New York Corporation New York With Song

Description

How to fill out New York Corporation New York With Song?

There’s no longer a justification to squander hours looking for legal documents to meet your local state obligations. US Legal Forms has consolidated all of them in one location and made their accessibility easier.

Our website provides over 85k templates for any business and personal legal situations organized by state and area of application. All forms are expertly prepared and verified for accuracy, so you can be confident in receiving a current New York Corporation New York With Song.

If you are acquainted with our platform and already possess an account, you must ensure your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also access all obtained documents at any time needed by navigating to the My documents tab in your profile.

Print your form to complete it manually or upload the sample if you prefer to use an online editor. Preparing official documents under federal and state laws and regulations is swift and simple with our platform. Try out US Legal Forms today to keep your paperwork organized!

- If you've never utilized our platform before, the process will involve a few additional steps to finish.

- Here’s how new users can find the New York Corporation New York With Song in our collection.

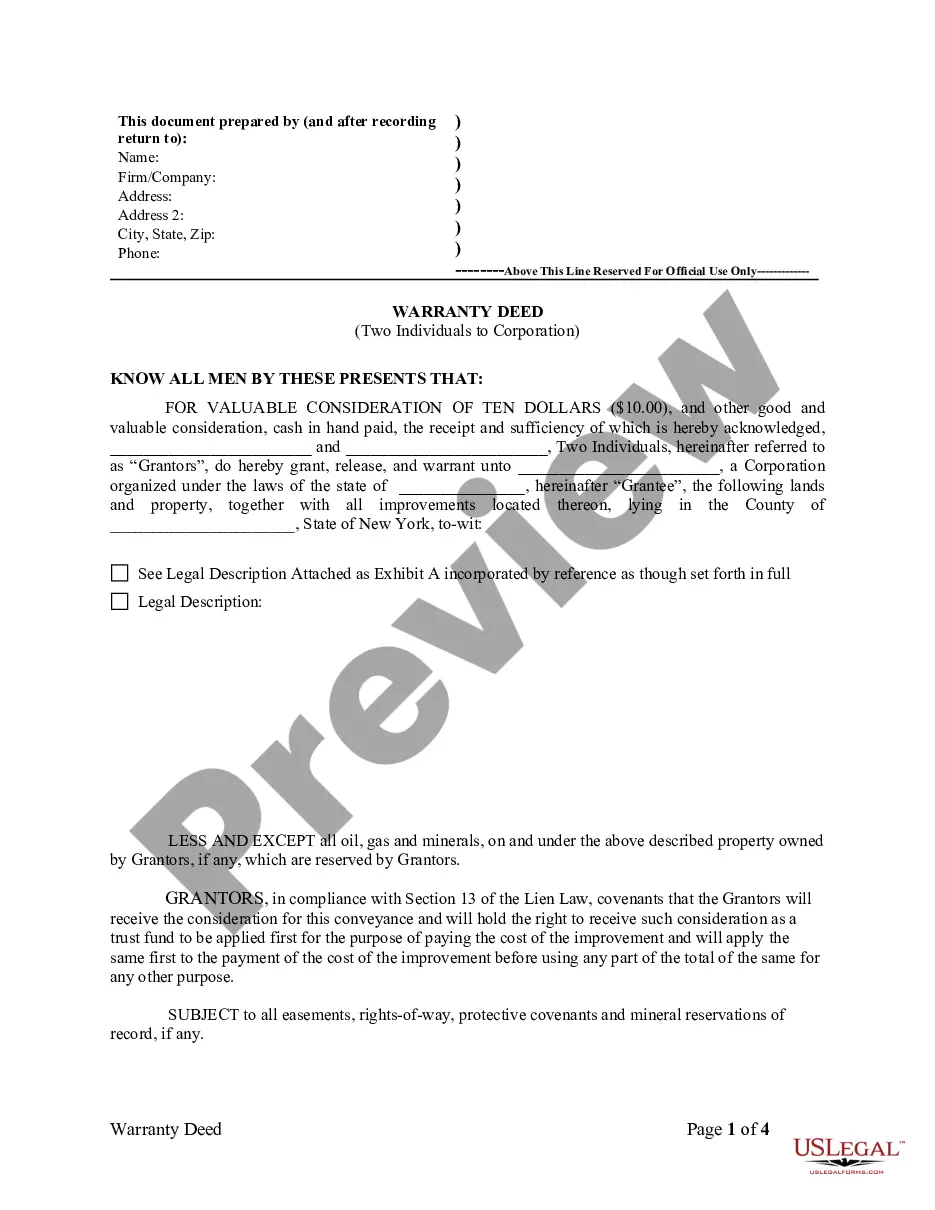

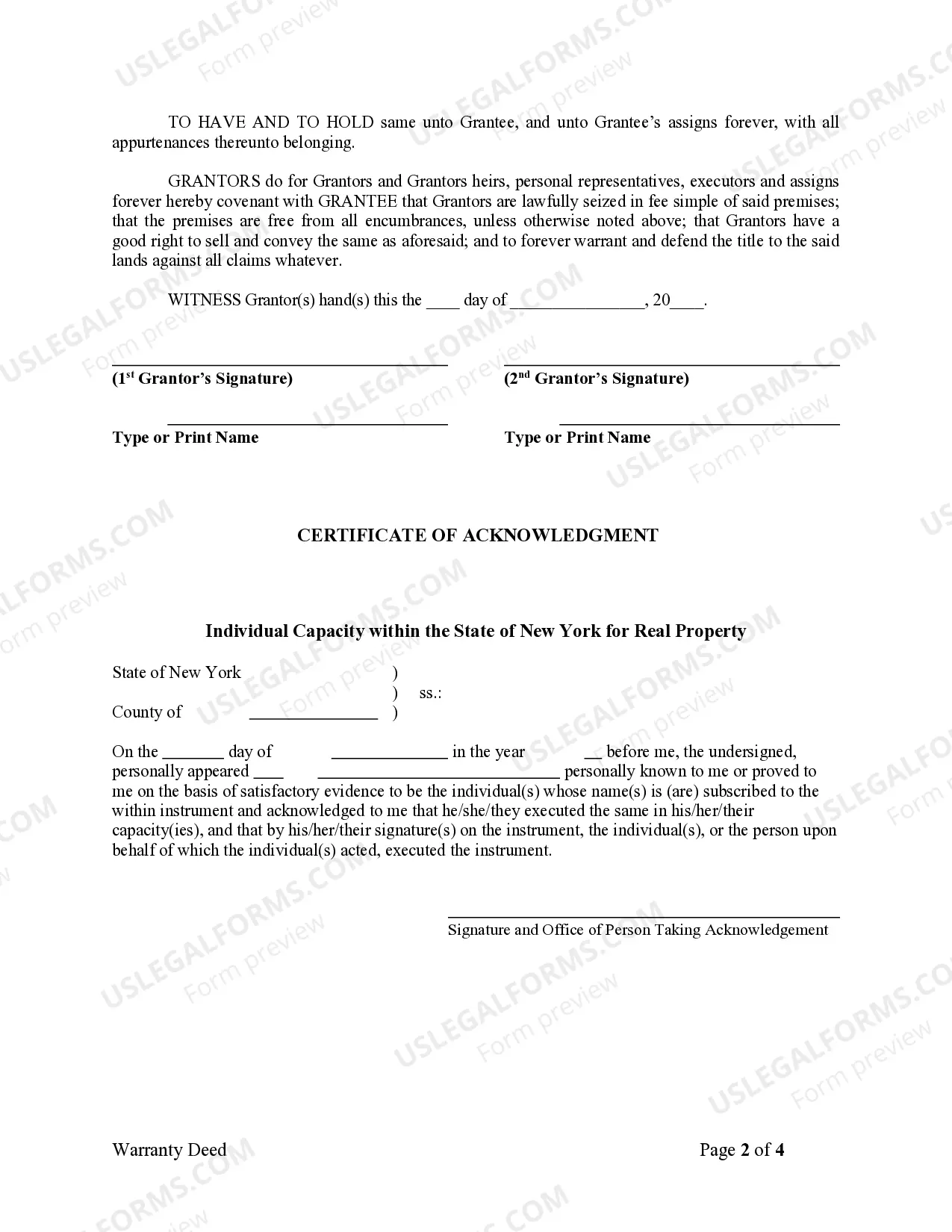

- Carefully examine the page content to confirm it has the example you need.

- To do this, use the form description and preview options if available.

- Use the Search field above to look for another example if the previous one doesn’t suit you.

- Click Buy Now next to the template title once you locate the correct one.

- Choose the most appropriate subscription plan and create an account or Log In.

- Pay for your subscription using a card or via PayPal to continue.

- Select the file format for your New York Corporation New York With Song and download it to your device.

Form popularity

FAQ

Yes, New York State imposes a corporate income tax, and if you run a New York corporation New York with song, you must adhere to this requirement. The tax rate varies depending on your corporation's income. Understanding these tax obligations helps your business plan better for expenses and promotes financial health.

To file for an S Corporation in New York, you must first form a traditional corporation with the New York Department of State. After that, submit IRS Form 2553 to elect S Corp status. Using platforms like uslegalforms can simplify this process, guiding you through the necessary paperwork and compliance steps.

Most corporations, including those classified under New York corporation New York with song, must file a tax return annually. However, certain exceptions may apply, such as inactive corporations or those that do not meet specific revenue thresholds. It is best to verify your requirement to file by checking with a tax advisor.

If your corporation operates within the five boroughs, then you must file a New York City tax return. This applies to New York corporations doing business or having an office in the city. Familiarizing yourself with NYC tax laws can help you stay compliant while maximizing your tax benefits.

Every New York corporation New York with song, including those based out of state but doing business in New York, is required to file a corporate tax return. This includes both for-profit and nonprofit entities. Ensure that your business meets its obligations by consulting with a tax professional for guidance.

Yes, if you operate a New York corporation New York with song, filing a corporate tax return is essential. It ensures compliance with New York State tax regulations and avoids potential penalties. By submitting your tax return, you contribute to the funding of state services which ultimately benefit your business.

Failing to file a biennial statement in New York can lead to administrative dissolution of your corporation. This means your New York corporation New York with song may lose its legal status, impacting your ability to operate. Additionally, there may be penalties that accrue over time. Ensure that you're up-to-date with these filings to prevent any disruptions and explore solutions with USLegalForms.

While not always required, a certificate of status in New York can support your corporation's operations. It acts as evidence of your New York corporation New York with song maintaining good standing. This document is particularly useful for securing loans or contracts. It’s advisable to have this on hand for enhancing your corporation's credibility.

Yes, New York operates under a certificate of need (CON) program, primarily for healthcare facilities. This requirement helps regulate healthcare services and ensures the community's needs are met. If your New York corporation New York with song is involved in healthcare, understanding the CON process is crucial. For assistance with navigating these regulations, consider exploring resources on USLegalForms.

A New York certificate of authority is essential for any business entity that plans to conduct business in New York but is incorporated in another state. If your corporation is a New York corporation New York with song, you don't need this certificate. However, if you plan to operate outside of your home state, obtaining this certificate allows you to legally transact business in New York.