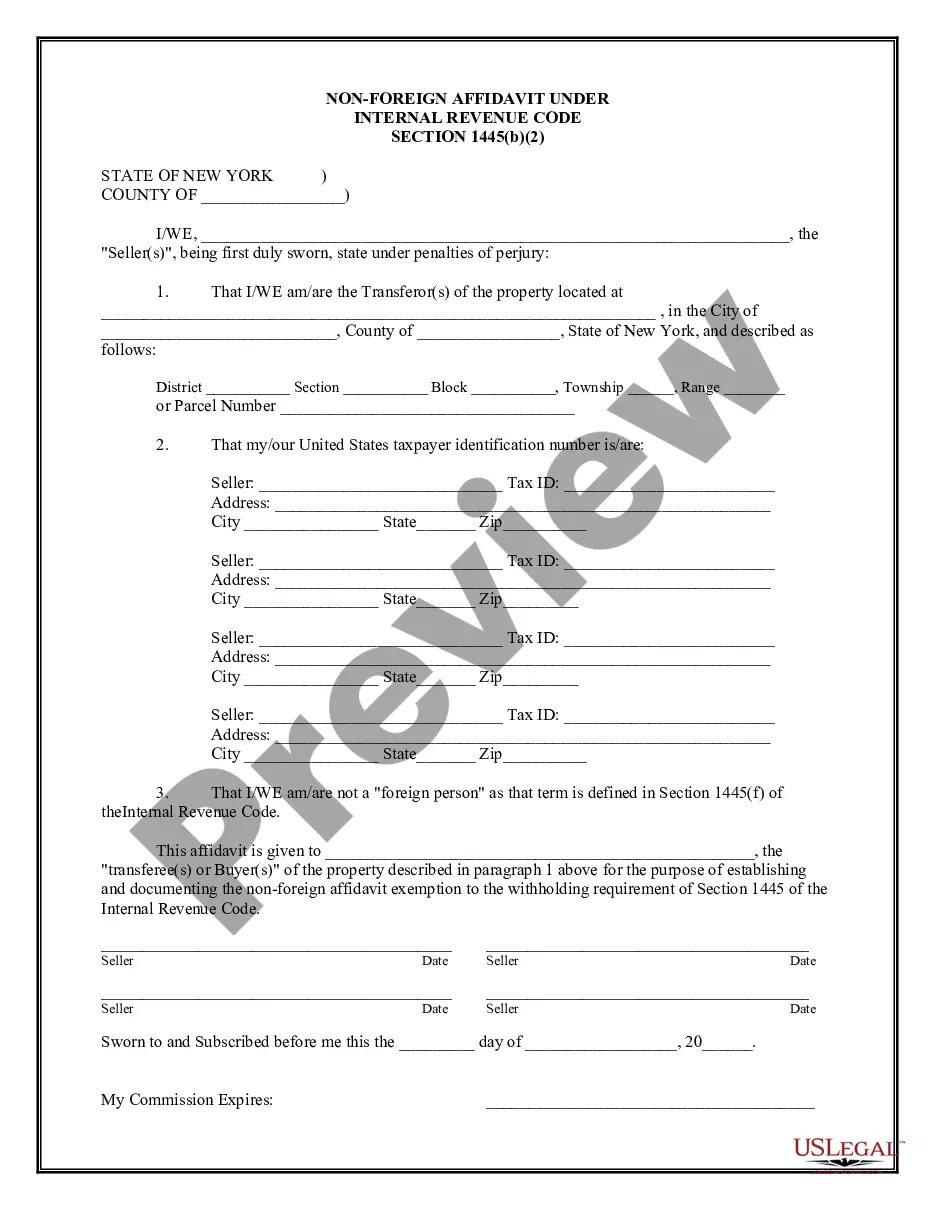

Firpta Affidavit Ny Withholding

Description

How to fill out New York Non-Foreign Affidavit Under IRC 1445?

The Firpta Affidavit Ny Withholding displayed on this page is a reusable legal template crafted by experienced attorneys in line with federal and local statutes.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific documents for any professional and personal situation. It’s the quickest, easiest, and most reliable method to acquire the documentation you require, as the service ensures the utmost level of data protection and anti-malware security.

Subscribe to US Legal Forms to have authenticated legal templates for all of life's situations available at your fingertips.

- Search for the document you require and examine it. Browse through the file you searched for and preview it or review the form description to verify it meets your needs. If it doesn’t, utilize the search feature to find the suitable one. Click Buy Now once you have found the template you need.

- Register and Log In. Choose the pricing option that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and review your subscription to continue.

- Acquire the fillable template. Select the format you desire for your Firpta Affidavit Ny Withholding (PDF, Word, RTF) and save the file on your device.

- Fill out and sign the documentation. Print the template to complete it by hand. Alternatively, use an online versatile PDF editor to swiftly and accurately fill in and sign your form with a valid signature.

- Redownload your documentation as needed. Use the same document again whenever required. Access the My documents section in your profile to redownload any previously saved documents.

Form popularity

FAQ

To obtain a copy of your federal tax ID certificate, you can contact the IRS directly or visit their website for guidance. You may need to provide specific information to verify your identity and confirm your request. For additional support, USLegalForms offers resources that can help you through this process efficiently.

Yes, it is possible to reclaim FIRPTA withholding if it exceeds your tax liability. To do this, you must file a U.S. tax return, reporting your actual gain or loss from the sale. If you find yourself in this situation, USLegalForms can assist you in preparing the necessary documentation to facilitate the refund process.

To secure a FIRPTA withholding certificate, submit IRS Form 8288-B along with supporting documentation to the IRS. This form outlines your request for reduced withholding based on specific qualifications. You can streamline this process by using USLegalForms, which provides comprehensive resources and guidance tailored to your needs.

Typically, the withholding agent files the FIRPTA certificate on behalf of the seller. In most cases, the buyer is designated as the withholding agent responsible for ensuring that the appropriate withholding tax is submitted to the IRS. By understanding this process, you can manage your responsibilities as a buyer or seller more effectively.

To obtain a withholding certificate, you must file IRS Form 8288-B with the Internal Revenue Service. This form requires detailed information about the transaction and the seller’s eligibility for a reduced withholding rate. By utilizing the services of USLegalForms, you can easily navigate this process and ensure that your application is completed correctly.

The withholding certificate is a crucial document that allows sellers of U.S. real estate to reduce or eliminate FIRPTA withholding. This certificate verifies that the seller qualifies for a lower withholding rate based on their circumstances. Essentially, it helps ensure that only the necessary amount is withheld, making the process fairer for sellers.

Filling out a NY withholding form involves gathering your personal information, details about the property being sold, and any applicable exemptions. Make sure to include the correct amounts for the sale and the withholding tax. When dealing with FIRPTA affidavit NY withholding, it’s crucial to provide accurate information to avoid delays or penalties. You may find it helpful to use USLegalForms for step-by-step guidance in completing these forms.

Yes, a FIRPTA affidavit is generally required when a foreign person sells real estate in the United States. This affidavit helps to certify the seller's foreign status and determine the appropriate withholding tax. By completing the FIRPTA affidavit NY withholding, you assist in ensuring compliance with tax regulations. It's advisable to consult resources like USLegalForms for accurate information on this requirement.

To file FIRPTA withholding, you must first complete the necessary forms, including the FIRPTA affidavit and the withholding certificate application. Submit these forms to the IRS along with your payment for the withholding amount. It's important to ensure that you follow the specific guidelines provided for FIRPTA affidavit NY withholding, as they can vary by state. For ease and accuracy, consider utilizing platforms like USLegalForms that provide guidance on this process.