New York Property Taxes By Town

Description

How to fill out New York Release Of Lien Of Estate Tax?

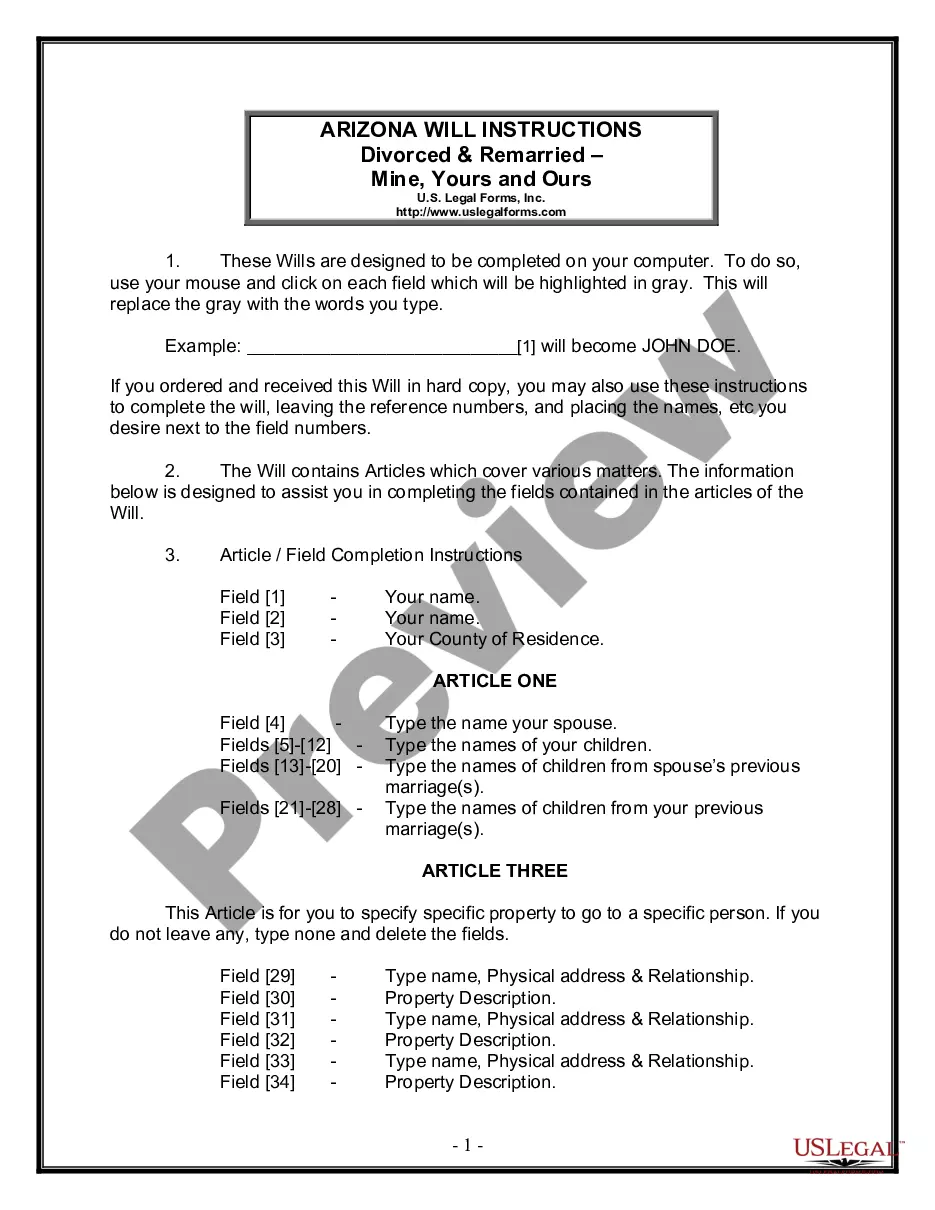

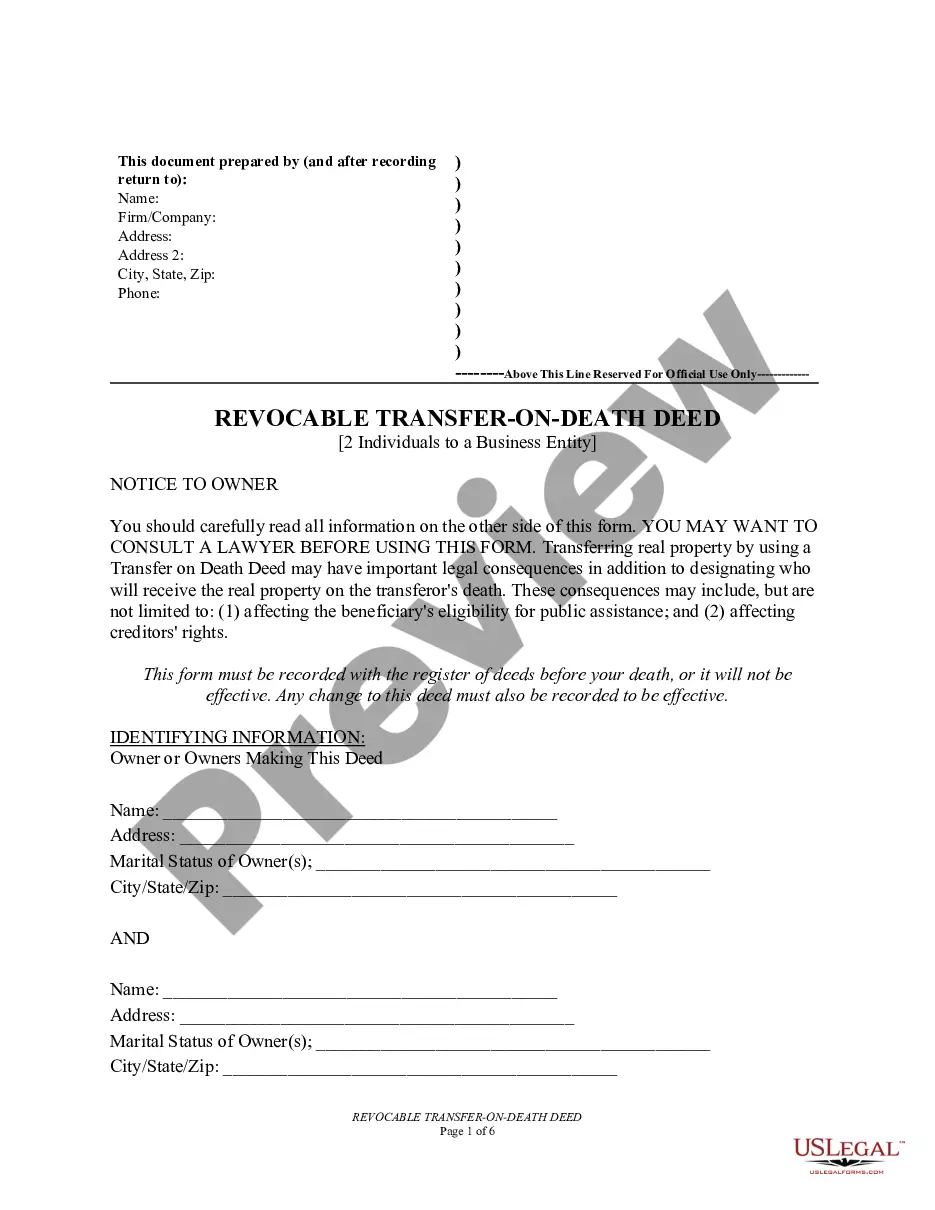

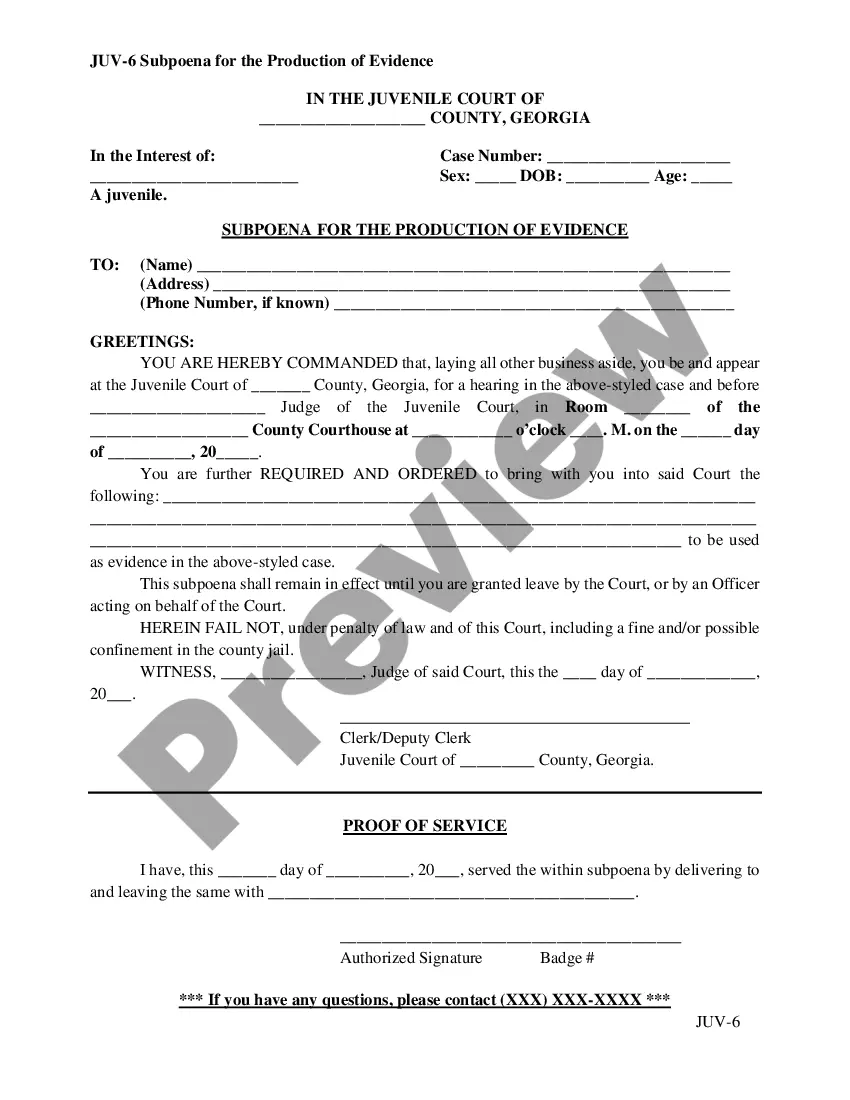

Accessing legal templates that comply with federal and state regulations is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the appropriate New York Property Taxes By Town sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by lawyers for any business and personal case. They are simple to browse with all documents grouped by state and purpose of use. Our professionals stay up with legislative updates, so you can always be confident your form is up to date and compliant when obtaining a New York Property Taxes By Town from our website.

Obtaining a New York Property Taxes By Town is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, follow the instructions below:

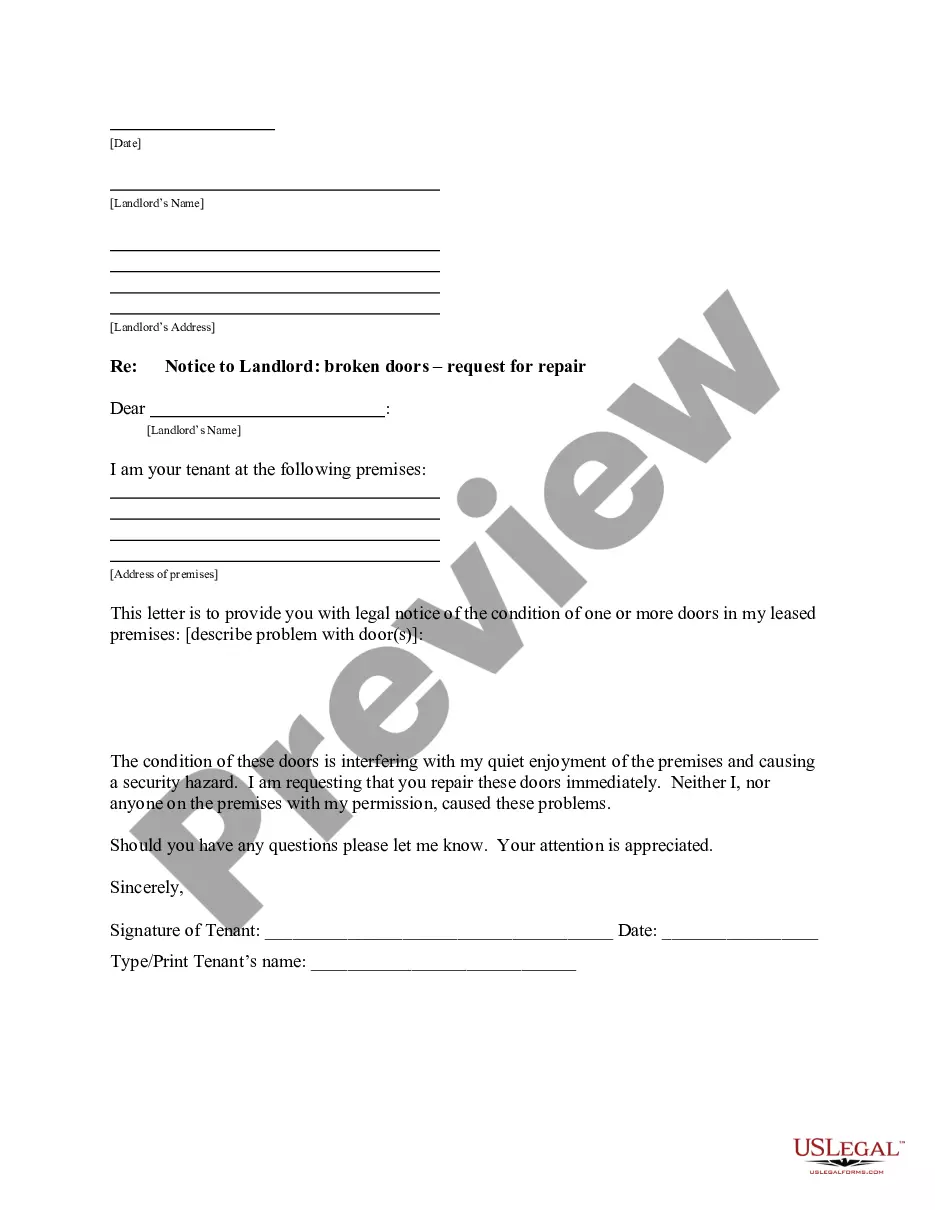

- Take a look at the template utilizing the Preview option or via the text description to make certain it meets your requirements.

- Locate a different sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your New York Property Taxes By Town and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Each of the owners of the property must be 65 years of age or over, unless the owners are: husband and wife, or.

In New York City, property tax rates are actually quite low. The average effective property tax rate in the Big Apple is just 0.98%, while the statewide average rate is 1.62%.

Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owner's property. The assessed value estimates the reasonable market value for your home. It is based upon prevailing local real estate market conditions.

The Senior Citizen Homeowners' Exemption (SCHE) provides a reduction of 5 to 50% on New York City's real property tax to seniors age 65 and older. To be eligible for SCHE, you must be 65 or older, earn no more than $58,399 for the last calendar year, and the property must be your primary residence.

To estimate your annual property tax: Multiply the taxable value of your property by the current tax rate for your property's tax class. Property tax rates change each year, as well as the value of exemptions and abatements.