Marital Separation With Withholding Tax

Description

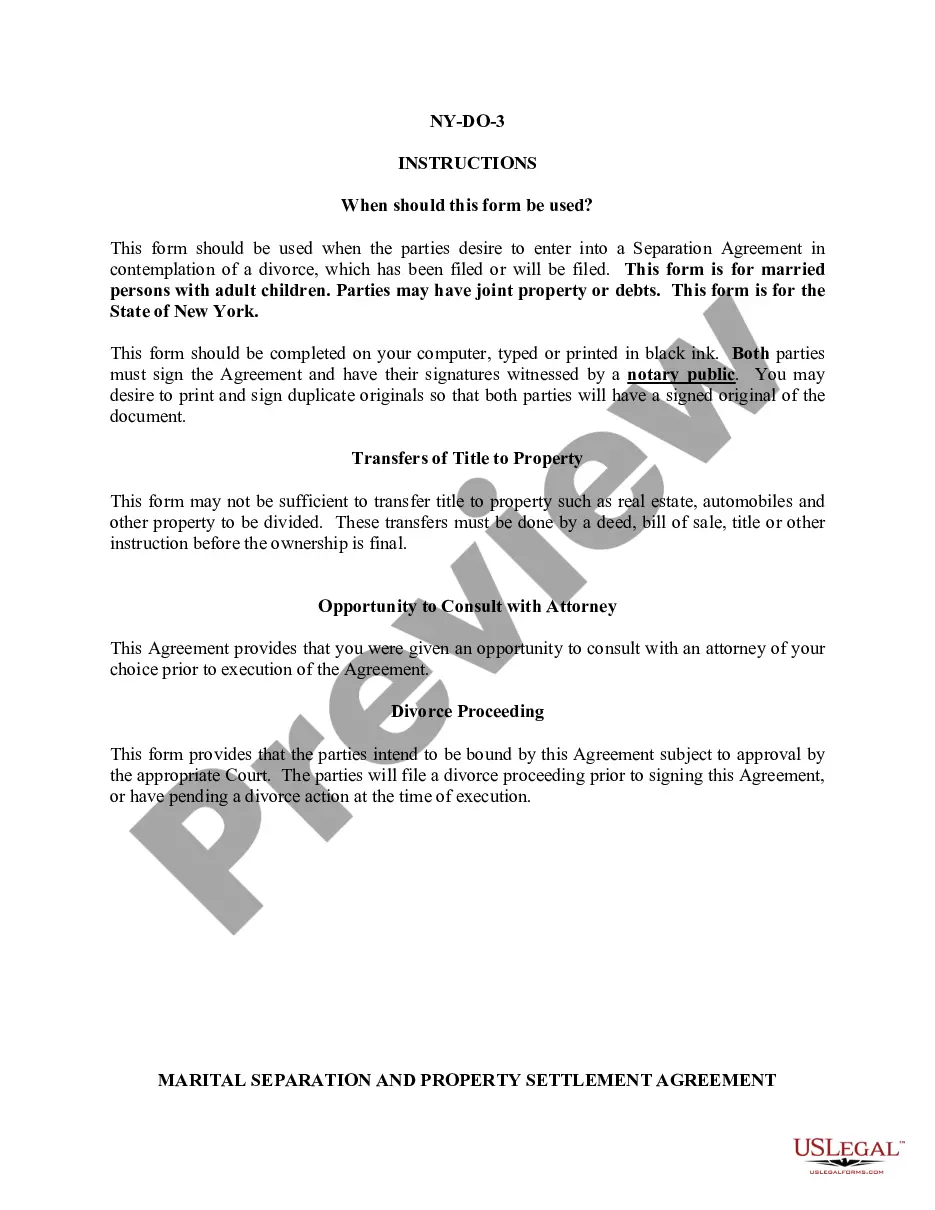

How to fill out New York Marital Separation With Property Settlement With Adult Children No Joint Property Or Joint Debts?

It's clear that you cannot transform into a legal specialist instantly, nor can you swiftly master how to prepare a Marital Separation With Withholding Tax without possessing a distinct array of expertise.

Drafting legal documents is a labor-intensive undertaking that demands particular education and skills.

So why not entrust the formulation of the Marital Separation With Withholding Tax to the experts.

You can retrieve your forms anytime from the My documents tab. If you are a returning customer, you can simply Log In, and locate and download the template from the same tab.

Regardless of the intent behind your documentation—whether it’s for financial and legal purposes, or personal—our platform has you covered. Give US Legal Forms a try now!

- Locate the document you require by utilizing the search bar at the top of the page.

- Review it (if this option is available) and examine the accompanying description to ascertain if Marital Separation With Withholding Tax is what you seek.

- Initiate your search anew if you require a different template.

- Sign up for a complimentary account and choose a subscription plan to purchase the template.

- Select Buy now. Once the payment is processed, you can acquire the Marital Separation With Withholding Tax, complete it, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

Typically, married individuals may face a lower tax rate when combining incomes, but it ultimately depends on their total earnings and deductions. Single filers can experience higher tax rates if they earn the same amount as a married couple. It's vital to understand how marital separation with withholding tax can impact your overall liability. Consider consulting a tax professional to navigate your specific situation.

If you are separated, you are still legally married. While you may think you should file separately, your filing status should be either: Married filing jointly (MFJ) Married filing separately (MFS)

Married, will my take-home pay be increased or decreased? Share: If you switch from married to one of the other withholding statuses, your take-home pay will be lower. More of your pay is withheld at the single rate than at the rate for married taxpayers.

Joint filers usually receive higher income thresholds for certain tax breaks, such as the deduction for contributing to an IRA. If you're married and file separately, you may face a higher tax rate and pay more tax. Filing separately may be a benefit if you have a large amount of out-of-pocket medical expenses.

If you're legally separated or divorced at the end of the year. You must file as single for that tax year unless you're eligible to file as head of household or you remarry by the end of the year.

Legally separated couples are still viewed as married couples by the IRS. Clients legally separated but not yet divorced must file as Married Filing Separately or Married Filing Jointly. Filing a joint return usually reduces overall tax liability, and many separated couples choose this option.