Joint Tenants With Right Of Survivorship In Spanish

Description

Form popularity

FAQ

A joint tenant account is typically not classified as a retirement account. Instead, it serves as a standard account that facilitates shared ownership and management of assets. While it can hold various types of funds, it does not offer the tax advantages associated with retirement accounts. If you're exploring options for retirement savings, it’s beneficial to consider separate retirement accounts alongside the advantages of Joint tenants with right of survivorship in Spanish.

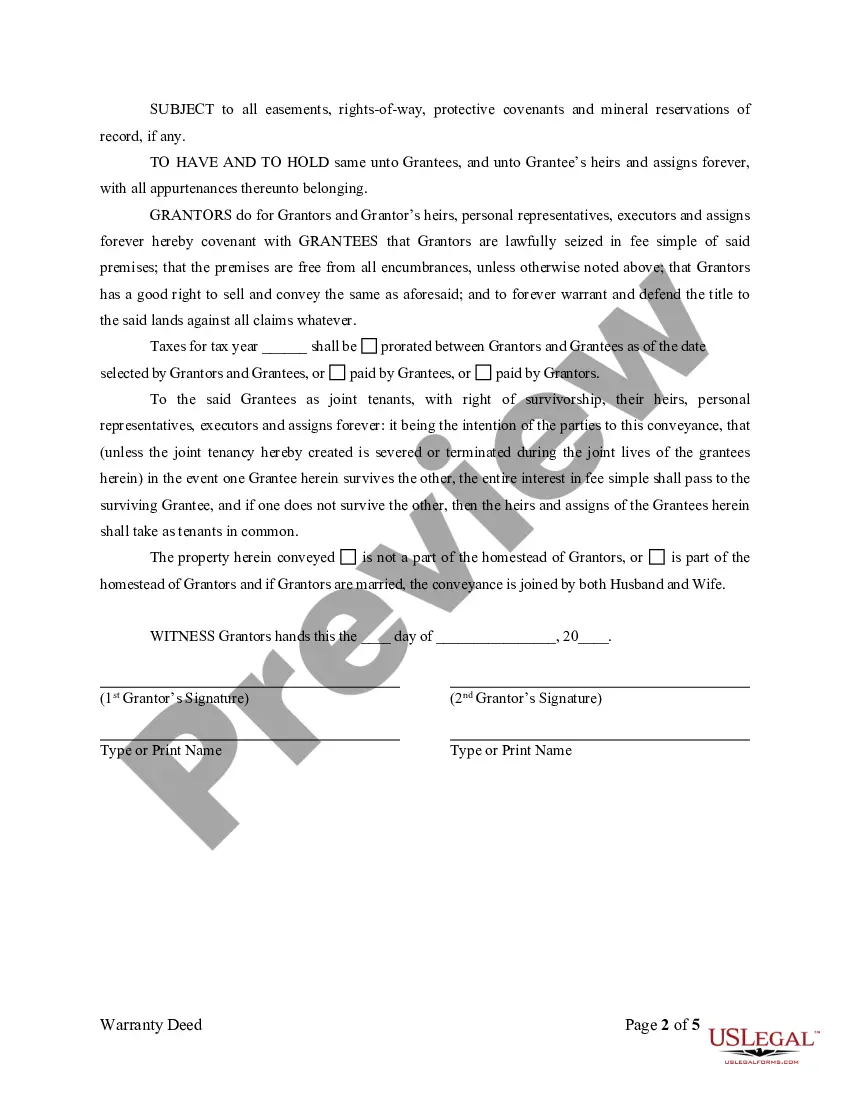

The term 'jointly with right of survivorship' refers to the legal arrangement where co-owners of an account retain equal rights over the shared assets. This means that if one owner dies, the surviving owner(s) automatically receive the deceased's interest in the account. This arrangement minimizes legal complications and accelerates the transfer of ownership. Understanding this concept is crucial when considering estate planning, especially in Spanish-speaking communities.

A joint account with right of survivorship includes contributions from multiple owners who share equal rights. Each account holder has the ability to deposit, withdraw, and manage the funds within the account. This setup enhances teamwork in financial management among the owners. Additionally, it simplifies future transactions and asset distribution after one holder passes, aligning well with the concept of Joint tenants with right of survivorship in Spanish.

A Joint Tenants with Right of Survivorship account is a shared account held by two or more individuals. This type of account allows all account holders to have equal access and ownership rights. When one account holder passes away, the remaining holders automatically inherit the deceased owner's share. This ensures a smooth transfer of assets without the need for probate.

While there are benefits to joint tenancy with right of survivorship in Spanish, there are also notable disadvantages to consider. One major drawback is that both tenants have equal ownership, meaning one tenant can make decisions that affect the entire property without the other's consent. Additionally, the property may become subject to the debts of either tenant, which can complicate matters if one tenant faces financial issues. It's important to weigh these factors before choosing this option.

The step-up basis for joint tenants with right of survivorship in Spanish refers to how the tax basis of a property adjusts upon the death of one tenant. When a joint tenant passes away, their share of the property receives a fair market value adjustment, which can be beneficial for the surviving tenant. This adjustment can potentially reduce capital gains tax if the property is sold later. Understanding this can help you effectively manage your estate.

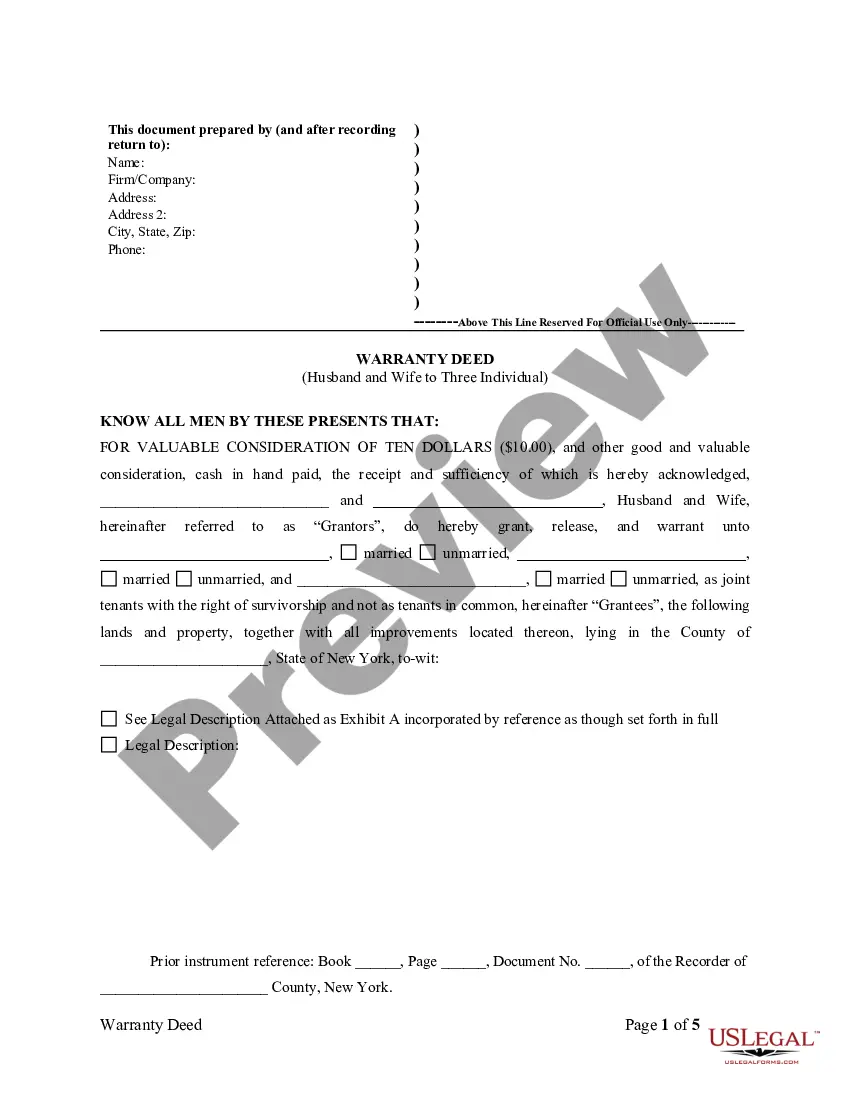

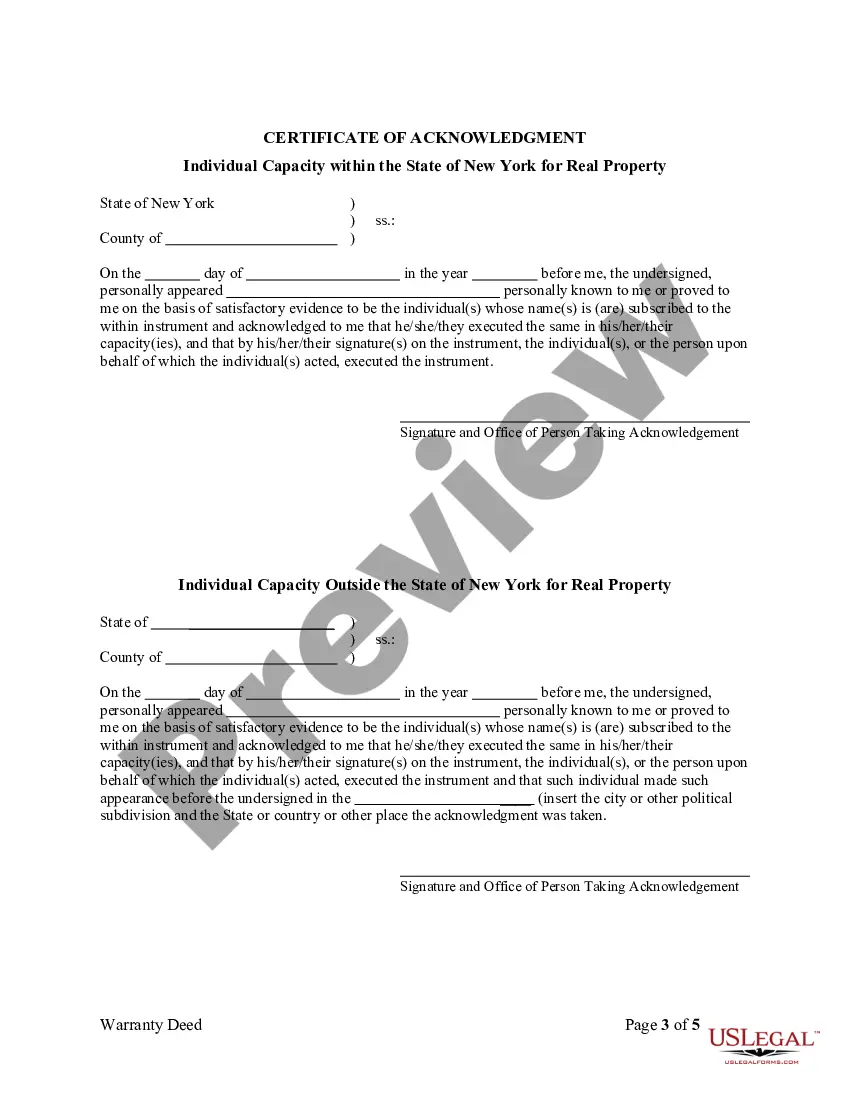

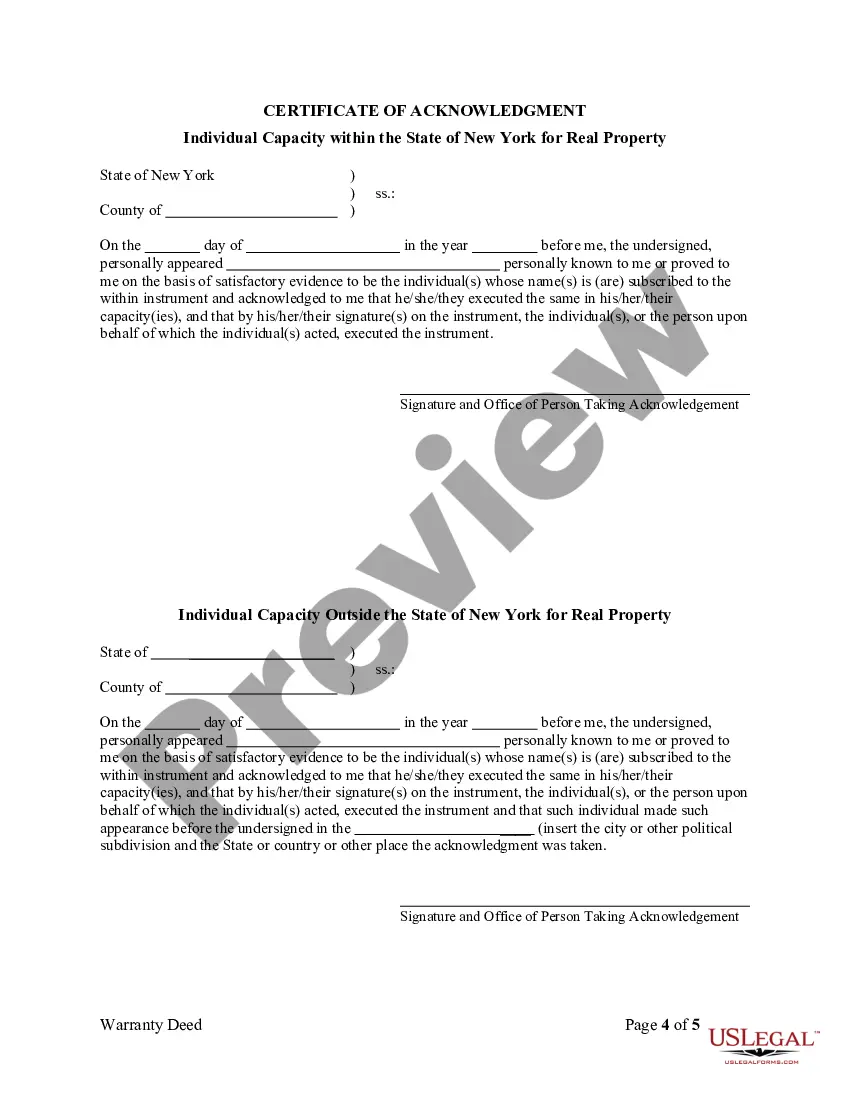

To file a joint tenancy with right of survivorship, you typically need to execute a deed that clearly states the intent to hold the property as joint tenants. It’s advisable to include language that specifies the right of survivorship. Additionally, you must file this deed with the appropriate local government office to ensure it is legally recognized. Resources available through US Legal Forms can provide guidance on this process and help you navigate the specifics of joint tenants with right of survivorship in Spanish.

For married couples, joint tenants with right of survivorship often serves as the best tenancy arrangement. This allows both partners to share ownership of assets while ensuring that one spouse automatically inherits the other’s share upon death. This setup minimizes legal complications and provides peace of mind to couples. Utilizing resources like US Legal Forms can help you create and manage your joint tenancy effectively.

Assets that pass by survivorship typically include property held in joint tenancy with right of survivorship. This means that when one owner dies, their share automatically transfers to the surviving owner. Common examples of such assets include real estate, bank accounts, and certain investments. It’s essential to note that the specific terms can vary, so consulting with a professional can clarify the details of joint tenants with right of survivorship in Spanish.

Joint tenancy with right of survivorship allows two or more people to own property together. For instance, if Maria and Juan buy a house as joint tenants with right of survivorship, if Maria passes away, Juan automatically becomes the sole owner of the house. This type of ownership ensures that the property transfers to the surviving co-owner without going through probate. Understanding joint tenants with right of survivorship in Spanish can be beneficial for Spanish-speaking individuals considering this arrangement.