Nevada Settlement Divorce Formula

Description

Form popularity

FAQ

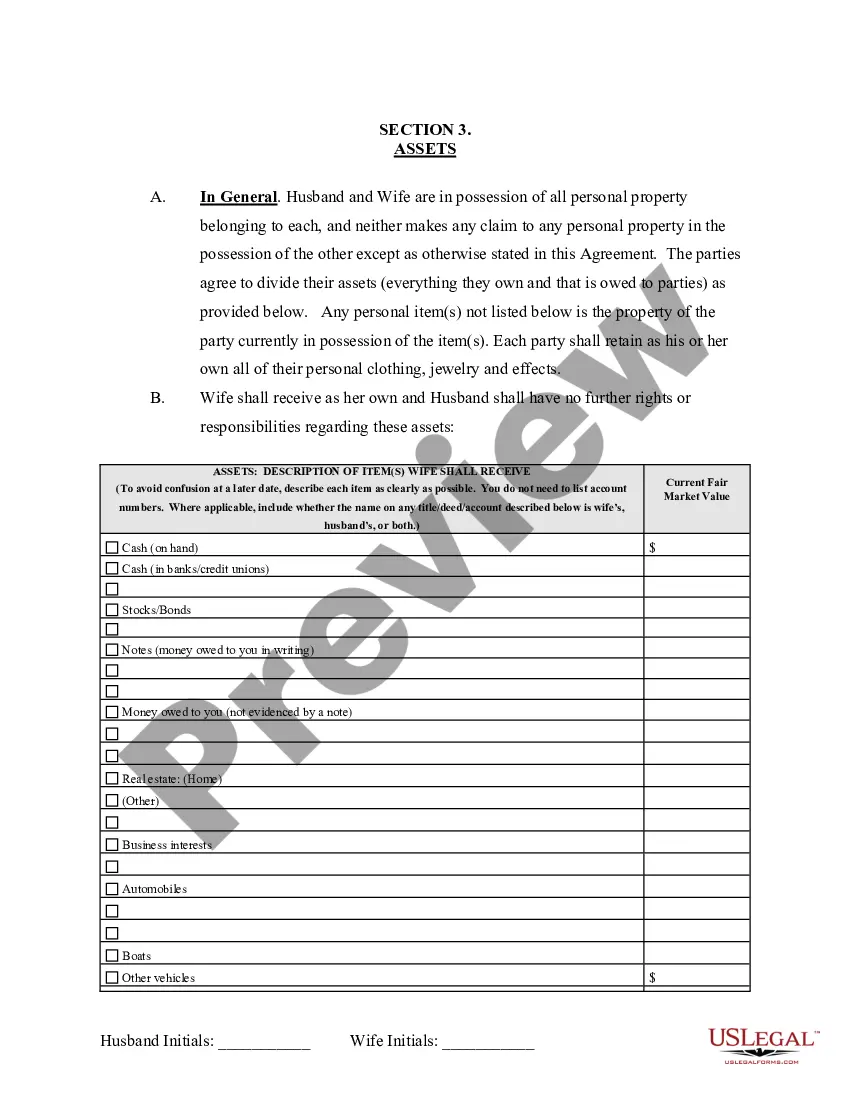

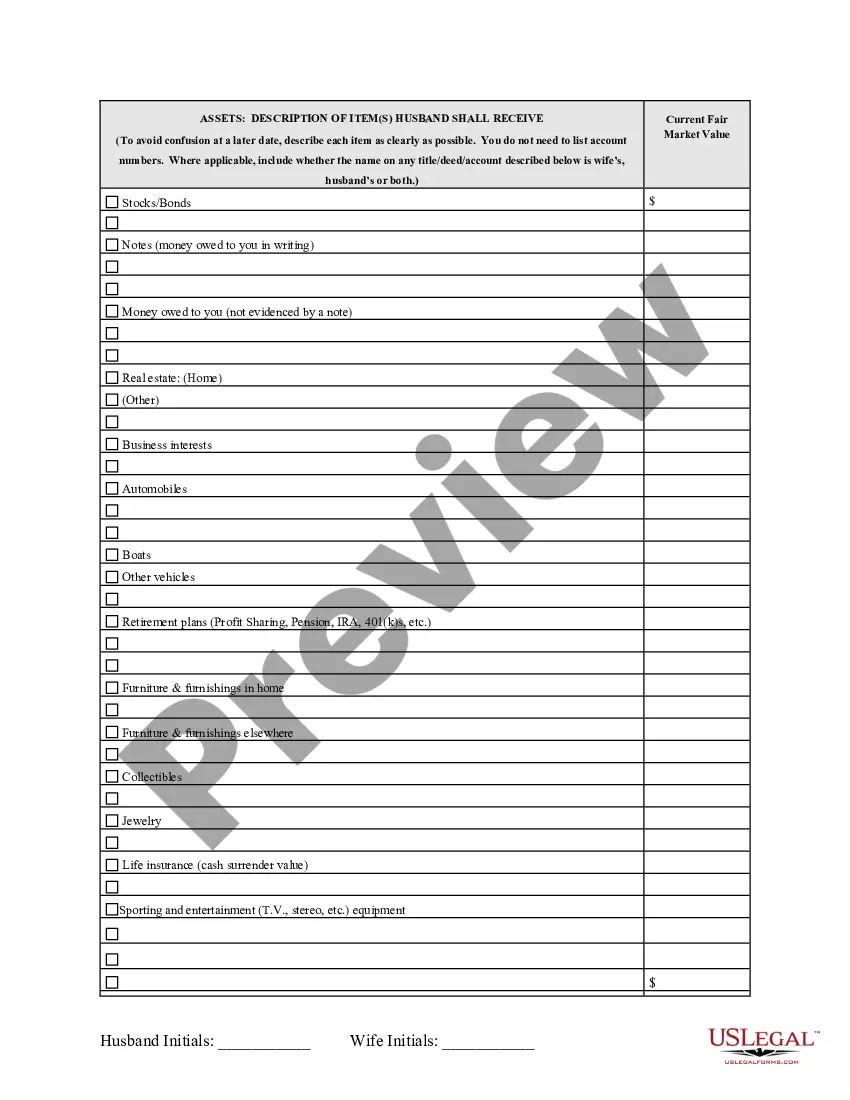

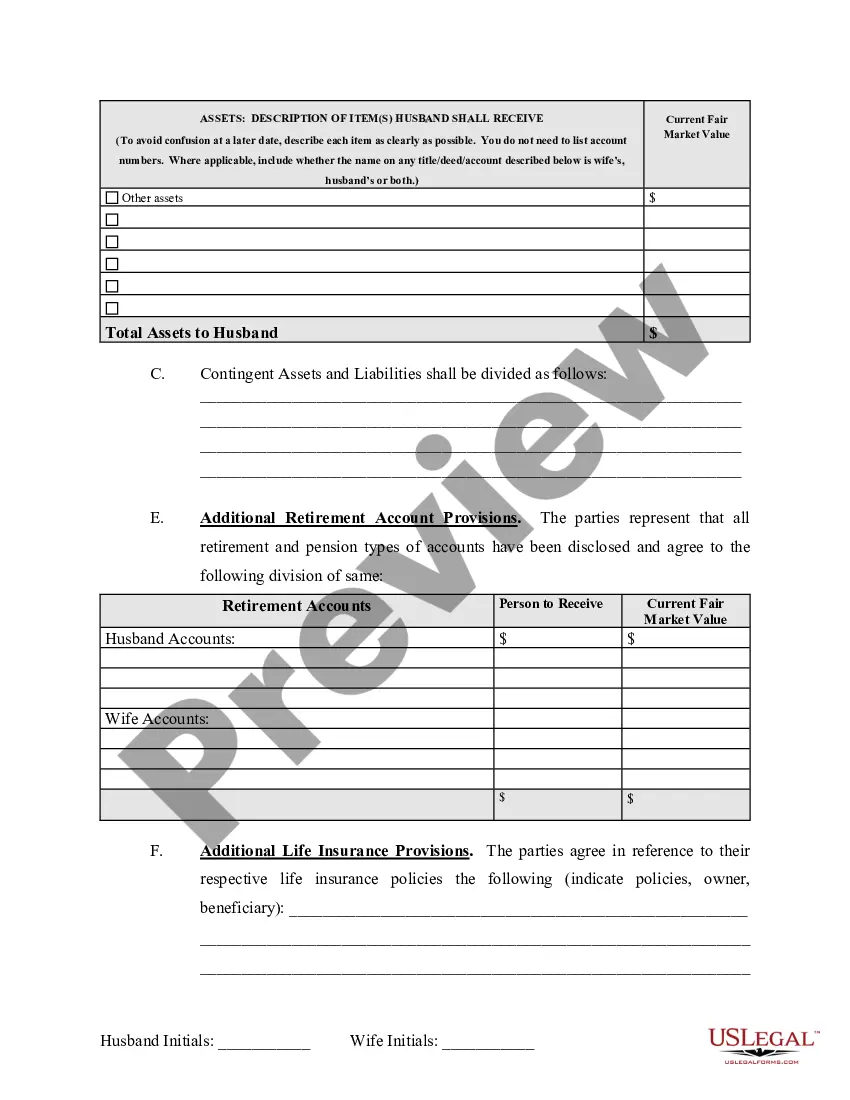

In Nevada, a husband is entitled to an equitable distribution of marital property. This includes assets acquired during the marriage, regardless of who holds the title. The Nevada settlement divorce formula aims to ensure a fair allocation of resources, which may include spousal support if warranted. It’s essential for husbands to be informed about their rights and obligations during this process to protect their interests.

In many cases, the spouse who primarily cares for the children may experience the most loss during a divorce. This spouse often faces financial hardship and emotional challenges as they navigate custody and support issues. Moreover, both parties may experience stress and uncertainty regarding their future. Understanding the Nevada settlement divorce formula can help both spouses achieve a fair distribution of assets and responsibilities.

The best way to calculate alimony is by using the Nevada settlement divorce formula, which emphasizes a fair assessment of both parties' financial situations. It’s advisable to gather all relevant financial documents, such as tax returns and expenses, to present a complete picture. Consulting with a legal expert or using platforms like US Legal Forms can provide valuable resources and guidance throughout this process.

To calculate alimony in Nevada, one typically employs the Nevada settlement divorce formula, which involves reviewing income statements, expenses, and financial resources. This approach aims to provide a tailored amount that addresses the needs of the lower-earning spouse while taking the payer’s capability to contribute into account. Engaging a legal professional can simplify this process and ensure all factors are considered.

Alimony in Nevada is granted based on the Nevada settlement divorce formula and the court's assessment of individual circumstances. Factors include the duration of the marriage, both parties' income and employment prospects, and their overall standard of living during the marriage. It's essential to provide comprehensive evidence to support your case when pursuing alimony.

Adultery does not directly affect the division of assets in a divorce in Nevada, as the state follows a no-fault divorce principle. However, it may influence alimony or other settlement terms, depending on the situation. For a comprehensive understanding of how these factors play into the Nevada settlement divorce formula, product offerings like US Legal Forms can provide valuable resources.

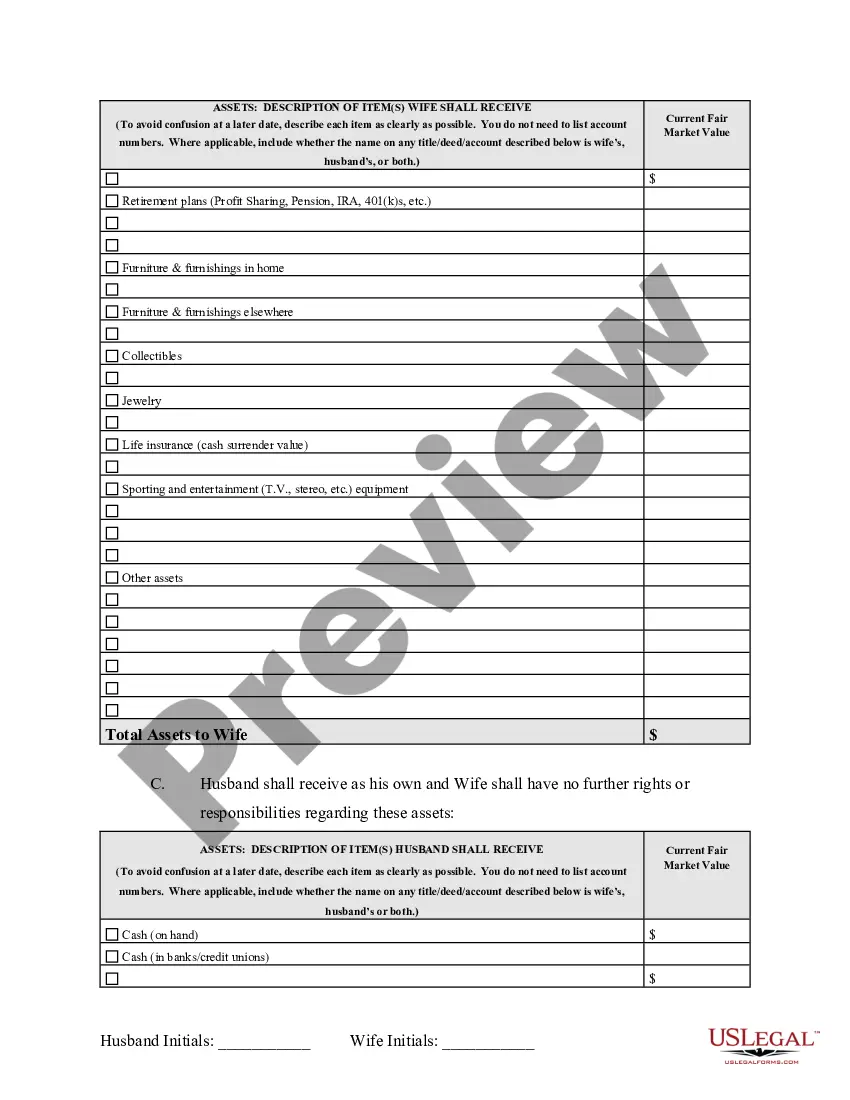

In Nevada, a wife is entitled to a fair distribution of marital assets and debts accrued during the marriage. The court also considers the duration of the marriage and each spouse's contributions. By applying the Nevada settlement divorce formula, you can obtain a clear understanding of what you may rightfully receive in your divorce settlement.

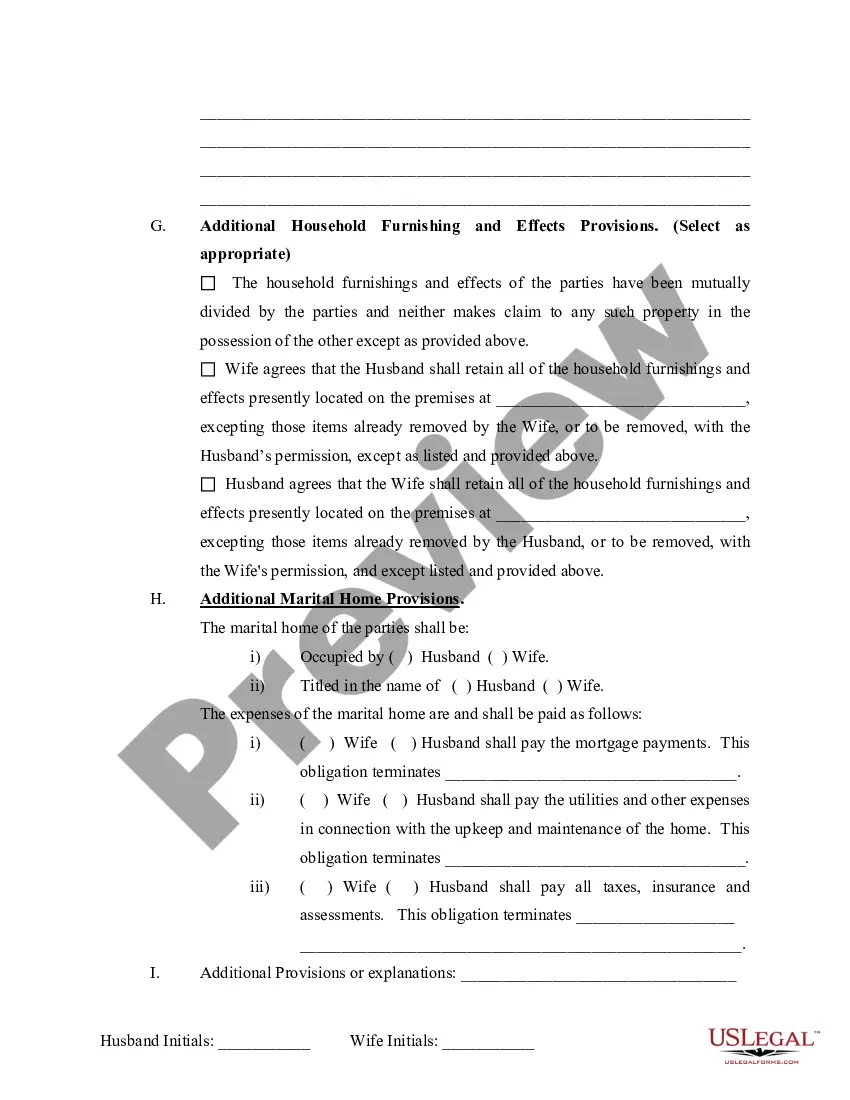

To maximize your divorce settlement, gather thorough documentation of your assets and liabilities before negotiating. It’s also beneficial to consider potential future income and expenses. The Nevada settlement divorce formula can guide you in identifying a fair settlement that reflects your contributions and needs during this transition.

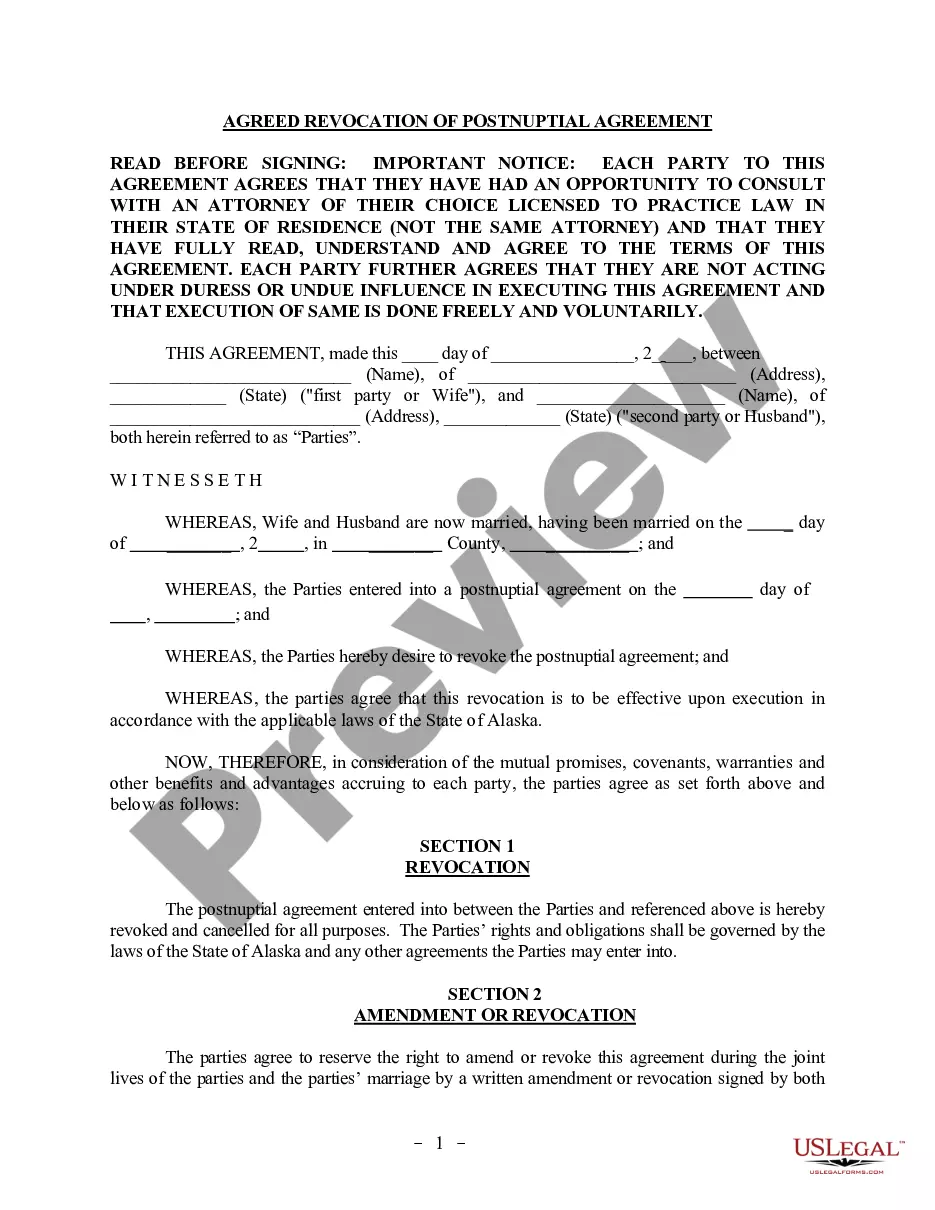

Yes, it is possible to divorce without splitting all assets in Nevada. If there is a prenuptial agreement in place, or if both parties agree to certain terms, a complete asset division may not be necessary. Understanding the Nevada settlement divorce formula can help you navigate these agreements and maintain control over your assets.

Nevada follows the principle of equitable distribution, which does not always mean a strict 50/50 split. Courts consider various factors, including the length of the marriage, the contributions of each spouse, and their economic circumstances. Utilizing the Nevada settlement divorce formula, you can understand how assets may be divided more fairly based on these factors.