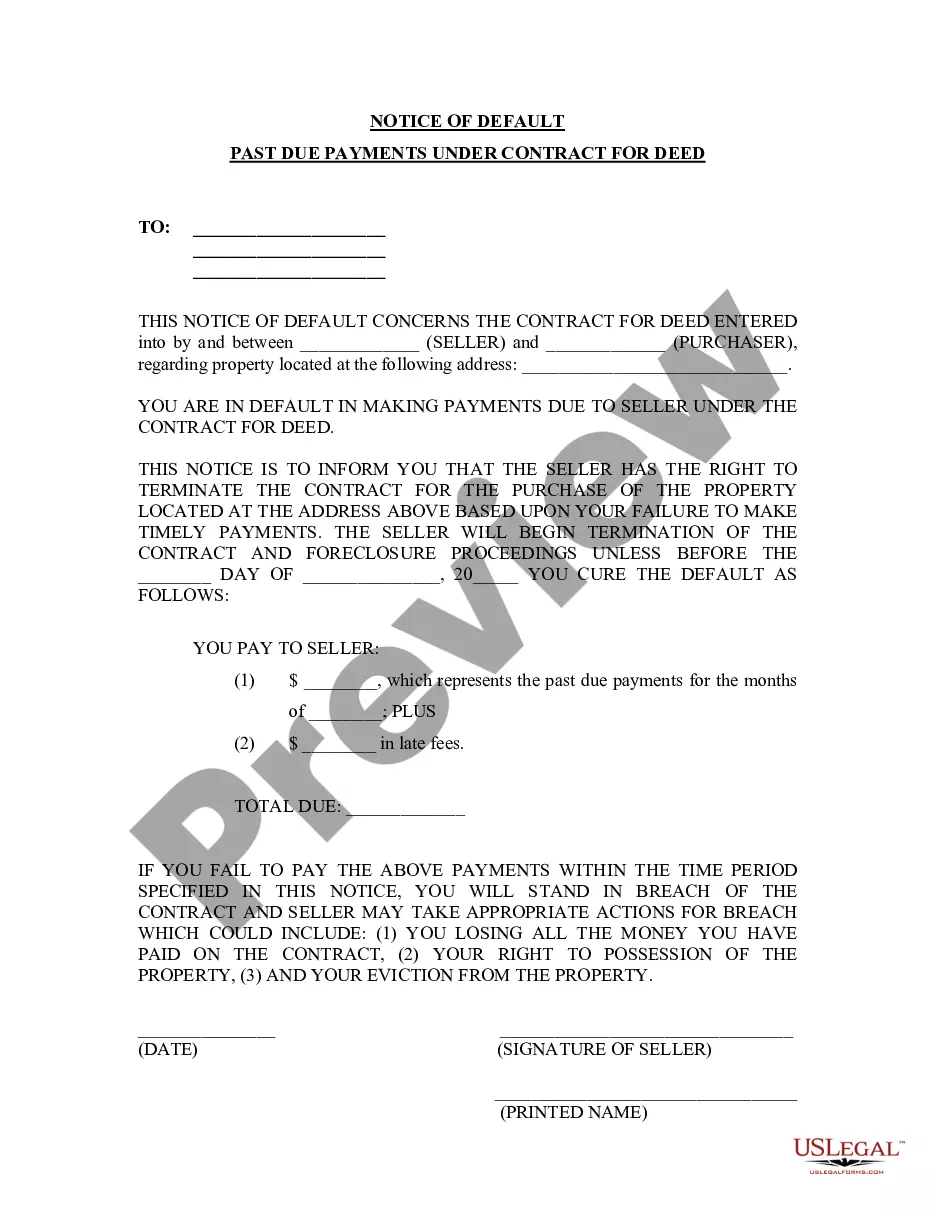

How to fill out Oklahoma Notice Of Default For Past Due Payments In Connection With Contract For Deed?

There’s no longer a necessity to squander hours searching for legal documents to fulfill your local state obligations.

US Legal Forms has gathered all of them in a single location and streamlined their accessibility.

Our platform offers over 85,000 templates for various business and personal legal matters categorized by state and purpose.

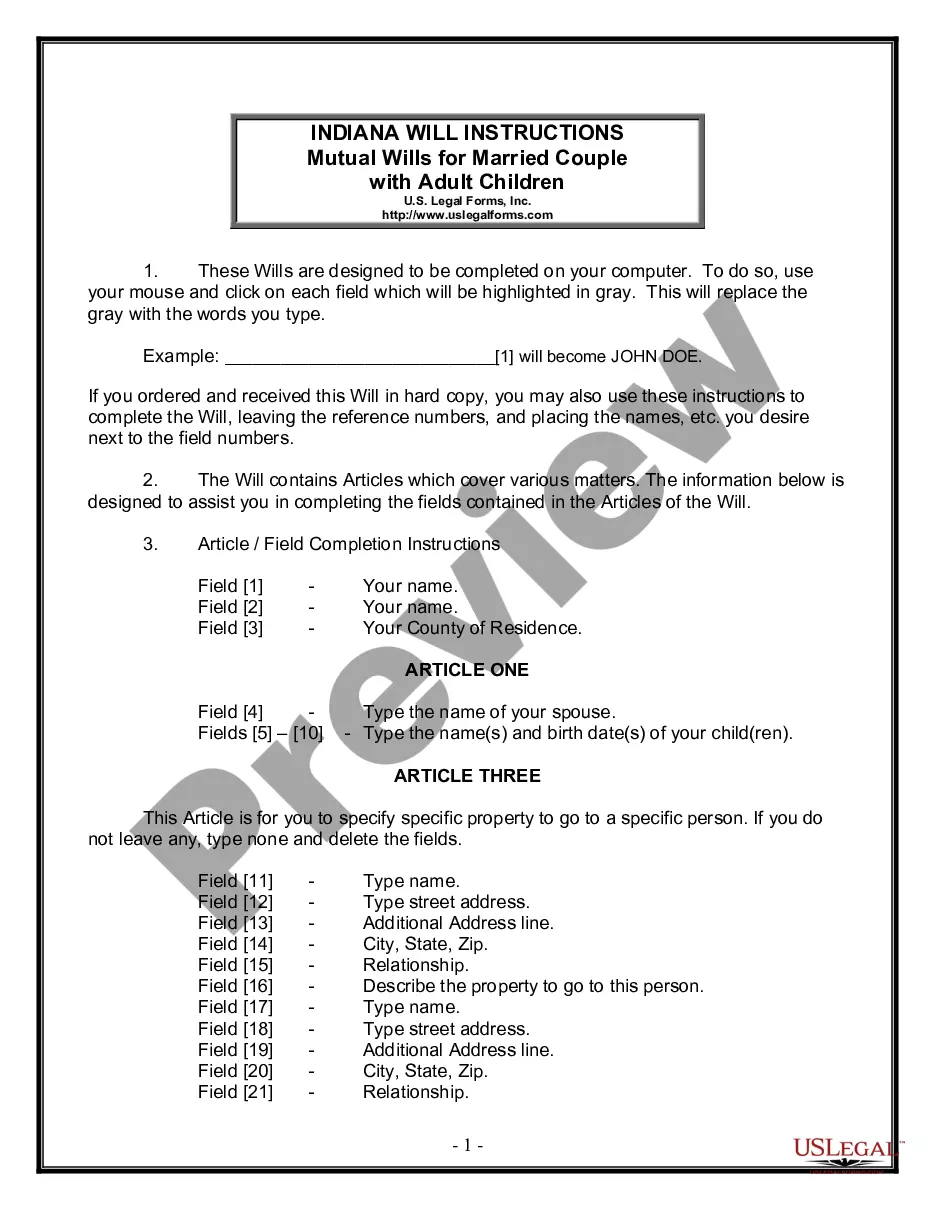

Utilize the Search field above to find another template if the previous one doesn't meet your needs. Click Buy Now next to the template title when you discover the correct one. Choose the most appropriate subscription plan and create an account or Log In. Complete your subscription payment using a card or PayPal to proceed. Choose the file format for your Notice Of Default Form Withdrawal and download it to your device. Print your form for manual completion, or upload the sample if you prefer to use an online editor. Organizing legal documents under federal and state regulations is quick and straightforward with our library. Try US Legal Forms now to maintain your documentation in order!

- All forms are properly drafted and validated for authenticity, ensuring you receive an up-to-date Notice Of Default Form Withdrawal.

- If you are acquainted with our service and already possess an account, verify that your subscription is active before accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all saved documents whenever necessary via the My documents tab in your profile.

- If you have not used our service before, the process will require a few additional steps to finalize.

- Here’s how new users can find the Notice Of Default Form Withdrawal in our catalog.

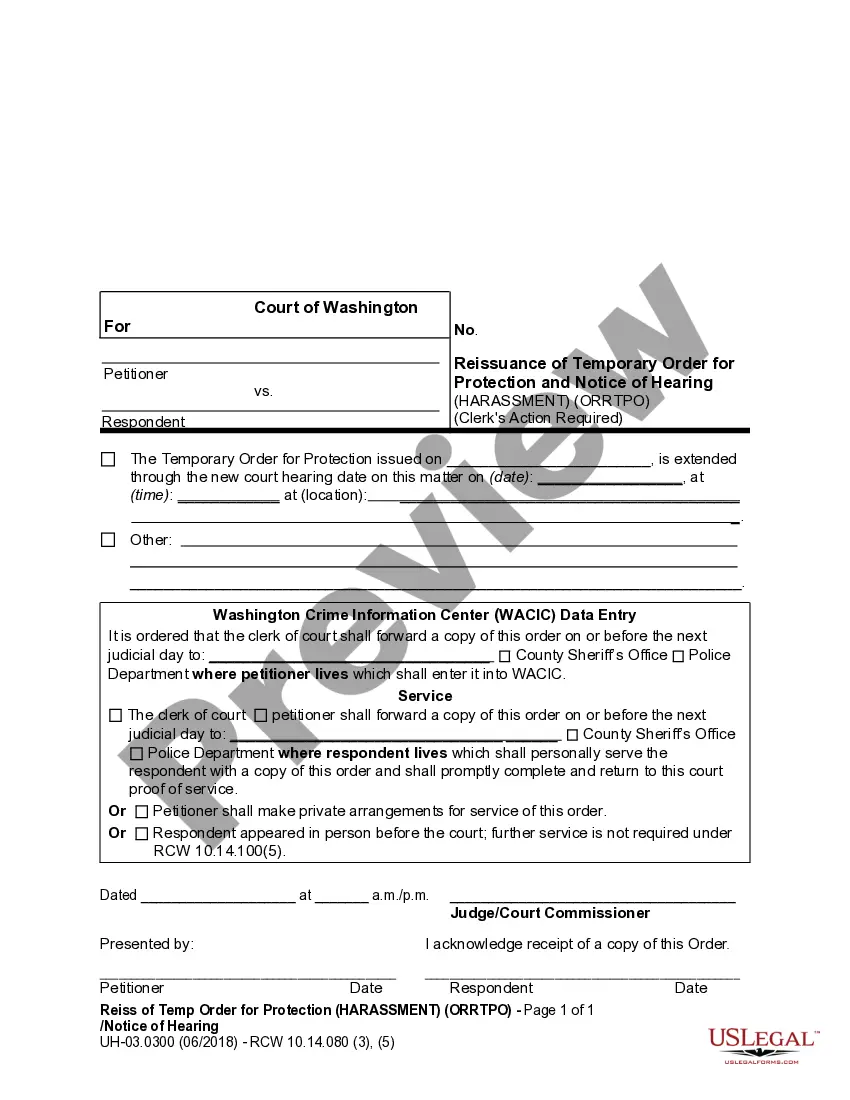

- Examine the page content closely to ensure it contains the sample you require.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

Filing a default in California requires specific steps that involve submitting your notice and supporting documents to the court. You must ensure all requirements are met, including completing the necessary forms accurately. Utilizing resources like USLegalForms can guide you through the process, particularly if you are dealing with a Notice of default form withdrawal. This platform provides templates and guidance to help streamline your filing experience.

A motion to vacate default judgment is a legal request to have a court's decision overturned due to a party's absence or failure to respond. This motion allows individuals to present new information or arguments that could change the outcome. If you’re dealing with a Notice of default form withdrawal, understanding this motion can be crucial for your case. It's advisable to seek assistance from legal professionals for proper filing and to increase your chances of success.

Letting go of an attorney involves notifying them of your decision in a straightforward manner. A written notice is often the best choice, and you can reference the need for a Notice of default form withdrawal if applicable. Ensure you review any fees or obligations that may exist before finalizing your decision. This keeps everything clear as you transition to another attorney or manage your legal matters independently.

Generally, a lawyer can withdraw from representing a client, but they must follow specific legal and ethical guidelines. While it may not be complicated, if a lawyer withdraws without proper procedure, it can lead to delays or complications in your case. Be informed about any Notice of default form withdrawal requirements as these can affect the withdrawal process. Consulting with another legal professional can also help you navigate any challenges.

To inform your lawyer that you no longer require their services, it is best to communicate clearly and respectfully. You can start with a written notice, stating your decision to seek a Notice of default form withdrawal. Be sure to explain your reasons briefly. This approach allows transparency and helps maintain professionalism in your closing relationship.

To get a lien release from the IRS, you need to make a formal request, typically using Form 12277. You should provide relevant details about your tax situation and payments made. Understanding the implications of a Notice of Default Form withdrawal can clarify the steps you need to take for a successful release.

A withdrawal of a filed notice of federal tax lien is a formal action that removes the lien from public records as if it never existed. This process can provide a fresh start for individuals or businesses. It is often necessary to submit specific forms, including references to the Notice of Default Form withdrawal, to achieve this effectively.

When asking your attorney to withdraw from your case, it’s important to communicate openly. You can simply express your concerns over email or in person, letting them know why you wish to end your professional relationship. Documenting this request can also be beneficial, especially if it relates to actions like a Notice of Default Form withdrawal.

To obtain a lien release letter, you must request this formally from the IRS. Complete the appropriate form, which usually involves providing details about your account. If your case involves a Notice of Default Form withdrawal, make sure to mention it, as it may expedite the process.

A notice of withdrawal indicates that a previously filed document, such as a tax lien or claim, is no longer valid. This document effectively removes the previous notice from public record. For those managing tax liens, understanding this concept can help clarify your next steps, especially in relation to the Notice of Default Form withdrawal.