Pay Employee Law Without Otp

Description

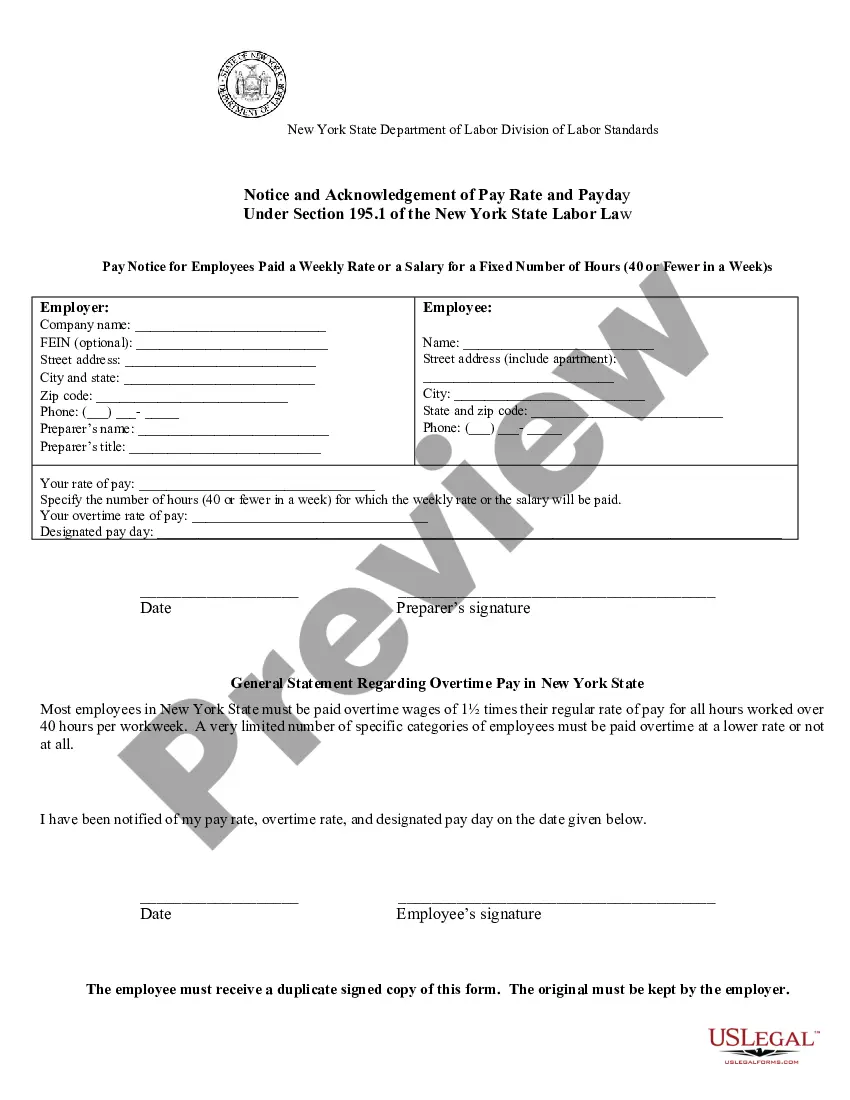

How to fill out New York Guidelines For Written Notice Of Rates Of Pay And Regular Payday?

Managing legal documents can be daunting, even for seasoned experts.

When searching for a Pay Employee Law Without Otp and unable to dedicate time to find the accurate and current version, the situation can be challenging.

US Legal Forms addresses all your needs, from personal to business documents, in one comprehensive location.

Utilize sophisticated tools to complete and oversee your Pay Employee Law Without Otp.

Here are the steps to follow after accessing the form you need: Verify it is the correct form by previewing it and reviewing its description. Ensure that the template is valid in your state or county. Select Buy Now when you are prepared. Choose a subscription plan. Find the format you prefer, and Download, fill out, eSign, print, and dispatch your document. Leverage the US Legal Forms online directory, supported by 25 years of experience and dependability. Simplify your daily document management into a straightforward and user-friendly process today.

- Access a resource library of articles, guides, and materials applicable to your situation and requirements.

- Conserve time and energy searching for the necessary documents, and utilize US Legal Forms’ advanced search and Review feature to find Pay Employee Law Without Otp.

- If you have a monthly membership, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Go to My documents tab to see the documents you've previously saved and to organize your folders as needed.

- If it is your initial experience with US Legal Forms, create a free account and gain unlimited access to all the library's advantages.

- A robust online form directory can significantly improve the handling of these circumstances.

- US Legal Forms is an industry frontrunner in online legal documents, offering over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can obtain state- or county-specific legal and business documents.

Form popularity

FAQ

Several payment gateways have features that allow transactions without the need for an OTP. Services like PayPal and certain local payment processors can facilitate secure payments while bypassing OTPs. To effectively manage employee payments under the umbrella of employee law without OTP, look for these payment gateways.

If your employer pays you in cash and fails to meet their bookkeeping obligations, they could face fines and criminal charges. Some people call this ?paying employees under the table? and it's illegal. It's a practice that might seem beneficial to you and the employer.

Choice of pay method As much as you may like to personalize pay, however, some rules apply. Regulation E states that employers can't mandate the use of pay cards. So, if you offer them, you're required to provide an alternate form of payment.

One of the options you can use to pay unbanked employees is to use Pay Cards. Pay cards work like debit cards. Like direct deposit, payroll cards are a form of electronic payment. Each payday, the employee's net wages are deposited directly into the pay card.

California law does not specify the method by which employees must be paid. This means that an employer can choose to pay via a business check, cash, personal check, or even electronically. However, regardless of the method chosen, employers must still comply with other aspects of the law.

The most common methods of payroll payments to employees are direct deposit, prepaid debit cards or paper check.