Florida Professional Service Corporation Withholding

Description

How to fill out Sample Bylaws For A New York Professional Service Corporation?

Drafting legal paperwork from scratch can often be intimidating. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re looking for a a more straightforward and more affordable way of creating Florida Professional Service Corporation Withholding or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our online library of over 85,000 up-to-date legal documents addresses virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-compliant forms carefully prepared for you by our legal experts.

Use our website whenever you need a trustworthy and reliable services through which you can easily find and download the Florida Professional Service Corporation Withholding. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No problem. It takes minutes to set it up and navigate the library. But before jumping directly to downloading Florida Professional Service Corporation Withholding, follow these recommendations:

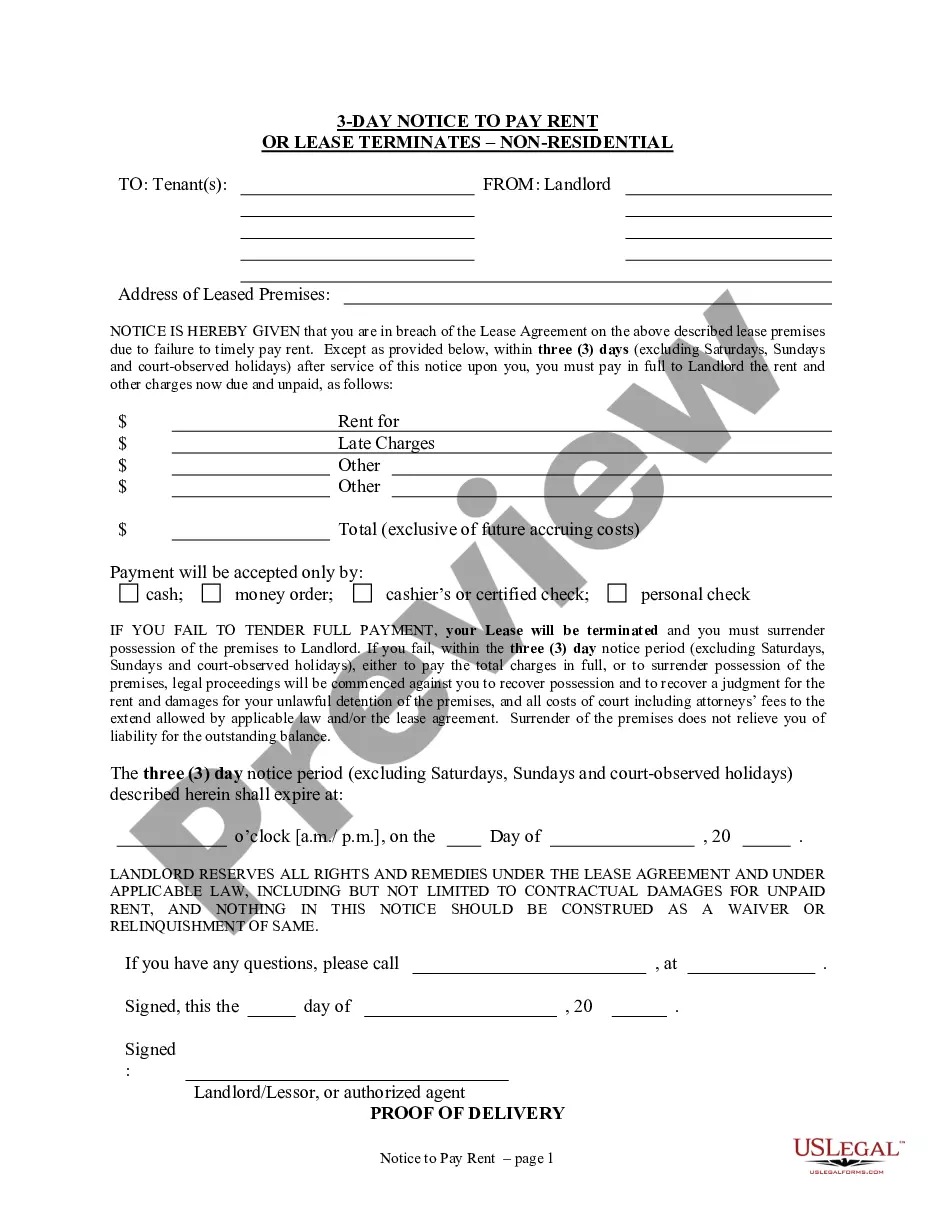

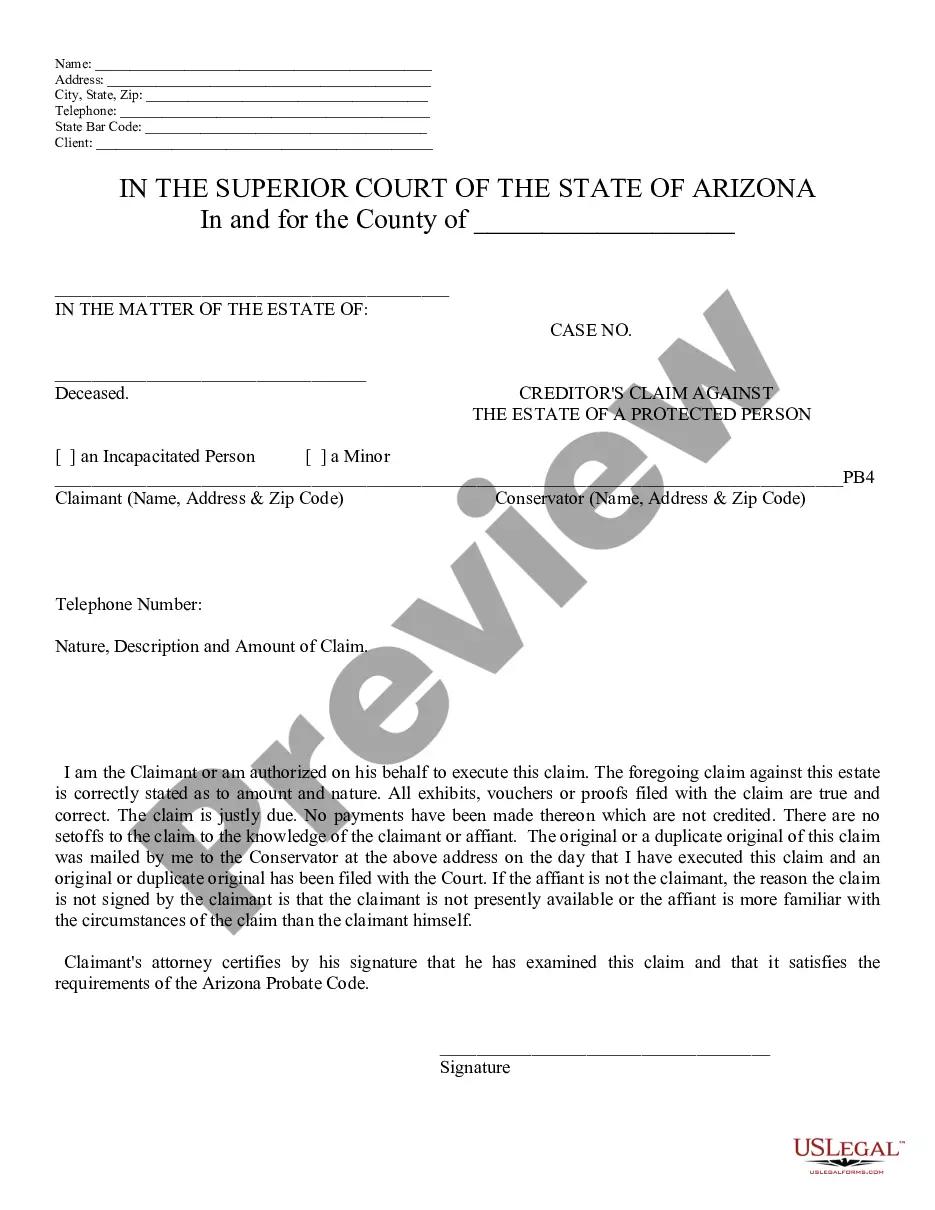

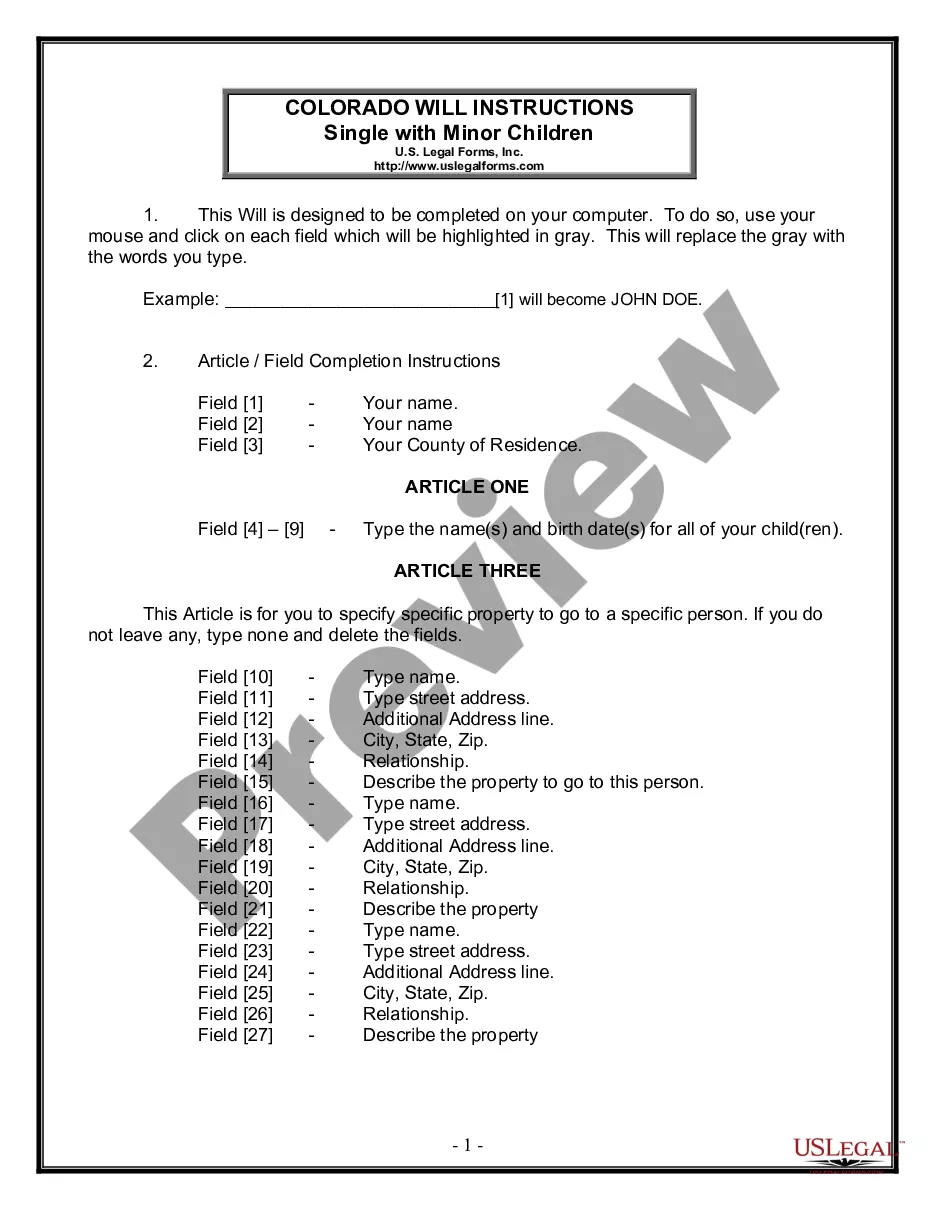

- Review the form preview and descriptions to make sure you have found the form you are searching for.

- Make sure the template you choose complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to get the Florida Professional Service Corporation Withholding.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us now and transform document completion into something simple and streamlined!

Form popularity

FAQ

Under Florida law, corporations are required to apportion their business income to the state using a three-factor formula comprised of a payroll, property, and double-weighted sales factor.

Florida Sales Tax Rules (1) Barber and beauty shops are not required to collect the tax on the receipts from their services. They are the consumers of the tangible personal property they use in rendering such services.

This means a C corporation pays corporate income tax on its income, after offsetting income with losses, deductions, and credits. A corporation pays its shareholders dividends from its after-tax income. The shareholders then pay personal income taxes on the dividends. This is the often-mentioned ?double taxation?.

Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income. Domestic corporations must file Form 1120, unless they are required, or elect to file a special return.

Professional services are not taxable in Florida unless a physical product is manufactured. How are professional services corporations taxed?