Warning Letter To Tenant For Property Damage

Description

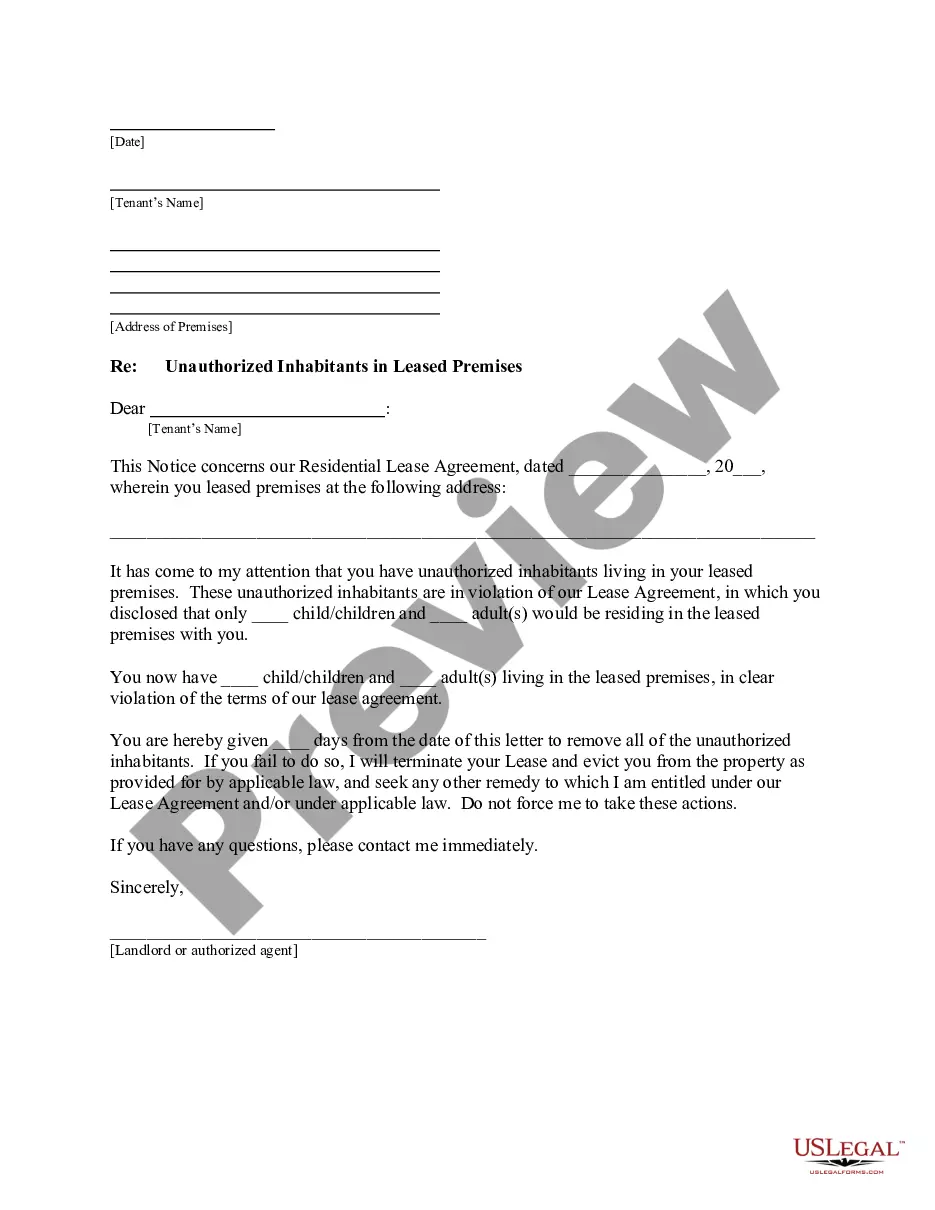

How to fill out New York Letter From Landlord To Tenant As Notice To Remove Unauthorized Inhabitants?

Whether for commercial objectives or for personal issues, everyone must handle legal circumstances at some stage in their life.

Filling out legal paperwork requires meticulous focus, starting with selecting the suitable form template.

With an extensive US Legal Forms collection available, you do not need to waste time searching for the right template online. Utilize the library’s straightforward navigation to find the proper form for any circumstance.

- Locate the template you need by using the search bar or catalog browsing.

- Review the form’s description to confirm it suits your case, state, and area.

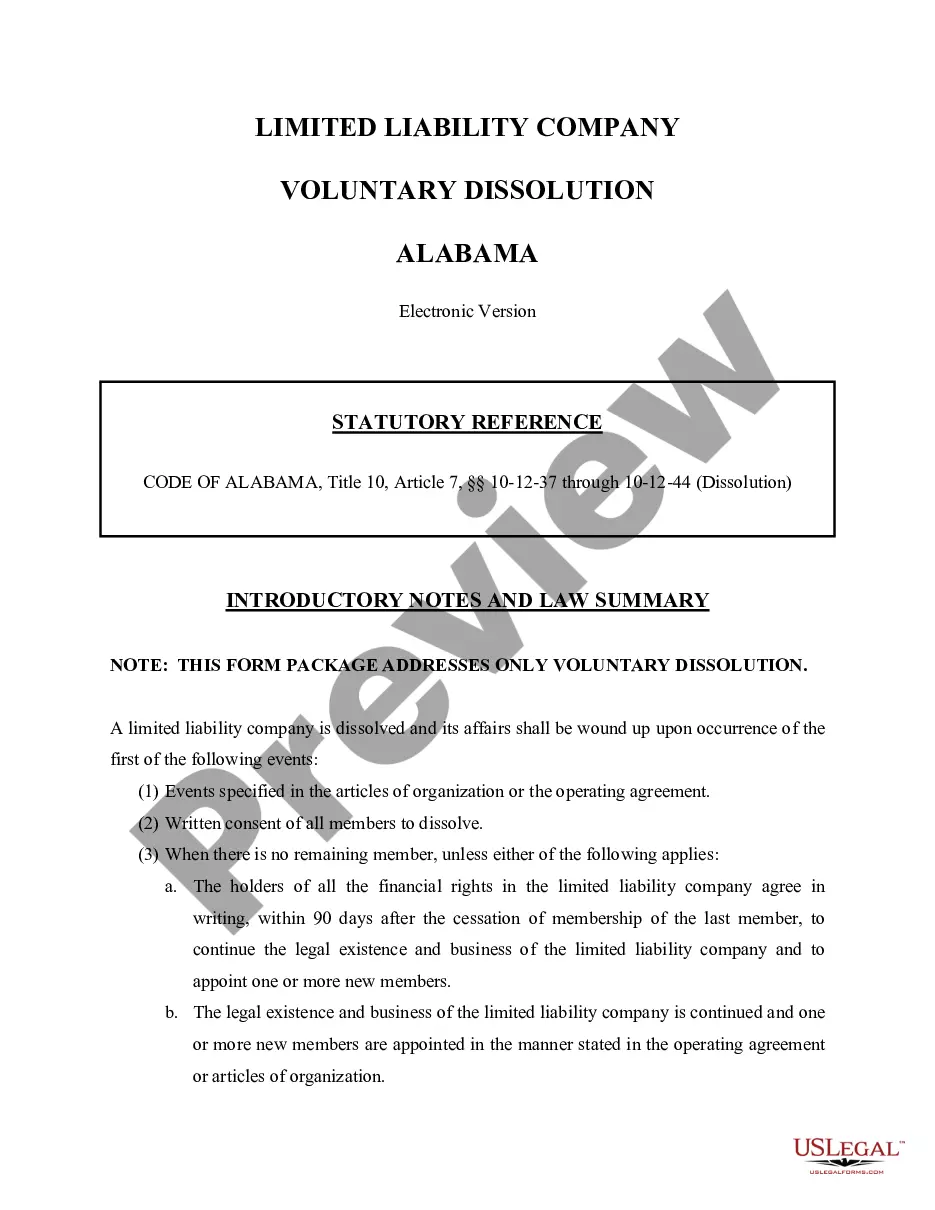

- Click on the preview of the form to view it.

- If it is not the correct form, return to the search function to find the Warning Letter To Tenant For Property Damage sample you need.

- Download the template if it aligns with your requirements.

- If you have a US Legal Forms account, simply click Log in to retrieve previously saved templates in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you desire and download the Warning Letter To Tenant For Property Damage.

- Once saved, you can fill out the form using editing software or print it out and complete it by hand.

Form popularity

FAQ

There are also no fees involved with forming or maintaining this business type. If you want to operate an Oklahoma sole proprietorship, all you need to do is start working. However, just because it's so easy to get started doesn't mean there aren't some additional steps you should take along the way.

If you are forming an LLC, partnership, non-profit, etc., you must file your business with the Oklahoma Secretary of State. As a registered business, you can legally sell goods or services in Oklahoma.

Filing for a DBA allows the company to register their secondary name with the state and makes the name a fully legal name for operating purposes. A business is not required to register a DBA in Oklahoma. However, doing so will secure the business' exclusive right to use a name within the state.

You don't have to register your Sole Proprietorship with the Oklahoma Secretary of State. It simply exists once you decide to start a business and engage in business activities. However, if your Sole Proprietorship will use a DBA (aka Fictitious Name), then that needs to be filed with the Oklahoma Secretary of State.

In the case of a sole proprietorship, you declare your profit and loss on Schedule C of Form 1040. But, to file Schedule C, you'll have to qualify first. The conditions to qualify are: Your goal is to engage in business activity for income and profit.

In Oklahoma, there is no general license required to start or own a business. However, for specific types of businesses and occupations, licenses, permits, or special registrations and filings may be required before opening or operating.

Though no action is required to legally create a sole proprietorship, you should follow four simple steps to start your business: Choose a business name. File a trade name with the Secretary of State (SOS). Apply for licenses, permits, and zoning clearance.