Quiet Title Action Nevada Without A Lawyer

Description

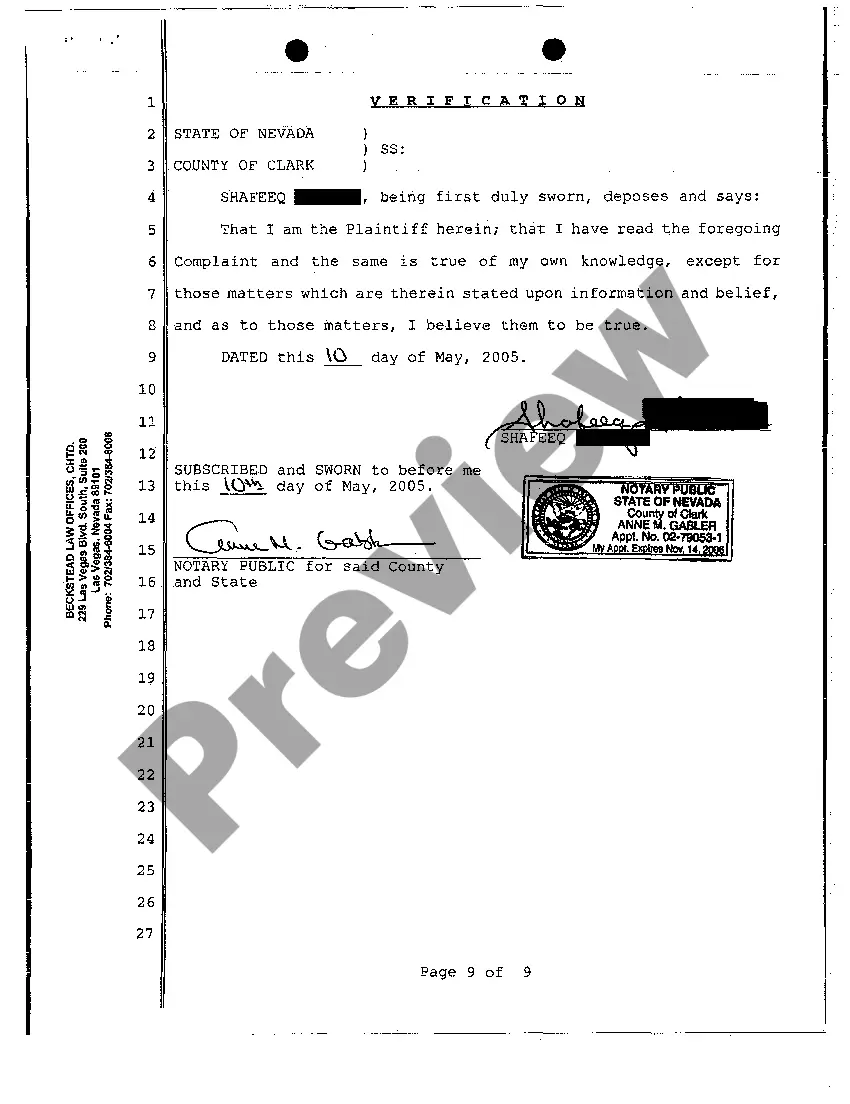

How to fill out Nevada Verified Complaint - Complaint To Quiet Title Due To Forged Quitclaim Deed?

The Quiet Title Action Nevada Without A Lawyer displayed on this page is a reusable formal document crafted by expert attorneys in compliance with national and local laws and regulations.

For over 25 years, US Legal Forms has offered individuals, companies, and legal professionals more than 85,000 verified, state-specific documents for any business and personal circumstances. It represents the quickest, simplest, and most dependable method to secure the paperwork you require, as the service ensures bank-level data security and anti-malware safeguards.

Register for US Legal Forms to have accessible verified legal documents for all of life’s situations.

- Search for the document you need and review it. Browse through the sample that you searched and preview it or check the form description to validate that it meets your criteria. If it doesn’t, use the search box to find the appropriate one. Click Buy Now when you have found the form you require.

- Subscribe and sign in. Choose the pricing plan that best fits your needs and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template. Select the format you desire for your Quiet Title Action Nevada Without A Lawyer (PDF, Word, RTF) and download the document onto your device.

- Complete and sign the documents. Print the template to manually fill it out. Alternatively, use an online multifunctional PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature.

- Download your documents once more. Use the same form again whenever necessary. Access the My documents tab in your profile to redownload any forms you have purchased previously.

Form popularity

FAQ

Article 9 of the Uniform Commercial Code requires a financing statement to include the name of the debtor. It is important to set forth the exact legal name of the debtor in any filings that are made.

Ask the lender to terminate the lien upon payoff. When you pay off a loan, a good rule of thumb is to immediately submit a request with the lender to file a UCC-3 form with your secretary of state. ... Visit your secretary of state's office. ... Dispute inaccurate information on your business credit reports.

It's possible to avoid a UCC filing by taking out an unsecured business loan rather than a secured one. For example, many online and alternative lenders offer unsecured loans, and you can get an SBA 7(a) loan of up to $25,000 without collateral.

If you have not filed a UCC-1, then you are considered unsecured, and as such, you are placed in the ?back of the line,? behind the secured creditors. Secured creditors are taken care of first in the division of assets.

Information Request (Form UCC11) (Texas) SOSDirect Online Services ? Internet Filings OnlyFiling FeeInitial FilingUCC Financing Statement (UCC1)$5.00Manufactured-Home Transaction60.00Public-Finance Transaction60.0016 more rows

Fill in the debtor's name and mailing address. It may be an individual, or it may be in the name of a business or organization. If the loan is in the name of the business, include the business mailing address. There is space for additional debtors. Include them exactly as they appeared on the loan agreement.

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.

1 financing statement is a legal form that a creditor files to give notice that it has the right to take possession of and sell certain assets belonging to the debtor for the repayment of a specific debt.?