Foreclosure For Not Paying Property Taxes

Description

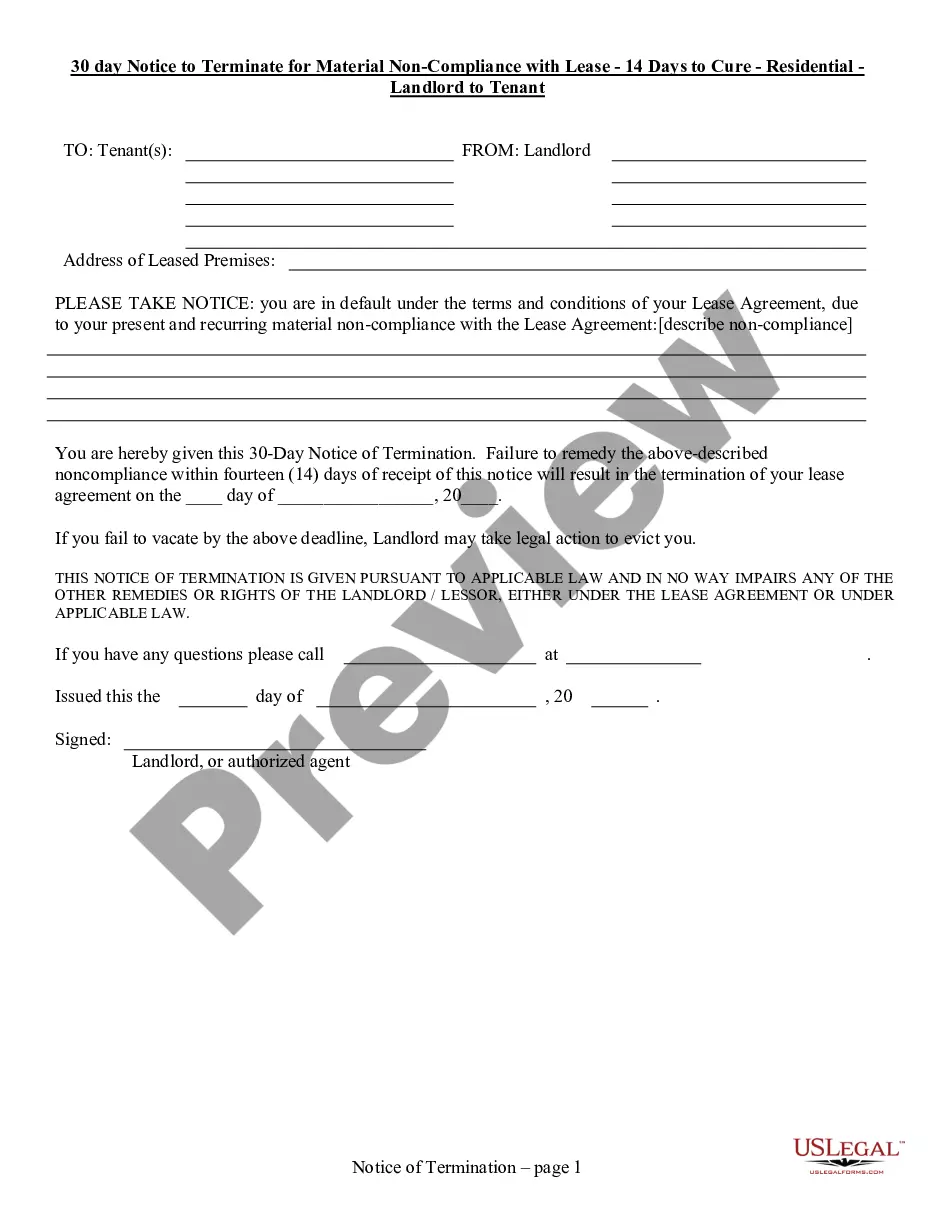

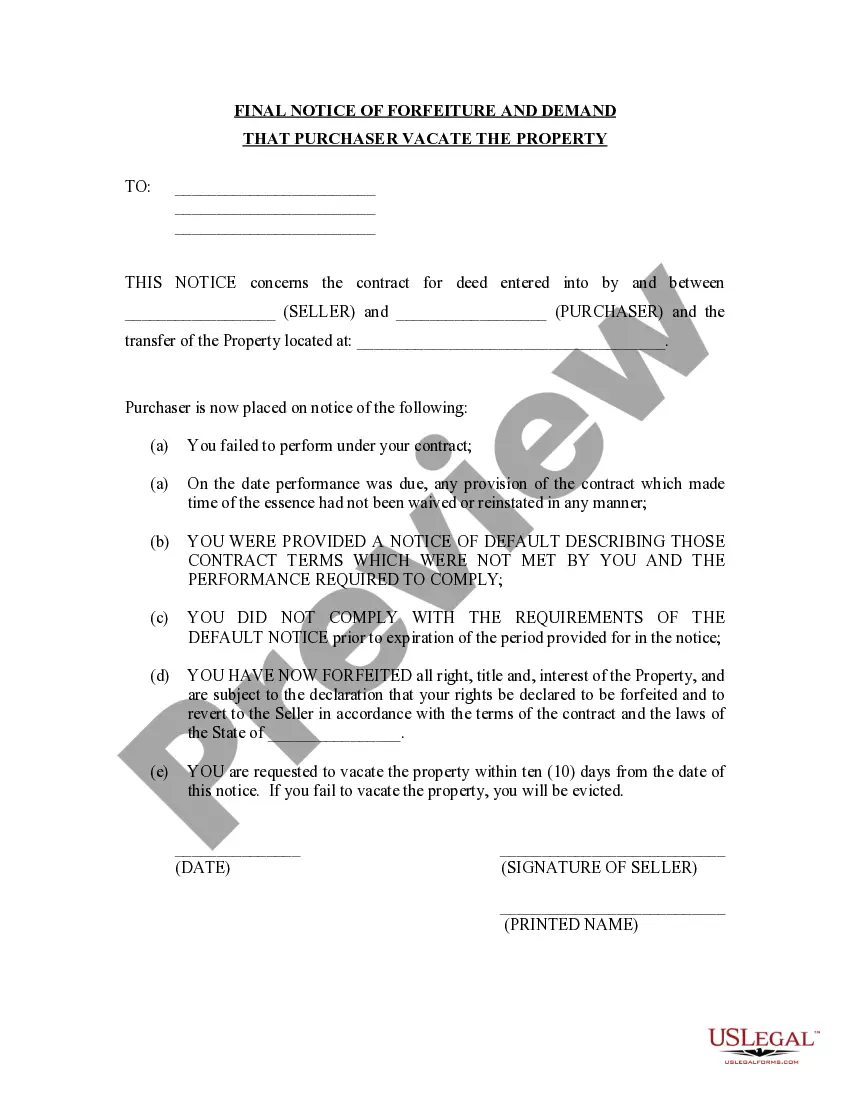

How to fill out New York Referee's Deed In Foreclosure?

- Log in to your US Legal Forms account. If it's your first time, create an account to access the document library.

- Review the form description available in the Preview mode to ensure it matches your requirements and complies with local jurisdiction.

- If necessary, use the Search tab to find alternative form templates that better suit your needs.

- Select your desired document by clicking on the Buy Now button and choose a subscription plan that fits your needs.

- Complete your purchase by providing your payment details via credit card or PayPal.

- Download the form to your device and store it securely. You can also access it anytime from the My Forms menu.

US Legal Forms provides a robust collection of legal documents, offering more forms than many competitors at a comparable price point. With over 85,000 editable templates, users can easily navigate legal complexities.

With US Legal Forms, you can confidently manage your legal documents and ensure they're completed correctly. Don't wait; start your journey to legal clarity today!

Form popularity

FAQ

Yes, you may be able to take ownership of a property by paying back taxes. In many cases, individuals can acquire properties at tax auctions after clearing the delinquent taxes. However, it's important to conduct thorough research and understand the risks involved to ensure a smooth transition into property ownership.

In Colorado, property taxes can go unpaid for up to three years before a tax lien is placed on the property. After this period, the county may initiate foreclosure proceedings, which can result in losing ownership of the property. It's crucial to address unpaid taxes as soon as possible to mitigate the risk of foreclosure.

Paying property taxes helps fund essential local services, such as schools, roads, and emergency services. Moreover, keeping your taxes current prevents the risk of foreclosure for not paying property taxes. This proactive approach protects your investment and supports community resources.

A tax deed signifies that you have acquired property after paying off the back taxes owed on it. While this deed indicates your right to the property, it may not represent full ownership until all legal matters are resolved. Therefore, it is essential to understand the conditions of a tax deed and any associated rights.

Paying property taxes alone does not confer ownership. Ownership is primarily established through legal documents, such as the deed. However, being current on your property taxes strengthens your position as the owner in the eyes of the authorities.

Paying property tax can support your claim of ownership, but it does not serve as definitive proof. The ownership of property is typically established through the deed, which is the official document. Nonetheless, regularly paying property taxes demonstrates your responsibility and connection to the property.

A foreclosure for not paying property taxes can have significant implications for your taxes. It may result in the cancellation of debt income, which could be taxable. Additionally, losing your property may affect your ability to claim certain deductions in the future. Staying informed about these changes can assist you in managing your tax responsibilities more effectively.

When reporting a foreclosure for not paying property taxes on your tax return, you need to include any relevant forms, including the 1099 if you received one. This informs the IRS about the cancellation of debt and any taxable income you may have. It's beneficial to keep detailed records of the foreclosure process and any transactions related to it. Having proper documentation can simplify your filing and reduce complications.

In New York, the local government can begin foreclosure proceedings for unpaid property taxes after a delinquency of approximately one to three years. This varies by county, as each has its own policies regarding property tax enforcement. It’s crucial to address any potential tax issues promptly to avoid foreclosure for not paying property taxes. Being proactive can save you from severe financial consequences.

You may be able to write off certain costs related to foreclosure on your tax return, especially if you're facing foreclosure for not paying property taxes. However, this often depends on the specific circumstances of your financial situation. Consulting a tax professional can provide clarity on what expenses you can claim. This can significantly impact your overall tax burden.