Certificate Of Trust Nevada Withholding Tax

Description

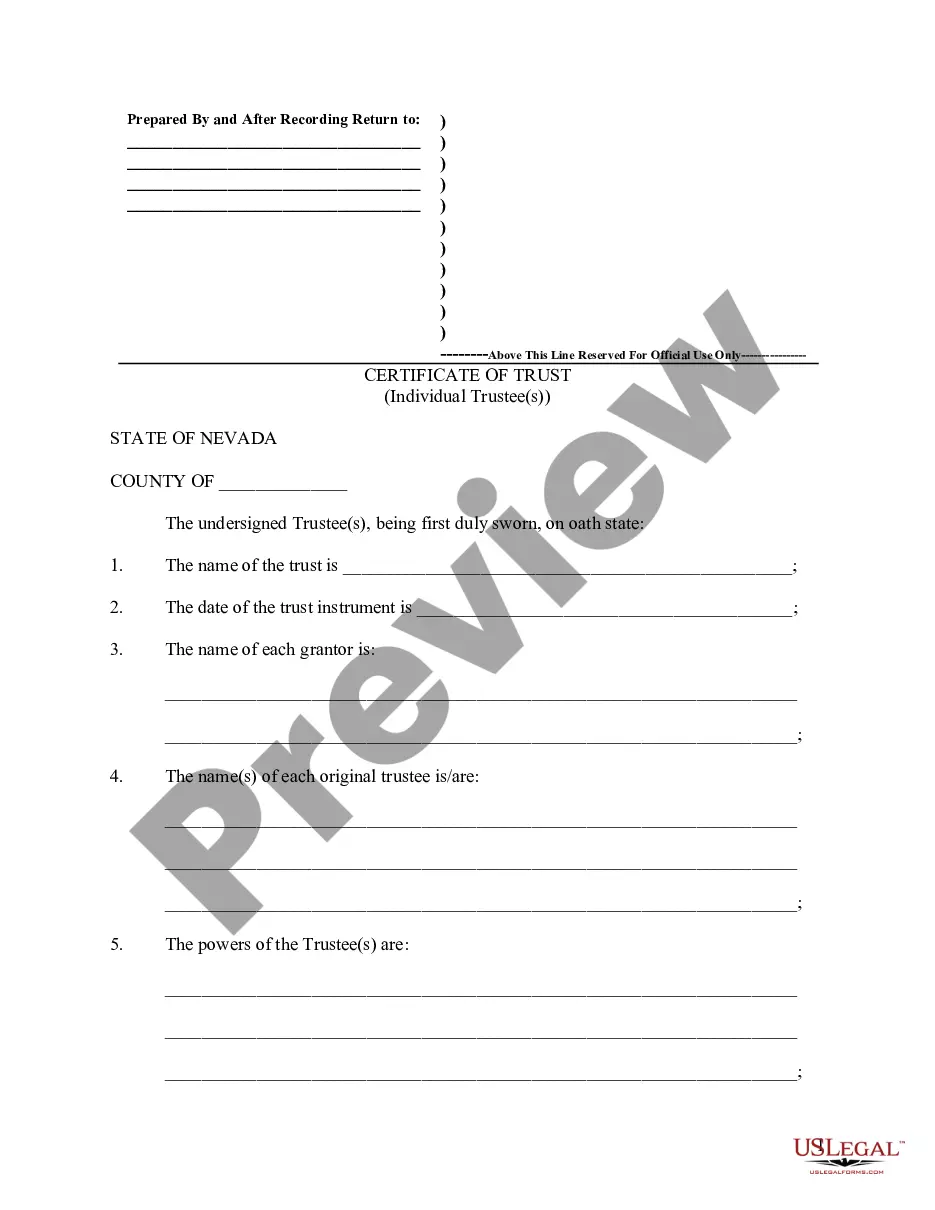

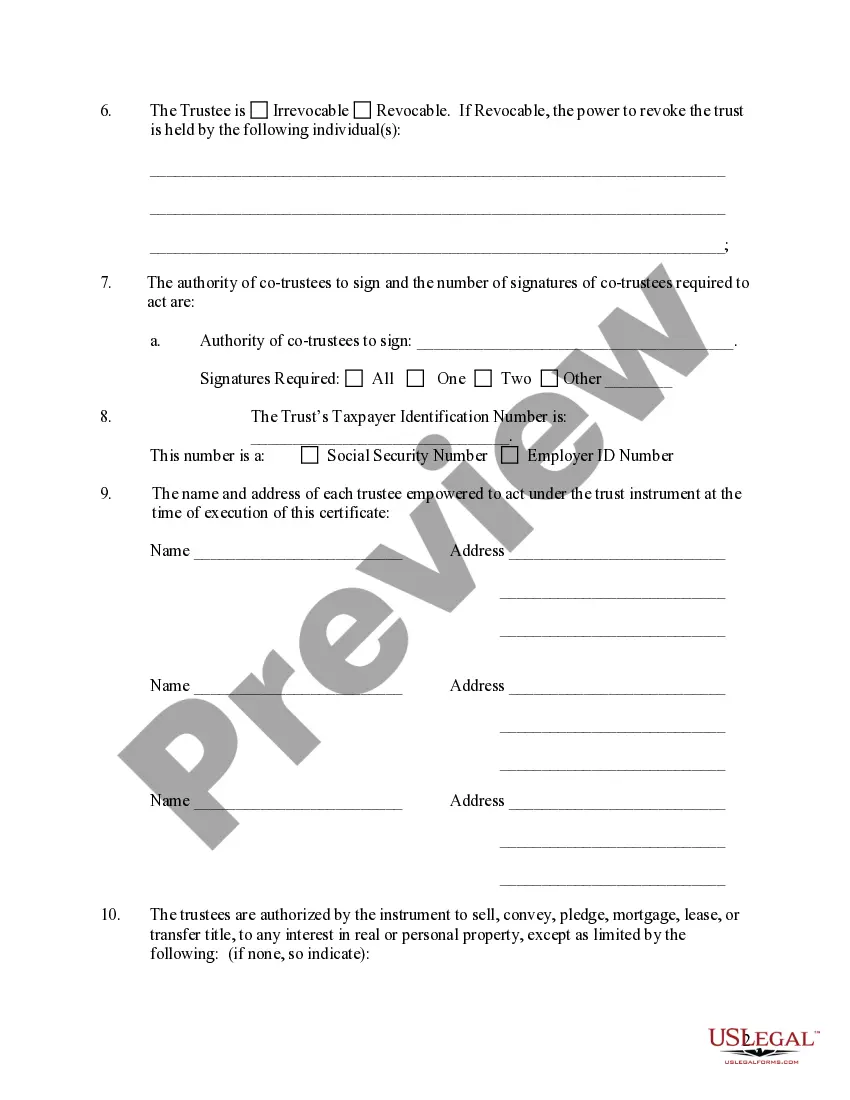

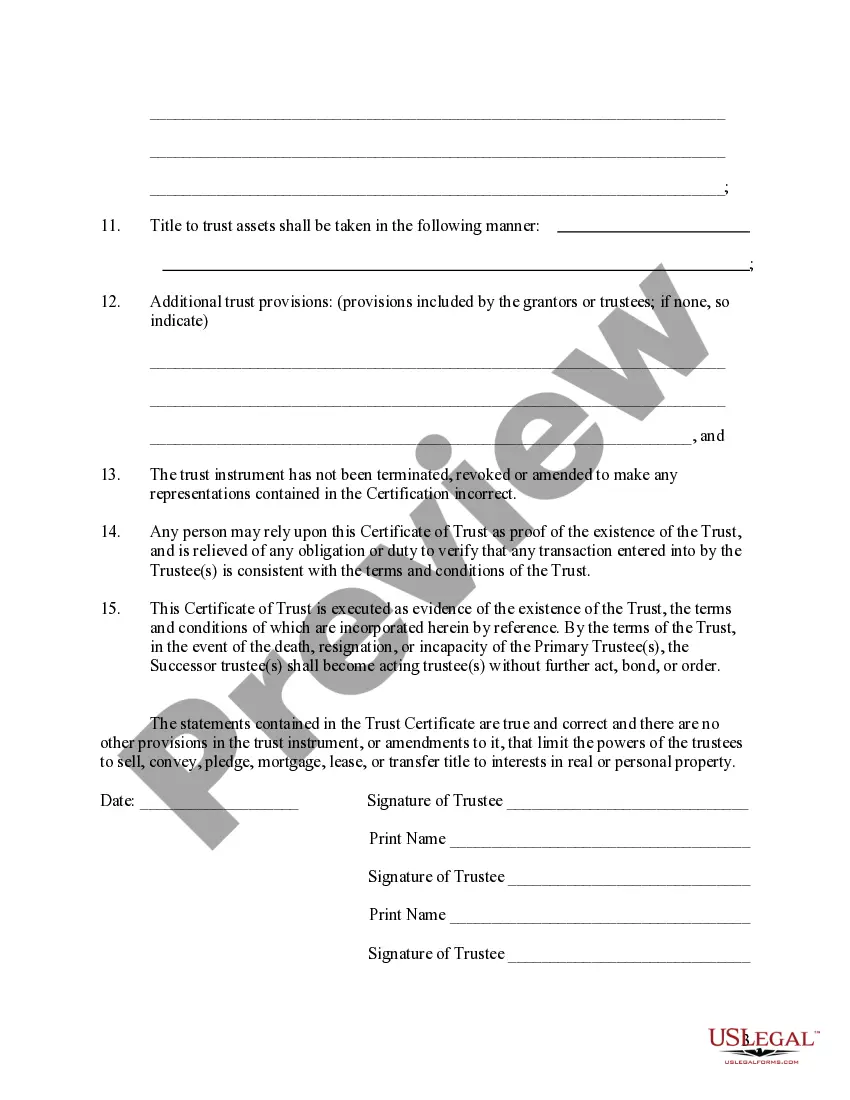

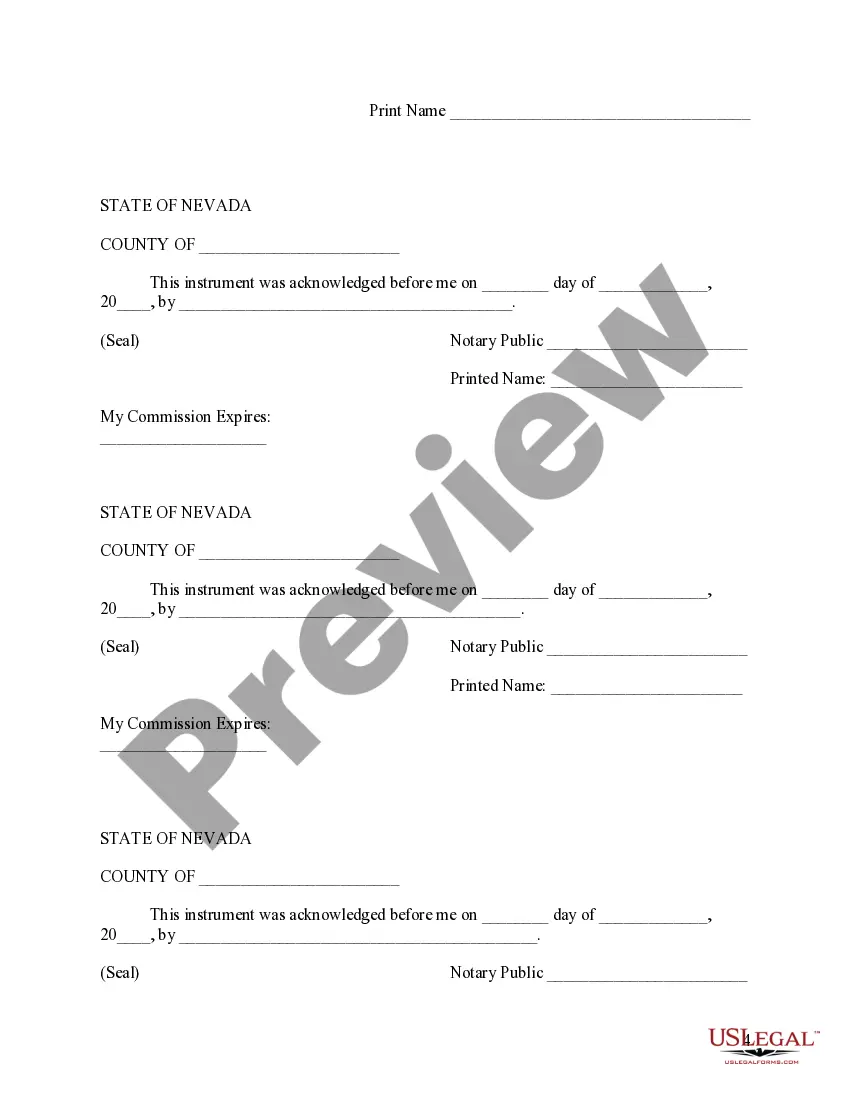

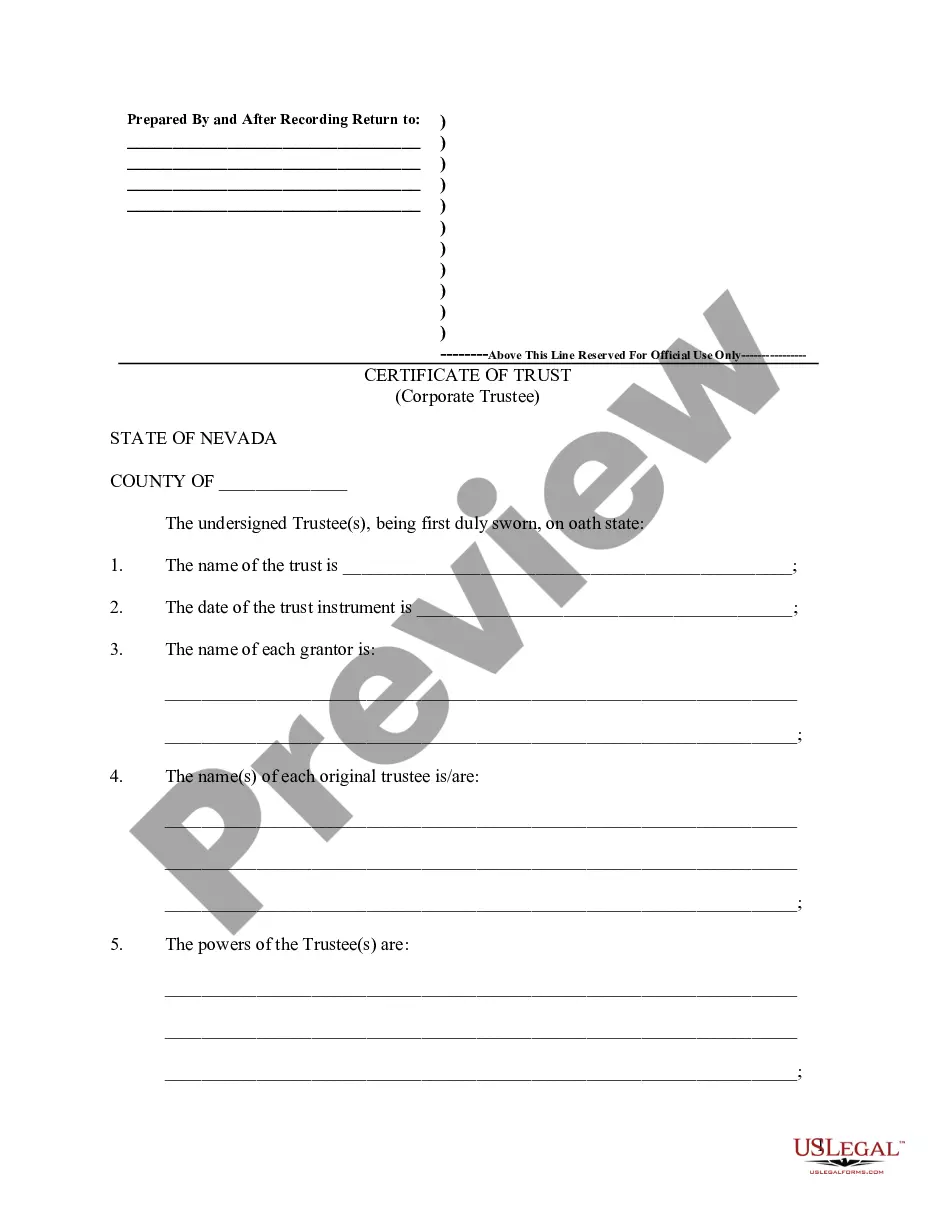

How to fill out Nevada Certificate Of Trust By Individual?

Managing legal paperwork can be perplexing, even for highly knowledgeable professionals.

If you're seeking a Certificate of Trust Nevada Withholding Tax but lack the time to find the suitable and current version, the procedures can be challenging.

Tap into a valuable library of articles, tutorials, and guides relevant to your situation and needs.

Save time and exertion searching for the documentation you need, and use US Legal Forms' sophisticated search and Preview feature to locate the Certificate of Trust Nevada Withholding Tax and download it.

Select a monthly subscription option. Choose the format you prefer, and then Download, fill out, eSign, print, and submit your documents. Enjoy the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your routine documentation management into a seamless and user-friendly process today.

- If you are a subscriber, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to see the documents you have previously downloaded and manage your files as necessary.

- If this is your initial experience with US Legal Forms, create an account for unlimited access to all the library's benefits.

- After downloading the desired form, verify that it is the correct document by previewing and reviewing its details.

- Confirm that the template is authorized in your state or county, then click Buy Now when you are prepared.

- Access locally-specific legal and business documents.

- US Legal Forms meets all your needs, from personal to corporate filings, all in one place.

- Leverage advanced tools to complete and manage your Certificate of Trust Nevada Withholding Tax.

Form popularity

FAQ

Filing taxes on behalf of a trust involves gathering all income statements and identifying deductions applicable to the trust. Generally, you will use Form 1041 to report income, deductions, and any tax owed. With a certificate of trust nevada withholding tax, you can more easily navigate the complexities of trust taxation and remain compliant.

Filling out a Nevada resale certificate requires including your resale number, the seller's information, and a description of the items purchased. Be sure to comply with state regulations to avoid any infractions. Utilizing a certificate of trust nevada withholding tax can aid in streamlining this process for your trust’s purchasing activities.

The 2 year rule refers to the requirement that trust assets must be distributed to beneficiaries within two years of the grantor's death. This regulation helps determine the tax treatment of the assets. When dealing with the certificate of trust nevada withholding tax, be aware of this timeline to avoid potential tax complications.

You should file the Nevada Modified Business Tax (MBT) with the Nevada Department of Taxation. Filing can typically be completed online through the department's website, providing a straightforward process. If you establish a certificate of trust nevada withholding tax, ensure you understand how it interacts with MBT requirements.

Nevada does not impose a state income tax on trust income, making it an attractive option for certain investors. This tax structure can help maximize the benefits of your investment strategy. The certificate of trust nevada withholding tax can further streamline tax obligations, providing additional advantages.

A Nevada trust offers greater privacy and protection for your assets. It allows you to manage your investments without the burden of state income tax. By establishing a certificate of trust nevada withholding tax, you ensure more favorable tax treatment, which can lead to increased returns over time.

In Nevada, trusts are generally taxed based on their income, which may include any gains from investments or assets. Depending on the type of trust, taxation can vary in structure and obligations. A Certificate of Trust Nevada Withholding Tax is crucial for managing these taxes, as it provides clarity on the trust's financial responsibilities.

Generating a withholding tax certificate involves compiling your financial information and determining the applicable withholding rates. You may use an online service like US Legal Forms to create your Certificate of Trust Nevada Withholding Tax efficiently. After filling out the required fields, ensure that you save and print the document for your records.

To obtain your trust certificate, you typically need to apply through a legal entity or financial advisor managing the trust. The process usually involves providing documentation regarding the trust and its beneficiaries. US Legal Forms simplifies acquiring a Certificate of Trust Nevada Withholding Tax by offering the necessary templates and guidance.

Yes, Nevada does impose a withholding tax on certain types of income, particularly for wages and payments made to non-residents. Understanding the specifics of this tax can help you manage your financial obligations effectively. Utilizing a Certificate of Trust Nevada Withholding Tax can help clarify withholding rates based on your income type.