Buy Sell Agreement For Sole Proprietorship

Description

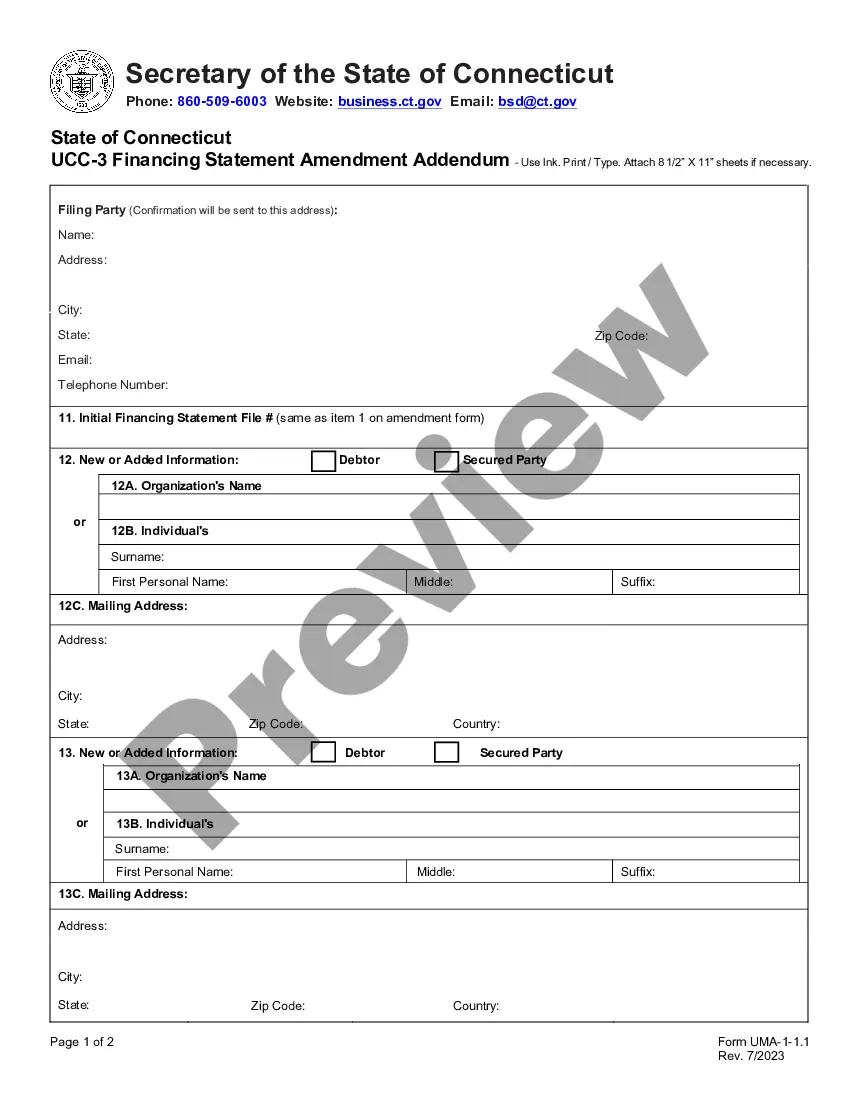

How to fill out New York Buy Sell Agreement Package?

- Log in to your US Legal Forms account if you're a returning user and ensure your subscription is active. Click the Download button to get your form.

- If you're new to the service, start by browsing the available templates. Check the Preview mode to confirm that the buy sell agreement matches your specific needs and complies with your local jurisdiction.

- Search for additional templates if the first choice is not suitable. Use the Search tab to find any forms that may better fit your requirements.

- Purchase the document by selecting the Buy Now button. Choose your preferred subscription plan and create an account to access the forms library.

- Complete your payment using your credit card or PayPal account to finalize the subscription.

- Download the buy sell agreement template and save it on your device. Access it anytime through the My Forms section of your profile for future needs.

In conclusion, US Legal Forms is designed to empower business owners with a comprehensive collection of legal forms. The easy-to-navigate interface and expert support ensure that your documentation is accurate and legally sound.

Start your journey today and protect your business by acquiring a buy sell agreement tailored for sole proprietors!

Form popularity

FAQ

sell agreement is essential for sole proprietors considering future business changes. If you plan to sell your business or if you have partners, this agreement provides clarity on ownership transfers. It sets terms for sales, ensuring that everyone understands their rights and responsibilities. Moreover, having a buy sell agreement for sole proprietorship can streamline the process and avoid confusion.

To sell a sole proprietorship, start by assessing the value of your business. Potential buyers will want to know its worth, so gather financial records and clarify any assets involved. Once you find a buyer, draft a buy sell agreement for sole proprietorship to outline the terms, ensuring everything is clear. This contract will help protect both parties during the transition.

To execute a buy-sell agreement, you should first draft the document detailing the terms of the buyout process. Both parties must agree and sign the document. It is advisable to have legal assistance to ensure compliance with laws and to protect your business interests effectively.

Yes, a family member can take over a sole proprietorship, but it's essential to document this transfer properly. A buy-sell agreement for sole proprietorship can simplify this process by clearly outlining the terms of the transfer. Always consider the legal and tax implications before proceeding with the transfer.

Exiting a sole proprietorship typically requires notifying clients, paying outstanding debts, and settling any business obligations. If you have a buy-sell agreement for sole proprietorship, follow its terms to facilitate a smooth transition. It's wise to consult with a legal professional to navigate the process efficiently.

sell agreement can help streamline the transfer of ownership, potentially avoiding probate complications. It typically allows for business ownership to be passed directly to predetermined parties. Thus, having a buysell agreement for sole proprietorship not only facilitates a smoother transition but also mitigates delays associated with probate.

Without a buy-sell agreement, the process of transferring ownership can become complicated and contentious. Disputes may arise among heirs, partners, or stakeholders when unclear situations occur. A buy-sell agreement for sole proprietorship offers clarity and direction, avoiding unnecessary confusion during critical times.

Backing out of a buy-sell agreement typically depends on the terms of the agreement itself. If the document contains exit clauses, you may have options to withdraw under certain conditions. However, it’s crucial to approach this carefully and consult legal advice, as a buy-sell agreement for sole proprietorship is legally binding.

Selling your sole proprietorship involves several key steps. First, assess the value of your business and prepare it for sale by ensuring it operates smoothly. When you have a buy-sell agreement for sole proprietorship, it simplifies the process, ensuring you meet any prerequisites before potential buyers can take over.

Typically, attorneys with experience in business law draft buy-sell agreements. They understand the necessary legal language and ensure that your buy-sell agreement for sole proprietorship reflects your specific needs. Consulting an attorney helps create an enforceable and comprehensive agreement that serves your best interests.