New York Estate Tax For Non Residents

Description

How to fill out New York Release Of Lien Of Estate Tax?

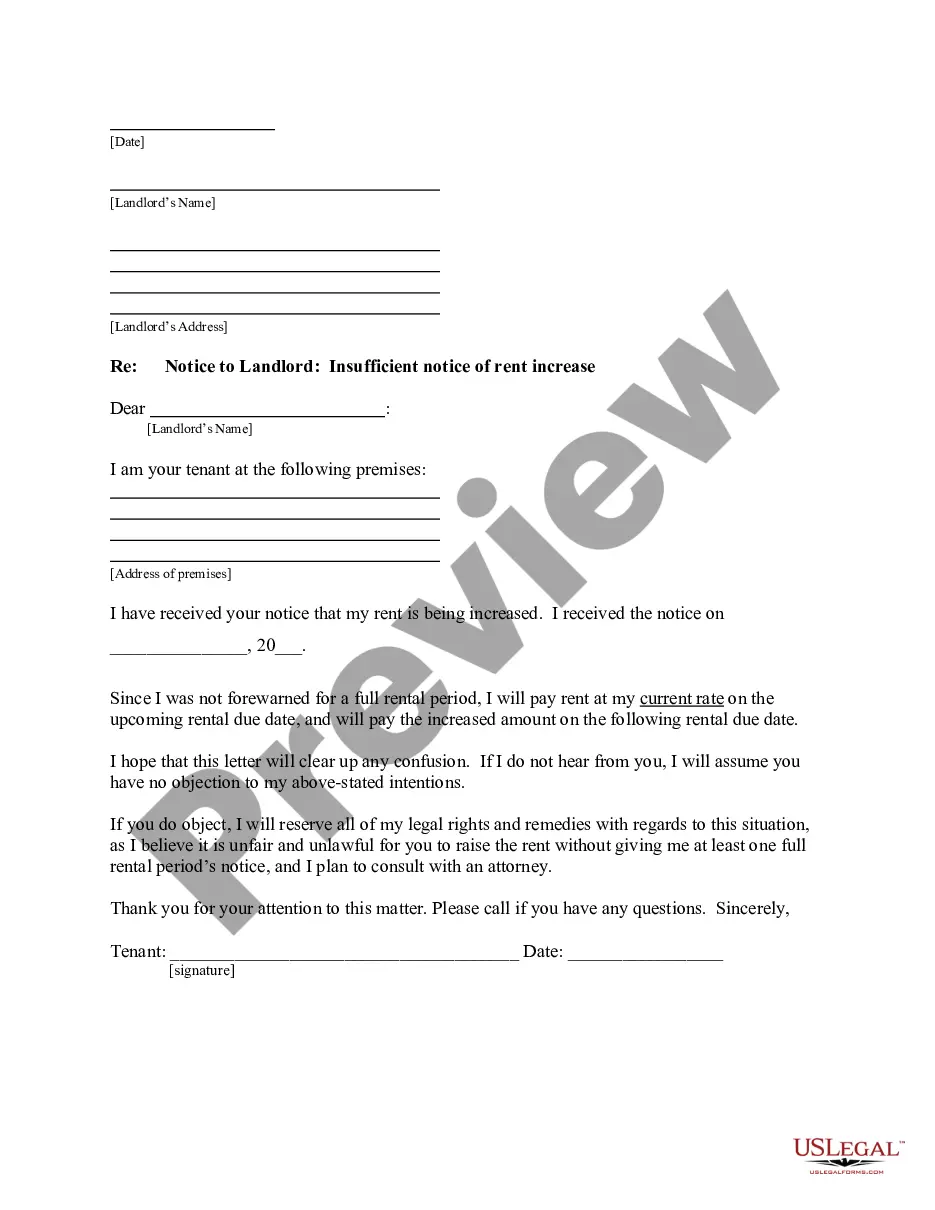

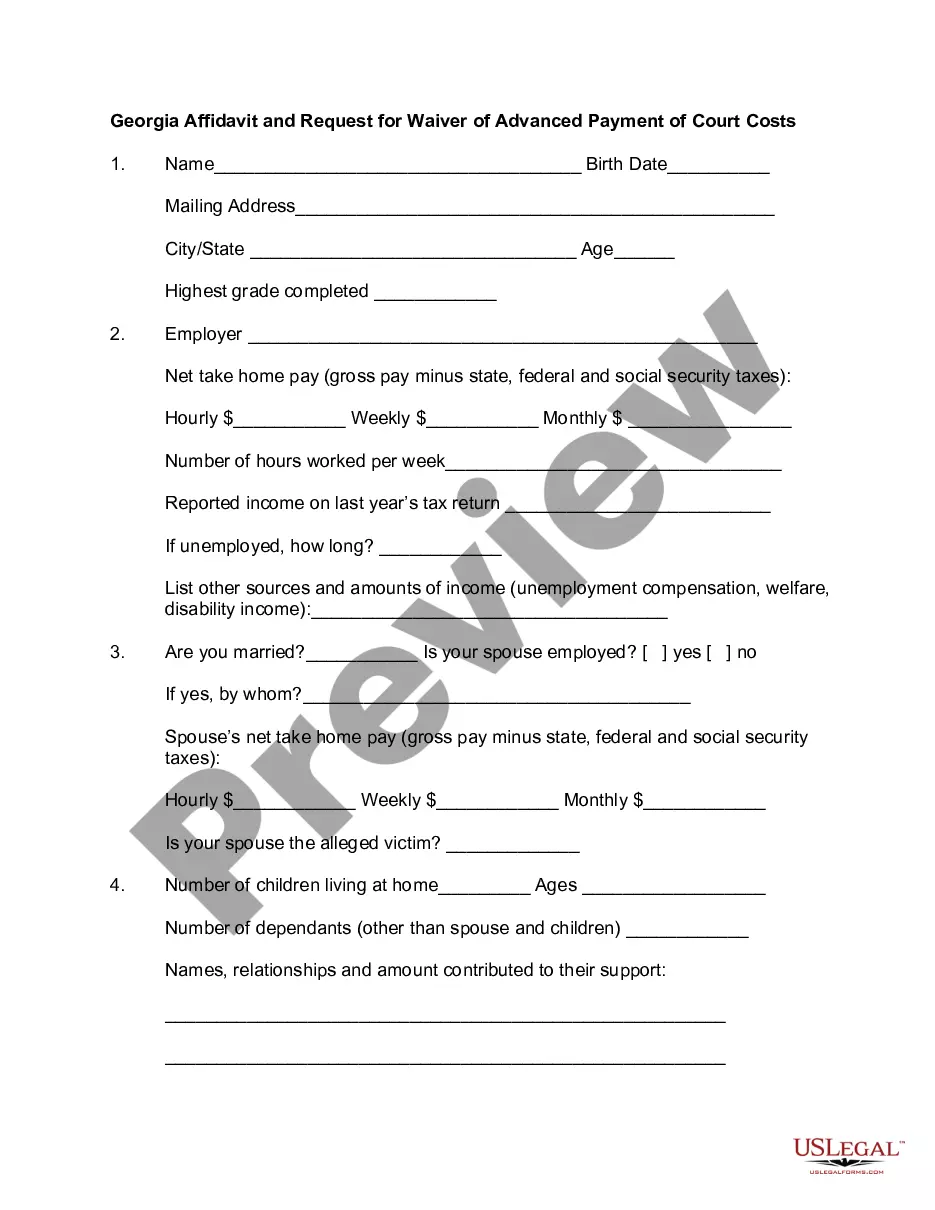

Accessing legal templates that comply with federal and regional regulations is essential, and the internet offers many options to choose from. But what’s the point in wasting time searching for the correctly drafted New York Estate Tax For Non Residents sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by lawyers for any business and personal situation. They are simple to browse with all papers grouped by state and purpose of use. Our specialists keep up with legislative changes, so you can always be sure your paperwork is up to date and compliant when acquiring a New York Estate Tax For Non Residents from our website.

Obtaining a New York Estate Tax For Non Residents is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, adhere to the guidelines below:

- Take a look at the template utilizing the Preview option or via the text outline to make certain it meets your needs.

- Browse for another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and select a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your New York Estate Tax For Non Residents and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and complete earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Non-Resident Employees of the City of New York - Form 1127 Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. This form calculates the City waiver liability, which is the amount due as if the filer were a resident of NYC.

Filing Requirements. Residents: The estate of a New York resident must file a New York State estate tax return if the amount of the resident's federal gross estate, plus the amount of any includible gifts, exceeds the basic exclusion amount applicable at the date of death.

Ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction.

As a resident, you pay state tax (and city tax if a New York City or Yonkers resident) on all your income no matter where it is earned. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

If you are a NYS Resident for tax purposes, download Form IT-201. If you are a NYS Nonresident for tax purposes, download Form IT-203.