Estate Lady Bird With A Big Head

Description

How to fill out New York Enhanced Life Estate Or Lady Bird Warranty Deed From Individual To Two Individuals?

- If you are a returning user, log in to your account and check your subscription's status. Click the Download button to obtain the required form template for your device.

- For first-time users, start by browsing the form descriptions and preview mode. Ensure the document aligns perfectly with your specific jurisdiction needs.

- If you need additional templates, utilize the Search tab to find comprehensive alternatives. Choose the one that suits your requirements best.

- Proceed to purchase your selected document by clicking the Buy Now button. Select a subscription plan that fits your needs and create an account.

- Finalize your transaction by entering your payment information, either via credit card or PayPal.

- Once your purchase is complete, download the form to your device. You can also access it through the My Forms section of your profile at any time.

By following these steps, you ensure a seamless experience in obtaining your legal forms quickly and efficiently.

Start your journey with US Legal Forms today and enjoy the benefits of access to extensive legal resources at your fingertips.

Form popularity

FAQ

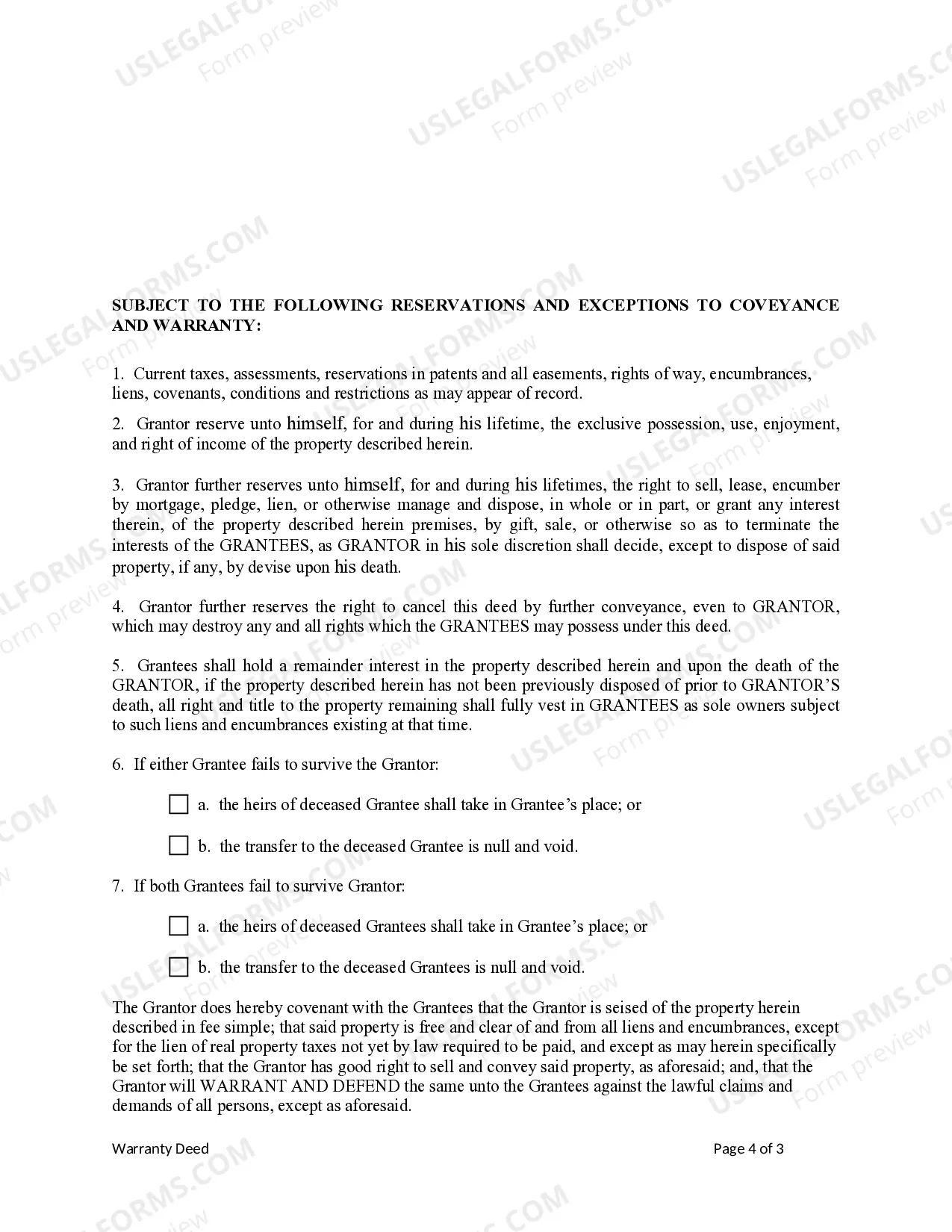

An estate lady bird with a big head can help avoid capital gains tax upon your death. When the property transfers to your heirs, they typically receive a 'step-up' in basis, minimizing potential tax liabilities. To navigate these complex issues, consider using platforms like uslegalforms, which provide resources and templates for creating ladybird deeds that suit your needs.

A ladybird deed does not necessarily trump a will, but it can create conflicts regarding property distribution. If you have a ladybird deed for your estate, it typically takes precedence over instructions in your will concerning that property. Therefore, it is essential to coordinate both documents to avoid disputes among heirs.

While an estate lady bird with a big head offers several benefits, it also has some drawbacks. For instance, if you need to sell the property, you must take steps to revoke the deed, which can complicate matters. Additionally, some states may not recognize ladybird deeds, leading to potential legal challenges.

The purpose of a ladybird deed is to transfer property to your heirs without going through probate. This type of deed allows you to retain full control over your property during your lifetime. Moreover, an estate lady bird with a big head can simplify the transfer process upon your death, ensuring a smooth transition of ownership.

Many individuals worry about Medicaid and the estate lady bird with a big head. Generally, this deed can offer some protection from Medicaid claims, as the ownership may not be fully transferred until after the owner's death. However, rules can vary based on state regulations, so it’s crucial to consult professionals who specialize in elder law to navigate these complexities.

Yes, the estate lady bird with a big head can indeed override a will under certain circumstances. If a ladybird deed is in place, it typically ensures that the property transfers directly to the designated beneficiary upon the owner's death, bypassing probate. However, any conflicting terms in a will must be considered. Consulting with a legal professional can clarify situations specific to your circumstances.

Many people inquire about the estate lady bird with a big head and its availability in various states. States like Florida and Michigan are prominent for accepting ladybird deeds. However, always verify your local laws, as this can change. USLegalForms can provide the relevant templates and advice to navigate these legal waters.

While the estate lady bird with a big head offers many benefits, it comes with some drawbacks. One major downside is the potential impact on your eligibility for Medicaid; improper use could complicate your asset protection strategy. Additionally, this type of deed may not protect your property from creditors in every situation. It's worth consulting with a legal expert to fully understand the implications.

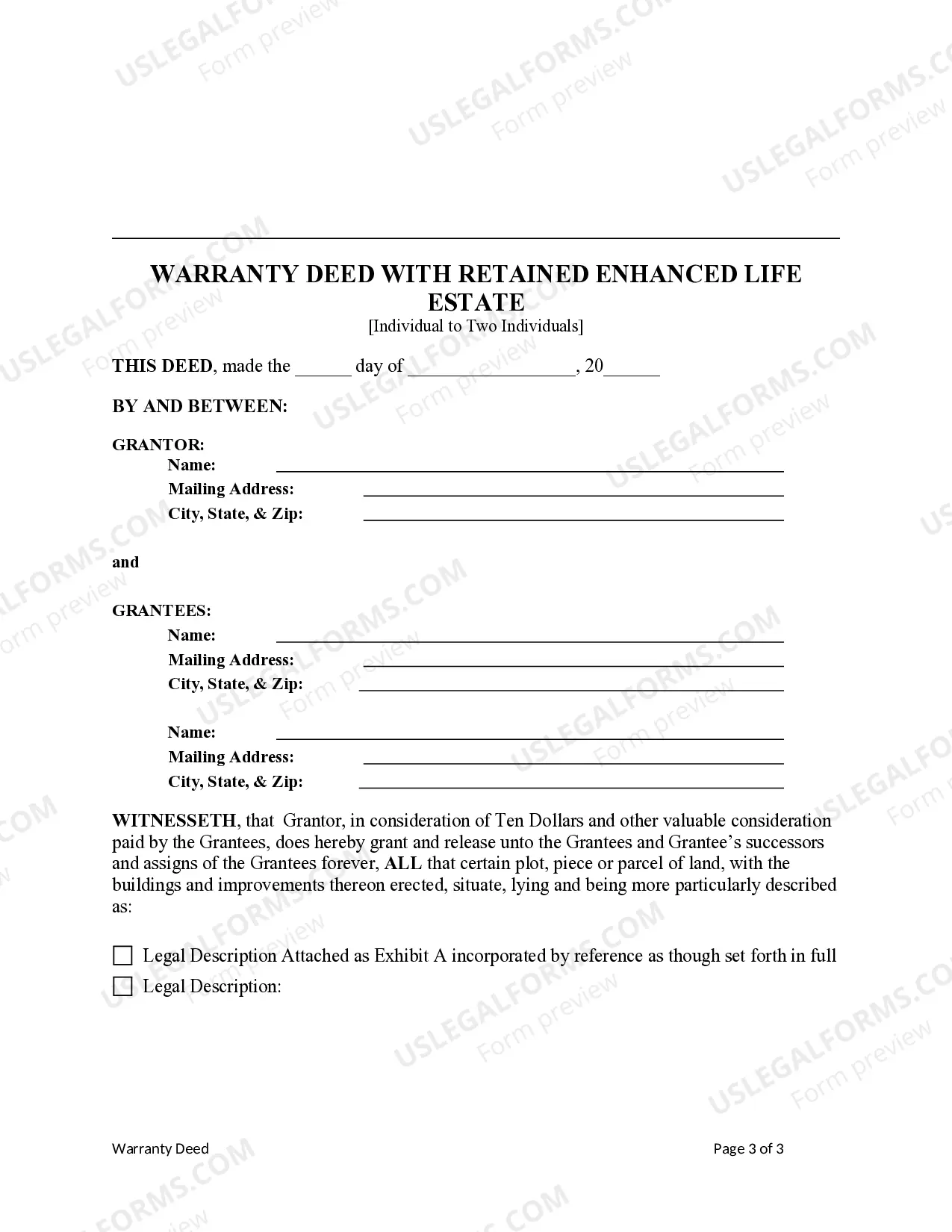

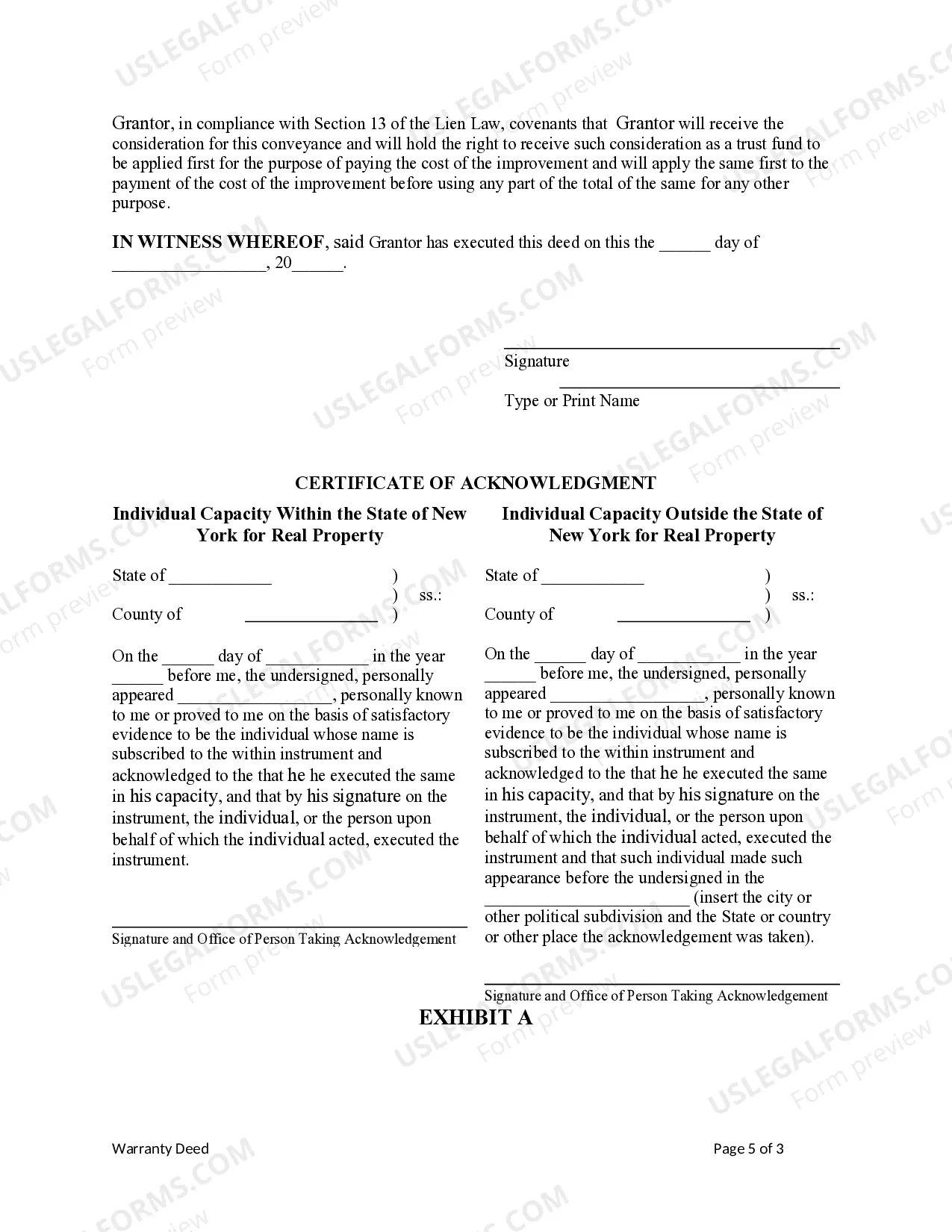

To complete an estate lady bird with a big head, start by gathering the necessary information about the property and the intended beneficiaries. Next, fill out the deed accurately and make sure to include pertinent details, such as the property’s legal description. After signing and notarizing the document, record it with the county clerk’s office to ensure legal compliance. For ease, consider using US Legal Forms; their resources can guide you through every step.

In Florida, an estate lady bird with a big head requires the property owner to be at least 18 years old and competent to manage their affairs. The deed must be executed and notarized to be valid. Additionally, it needs to be recorded in the county where the property is located. Familiarizing yourself with these requirements ensures a smooth transfer process.