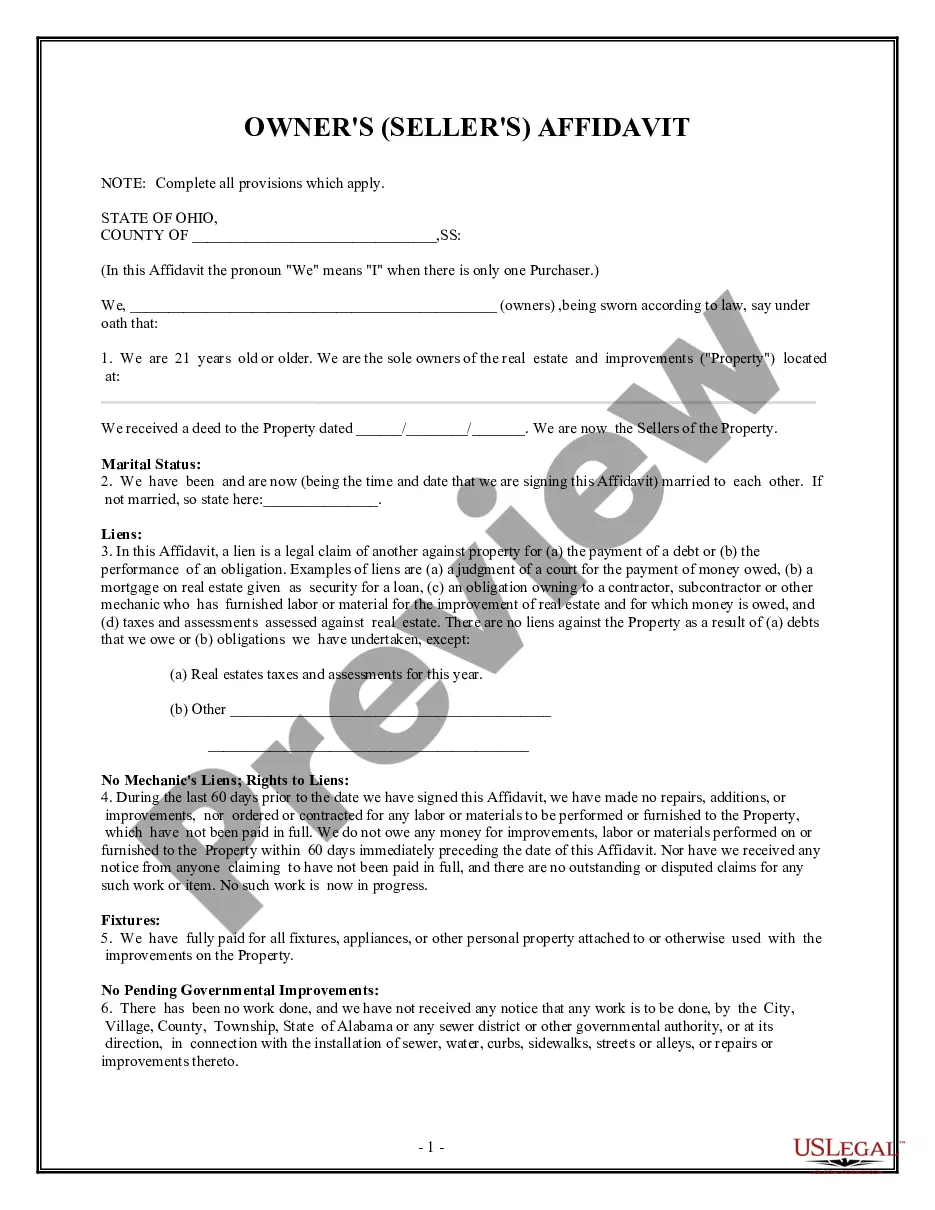

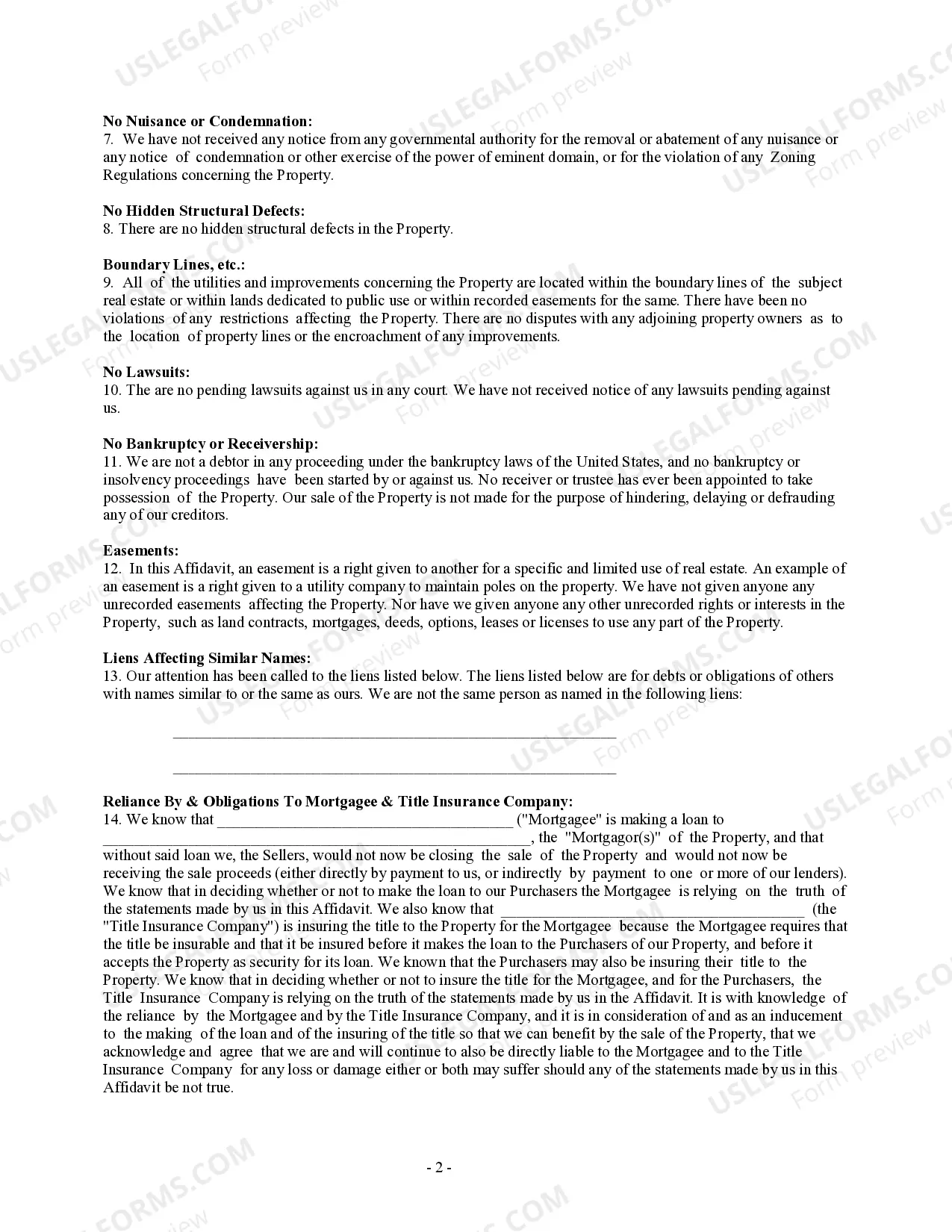

This Owner/Seller Affidavit is for seller(s) to sign at the time of closing certifying that, among other assurances, there are no liens on the property being sold, that they are the owners of the property, that there are no mechanic liens on the property and other certifications. This form must be signed and notarized.

Seller Affidavit Real Estate For Redeeming

Description

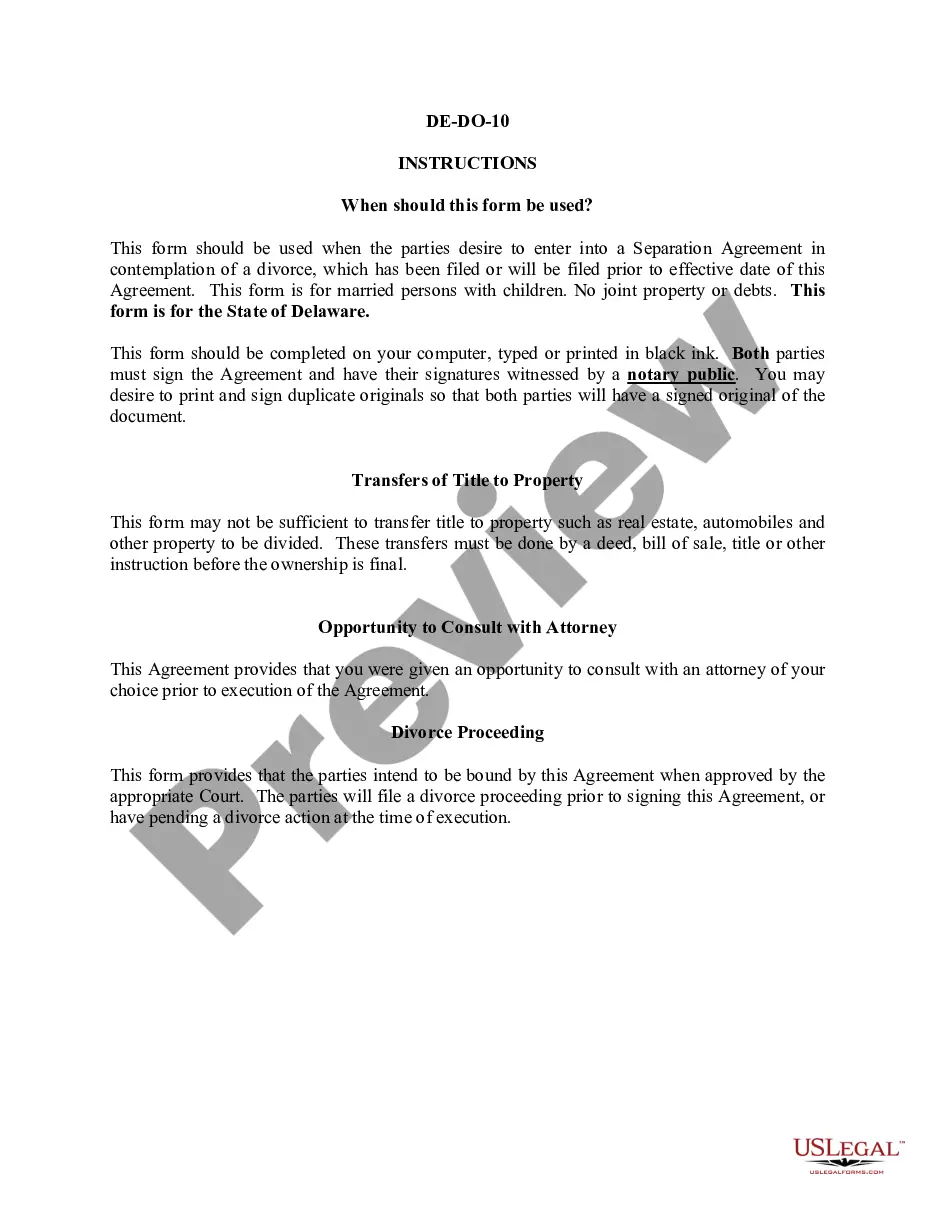

How to fill out Ohio Owner's Or Seller's Affidavit Of No Liens?

Individuals commonly connect legal documentation with something intricate that only an expert can manage.

In a certain way, this is accurate, as preparing Seller Affidavit Real Estate For Redeeming demands considerable knowledge in subject matter requirements, including state and county laws.

However, with the US Legal Forms, everything has become more user-friendly: ready-to-use legal templates for any personal and business circumstance tailored to state regulations are gathered in a single online archive and are now accessible for everyone.

Register for an account or Log In to proceed to the payment section. Purchase your subscription via PayPal or with your credit card. Choose the format for your document and click Download. Print your file or upload it to an online editor for a quicker completion. All templates in our collection are reusable: once acquired, they are stored in your profile. You can access them whenever needed via the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current documents categorized by state and purpose, so searching for Seller Affidavit Real Estate For Redeeming or any other specific template takes just minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to obtain the form.

- New users to the platform will need to register for an account and subscribe before saving any legal documents.

- Here’s a step-by-step manual on how to obtain the Seller Affidavit Real Estate For Redeeming.

- Carefully review the page content to ensure it matches your requirements.

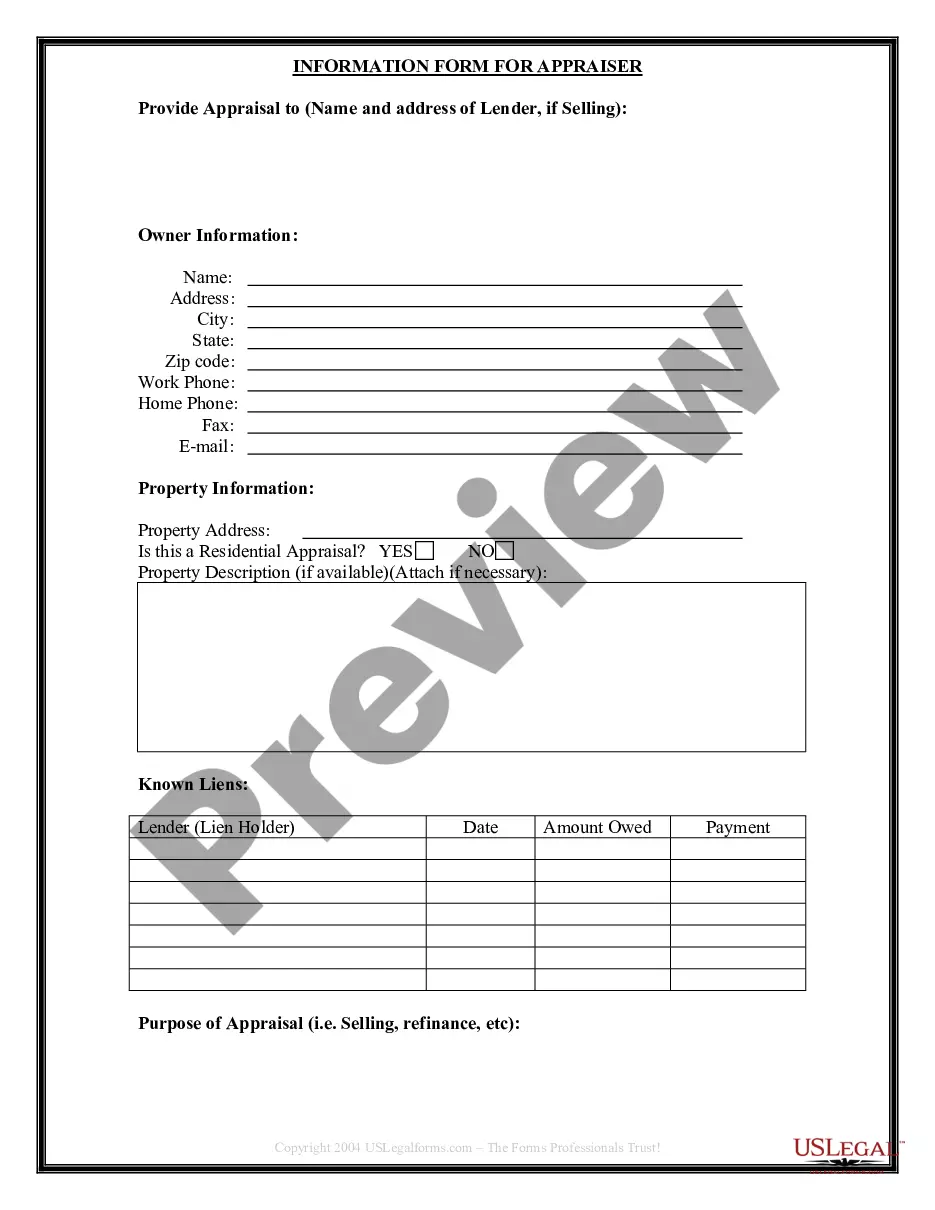

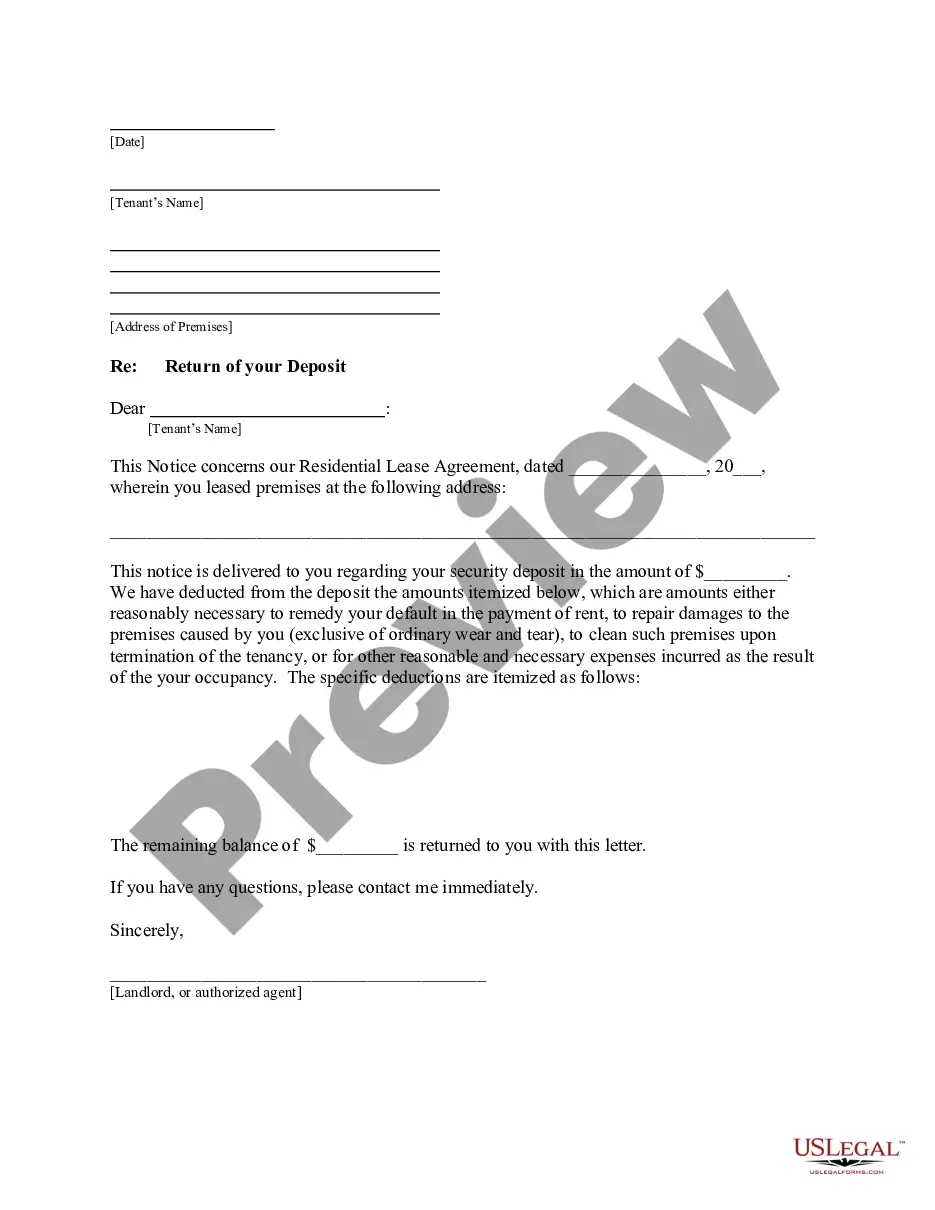

- Examine the form description or check it through the Preview option.

- If the prior one isn’t suitable, look for another example using the Search field in the header.

- Upon finding the appropriate Seller Affidavit Real Estate For Redeeming, click Buy Now.

- Choose a subscription plan that aligns with your needs and financial plan.

Form popularity

FAQ

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

U.S. Real Property Holding Corporation (USRPHC) In general, a corporation is a U.S. real property holding corporation if the fair market value of the U.S. real property interests held by the corporation on any applicable determination date equals or exceeds 50 percent of the sum of the fair market values of its -

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

For U.S. property dispositions subject to FIRPTA, the transferee (purchaser) is required to withhold and remit to the IRS 15% of the gross sales price to ensure that any taxable gain realized by the seller is actually paid.

In general, IRC § 1445 requires the purchaser of a USRPI from a foreign person to withhold 10 percent (or more) of the amount realized on the disposition.