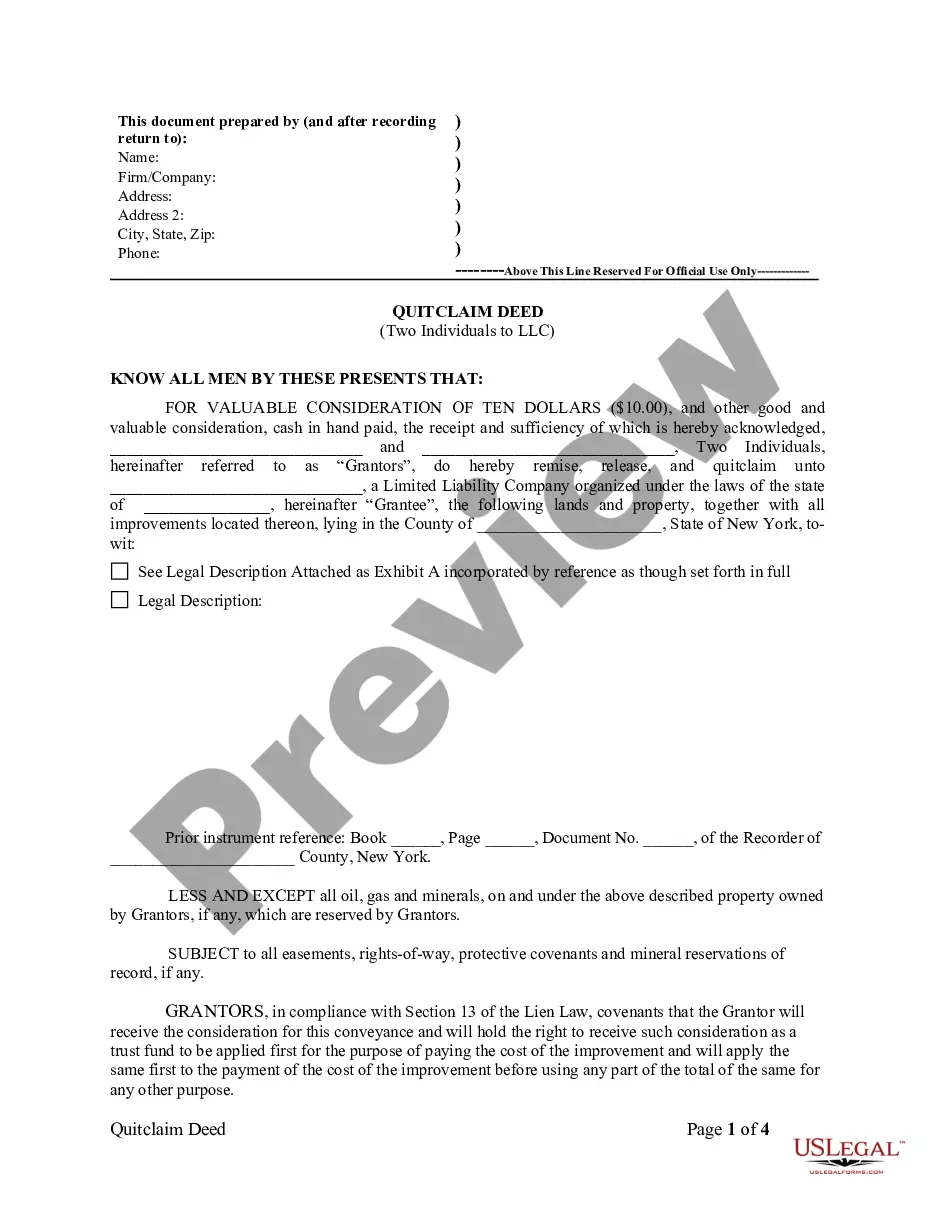

Limited Liability Company With Example

Description

How to fill out New York Quitclaim Deed By Two Individuals To LLC?

- If you're already a member, log in and access your account to download your required form template.

- If this is your first visit, start by searching for the desired document using the search bar and carefully review the description to ensure it meets your jurisdiction’s requirements.

- Once you find the correct document, select the 'Buy Now' option and choose a subscription plan that fits your needs.

- Complete your purchase by providing payment information via credit card or PayPal.

- After purchasing, download your template and save it to your device for easy access.

In conclusion, US Legal Forms simplifies the process of obtaining necessary legal documents. Their extensive library and access to premium expertise ensure that you can create legally sound and tailored forms efficiently.

Visit US Legal Forms today to get started on your LLC documentation!

Form popularity

FAQ

Yes, you can establish a limited liability company alone, as an individual member. This is known as a single-member LLC, which provides personal liability protection while allowing complete control over the business. This structure offers flexibility and simplicity, making it ideal for solo entrepreneurs. With uSlegalForms, you can easily navigate the setup process to create your limited liability company with example efficiently.

Creating a limited liability company is a straightforward process. First, you need to choose a unique name for your LLC that complies with your state’s regulations. After that, file the necessary paperwork with your state, which typically includes Articles of Organization. You can use uSlegalForms to access templates and guidance, ensuring your limited liability company with example aligns with your state's requirements.

Yes, forming a limited liability company before launching your business is often a smart move. An LLC can protect your personal assets from business liabilities, which is crucial in today’s uncertain market. By utilizing platforms like uslegalforms, you can streamline the formation process to ensure you meet all necessary legal requirements.

Starting a limited liability company with example formation but taking no further action can lead to complications. You will still need to comply with state requirements, such as annual filings or fees, even if the business is inactive. If left unattended, your LLC could be dissolved after a certain period for not meeting these obligations.

Creating a limited liability company for your side hustle is a wise decision to protect your personal assets. An LLC provides a legal separation between yourself and your business, which minimizes your risk if things do not go as planned. Additionally, having an LLC can make your side hustle appear more professional to clients.

Yes, you can start a limited liability company with example purposes in mind, even if you do not have a functioning business. Forming an LLC establishes a legal entity that can protect your personal assets. However, it is important to consider that an LLC may incur certain fees and obligations, like state fees and annual reports, even without active business operations.

Various types of businesses use a limited liability company structure, including small startups, professional services, and family-owned businesses. The LLC setup is particularly appealing for entrepreneurs who want to limit personal liability while enjoying the simplicity of managing a pass-through tax entity. At US Legal Forms, you can find resources to help you establish your LLC and answer any questions you might have.

No, Amazon is not structured as a limited liability company. It is organized as a corporation, which provides different advantages like stock issuance for raising capital. In contrast, an LLC structure may be suitable for smaller businesses seeking personal liability protection, providing a flexible alternative.

No, Google is not an example of a limited liability company. Google operates as a corporation which allows for different operational capabilities compared to an LLC. A notable example of an LLC might include a small business that benefits from limited liability while maintaining straightforward tax options.

Google is a corporation, specifically a subsidiary of Alphabet Inc. This corporate structure allows greater flexibility in operations and the ability to access larger funding sources than a limited liability company. Thus, while an LLC provides personal asset protection, Google's corporate structure enables different strategic advantages in the business landscape.