Affidavit Of Heirship New York Withholding

Description

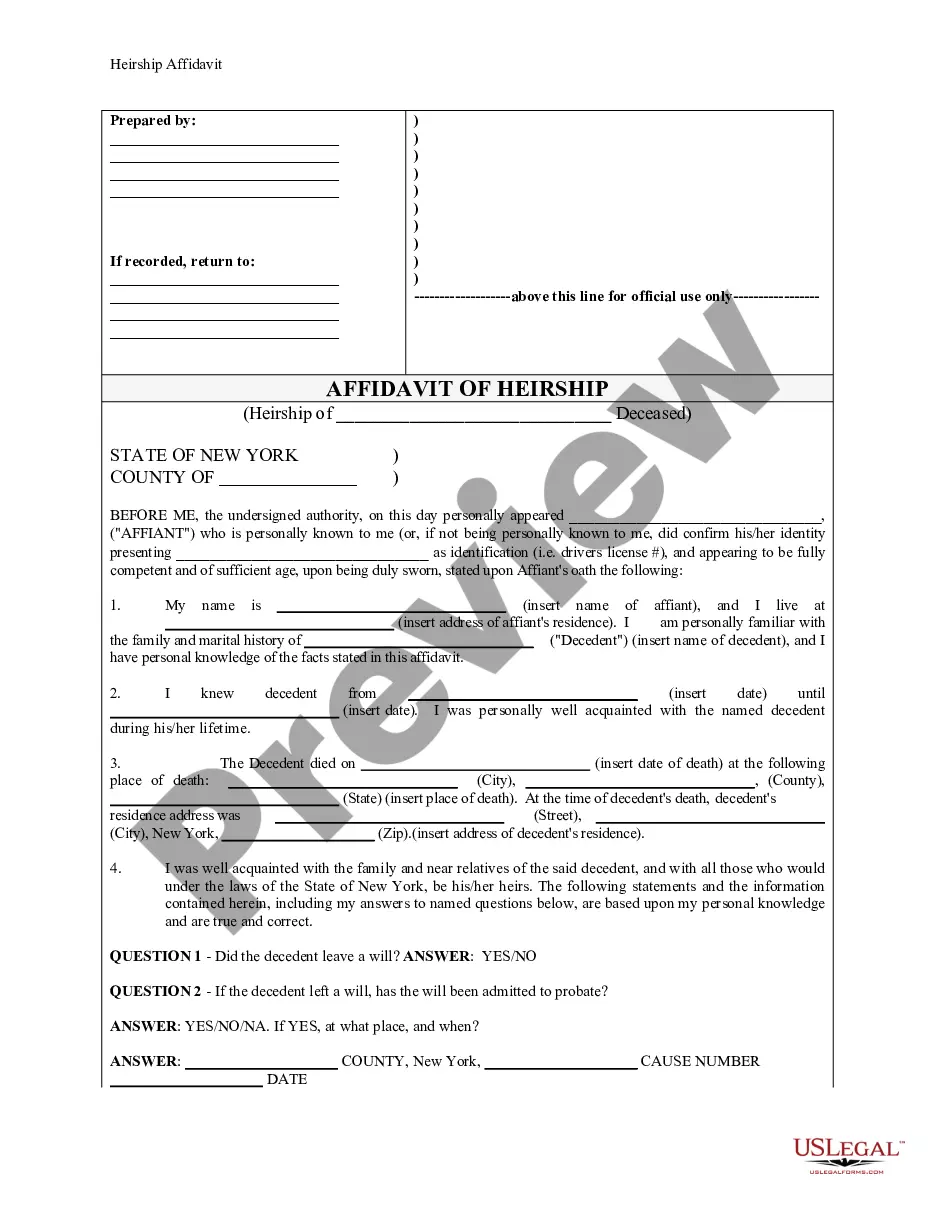

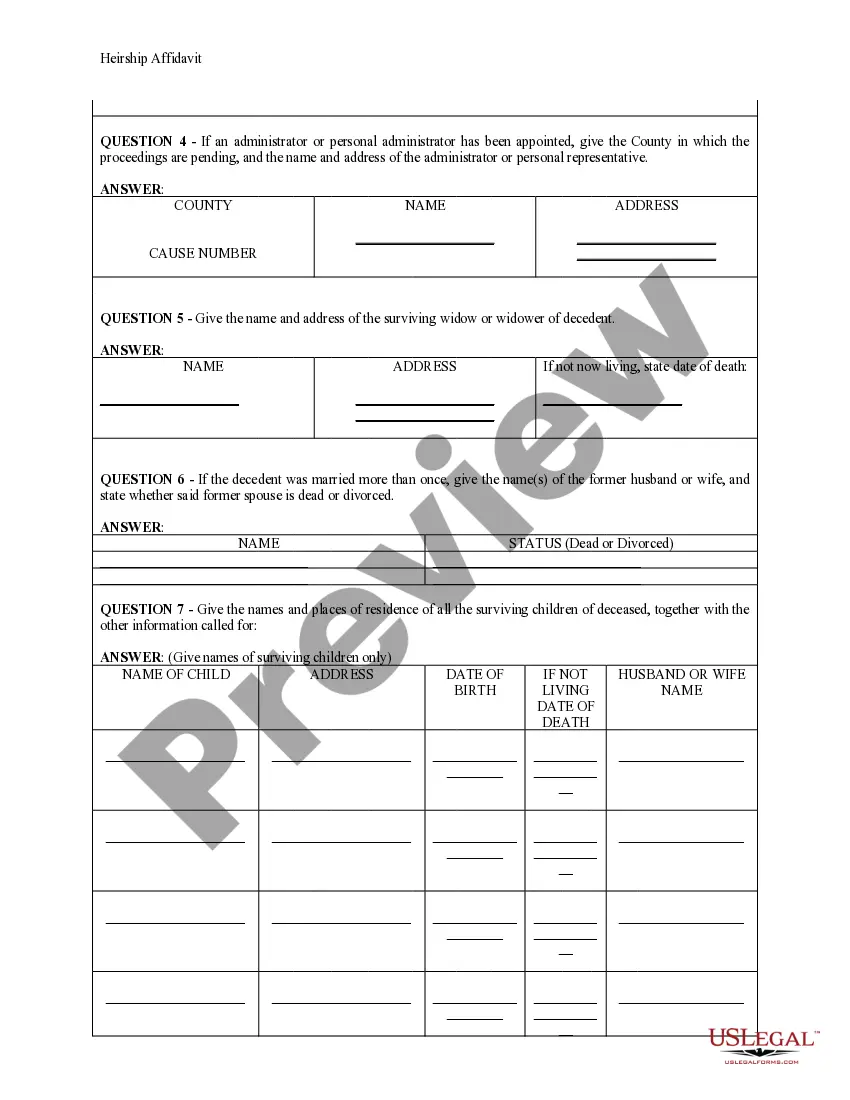

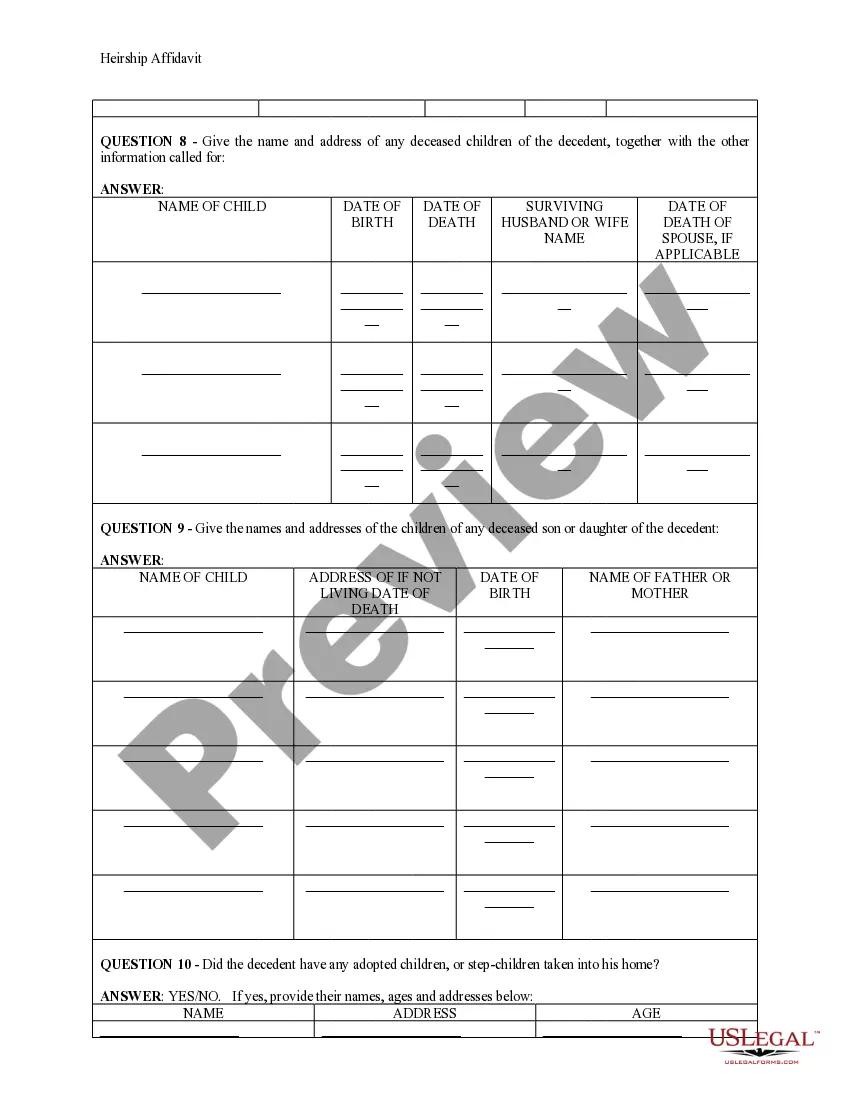

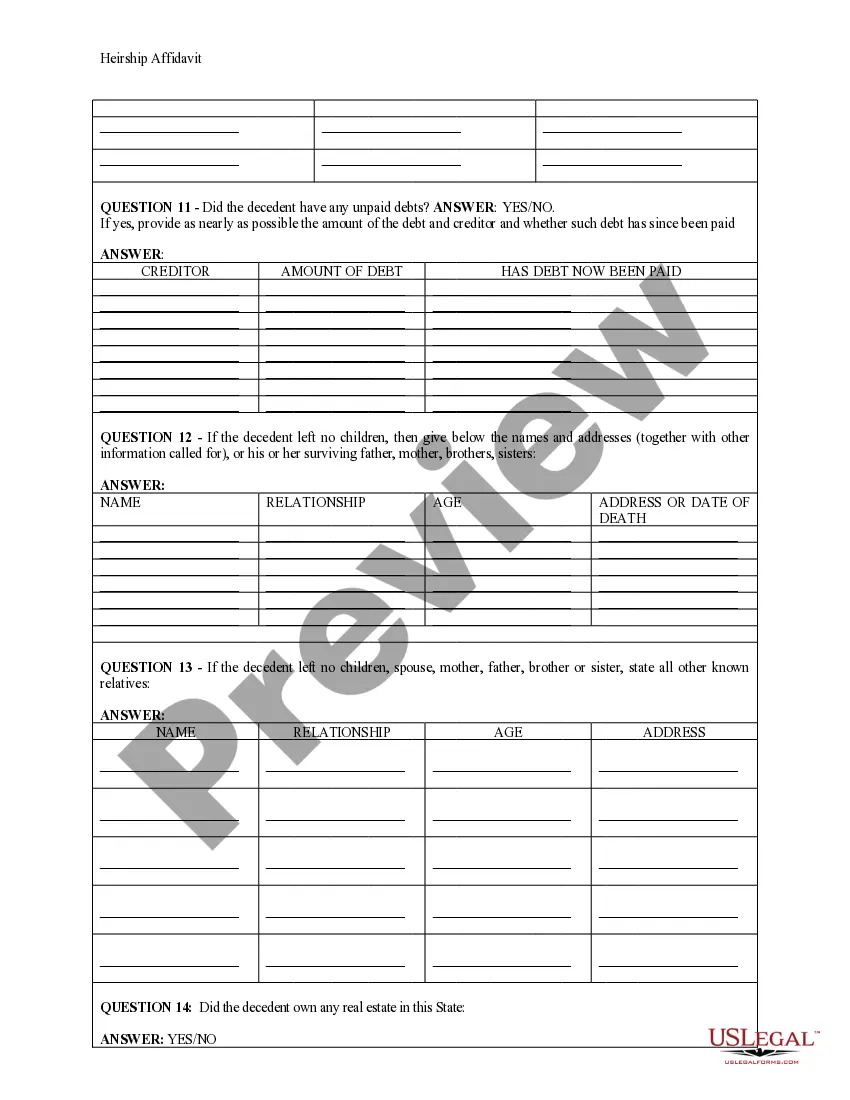

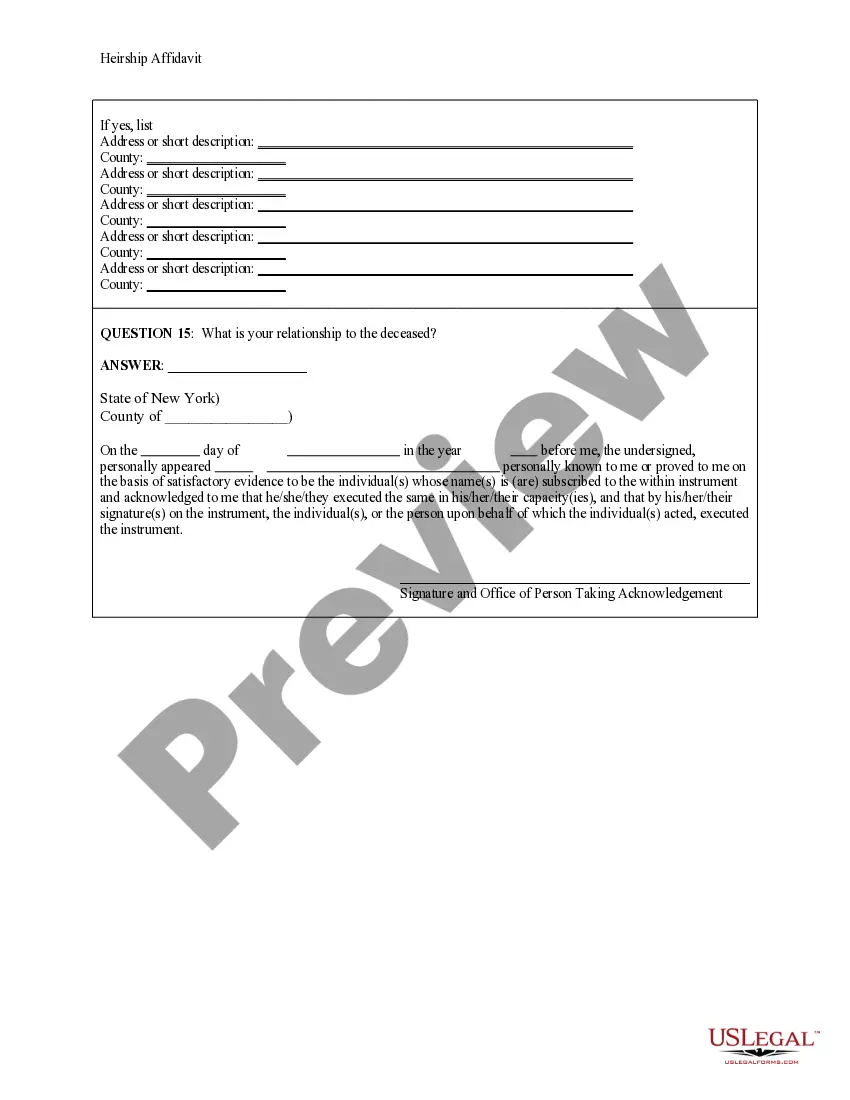

How to fill out New York Heirship Affidavit - Descent?

Drafting legal documents from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more affordable way of creating Affidavit Of Heirship New York Withholding or any other forms without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual library of more than 85,000 up-to-date legal documents covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-specific templates diligently put together for you by our legal specialists.

Use our platform whenever you need a trusted and reliable services through which you can easily find and download the Affidavit Of Heirship New York Withholding. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No problem. It takes little to no time to register it and navigate the library. But before jumping directly to downloading Affidavit Of Heirship New York Withholding, follow these tips:

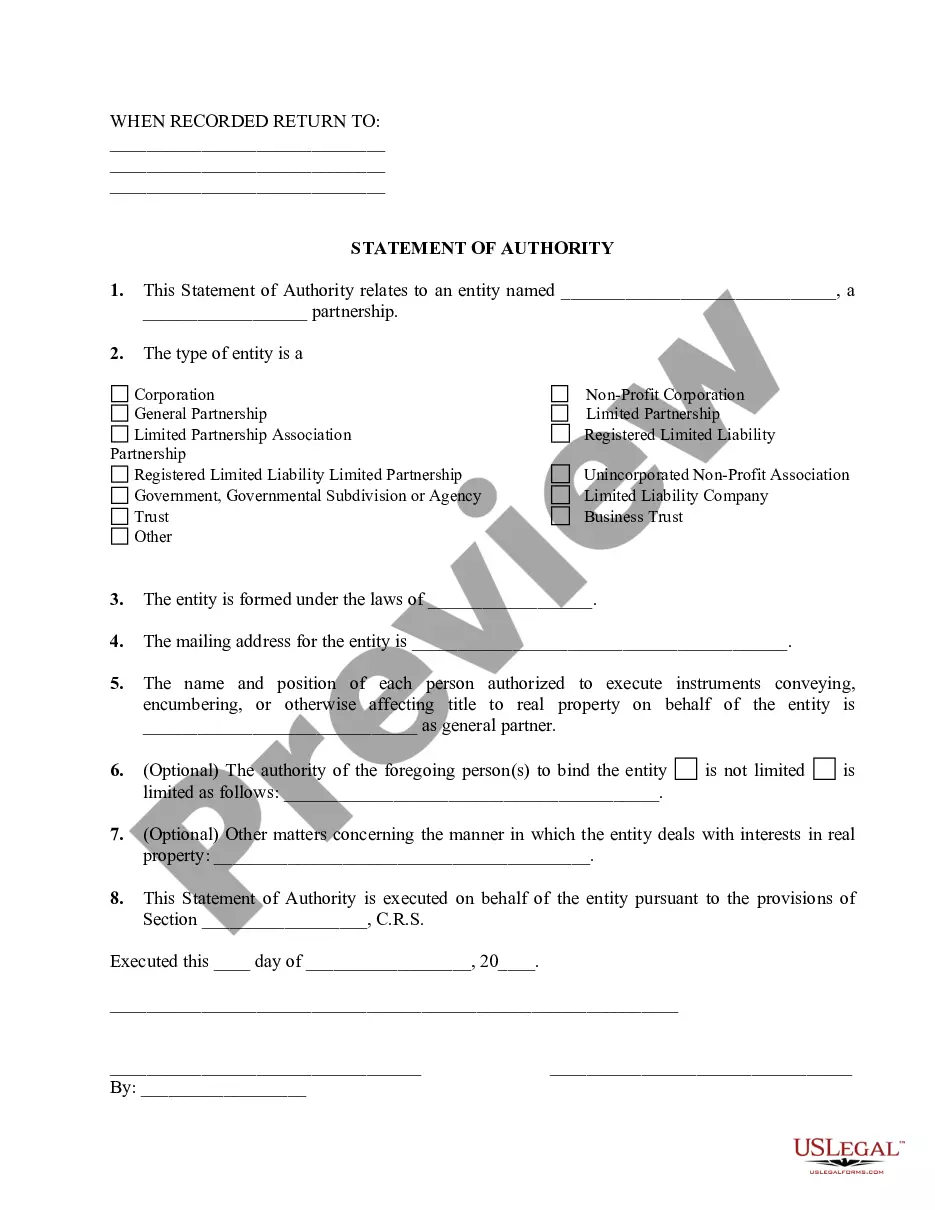

- Check the document preview and descriptions to ensure that you have found the document you are looking for.

- Check if form you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to purchase the Affidavit Of Heirship New York Withholding.

- Download the file. Then complete, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us now and transform document completion into something easy and streamlined!

Form popularity

FAQ

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

How to Fill Out Affidavit of Heirship | PDFRUN - YouTube YouTube Start of suggested clip End of suggested clip Read the clause above the signature. Lines. Once you have understood this clause. And have confirmedMoreRead the clause above the signature. Lines. Once you have understood this clause. And have confirmed the information contained in this affidavit. You may sign it a fix your signature.

The form is fairly straightforward and requires the following information: Name, address, and date of death of the decedent. Whether the deceased person was ever married. Names of the surviving heirs. Statement that the deceased did not leave a will. Statement that you are an heir under your state intestacy law.

The affidavit must be signed by a disinterested person, meaning someone who has no financial interest in the estate's assets. Family members who stand to gain or lose something of value by omitting the name of another possible heir are barred from signing the affidavit of heirship.