Tenants In Common With Right To Survivorship

Description

Form popularity

FAQ

Yes, the right of survivorship can be challenged under certain circumstances. If one owner disputes the joint tenancy or if there is ambiguity in the deed, legal complications may arise. Moreover, if a owner has a financial obligation or pending creditor claims, this could lead to legal scrutiny of ownership rights. Understanding the legal framework around tenants in common with right to survivorship can help you navigate potential challenges effectively.

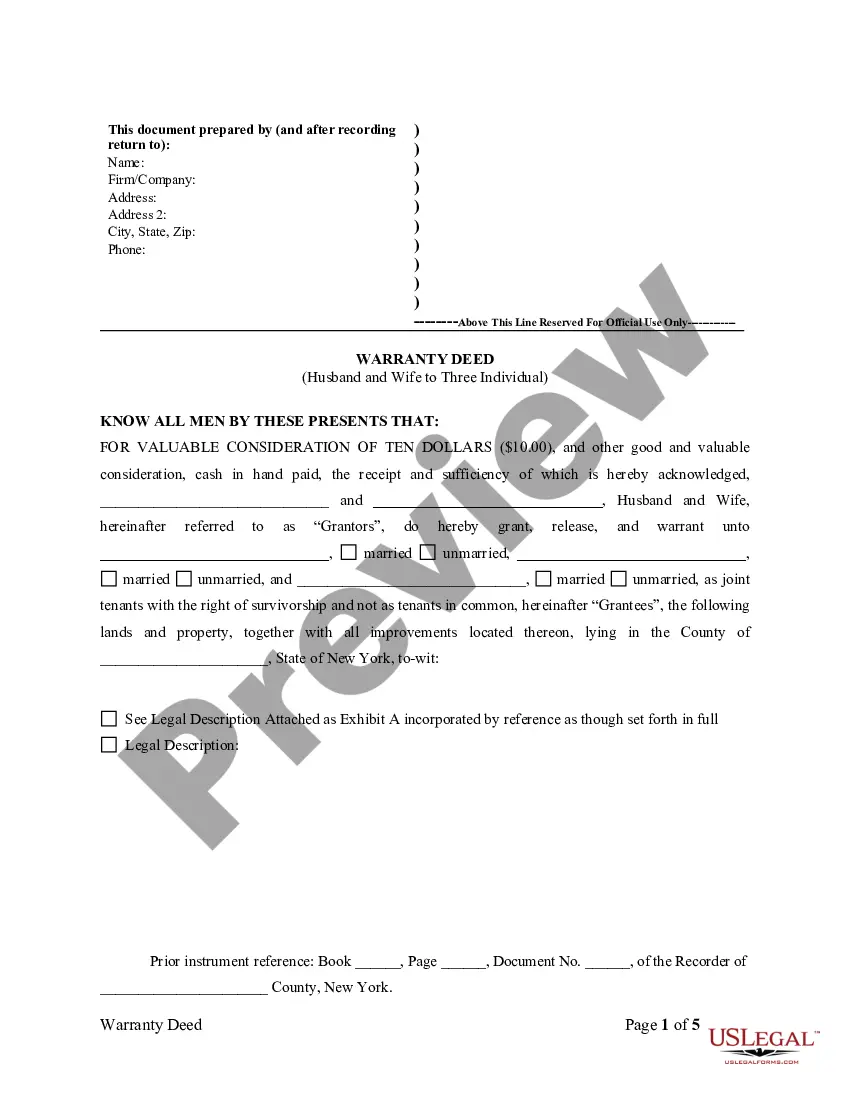

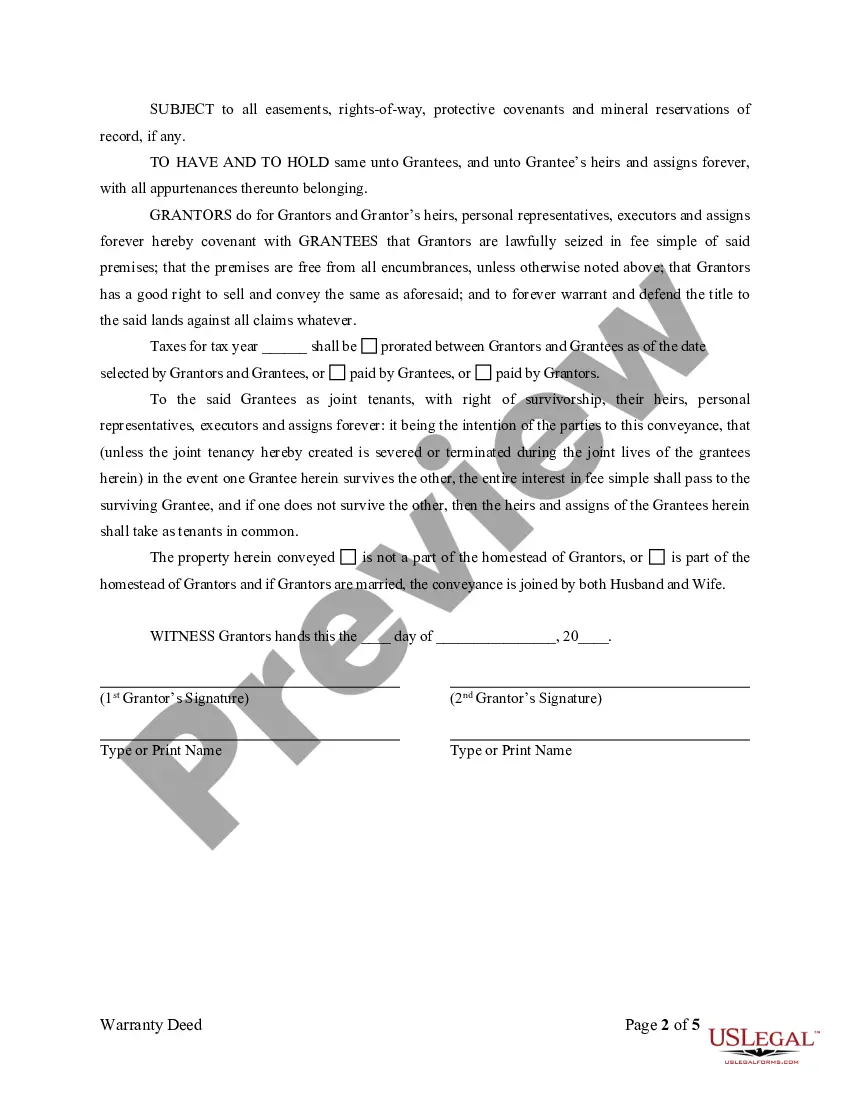

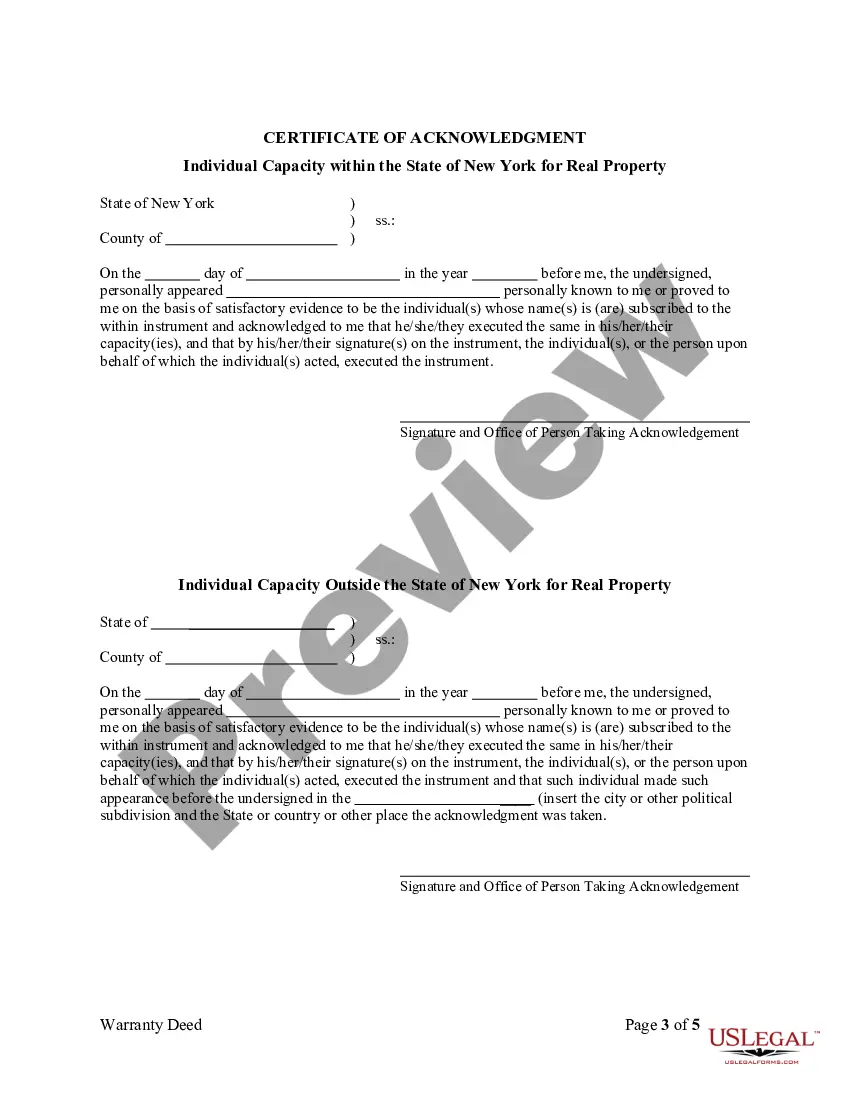

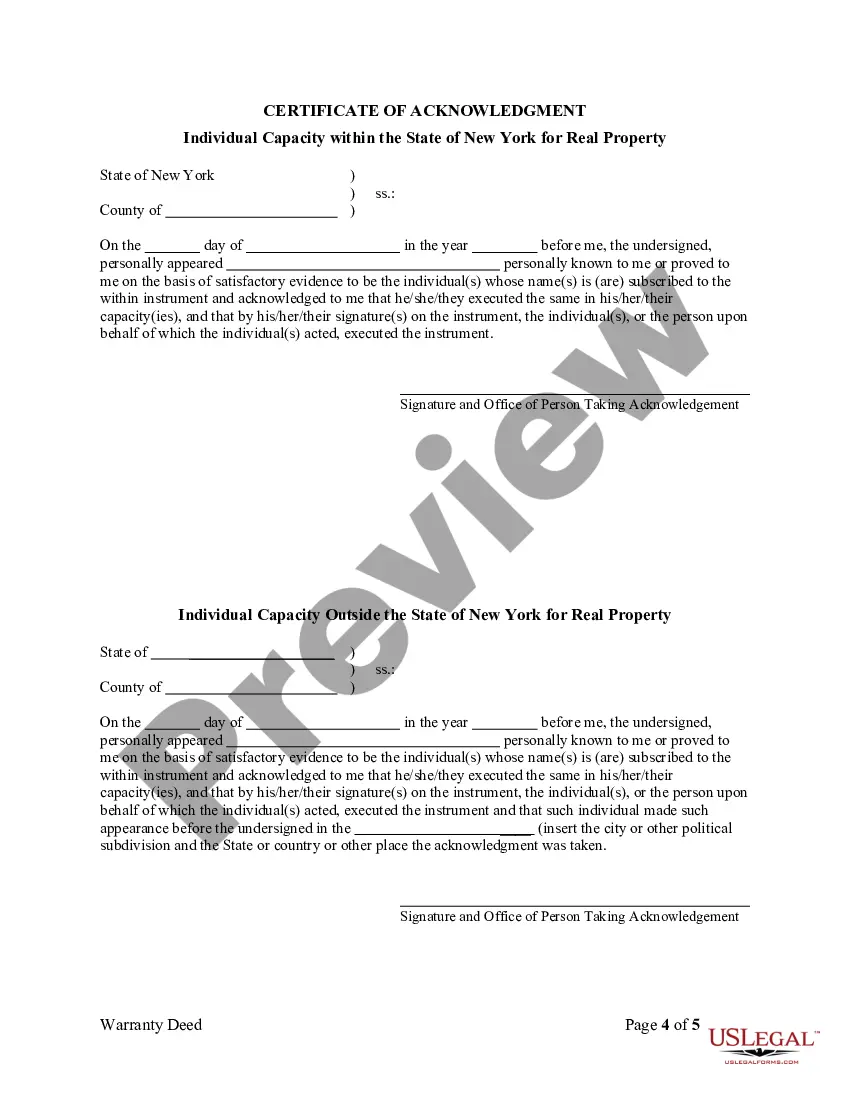

To establish joint tenancy with right of survivorship, you must take specific legal steps. First, you need to create a deed that clearly states your intention to form this type of ownership. Both parties must then sign the deed and have it recorded with the appropriate government office. By following these steps, you ensure that all property owners are recognized as tenants in common with the right to survivorship.

Joint tenancy with right of survivorship can limit your options when it comes to estate planning. If one joint tenant wishes to sell or transfer their share, the other tenant must agree, potentially leading to disputes. Furthermore, joint tenancy may not always align with your personal or family planning goals. Exploring tenants in common with right to survivorship can offer a more tailored solution to ownership issues.

Avoiding joint ownership can provide individuals with more control over their assets. Joint ownership ties your financial future to someone else's decisions, which can lead to complications if relationships change. By choosing tenants in common with right to survivorship, you can determine how your share is treated in matters of inheritance or sale, thus protecting your interests.

Tax implications can arise in joint tenancy situations, particularly concerning property taxes and capital gains. When a joint tenant passes away, their share often receives a step-up in basis, benefiting the surviving owner. However, this can complicate future tax calculations. To navigate these issues effectively, explore tenants in common with right to survivorship, as they may present a more favorable tax situation.

One major disadvantage of joint tenants with rights of survivorship is the lack of control you have over the property. If one owner passes away, their share automatically transfers to the surviving owner, which may not align with everyone’s wishes. Additionally, joint tenancy does not allow for easy division of assets if the relationship between owners deteriorates. For more flexible arrangements, consider tenants in common with right to survivorship.

The essential difference between joint tenancy and tenancy in common relates to the inheritance of property ownership. Joint tenants automatically transfer their share to surviving owners upon death, creating a seamless transfer of ownership. However, tenants in common with right to survivorship can leave their share to anyone they choose, which allows for more individualized estate planning. To navigate these options effectively, consider using US Legal Forms to create precise legal documents.

The main difference between joint tenancy and a tenancy in common centers around the rights each owner has over the property. Joint tenants enjoy the right of survivorship, which means that if one joint tenant dies, their share automatically passes to the remaining joint tenants. In contrast, tenants in common with right to survivorship can designate who inherits their share upon their death, giving them more control over estate matters. Understanding this difference will help you make informed decisions about property ownership.

The primary difference between joint tenancy and a tenancy in common lies in the ownership rights of the property. In a joint tenancy, all owners share equal rights to the property and have the right of survivorship, meaning if one owner passes away, their share automatically transfers to the remaining owners. Conversely, tenants in common with right to survivorship do not automatically pass their share to other owners; instead, they can leave their share to heirs, allowing for greater flexibility in property distribution. This distinction is crucial when planning your estate.

Yes, the right of survivorship does override a will. This means that if you have property held as tenants in common with right to survivorship, it will transfer directly to the surviving owner upon your death, regardless of any instructions in your will. It's crucial to understand how this works when planning your estate.