Affidavit Of Regularity Foreclosure

Description

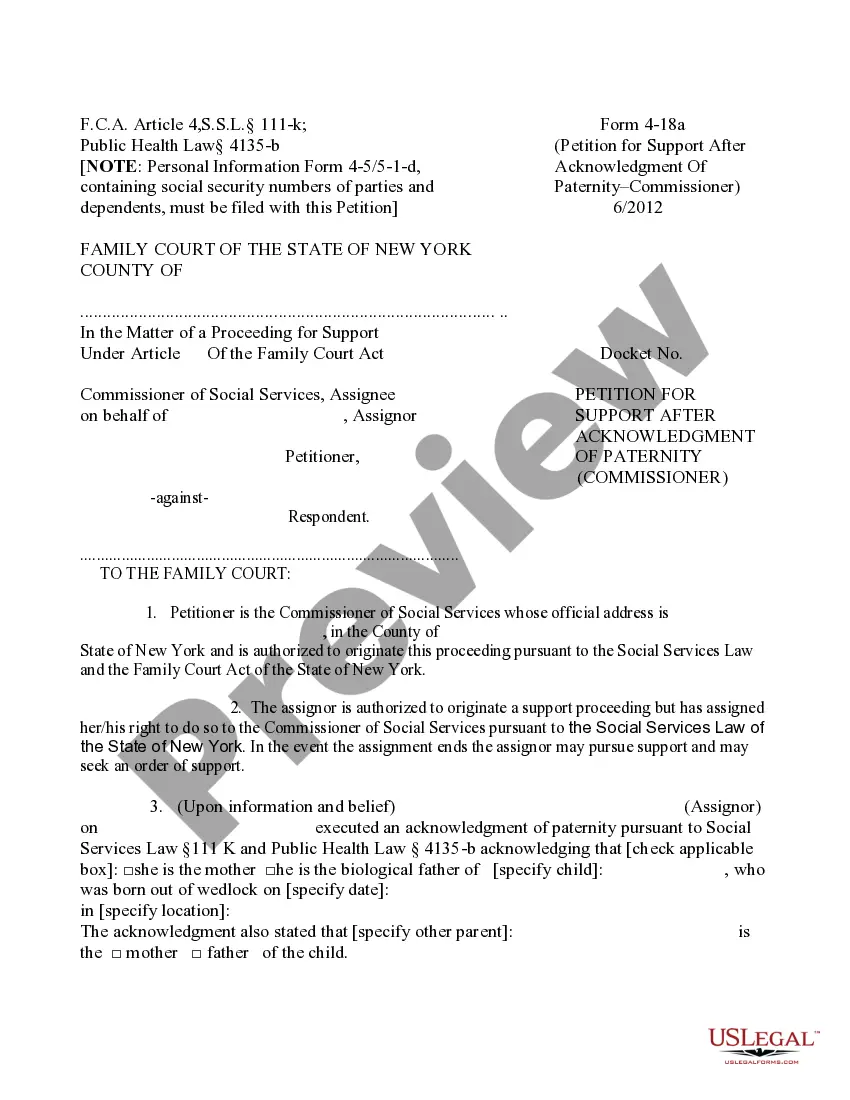

How to fill out New York Affidavit Of Regularity (form UD-5)?

There's no further requirement to squander time searching for legal documents to meet your local state regulations.

US Legal Forms has compiled all of them in one location and enhanced their accessibility.

Our site provides over 85,000 templates for various business and personal legal situations organized by state and area of application. All forms are expertly drafted and validated for accuracy, ensuring that you can confidently obtain a current Affidavit Of Regularity Foreclosure.

Choose the desired subscription plan and register for an account or Log In. Pay for your subscription using a credit card or PayPal to continue. Select the file format for your Affidavit Of Regularity Foreclosure and download it to your device. Print your form to fill it out by hand or upload the template if you prefer to do it in an online editor. Creating legal documentation under federal and state laws is swift and straightforward with our library. Give US Legal Forms a try now to keep your paperwork organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all purchased documents at any necessary time by accessing the My documents section in your profile.

- If this is your first time using our platform, the procedure will necessitate additional steps to complete.

- Here’s how new users can locate the Affidavit Of Regularity Foreclosure in our catalog.

- Examine the page details thoroughly to ensure it contains the example you require.

- To do this, utilize the form description and preview options if available.

- Employ the Search bar above to look for another sample if the present one does not suit you.

- Click Buy Now next to the template title when you discover the right one.

Form popularity

FAQ

If you choose to file an answer, you must do so within 35 days from the date that you receive the summons and complaint; and you must include a completed Foreclosure Case Information Statement, a Certification Pursuant to Court Rule -1 and the $175.00 filing fee ($250 for Answers with Counter-Claim, Cross-Claim and/

Ways to Stop or Prevent a ForeclosureCatch up on your default. In many cases, the first notice of default provides you with options for catching up on what you owe.Ask for a loan modification. Many lenders will work with you if you need help making your loan payments.Request a short sale.File for bankruptcy.

Major reasons for foreclosures are:Job loss or reduction in income. Debt, particularly credit card debt. Medical emergency or illness resulting in a lot of medical debt. Divorce, or death of a spouse or partner who contributed income.

Answering the Complaint. If you got a Summons and Complaint, you need to deliver a written Answer form to the plaintiff and the Court. Your Answer is what you tell the court about what the plaintiff said in the Complaint. The Answer tells the court your defenses or reasons the plaintiff must not win the case.

How to Respond to a Foreclosure Summons showStep 1: Read the Summons.Step 2: Speak to Foreclosure Lawyer.Step 3: Decide If You Want to Contest.Step 4: Prepare a Mortgage Foreclosure Appearance and Answer to the Complaint.Step 5: File the Form with the Court Clerk.Step 6: Send a Copy of Your Answer to the Other Parties.More items...?