New York Business Incorporation For Nonprofit

Description

How to fill out New York Business Incorporation Package To Incorporate Corporation?

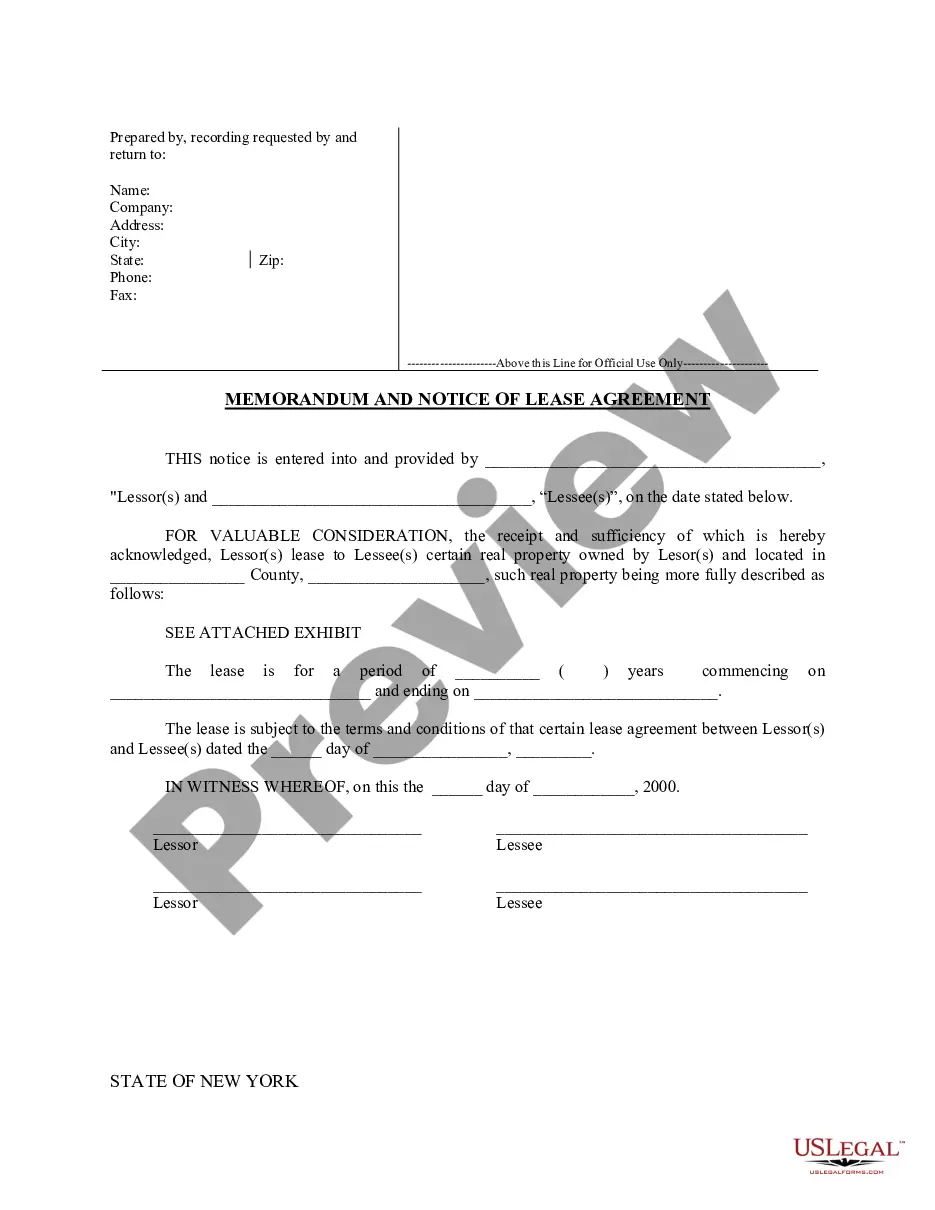

Whether for business purposes or for personal affairs, everyone has to manage legal situations at some point in their life. Completing legal documents requires careful attention, starting with choosing the appropriate form sample. For instance, if you pick a wrong edition of a New York Business Incorporation For Nonprofit, it will be declined when you send it. It is therefore important to get a trustworthy source of legal files like US Legal Forms.

If you need to get a New York Business Incorporation For Nonprofit sample, follow these easy steps:

- Find the sample you need using the search field or catalog navigation.

- Check out the form’s information to ensure it matches your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect form, go back to the search function to locate the New York Business Incorporation For Nonprofit sample you require.

- Download the file when it matches your requirements.

- If you have a US Legal Forms account, just click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Choose the document format you want and download the New York Business Incorporation For Nonprofit.

- After it is saved, you can complete the form by using editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time looking for the appropriate sample across the web. Take advantage of the library’s straightforward navigation to find the right form for any occasion.

Form popularity

FAQ

How to Start a Nonprofit in New York Name Your Organization. ... Choose a New York nonprofit corporation structure. ... Recruit Incorporators and Initial Directors. ... Appoint a Registered Agent. ... Prepare and File Articles of Incorporation. ... File Initial Report. ... Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records.

Overview. A not-for-profit corporation may be formed under the Not-for-Profit Corporation Law as a ?charitable corporation? or a ?non-charitable corporation? unless it may be formed under any other corporate law of New York State (See Not-for-Profit Corporation Law section 201).

Under New York law, Type B and Type C nonprofit corporations may be formed for 501(c)(3) purposes. Your articles of incorporation must state which type of corporation you are forming.

The nonprofit LLC is an option in some states for groups working in the nonprofit sector. However, in New York, you are limited to forming a nonprofit corporation to acquire tax exemption. At Lawyer For Business, we are business lawyers with extensive experience in New York State.

Not-for-profit corporations ("non-profits") must file a Certificate of Incorporation. Certificates are filed with the New York State Department of State (NYSDOS). Businesses should consult an attorney to learn about legal structures.