Dissolution Limited Liability Company New York For Business Owners

Description

How to fill out New York Dissolution Package To Dissolve Limited Liability Company LLC?

- Log in to your US Legal Forms account to access your forms by clicking the Download button. Ensure your subscription is up-to-date or renew it if necessary.

- Preview the form and read the description carefully to confirm it aligns with your requirements and complies with local regulations.

- If the form does not fit your needs, utilize the Search tab to find the appropriate template that suits your situation.

- Select the desired document and click on the Buy Now button. Choose your preferred subscription plan and create an account for access.

- Complete your purchase with credit card information or your PayPal account to finalize the subscription.

- Once purchased, download the form to your device, access it via the My Forms menu, and prepare it for submission.

In conclusion, utilizing US Legal Forms offers an efficient way for business owners in New York to manage the dissolution of their limited liability company. With an extensive collection of templates and expert assistance, you can ensure your documentation is accurate and compliant.

Ready to get started? Visit US Legal Forms today and simplify your document management!

Form popularity

FAQ

It is generally possible to sue an LLC that is no longer in business, but the process can be complex. If the LLC was dissolved properly, it might be challenging to pursue a lawsuit, as it no longer exists as a legal entity. However, if the dissolution occurred under suspicious circumstances, you might be able to pursue claims against the members or managers. It's advisable to consult with legal experts familiar with the dissolution of limited liability companies in New York to understand your options.

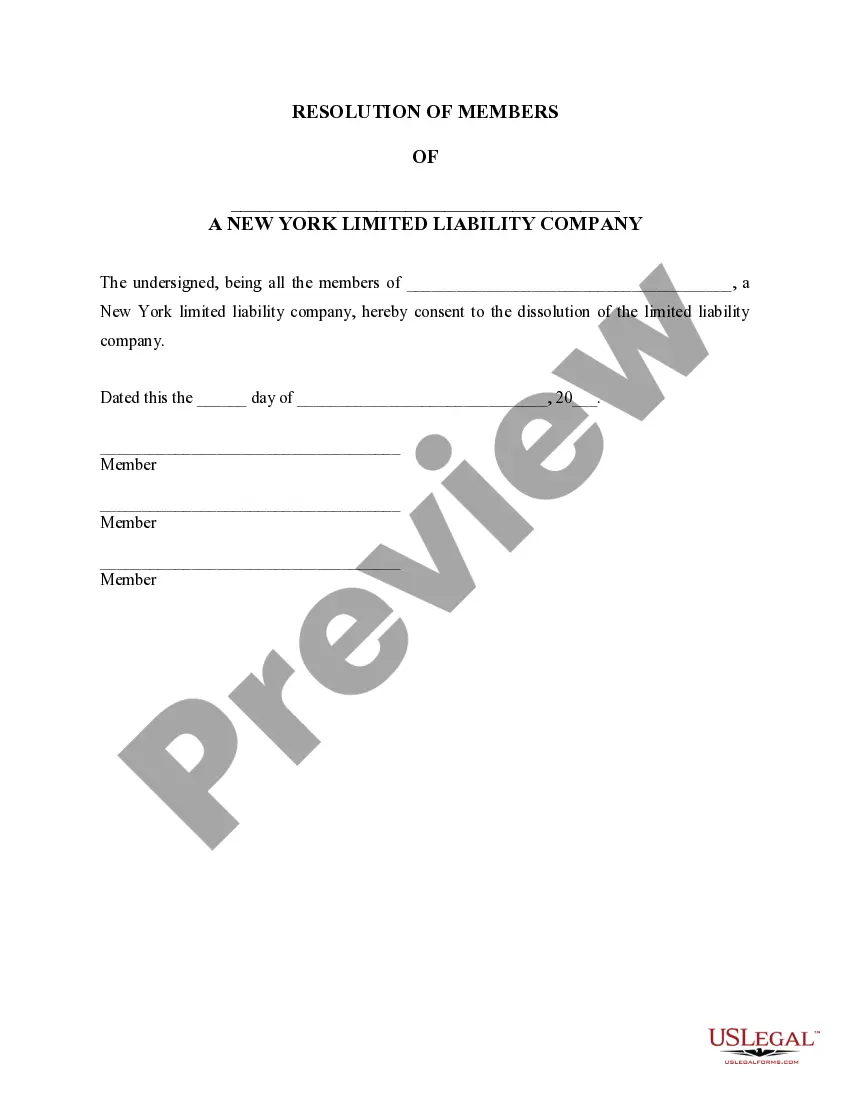

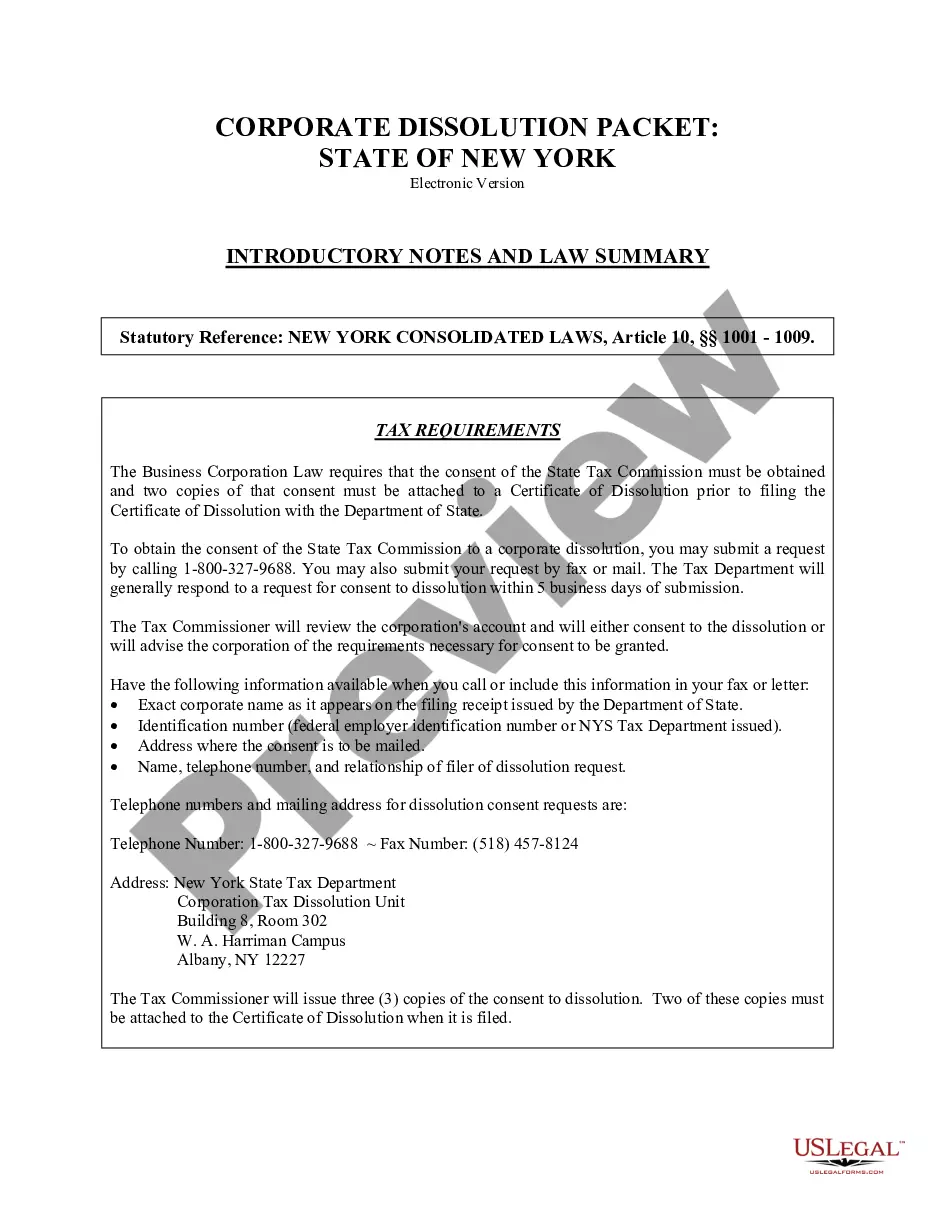

To officially close a limited liability company (LLC) in New York, you must take specific steps. First, you need to file a Certificate of Dissolution with the New York Department of State. After that, you should settle any outstanding debts, distribute remaining assets, and notify your members. Following these steps ensures a proper dissolution of your LLC and safeguards your interests as a business owner.

Dissolving an LLC is not necessarily hard, but it involves several steps that must be followed correctly. Business owners need to gather necessary documentation, settle liabilities, and file official forms to ensure that the dissolution is legally valid. With proper planning and perhaps assistance from platforms like uslegalforms, the process can become much more manageable and straightforward.

Dissolving an LLC can have various tax implications, such as the necessity to file a final tax return. Business owners may also have to account for any gains or losses from asset distribution. It’s important to consult with a tax professional to understand your specific situation and ensure compliance with tax regulations related to the dissolution of a limited liability company in New York.

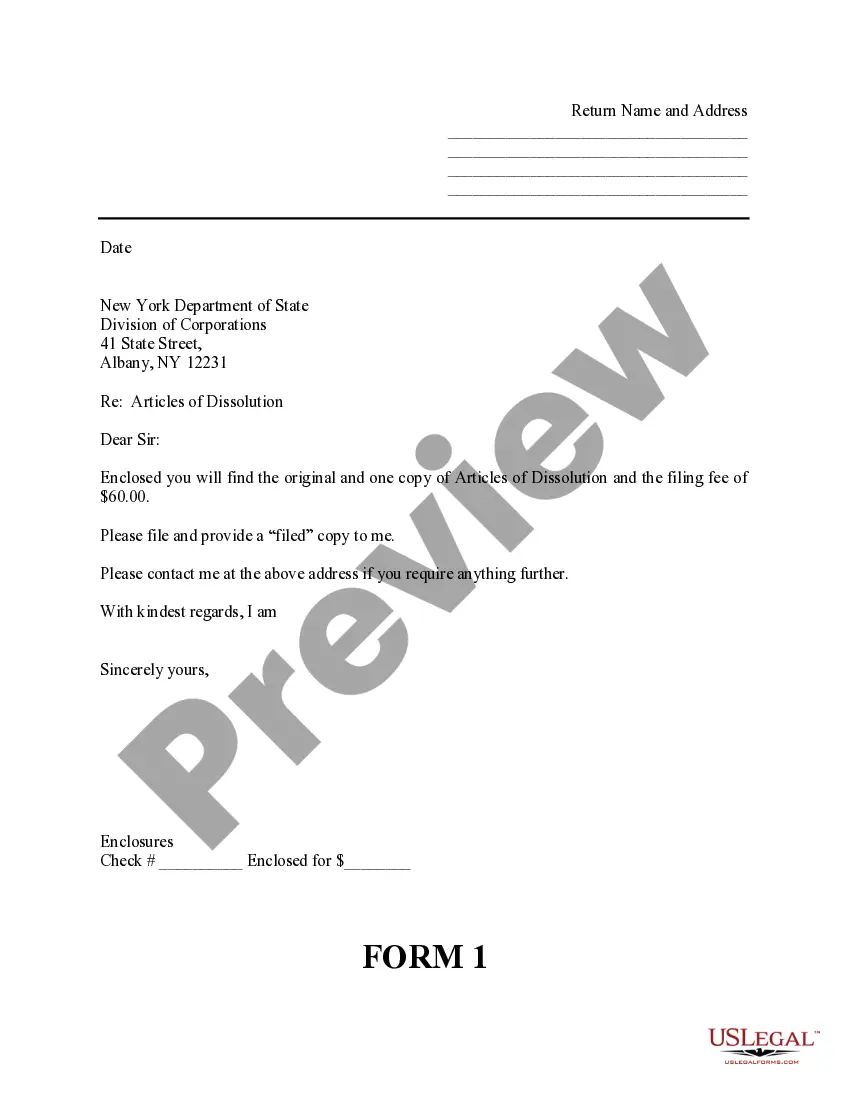

To dissolve an LLC in New York, you will need to file the Articles of Dissolution with the New York Department of State. You'll also need to settle any outstanding debts, notify creditors, and distribute any remaining assets to members. For business owners, engaging with a service like uslegalforms can simplify this process, providing you with the guidance and documents needed to ensure a smooth dissolution.

Dissolving an LLC refers to the legal process of ending the business, while terminating an LLC can imply a more informal cessation of operations. Dissolution requires proper filing with the state of New York, ensuring all legal procedures are followed. For business owners, understanding this difference is vital in order to avoid potential legal pitfalls and ensure that your business ends on proper legal grounds.

Dissolution of a limited liability corporation, or LLC, refers to the process of officially closing down the business entity. This involves settling any outstanding debts and obligations, notifying relevant stakeholders, and filing the necessary paperwork with the state. For business owners, it's crucial to understand that this process ensures that the LLC no longer exists in legal terms, which can protect you from further liabilities.

No, a corporation does not dissolve on its own in New York. You must actively initiate the dissolution process by filing the appropriate documents. Business owners should be aware that the dissolution limited liability company New York for business owners requires attention to detail to avoid complications down the line, and uslegalforms can assist in ensuring all steps are completed correctly.

If you dissolve your LLC, its existence will legally end, and you will no longer have to deal with ongoing state requirements. This process ensures that you are no longer liable for future taxes and fees associated with the LLC. For business owners, completing the dissolution limited liability company New York for business owners properly can protect your interests and alleviate any unwanted obligations.

An LLC itself is not a dissolution or cancellation; these terms describe the process of officially ending the company’s status. When you dissolve an LLC, you are completing the necessary actions to cancel its existence in state records. It’s vital for business owners to navigate dissolution limited liability company New York for business owners correctly to ensure compliance with state laws and to protect their personal assets.