New York Business Incorporation Withholding Tax

Description

How to fill out New York Business Incorporation Package To Incorporate Corporation?

Whether for business purposes or for personal matters, everyone has to deal with legal situations at some point in their life. Filling out legal documents needs careful attention, beginning from selecting the correct form template. For instance, if you select a wrong version of the New York Business Incorporation Withholding Tax, it will be turned down once you submit it. It is therefore crucial to get a dependable source of legal papers like US Legal Forms.

If you need to obtain a New York Business Incorporation Withholding Tax template, follow these simple steps:

- Find the sample you need using the search field or catalog navigation.

- Look through the form’s description to make sure it fits your situation, state, and region.

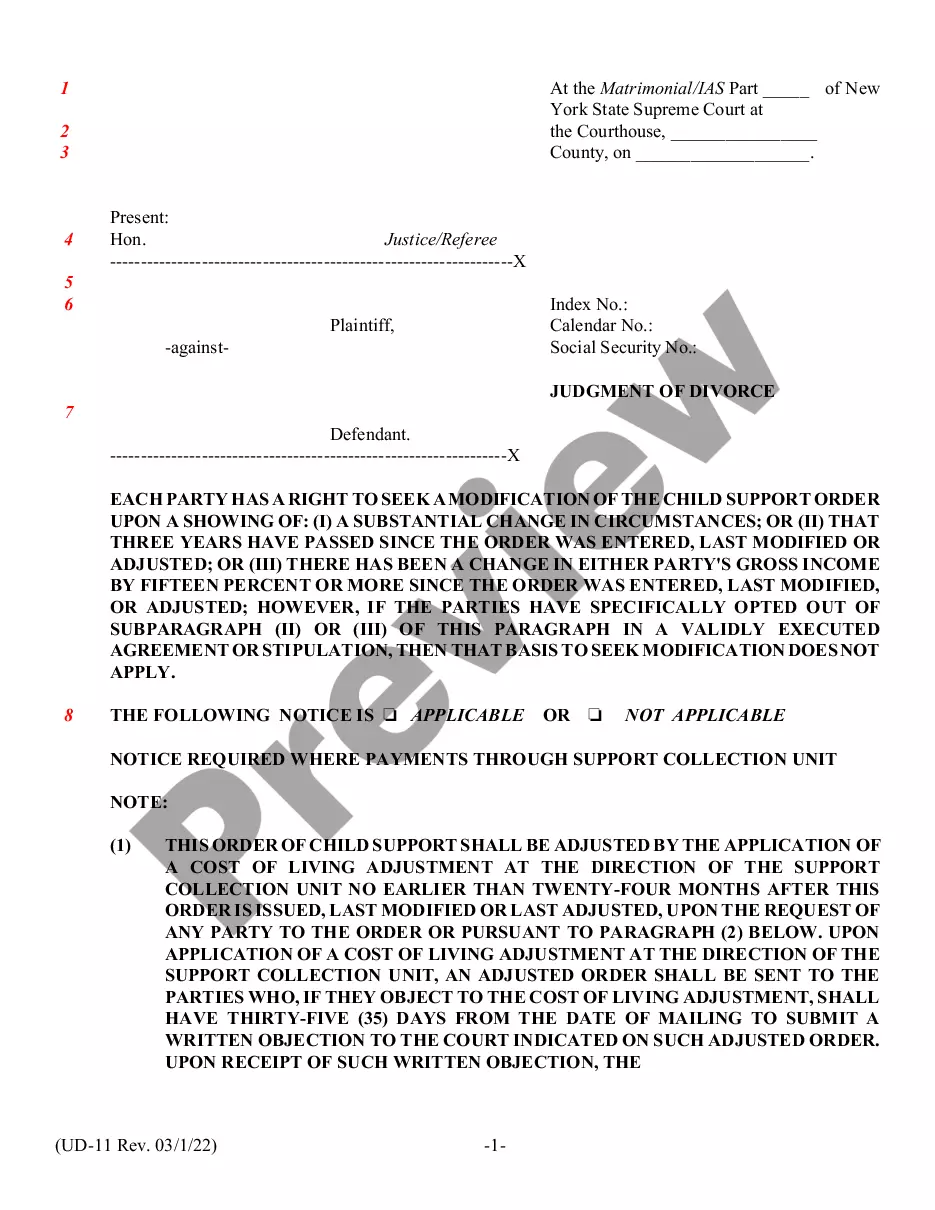

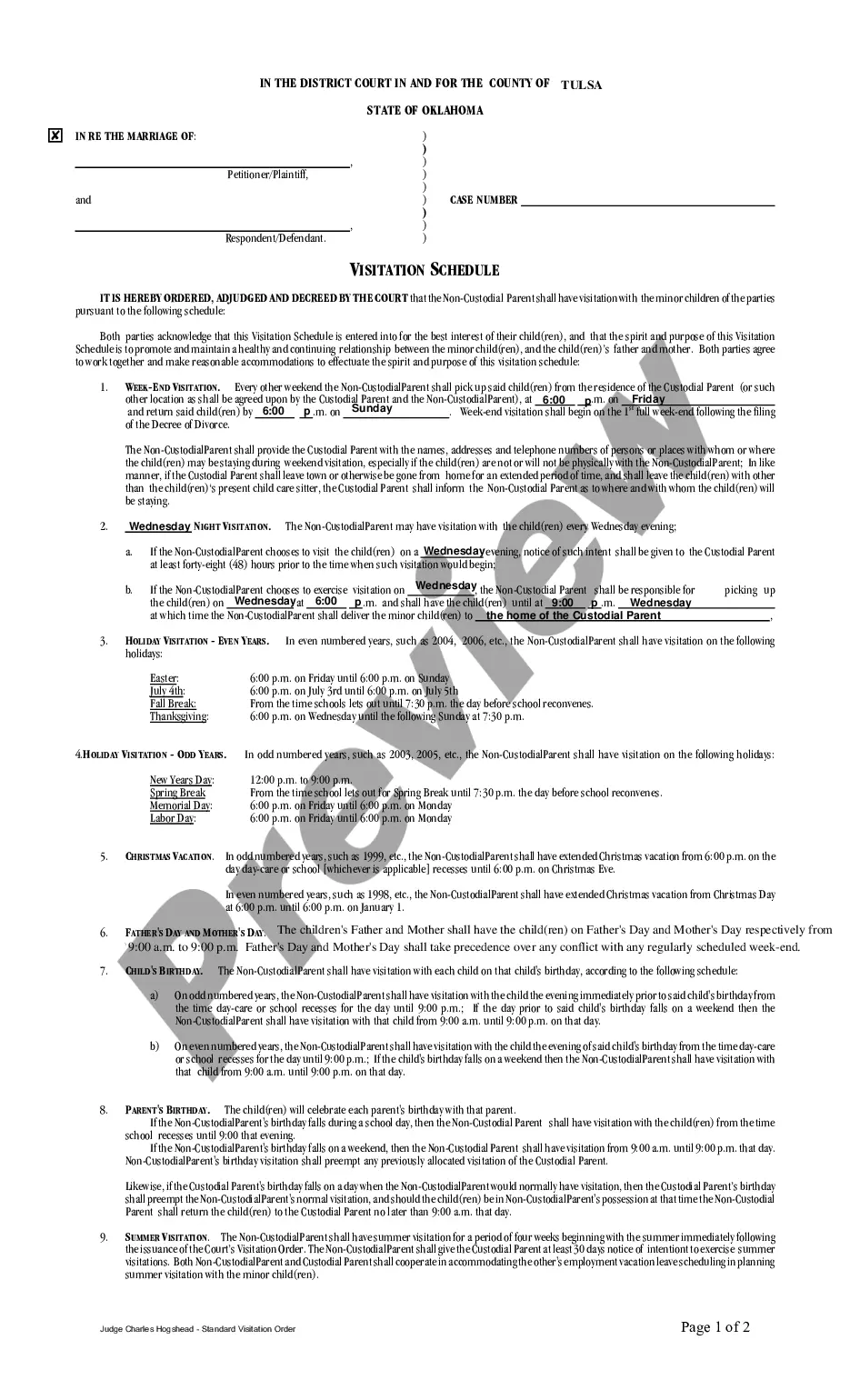

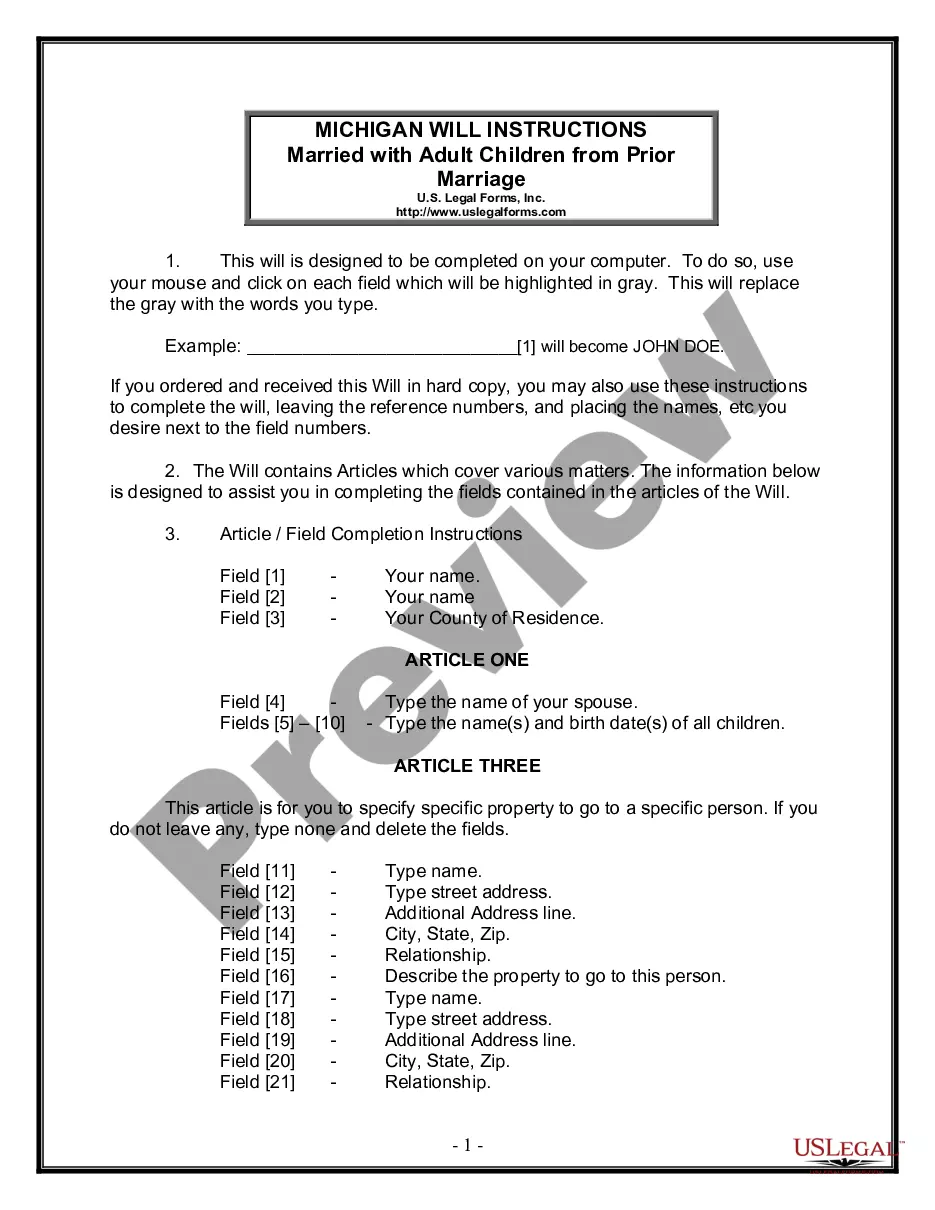

- Click on the form’s preview to examine it.

- If it is the wrong form, get back to the search function to locate the New York Business Incorporation Withholding Tax sample you require.

- Download the template if it matches your requirements.

- If you already have a US Legal Forms account, just click Log in to access previously saved files in My Forms.

- In the event you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Finish the account registration form.

- Pick your payment method: use a bank card or PayPal account.

- Select the document format you want and download the New York Business Incorporation Withholding Tax.

- After it is downloaded, you can fill out the form with the help of editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you do not need to spend time seeking for the appropriate sample across the web. Take advantage of the library’s straightforward navigation to get the proper form for any situation.

Form popularity

FAQ

For NYS/NYC/Yonkers taxes: the IT-2104 Employee's Withholding Allowance Certificate form filed with the NY State Department of Taxation and Finance.

Employers are required to withhold and pay personal income taxes on wages, salaries, bonuses, commissions, and other similar income paid to employees.

The state as a whole has a progressive income tax that ranges from 4. % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions.

Register your business for income withholding and unemployment tax on the New York Department of Labor website. (Registering with the New York Department of Labor will automatically register you for the New York Department of Taxation and Finance as well.)

New York has a progressive income tax that ranges from 4 to 8.82 percent depending on an employee's earnings. A 9.62 percent withholding rate is applied to any additional commissions or bonuses.