New York Professional New York With Las Vegas

Description

How to fill out Sample Bylaws For A New York Professional Service Corporation?

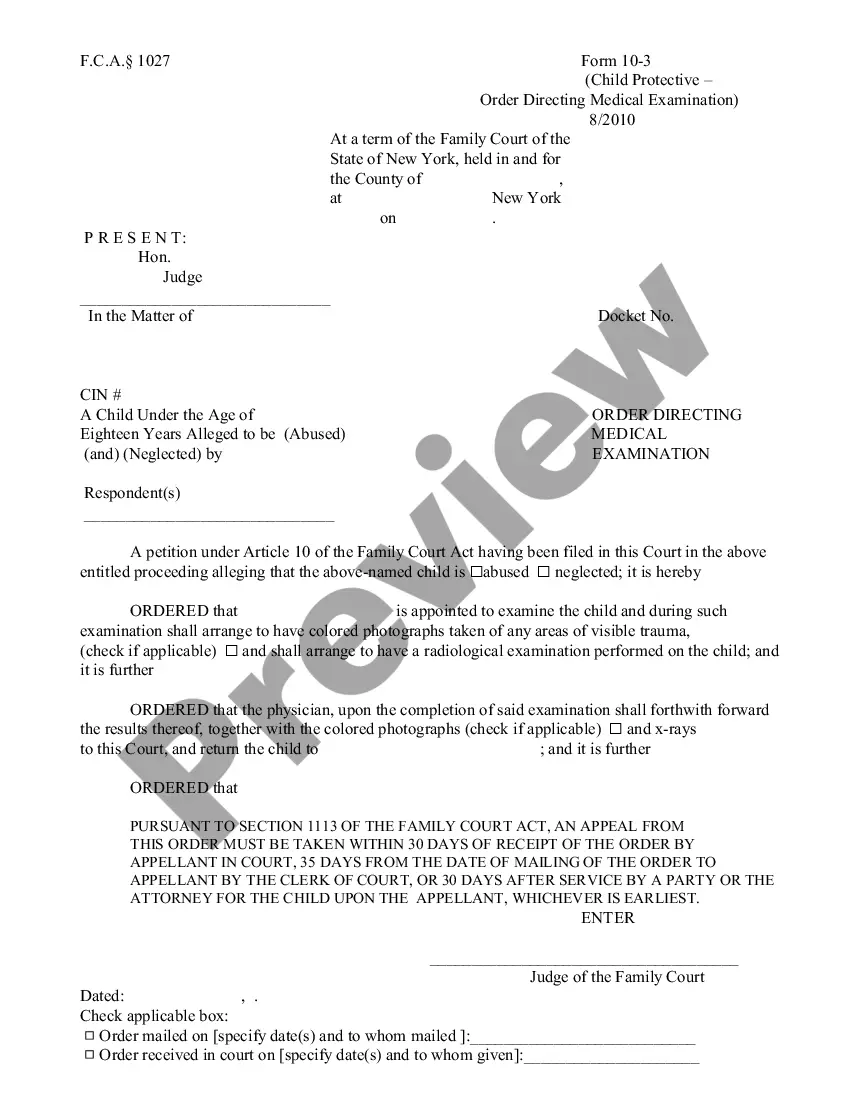

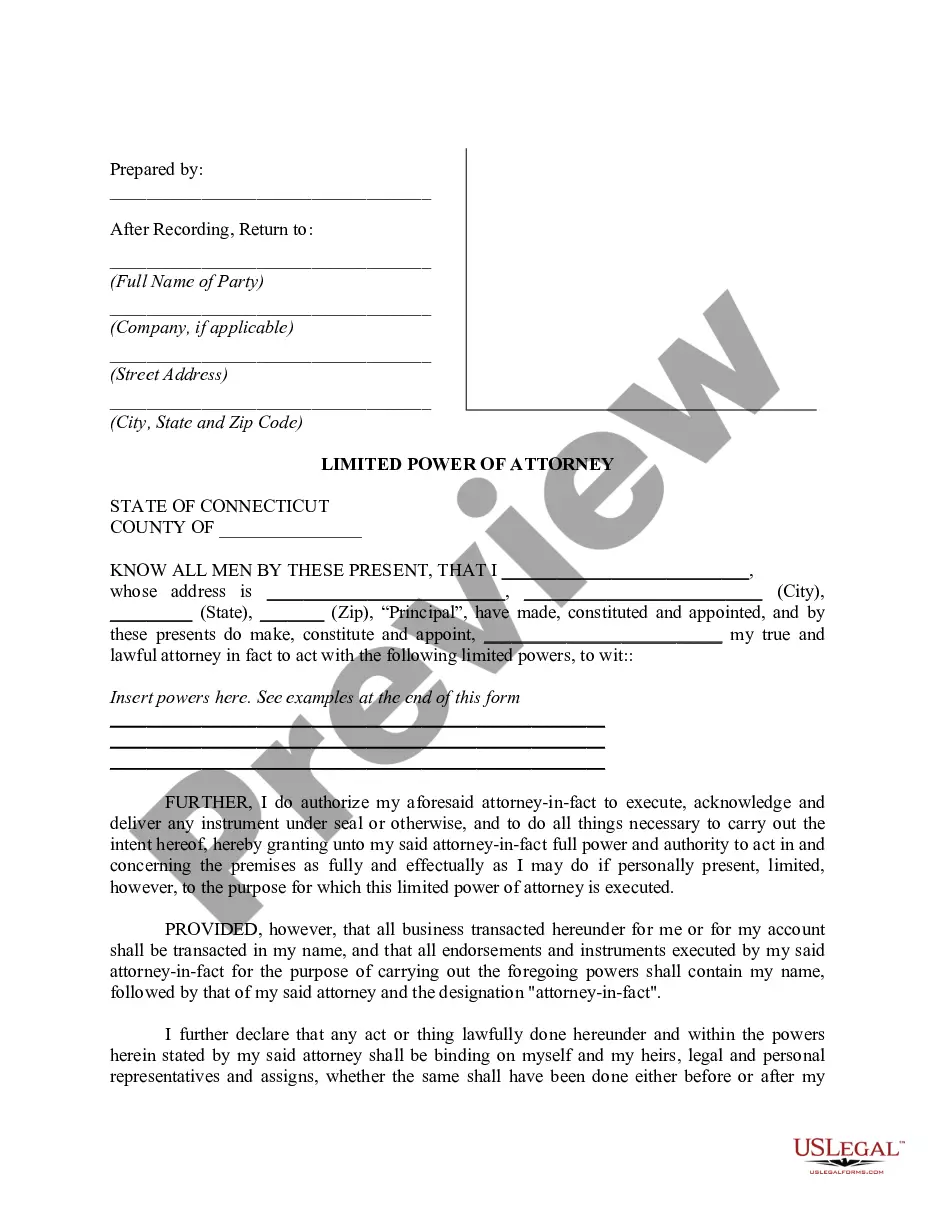

Whether for business purposes or for individual affairs, everybody has to deal with legal situations at some point in their life. Filling out legal documents demands careful attention, starting with choosing the correct form template. For example, if you choose a wrong version of a New York Professional New York With Las Vegas, it will be rejected once you submit it. It is therefore essential to get a trustworthy source of legal files like US Legal Forms.

If you need to get a New York Professional New York With Las Vegas template, follow these easy steps:

- Find the sample you need using the search field or catalog navigation.

- Check out the form’s information to make sure it matches your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect form, go back to the search function to locate the New York Professional New York With Las Vegas sample you need.

- Download the template if it matches your needs.

- If you already have a US Legal Forms account, simply click Log in to access previously saved templates in My Forms.

- In the event you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Select the document format you want and download the New York Professional New York With Las Vegas.

- After it is downloaded, you are able to fill out the form with the help of editing software or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you don’t have to spend time looking for the right sample across the internet. Take advantage of the library’s straightforward navigation to get the appropriate template for any situation.

Form popularity

FAQ

It is owned by Vici Properties and operated by MGM Resorts International, and is designed to evoke New York City in its architecture and other aspects. The design features downsized replicas of numerous city landmarks such as the Statue of Liberty.

If you are a nonresident individual, estate, or trust, you are subject to tax on your New York source income. New York source income includes income derived from or connected with a business, trade, profession, or occupation carried on in New York State.

All city residents' income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax. The rules regarding New York City domicile are also the same as for New York State domicile.

State Only Return Requirements ? New York returns can be transmitted with the Federal return or as a state-only return unlinked from the Federal return. Amended Returns - Amended returns are required to be e-filed. Form to use: Use Form IT-201-X if the original return was Form IT-201.

Unemployment received from NY is also taxable to NY (and Connecticut). On the NY return, it will be 100% ?New York source portion.? New York does not recognize the $10,200 exemption for unemployment so there is no subtraction.