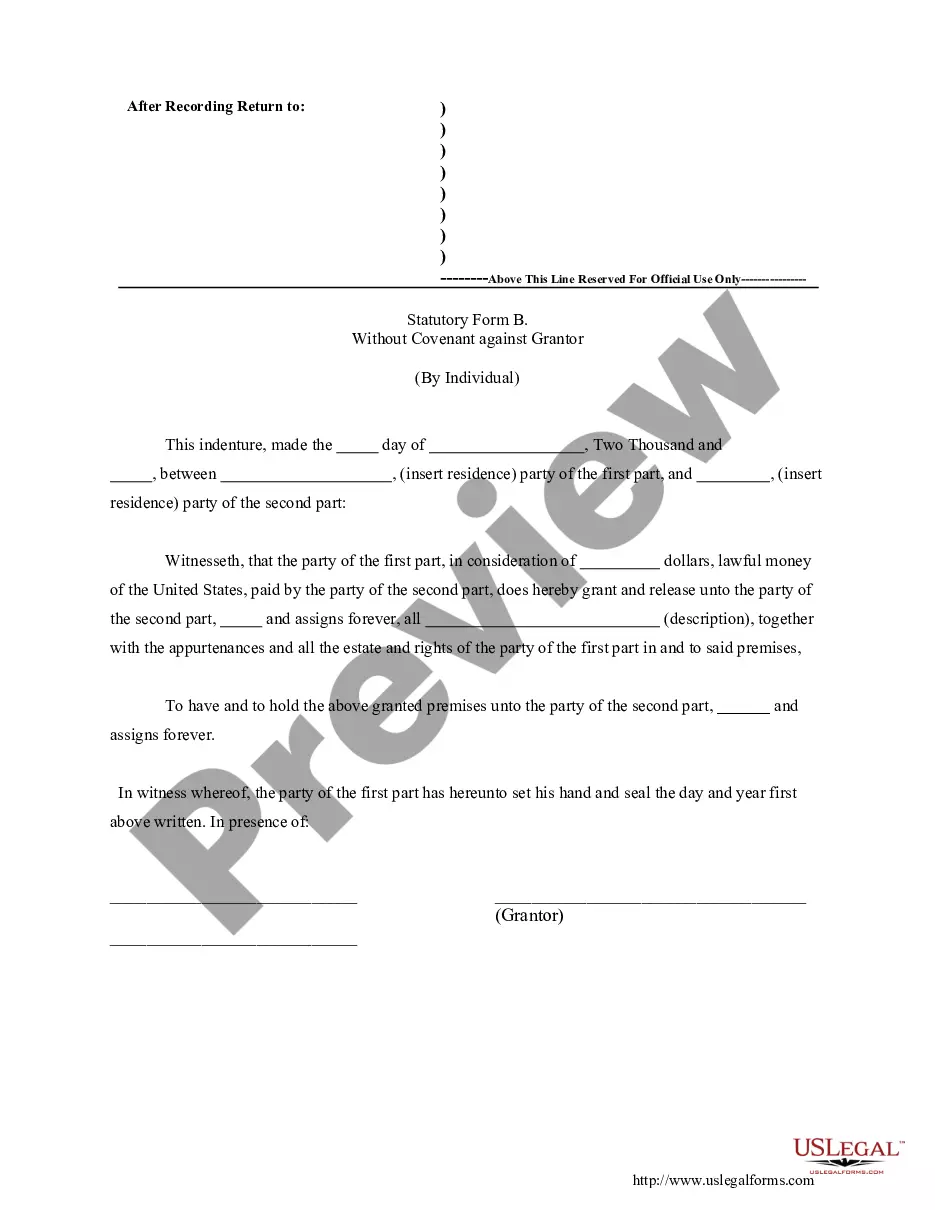

New York Form Application For Taxation And Finance

Description

How to fill out New York Form Application For Taxation And Finance?

Red tape necessitates exactness and correctness.

If you do not manage completing paperwork like the New York Form Application For Taxation And Finance on a daily basis, it can lead to some confusions.

Choosing the proper template from the outset will ensure that your document submission will proceed smoothly and avoid any hassles of re-sending a document or repeating the same task from the start.

If you are not a registered user, finding the required sample will involve a few additional steps.

- You can always find the appropriate template for your paperwork in US Legal Forms.

- US Legal Forms is the largest web-based forms repository, providing over 85 thousand samples across various fields.

- You can acquire the most recent and pertinent version of the New York Form Application For Taxation And Finance by simply searching for it on the platform.

- Locate, store, and retain templates in your profile or check the description to ensure you have the right one available.

- With a US Legal Forms account, you can conveniently obtain, keep in one location, and browse the templates you save for easy access in a few clicks.

- When on the website, click the Log In button for authorization.

- Then, go to the My documents page, where your document history is maintained.

- Review the description of the forms and save the ones you may need at any time.

Form popularity

FAQ

Federal tax forms are available on the IRS website, while state tax forms can be found on your state’s department of revenue website. For added convenience, consider the US Legal Forms platform, which consolidates access to both federal and state tax forms, including the New York form application for taxation and finance ensuring you have everything in one place.

To pick up paper IRS forms, visit your local IRS office or check with select public libraries. Keep in mind that the availability of forms may vary. You can also use the US Legal Forms platform to easily access and print the required paper IRS forms for your New York form application for taxation and finance.

You can get federal, state, and local tax forms from their respective government websites. The IRS site provides federal forms, while state taxation websites handle state forms. For a user-friendly experience, check out the US Legal Forms platform; it offers a complete suite of forms, including the New York form application for taxation and finance.

Yes, some post offices may carry a few tax forms, but the selection is usually limited. For comprehensive access, consider visiting the official IRS website. Additionally, the US Legal Forms platform is an excellent resource to find all necessary tax forms, including those needed for your New York form application for taxation and finance.

Typically, you will not find IRS tax forms at the post office. While some post offices might carry limited supplies, it’s more efficient to visit the IRS website for downloading the necessary forms. Using the US Legal Forms platform can also provide you with the required IRS forms and simplify your New York form application for taxation and finance.

To obtain New York state tax forms, you can visit the New York State Department of Taxation and Finance website. Here, you can download and print various forms directly. Alternatively, the US Legal Forms platform can streamline the process to ensure you have all the necessary New York form applications for taxation and finance.

You can pick up tax forms at various locations, including state and local tax offices, libraries, and some banks. For convenience, consider using the US Legal Forms platform, which provides easy access to the New York form application for taxation and finance. This way, you can fill out the necessary forms from the comfort of your home.

Applying for a New York State tax payment plan involves a straightforward process. First, you need to complete the online application on the New York State Tax Department's website or use the appropriate NYS form. After submitting your application, the department will review your request and inform you of the terms. Utilizing the New York form application for taxation and finance can streamline this process and help you stay on track with your payments.

To file your New York state tax return, you will generally need Form IT-201, the Resident Income Tax Return. This form is designed for individuals who meet the state’s residency requirements. If your situation is more complex, different forms may apply, but starting with the IT-201 is usually the best choice. You can find the necessary forms using the New York form application for taxation and finance to facilitate your filing.

To write a check for New York State income tax, start by filling out the payee line with 'New York State Tax Department.' Then, indicate the amount you owe and write the check date. It's essential to include your Social Security number or Employer Identification Number on the memo line, which helps the tax department correctly apply your payment. Consider using the New York form application for taxation and finance to ensure your payment is processed efficiently.