Ny Business Corporation With Payments

Description

How to fill out New York Business Incorporation Package To Incorporate Corporation?

Legal papers managing can be overpowering, even for the most knowledgeable professionals. When you are searching for a Ny Business Corporation With Payments and don’t get the time to spend in search of the right and up-to-date version, the operations might be stress filled. A robust web form library can be a gamechanger for everyone who wants to manage these situations successfully. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available to you anytime.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any requirements you may have, from personal to organization documents, all-in-one place.

- Utilize innovative tools to accomplish and handle your Ny Business Corporation With Payments

- Gain access to a resource base of articles, guides and handbooks and materials highly relevant to your situation and needs

Help save time and effort in search of the documents you need, and employ US Legal Forms’ advanced search and Review tool to find Ny Business Corporation With Payments and acquire it. For those who have a monthly subscription, log in to your US Legal Forms account, search for the form, and acquire it. Review your My Forms tab to find out the documents you previously downloaded and also to handle your folders as you can see fit.

If it is your first time with US Legal Forms, create a free account and have unlimited use of all advantages of the library. Here are the steps for taking after accessing the form you need:

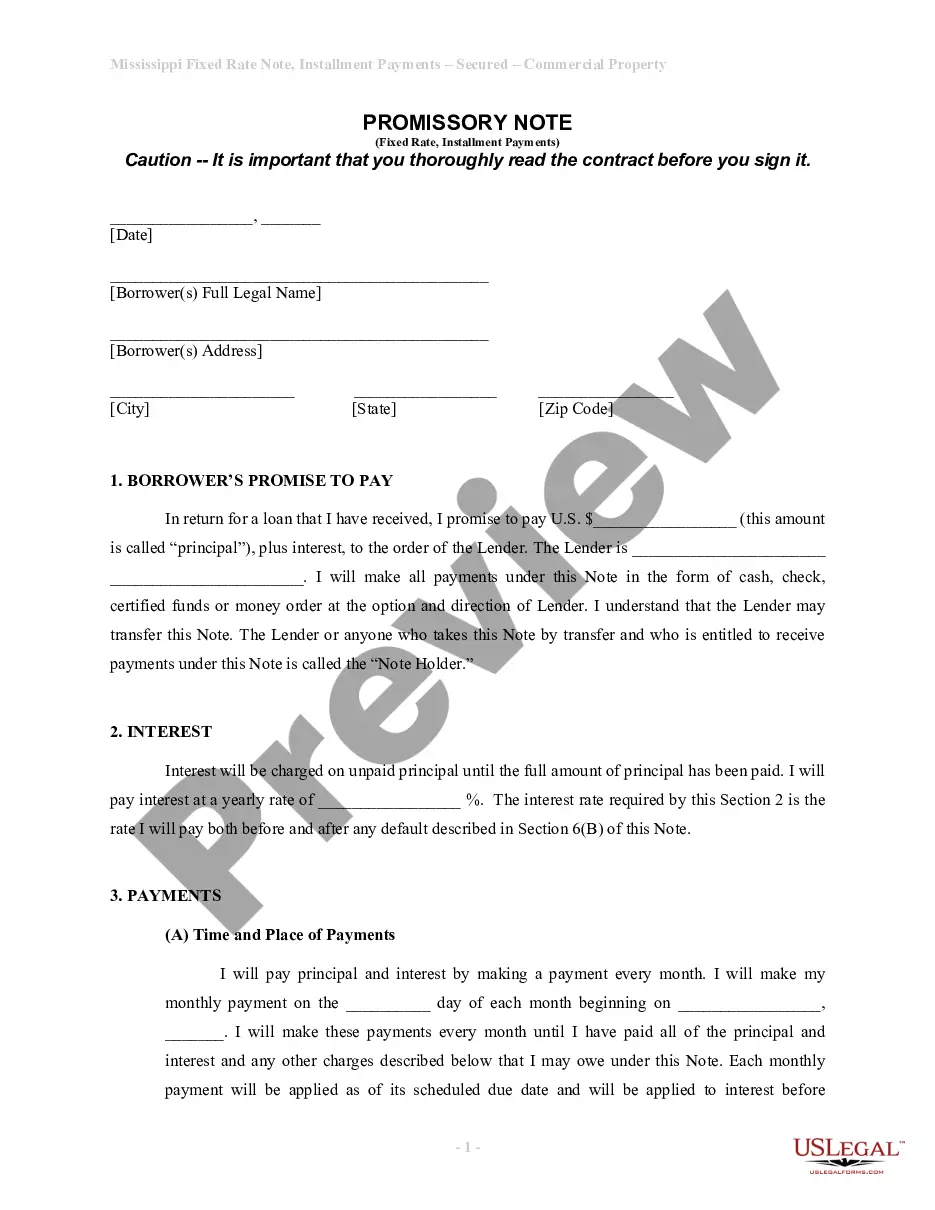

- Validate this is the right form by previewing it and reading its information.

- Be sure that the sample is accepted in your state or county.

- Choose Buy Now once you are all set.

- Select a subscription plan.

- Find the format you need, and Download, complete, eSign, print and deliver your papers.

Enjoy the US Legal Forms web library, backed with 25 years of experience and trustworthiness. Transform your everyday papers management in a easy and user-friendly process right now.

Form popularity

FAQ

Fixed dollar minimum tax for general business taxpayers For a corporation with New York State receipts of:TaxNot more than $100,000$25More than $100,000 but not over $250,000$75More than $250,000 but not over $500,000$175More than $500,000 but not over $1,000,000$5008 more rows ?

All domestic and foreign S corporations and qualified S subsidiaries in New York City that are: Doing business; Employing capital; Owning or leasing property, in a corporate or organized capacity; or.

Creating a New York State S Corp The total charge for creating a New York corporation is about $195. Even if you've already elected S corp status at the federal level, you also have to make this election for New York State. You must file Form CT-6 to receive approval from the state.

A minimum tax based on the S corporation's NYC gross receipts which is determined as follows: $100,000 or less = $25 minimum tax. More than $100,000 but not more than $250,000 = $75. New York - NY City GCT (General Corporation Tax) collective.com ? articles ? 7321403-new-yor... collective.com ? articles ? 7321403-new-yor...

A New York LLC will automatically be taxed as a pass-through entity. In other words, the LLC won't pay federal taxes directly. Instead, the revenue the LLC earns passes through the business to you. Then, you'll report your share of the profits on your personal tax return.