Life Estate

Description

How to fill out New York Enhanced Life Estate Or Lady Bird Warranty Deed From Individual To Two Individuals?

- Log in to your US Legal Forms account if you’re a returning user. Ensure your subscription remains active to proceed.

- For first-time users, start by previewing the form options available. Review the description to confirm it meets your legal needs.

- If you need a different document, use the search function to find alternative templates that match your criteria.

- Select the appropriate life estate document by clicking the 'Buy Now' button and choose the subscription plan that suits your requirements.

- Complete your purchase by entering your payment details or using your PayPal account for added convenience.

- Finally, download the form to your device and access it anytime from the 'My documents' section on your profile.

In conclusion, US Legal Forms simplifies the process of obtaining a life estate document with an extensive library and customer support. Be sure to utilize these resources to ensure a legally sound outcome.

Take the first step towards securing your life estate today by visiting US Legal Forms and exploring their offerings.

Form popularity

FAQ

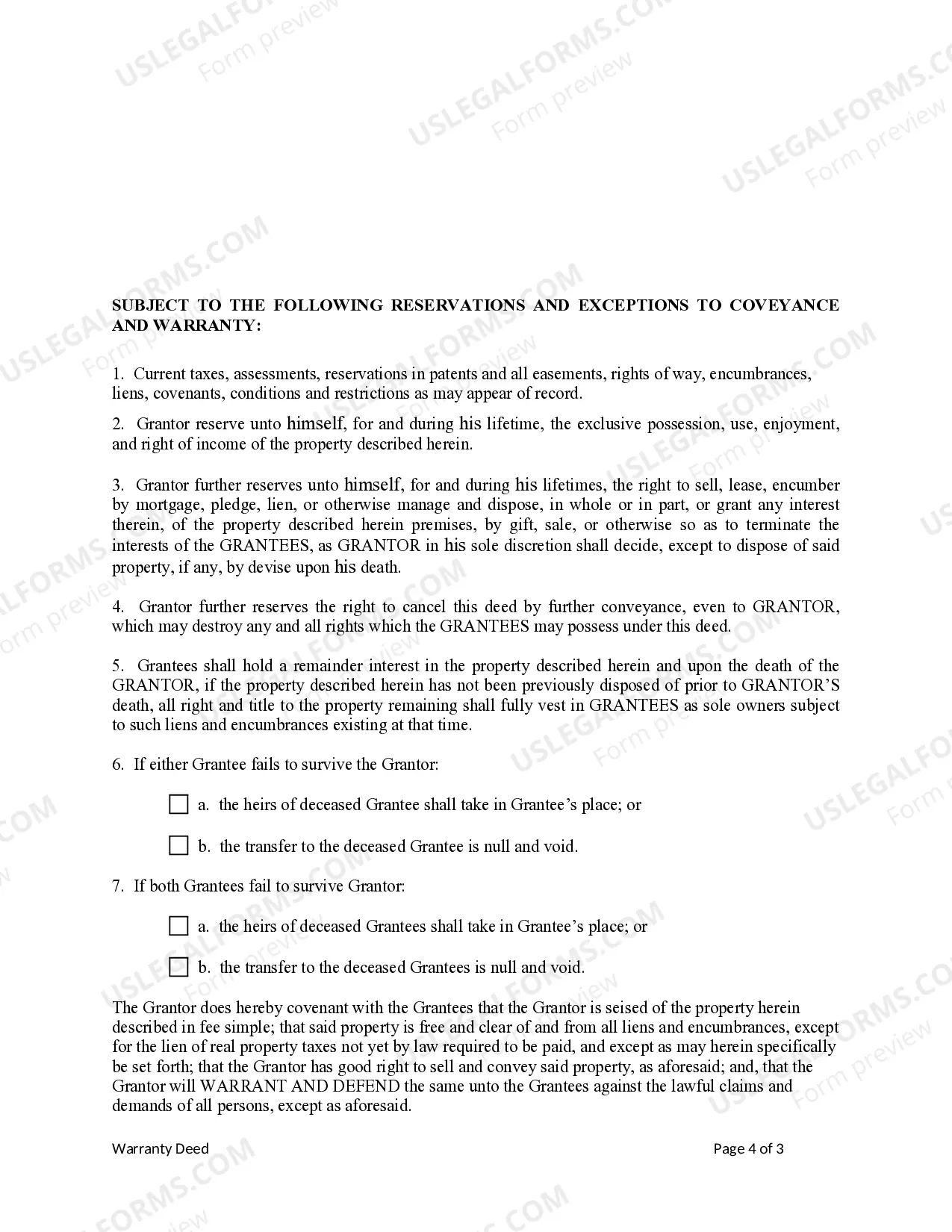

Having a life estate means that you have the right to occupy and use a property for your lifetime, but this right is tied to your life. Once you pass away, the property will transfer automatically to the designated beneficiary, known as the remainderman. This arrangement can provide peace of mind and ensures that your wishes regarding the property are honored after your death.

Generally, a will does not override a life estate because the life estate has its own terms that dictate the transfer of property after the life tenant's death. Even if a will specifies different beneficiaries, the property will still pass to the remainderman named in the life estate. Therefore, it is crucial to understand how a life estate works when making estate planning decisions.

One disadvantage of a life estate is that it limits the owner's ability to sell or mortgage the property without the consent of the remainderman. This can restrict financial flexibility, especially if unexpected expenses arise. Additionally, the life tenant may remain responsible for property taxes and maintenance, which can lead to additional financial burdens.

A life estate grants someone the right to use property for their lifetime, while a living trust holds assets for beneficiaries and allows for easier management of those assets during one's life and after death. Unlike a life estate, a living trust can include various types of property and investments. Furthermore, living trusts avoid probate and can provide more comprehensive control over asset distribution.

The purpose of a life estate is to allow a person to use and benefit from property during their lifetime, while ensuring that the property passes to a designated beneficiary after their death. This arrangement provides security for the occupant, as they can live in the property without fear of eviction. Additionally, it can simplify the transfer of assets, making estate planning more efficient.

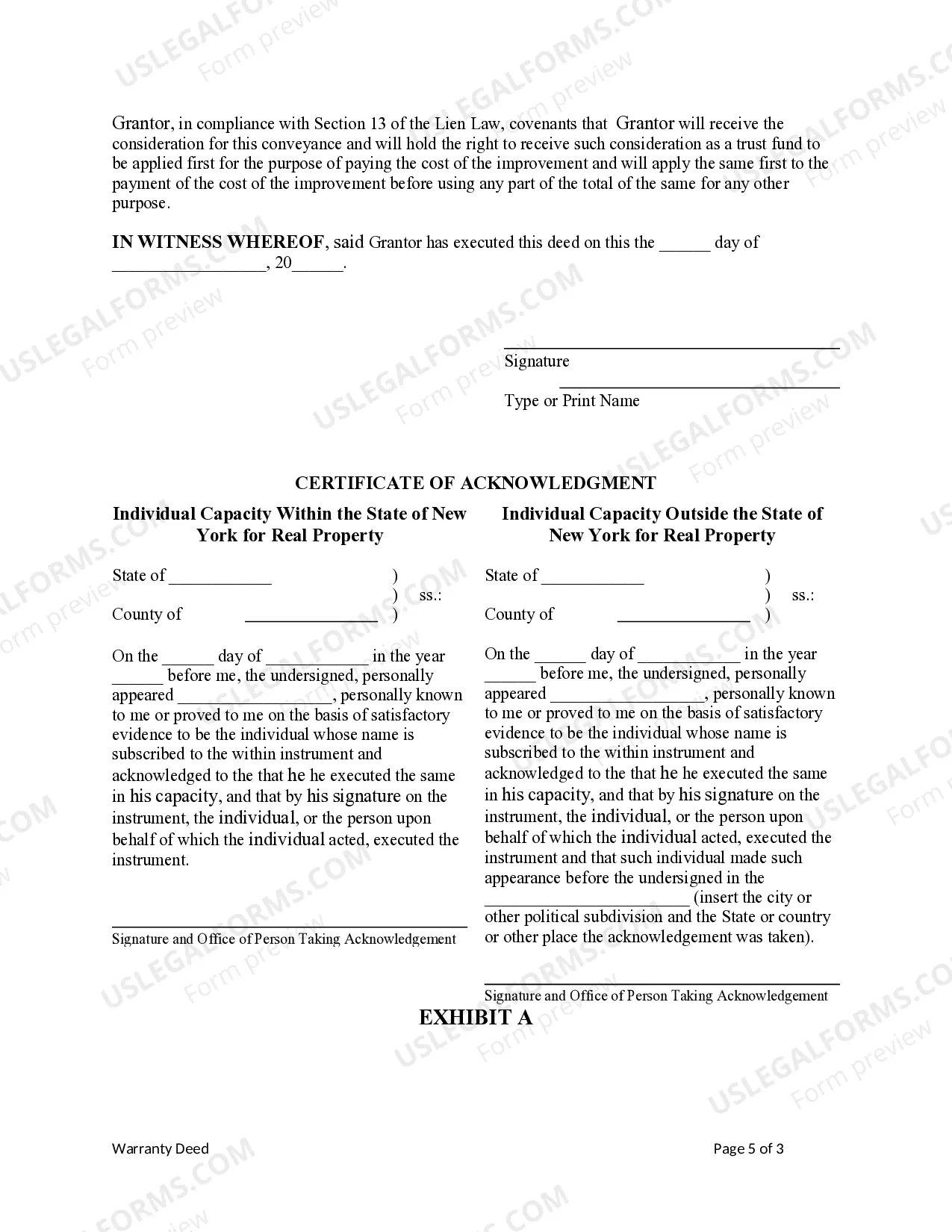

Claiming a life estate involves demonstrating your interest in a property during your lifetime. First, you should review any relevant legal documents that specify your rights. You may need to work with an attorney to confirm your claim and ensure it aligns with state laws. Using platforms like USLegalForms can streamline this process by providing customizable legal documents tailored to your situation.

To release a life estate, you need to execute a formal document, often called a deed of release. This document should clearly state your intent to relinquish your life estate rights. After preparing the deed, you must sign it and have it notarized. Finally, file the deed with the appropriate county office to ensure the release is recognized legally.

Giving someone a life estate involves legally transferring property to an individual while retaining the rights to occupy it until they pass away. This means the individual can live in the property and control it during their lifetime, but the property will eventually go to the designated remainderman. This type of arrangement promotes stability for the life tenant while also defining future ownership clearly. If you're considering this option, check out US Legal Forms for useful resources.

Leaving someone a life estate means granting them the right to use and occupy a property for their lifetime, after which ownership passes to another party. This legal arrangement protects the current user while also securing the future reevaluation of the property for the listed heirs. Life estates can be a thoughtful way to provide for a loved one while ensuring your wishes for the property's future are met. Utilizing US Legal Forms can help clarify these intentions in your estate planning.

A common example of a life estate could involve a parent transferring their home to their child while retaining the right to live there until their death. In this scenario, the parent maintains control and residence in the property during their lifetime, while the child becomes the remainderman. This arrangement illustrates how life estates can facilitate family wealth transfer while ensuring current living arrangements. Exploring examples of life estates helps clarify how they fit into your estate planning.