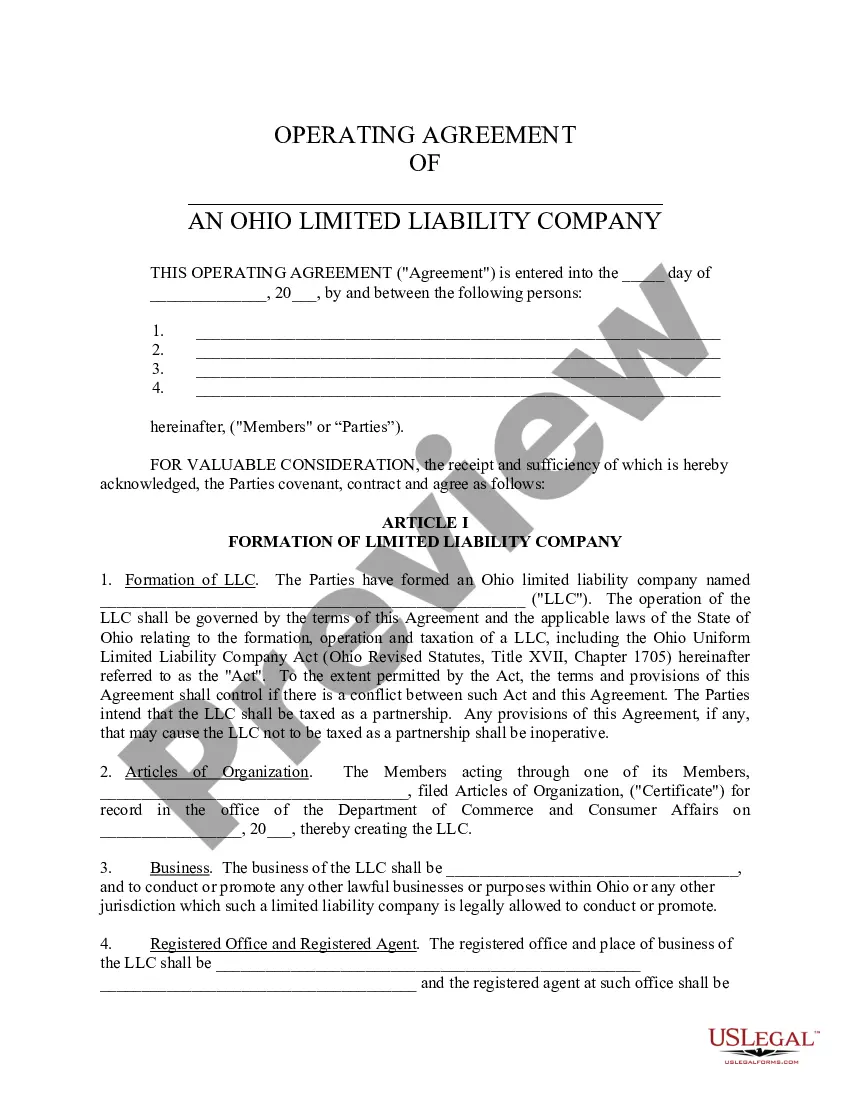

Ohio Llc Operating Agreement Template For Partnership

Description

How to fill out Ohio Limited Liability Company LLC Operating Agreement?

Whether for business purposes or for personal matters, everyone has to manage legal situations sooner or later in their life. Completing legal paperwork requires careful attention, starting with choosing the correct form template. For example, if you choose a wrong edition of the Ohio Llc Operating Agreement Template For Partnership, it will be turned down when you submit it. It is therefore essential to have a reliable source of legal files like US Legal Forms.

If you have to obtain a Ohio Llc Operating Agreement Template For Partnership template, follow these simple steps:

- Find the sample you need by using the search field or catalog navigation.

- Look through the form’s description to make sure it fits your case, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to find the Ohio Llc Operating Agreement Template For Partnership sample you need.

- Download the file when it meets your requirements.

- If you have a US Legal Forms account, simply click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Select the correct pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you want and download the Ohio Llc Operating Agreement Template For Partnership.

- When it is downloaded, you can fill out the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time looking for the appropriate sample across the internet. Make use of the library’s easy navigation to get the correct template for any occasion.

Form popularity

FAQ

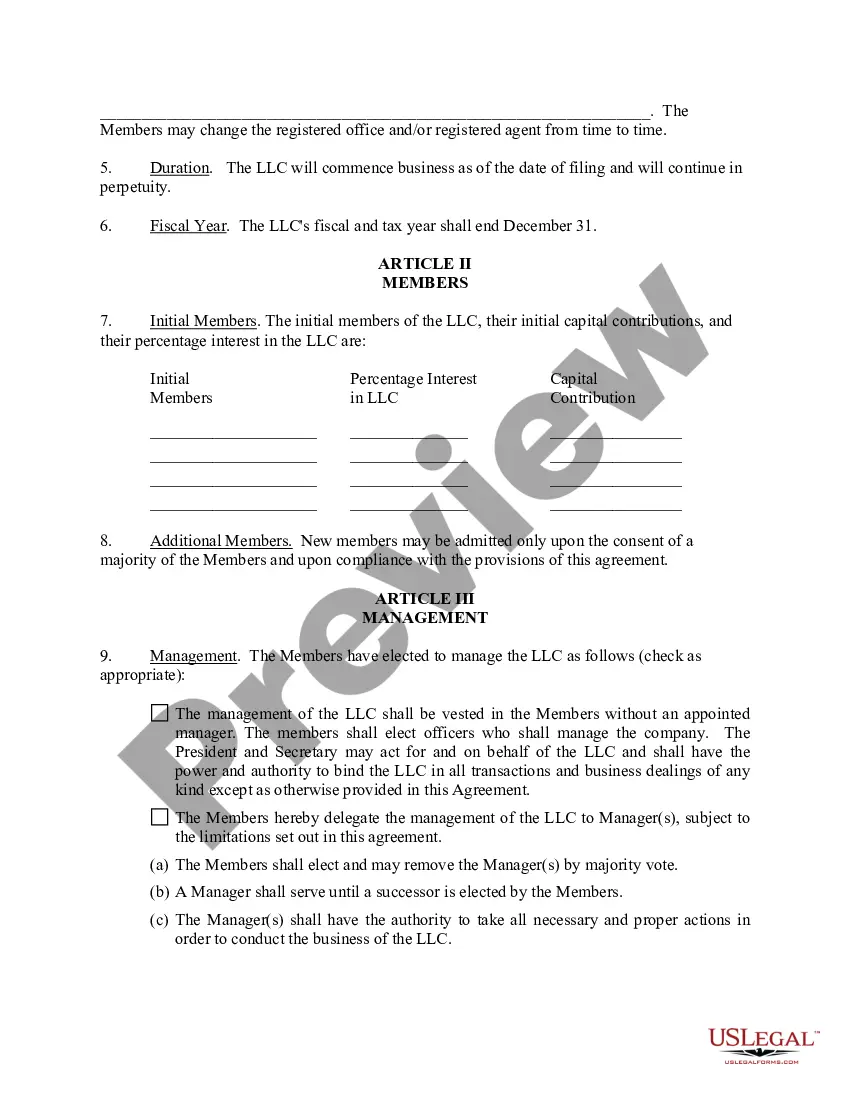

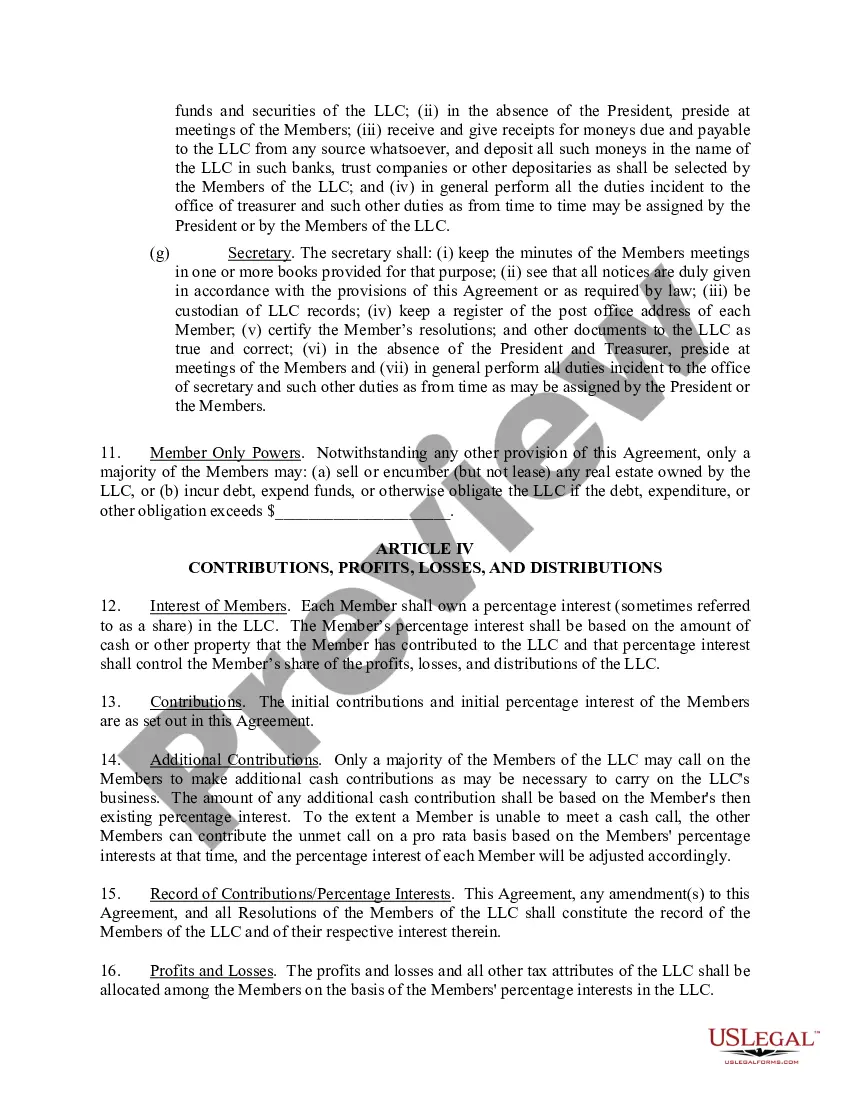

member LLC operating agreement is a binding document between the members of a company that includes terms related to ownership (%), management, and operations. The agreement should be created when forming the company as an understanding of how the organization will run.

How to Add a Member to Your Ohio LLC Make sure you comply with Ohio's Revised LLC Act. ing to Ohio Rev Code § 1706.27, an Ohio LLC may add a new member in any of the following ways: ... Update your Ohio LLC Operating Agreement. ... Check your Ohio LLC Articles of Organization. ... Contact the IRS.

Yes, even Single-Member LLCs need an Operating Agreement. It's best to have a written Operating Agreement, even if you are the sole Member of your Ohio LLC (a Single-Member LLC). If you go to court, an Operating Agreement helps prove that your Single-Member LLC is being run as a separate legal entity.

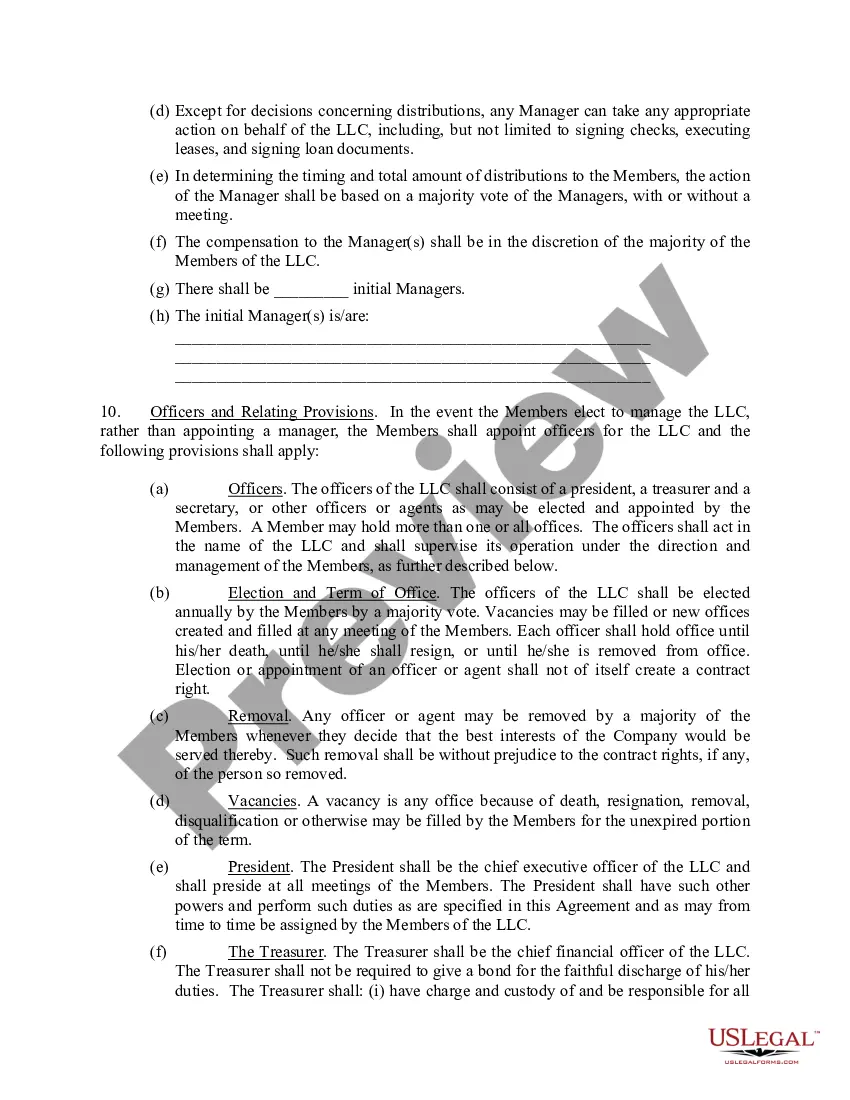

In order to complete your Operating Agreement, you will need some basic information. The formation date of your LLC. The name and address of the Registered Office and Registered Agent. The general business purpose of the LLC. Member(s) percentages of ownership. Names of the Members and their addresses.

A partnership agreement and an operating agreement are very similar in what they define: ownership and investment stakes, division of profits and losses, and so on. However, a partnership agreement is used in partnerships, while operating agreements are used in LLCs.