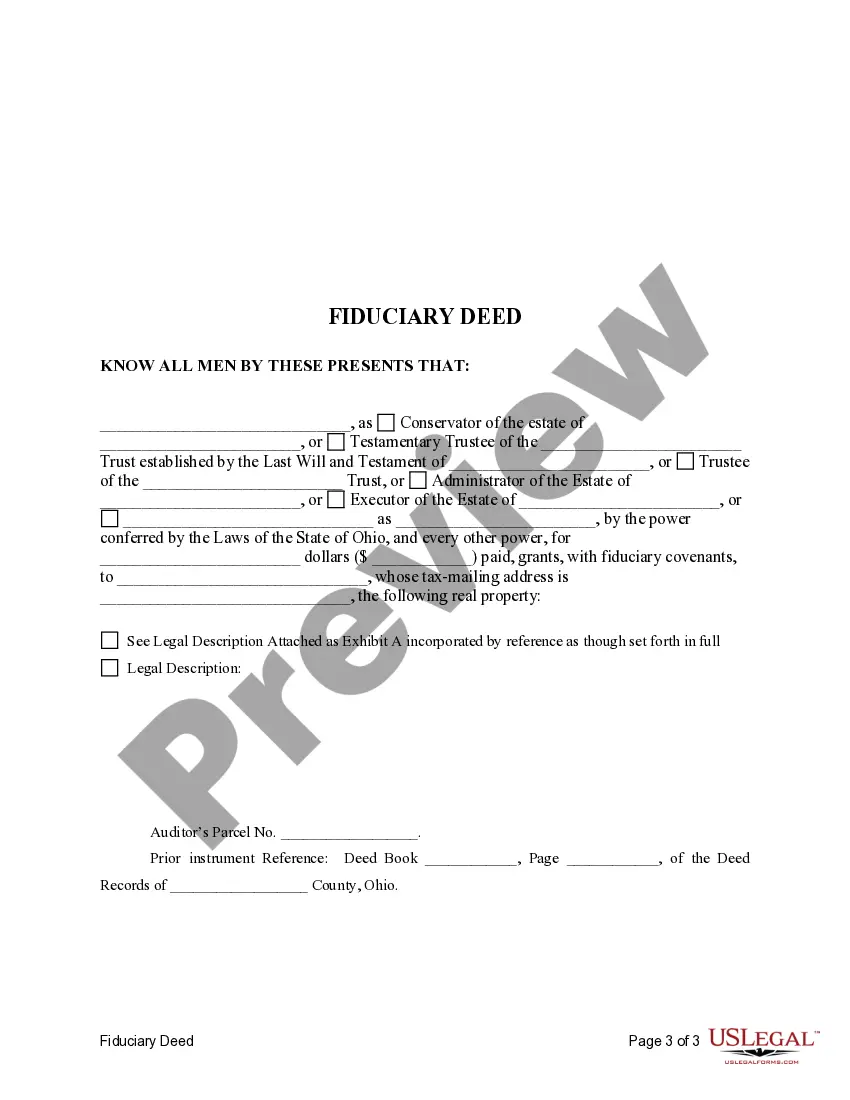

A fiduciary deed in Michigan is a legal document that transfers property ownership from a trustee or fiduciary to a designated recipient. This type of deed is typically used in situations where the property is held in trust and needs to be transferred to a beneficiary or sold. Fiduciary deeds serve to protect the interests of both the trustee and the beneficiary by ensuring that the transfer is carried out in a reliable and transparent manner. In Michigan, there are several types of fiduciary deeds, including: 1. Executor's Deed: This type of fiduciary deed is used by an executor of a deceased person's estate to transfer property to the rightful heirs or beneficiaries. The executor is responsible for managing the estate and distributing assets according to the decedent's will or Michigan's intestate succession laws if there is no will. 2. Trustee's Deed: When a property is held in a trust, the trustee is responsible for managing and distributing the assets in accordance with the trust document. A trustee's deed is used to transfer ownership of the property from the trust to the named beneficiary upon certain conditions being met, such as the death of the original owner. 3. Guardian's Deed: In cases where a minor or incapacitated individual owns property, a guardian may be appointed to make decisions on their behalf. A guardian's deed is used by the court-appointed guardian to transfer property ownership to another person, such as a family member or caregiver responsible for the individual's welfare. 4. Conservator's Deed: Similar to a guardian's deed, a conservator's deed is used when a conservator is appointed by the court to manage the affairs and assets of an individual who is deemed incapable of managing them independently due to health, age, or disability. The conservator's deed allows for the transfer of property ownership as part of the conservatorship process. It is crucial to consult with a qualified attorney or legal professional familiar with Michigan law when dealing with fiduciary deeds. The specific requirements and procedures may vary depending on the circumstances of the transfer of property, the type of fiduciary involved, and any applicable municipal or county regulations.

Fiduciary Deed In Michigan

Description

How to fill out Fiduciary Deed In Michigan?

It's well known that you cannot become a legal professional instantly, nor can you swiftly understand how to prepare a Fiduciary Deed In Michigan without a specialized knowledge base.

Drafting legal documents is a lengthy endeavor that demands specific training and capabilities. Therefore, why not leave the creation of the Fiduciary Deed In Michigan to the experts.

With US Legal Forms, one of the most comprehensive legal template repositories, you can obtain various documents ranging from court filings to templates for internal corporate correspondence.

You can revisit your documents at any time from the My documents section. If you're a current client, you can easily Log In, find and download the template from the same section.

Regardless of the intent behind your documents—be it financial, legal, or personal—our platform has everything you need. Give US Legal Forms a try today!

- Locate the document you require using the search feature at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if the Fiduciary Deed In Michigan meets your needs.

- If you require a different template, restart your search.

- Create a free account and select a subscription plan to acquire the form.

- Click Buy now. Once the payment is finalized, you can download the Fiduciary Deed In Michigan, fill it out, print it, and send or deliver it to the appropriate individuals or entities.

Form popularity

FAQ

The best deed to transfer property depends on various factors, including the intentions of the parties involved and the level of protection required. A fiduciary deed in Michigan is often recommended for situations where a fiduciary is involved, as it aligns with their legal responsibilities. For other situations, a warranty deed may be more appropriate if full ownership rights and protections are desired. To navigate these decisions effectively, consider using platforms like uslegalforms, which can provide tailored solutions and guidance on property transfers.

The highest level of deed is often considered the warranty deed, which provides the most protection to the buyer when transferring property. However, in the context of fiduciary deeds in Michigan, the fiduciary deed carries certain responsibilities and limitations based on the fiduciary's role. While the warranty deed assures that the seller holds clear title to the property, the fiduciary deed focuses on the fiduciary's duties and obligations. Understanding these nuances is vital when making property transfers.

A fiduciary deed in Michigan transfers property from a fiduciary to another party, such as a beneficiary or buyer. Unlike ordinary deeds, fiduciary deeds carry specific legal obligations, ensuring that the fiduciary acts in the best interest of the beneficiaries. It is crucial to understand these differences, as they affect the level of protection for the involved parties. When executed correctly, fiduciary deeds provide a clear and legally binding method to transfer property ownership.

Fiduciary law in Michigan involves the responsibilities of individuals who act on behalf of others in matters of finance and property. It ensures that fiduciaries, such as trustees or agents, act in the best interests of the individuals they serve. Understanding fiduciary law is essential when dealing with a fiduciary deed in Michigan, as it governs how property transfers and management are handled. This law helps protect parties from potential conflicts of interest and ensures ethical dealings.

The best form of deed varies based on individual circumstances, but a warranty deed is highly regarded for its level of protection. For those specifically needing to manage property interests on behalf of others, a fiduciary deed in Michigan is a strong option for ensuring proper legal authority. Selecting the right deed hinges on the purpose of the transfer and the roles of the parties involved.

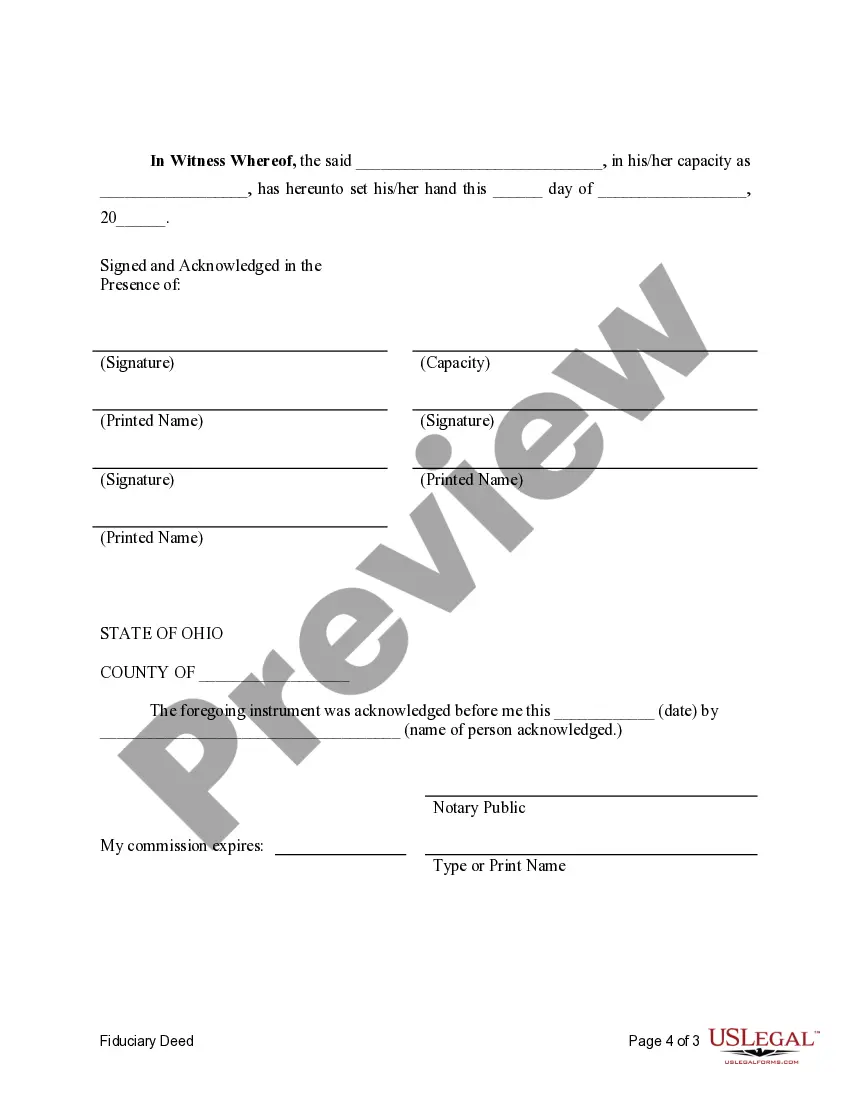

In Michigan, a deed does not have to be recorded to be valid; however, recording it provides public notice of the property transfer. Filing a fiduciary deed in Michigan ensures that there is a record of the transaction, which can be valuable for future reference. It protects your rights and can prevent disputes over ownership down the line.

A fiduciary deed in Michigan is a legal document used by a fiduciary to transfer property on behalf of another person or entity. This type of deed confirms that the fiduciary has the authority to act on behalf of the property owner. Understanding the specifics of a fiduciary deed is essential, as it helps maintain the integrity of the transaction and ensures that the interests of all parties are protected.

While it is not legally required to have an attorney file a deed, it is highly recommended, especially for complex transactions. If you are working with a fiduciary deed in Michigan, having legal guidance can ensure that you fully understand the implications and obligations associated with the deed. Utilizing services like USLegalForms can simplify the process and provide you with the necessary forms and guidance.

Deeds that carry a warranty, such as a warranty deed, tend to offer the most protection to the buyer. Additionally, a fiduciary deed in Michigan is crafted to ensure that the transactions conducted by the fiduciary are legitimate, providing protection for both parties involved. This type of deed helps safeguard against potential disputes over ownership.

The highest quality form of deed is often the warranty deed, which offers the most assurances to the buyer. In particular, a fiduciary deed in Michigan also serves a high-quality function as it allows a fiduciary to transfer property under their management with the same level of trust and authority. This makes it a reliable option for those involved in fiduciary transactions.