What Is A Release Of Lien

Description

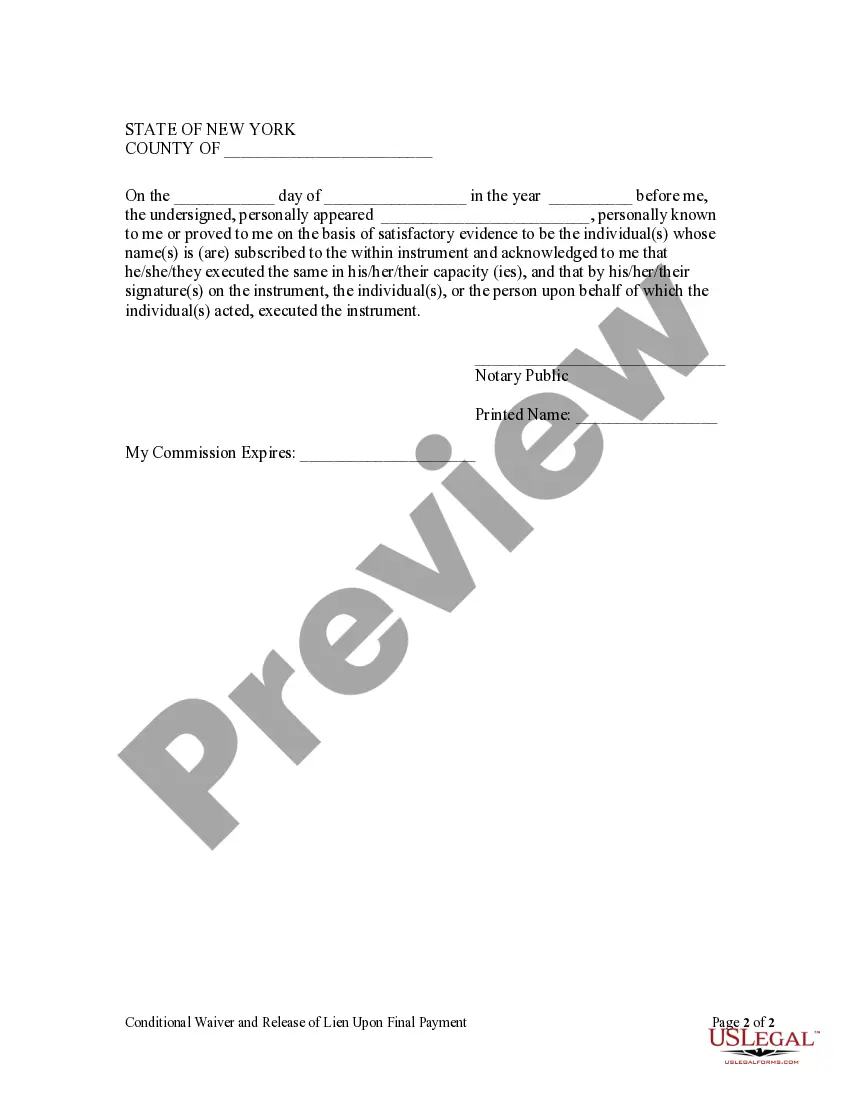

How to fill out New York Conditional Waiver And Release Of Lien Upon Final Payment?

- If you're a returning user, log in to your account. Ensure your subscription is active to access the download options.

- For new users, begin by exploring our vast library. Check the Preview mode to understand the form's details and ensure it meets your jurisdiction's standards.

- If the chosen form doesn’t meet your needs, utilize the Search tab to find another suitable template.

- Once satisfied with your selection, click on the Buy Now button and select a subscription plan that fits your requirements. You will need to register for an account to access our extensive library.

- Complete your purchase by providing your payment details, either via credit card or PayPal.

- Finally, download the completed form to your device. You can also access it anytime under the My Forms section of your account.

US Legal Forms offers a comprehensive and user-friendly library with over 85,000 easily editable legal documents, making the form retrieval process efficient. Our service empowers both individuals and legal professionals to effectively navigate their legal documentation needs.

In summary, understanding a release of lien and utilizing US Legal Forms can greatly streamline your legal paperwork. Don’t hesitate to explore our options and simplify your legal journey—get started today!

Form popularity

FAQ

Someone may need a lien release to move forward with transactions such as selling or refinancing property. A lien release assures prospective buyers or lenders that there are no existing financial encumbrances on the asset. Having a clear title with a lien release can facilitate smoother business dealings and enhance trust. Thus, understanding what is a release of lien is essential for any property owner.

Typically, it is the responsibility of the creditor to file a lien release once the debt is fulfilled. However, borrowers can also ensure that a lien release is filed to protect their interests. Promptly managing lien releases is essential for maintaining clear title to property and preventing future legal complications. Understanding what is a release of lien empowers both borrowers and lenders in this process.

A lien is a legal right or interest that a lender has in a borrower's property, granted until the debt obligation is satisfied. This allows creditors to secure their loans by holding a claim over assets. Understanding the full meaning of a lien helps individuals realize the implications of borrowing and the importance of lien releases. Knowing what is a release of lien is crucial for protecting your ownership rights.

You can acquire a lien release paper by contacting the creditor or the IRS to request the formal release document. Be prepared to provide proof that the obligations associated with the lien have been met. Gaining insight into what a release of lien signifies is necessary for managing your debt effectively. Engaging with platforms like uslegalforms can offer you templates and guidance for this process.

To obtain a lien release letter, you must first ensure that the underlying debt has been settled. After that, you can request the release letter from the creditor or the IRS, depending on who placed the lien. Knowing what a release of lien means will assist you in understanding why this letter is essential for your records. A systematic approach can simplify this process.

You can look up a lien on the IRS by using their online services or by accessing your account through the IRS website. They usually provide a tax account transcript that reflects liens against your property. Familiarizing yourself with what a release of lien is can help clarify the implications of any existing liens. If needed, you can also seek assistance from professionals or services like uslegalforms to streamline the process.

To get an IRS lock-in letter release, you may need to contact the IRS directly to discuss your specific case. The lock-in letter is typically issued under certain circumstances, and resolving it may require additional documentation from you. Understanding what a release of lien entails can help you navigate through the process effectively. The IRS provides various resources for guidance in these matters.

You can verify a lien release by checking the public records in your county's recorder's office or on the IRS's website. They maintain a record of all filed liens, allowing you to confirm if a lien has been officially released. Being aware of what a release of lien means is vital in evaluating your financial landscape. This verification can reassure you that the debt has been resolved.

To secure a copy of a lien release from the IRS, you'll need to contact them directly. You can request it by calling their customer service or through their online services. Alternatively, submitting Form 4506 will help you obtain records of your lien and understand what a release of lien represents. This step is essential for accurately documenting your financial status.

To obtain proof of an IRS lien release, you can request a copy of the lien release document from the IRS. This document shows that the IRS has released their claim against your property. You can typically get this through Form 4506-T, which allows you to request transcripts directly from the IRS. Understanding what a release of lien entails is crucial to ensuring your financial freedom.