New York Certificate Name Withholding

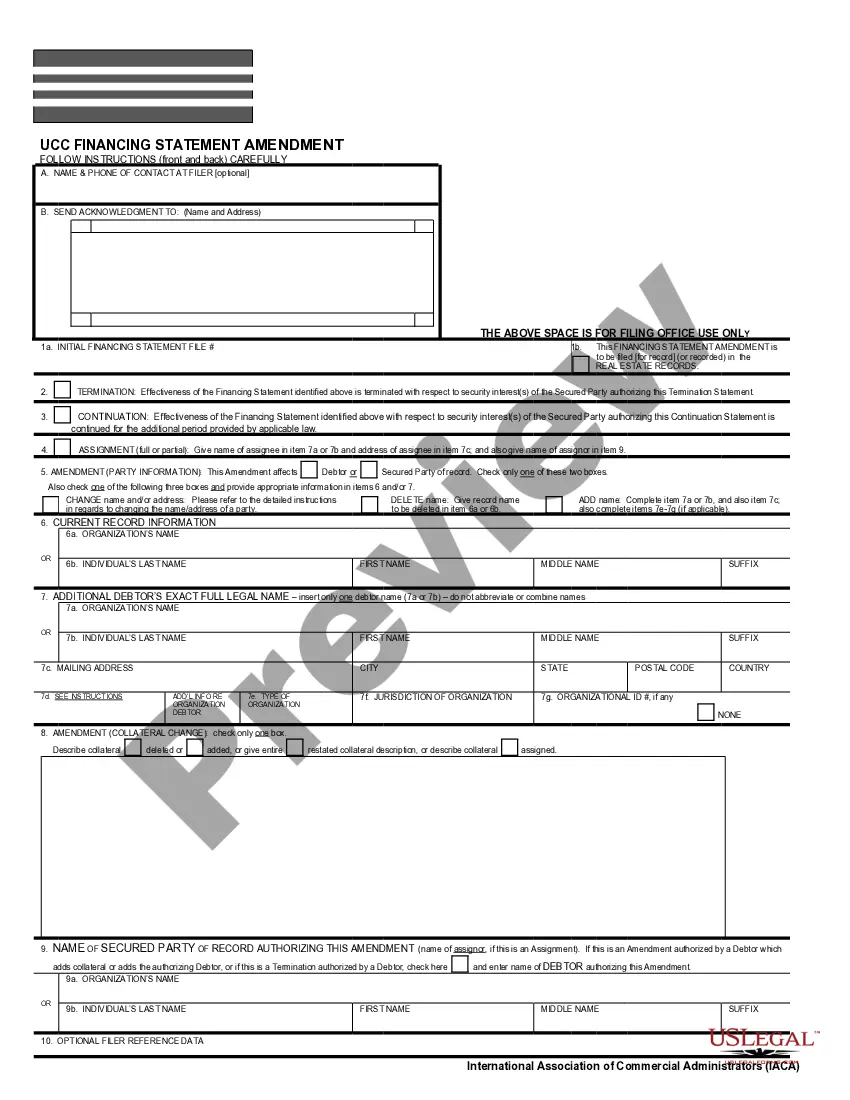

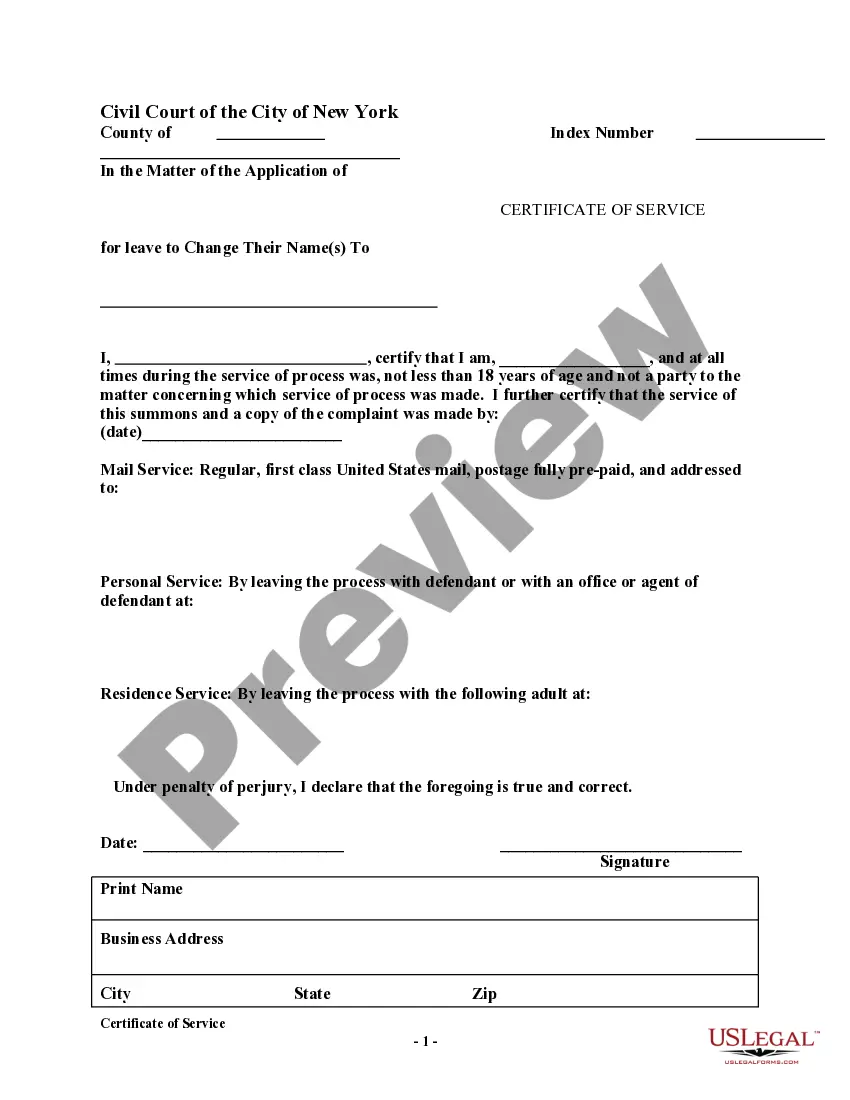

Description

How to fill out New York Certificate Name Withholding?

Whether you handle paperwork frequently or you occasionally need to send a legal document, it is crucial to have a resource where all the examples are connected and current.

One aspect you have to verify with a New York Certificate Name Withholding is ensuring that it is indeed its most recent version, as it determines if it can be submitted.

If you wish to streamline your search for the most current document samples, look for them on US Legal Forms.

To acquire a form without an account, follow these guidelines: Use the search feature to locate the form you need. Review the New York Certificate Name Withholding preview and description to confirm it is the exact one you’re seeking. After verifying the form, click Buy Now. Select a subscription model that suits you. Create an account or Log In to your existing one. Provide your credit card details or PayPal account to finalize the transaction. Choose the document format for download and confirm it. Forget about the confusion of handling legal documents. All your templates will be structured and authenticated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents consisting of nearly any template sample you may seek.

- Search for the forms you need, immediately assess their appropriateness, and learn more about their applications.

- With US Legal Forms, you gain access to over 85,000 form samples across a broad spectrum of fields.

- Retrieve the New York Certificate Name Withholding samples in just a few clicks and store them at any time in your profile.

- A US Legal Forms account will assist you in obtaining all the samples you need with added ease and less hassle.

- Simply click Log In in the site's header and navigate to the My documents section, where all the forms you need are readily available.

- You won’t have to spend time searching for the ideal template or verifying its legitimacy.

Form popularity

FAQ

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

This certificate, Form IT-2104, is completed by an employee and given to the employer to instruct the employer how much New York State (and New York City and Yonkers) tax to withhold from the employee's pay. The more allowances claimed, the lower the amount of tax withheld.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

You must file the state form Employee's Withholding Allowance Certificate (DE 4) to determine the appropriate California PIT withholding. If you do not provide your employer with a withholding certificate, the employer must use Single with Zero withholding allowance.