Foreclosure

Description

How to fill out New York Referee's Deed In Foreclosure?

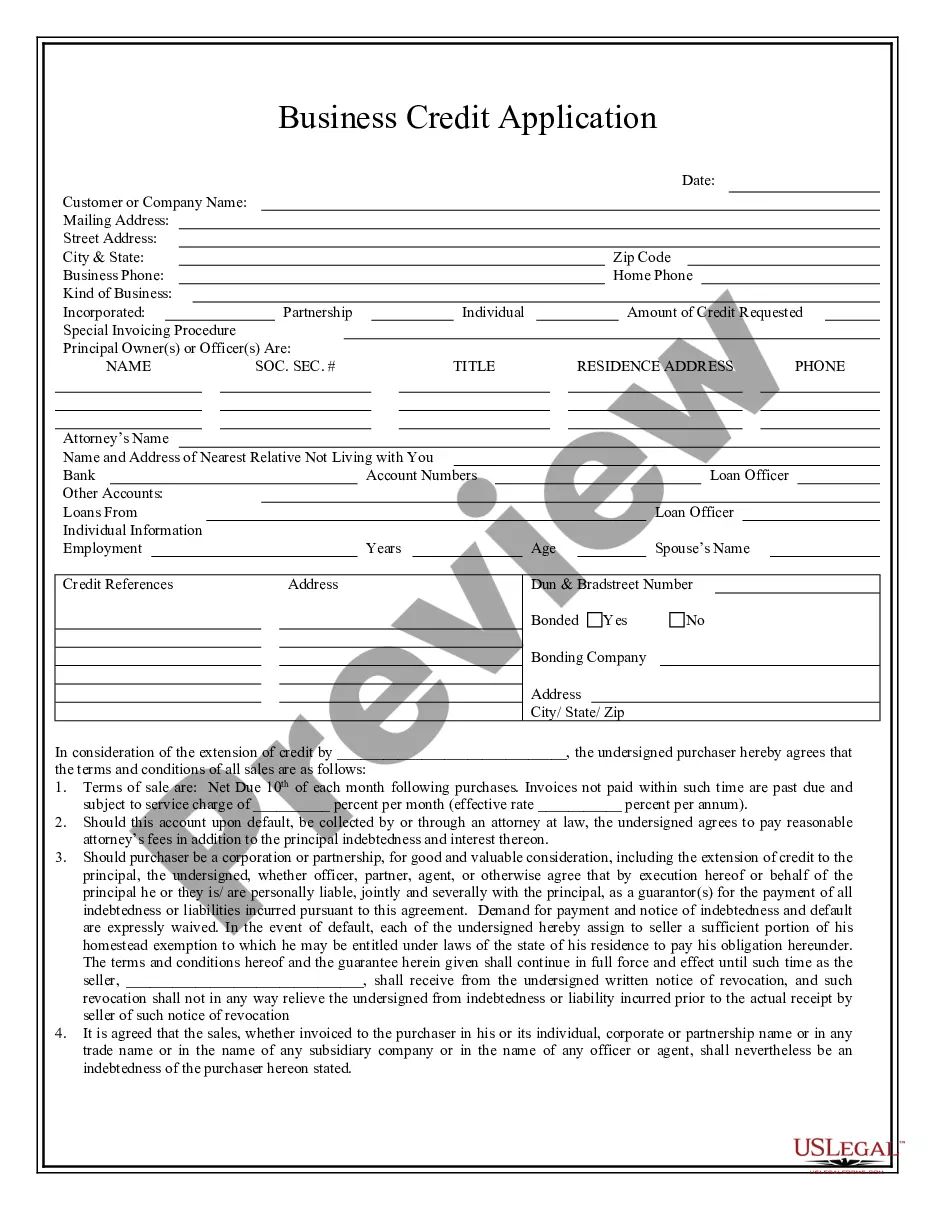

- Log in to your US Legal Forms account. If you're a new user, create an account to access the library.

- Review the preview mode and form description to ensure the document meets your needs and local requirements.

- Use the search feature to locate any additional forms you may need. Make sure all selected forms are accurate for your situation.

- Select the Buy Now option to purchase the documents. Choose a subscription plan that suits your needs.

- Complete your order by providing payment details through a credit card or PayPal.

- Download the completed document to your device and access it at any time from the My Forms section of your profile.

By using US Legal Forms, you not only gain instant access to a vast library of legal documents, but you also receive support from premium experts for any assistance required in form completion.

Take control of your legal needs today. Visit US Legal Forms and get started on your foreclosure documentation!

Form popularity

FAQ

A house can be foreclosed relatively quickly, often within a few months if the borrower fails to make payments. Factors such as state laws, whether the process is judicial or non-judicial, and the lender's practices influence the duration. Understanding these elements can help homeowners prepare for potential foreclosure and seek timely solutions.

The foreclosure process in Georgia is usually completed within 30 to 90 days. After the lender decides to pursue foreclosure, they must send a notice to the borrower and post public notices. Due to Georgia's non-judicial foreclosure process, the timeline is generally quicker than in other states. Knowing this timeline can help you prepare for the next steps in the process.

In Washington, the foreclosure process typically takes about four months to a year, depending on whether it follows a judicial or non-judicial process. Non-judicial foreclosures are usually faster and involve a few specific steps such as sending notices and conducting a public sale. Familiarizing yourself with these processes can save you time and confusion during the foreclosure period.

Acquiring a foreclosed home involves several steps, starting with researching available properties. Buyers can seek listings through real estate agents, bank websites, or online auction sites. Once you find a foreclosed property, you typically need to submit a bid and get financing lined up. Platforms like USLegalForms can help you navigate the necessary documentation and procedures.

In Florida, the foreclosure process can take anywhere from several months to over a year. The timeline often depends on whether the foreclosure is contested and the specific county rules. Generally, judicial foreclosure proceedings in Florida are slower than non-judicial processes. Understanding these timelines can help you prepare for potential outcomes.

Foreclosure begins when a homeowner fails to make mortgage payments. Typically, lenders require a specific number of missed payments before starting the foreclosure process. Each state may have varying laws regarding the timeframe and requirements for foreclosure, so it's important to understand your local regulations. Platforms like USLegalForms provide resources to guide you through these requirements.

A foreclosure can significantly impact your credit score, making it difficult to secure loans or favorable interest rates in the future. Additionally, it can create emotional stress and uncertainty about housing. Understanding the long-term effects of foreclosure empowers you to take steps to mitigate potential problems. Resources like US Legal Forms can provide you with the information you need to navigate this process effectively.

In Michigan, the foreclosure process usually takes around six months, but it can vary depending on the specific case. The timeline begins after the homeowner misses their first payment and continues through a series of legal steps. It’s essential to know that the process can be extended if the homeowner takes legal action. Being informed about foreclosure timelines can help you make better financial decisions.

Buying a foreclosed house can be a great opportunity, but it comes with potential risks. Often, these homes are priced lower than market value, making them attractive. However, they may require repairs or have underlying issues due to neglect. Always perform thorough inspections and consider how foreclosure can affect the home's overall value.

Foreclosure is the legal process where a lender takes ownership of a property when the homeowner fails to make mortgage payments. In simple terms, it means that the bank or lender repossesses the house. This process allows the lender to recover their investment by selling the home. Understanding foreclosure is important because it can affect your financial future.