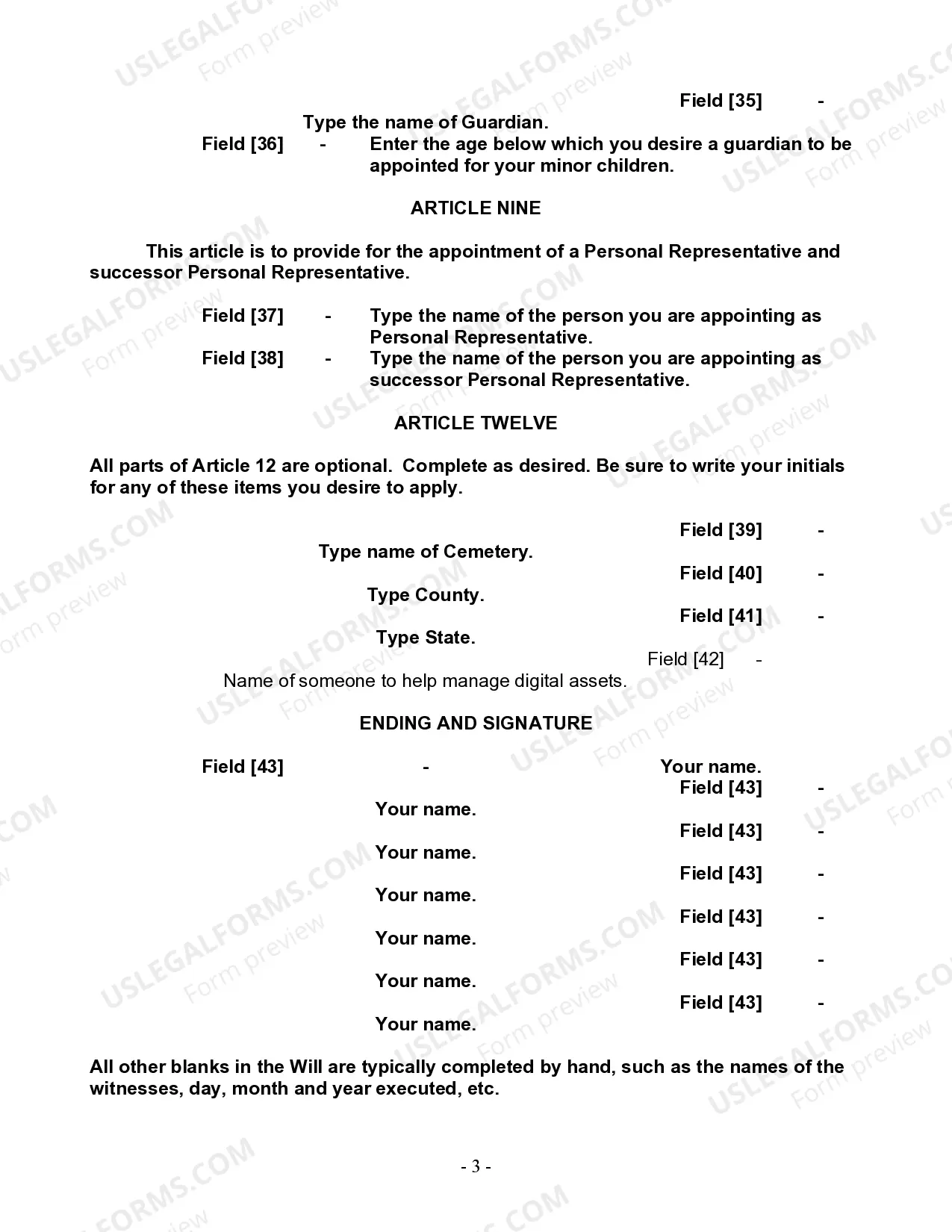

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Form Single Person With Child Universal Credit

Description

How to fill out Form Single Person With Child Universal Credit?

Navigating through the red tape of traditional documents and forms can be difficult, particularly if one is not engaged in that professionally.

Even locating the appropriate template for obtaining a Form Single Person With Child Universal Credit will be labor-intensive, as it needs to be valid and precise down to the very last digit.

However, you will likely spend significantly less time selecting a suitable template if it originates from a source you can trust.

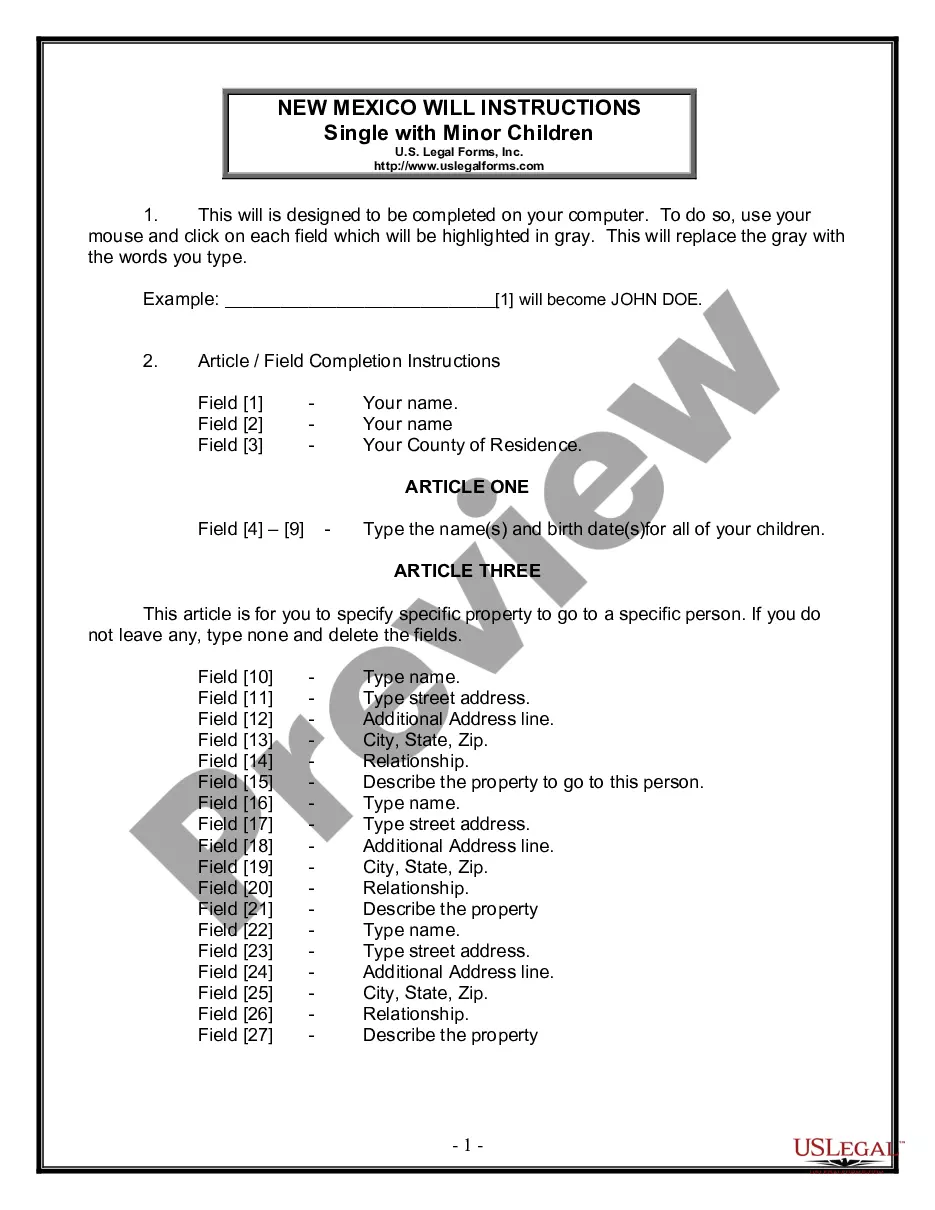

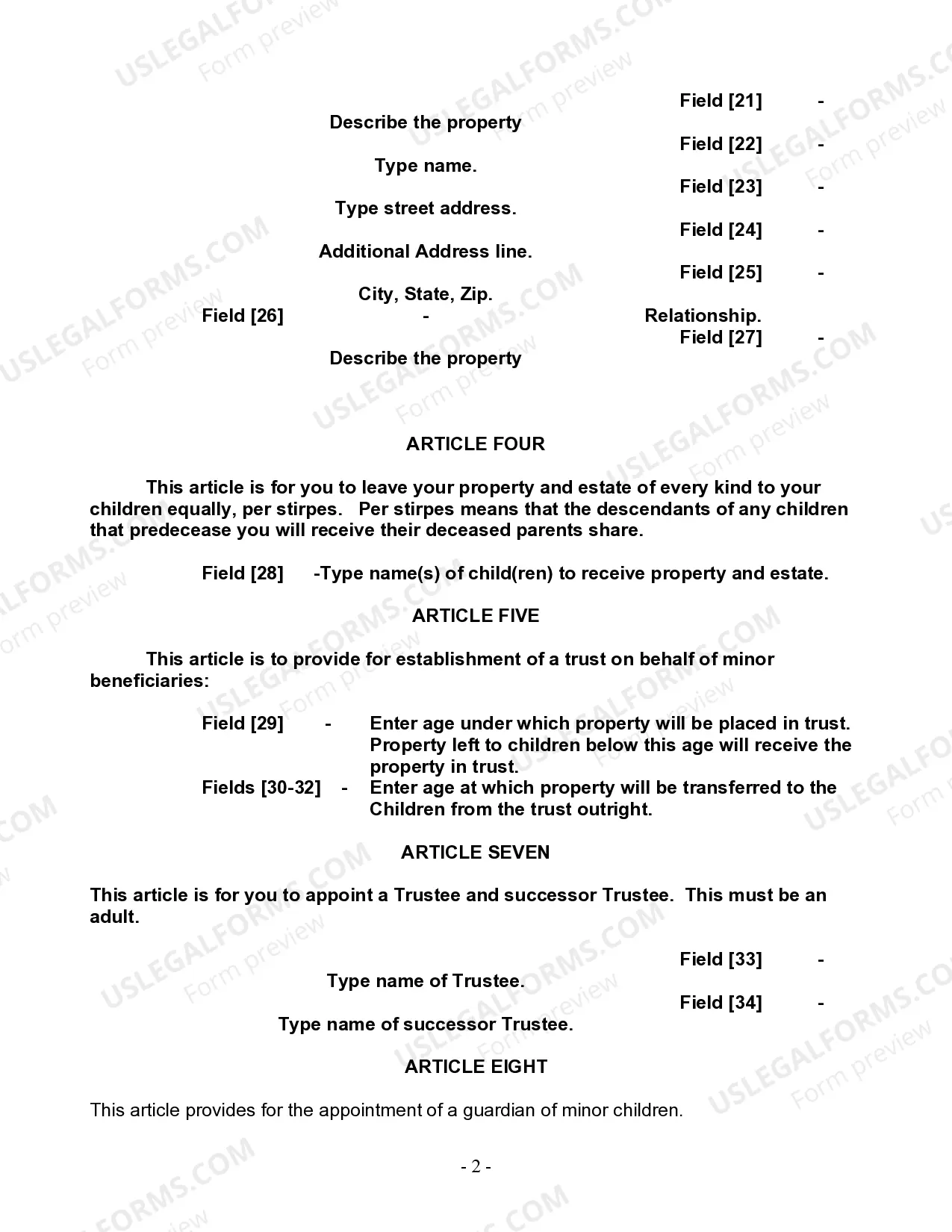

Obtain the correct form in a few straightforward steps: Enter the document name in the search bar, locate the appropriate Form Single Person With Child Universal Credit in the list of results, review the sample description or open its preview, if the template fulfills your requirements, click Buy Now, then select your subscription plan, use your email to create a secure password for registering an account with US Legal Forms, choose a credit card or PayPal as your payment method, and save the template document to your device in the desired format. US Legal Forms will greatly reduce the time you spend verifying if the form you discovered online meets your needs. Register for an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of searching for the correct documents online.

- US Legal Forms serves as a central hub you require to discover the latest examples of paperwork, learn how to use them, and download these examples for completion.

- This collection includes over 85,000 forms applicable in various professional fields.

- When seeking a Form Single Person With Child Universal Credit, there's no need to question its authenticity as all forms are validated.

- Having an account at US Legal Forms guarantees that all essential documents are within your reach.

- You can store them in your history or add them to the My documents section.

- Access your saved forms from any device effortlessly by simply clicking Log In on the library website.

- If you don't possess an account yet, you can always search for the template you require.

Form popularity

FAQ

If you receive Carer's Allowance, your Universal Credit payment may be affected, as it counts as income. The amount you get when you complete the Form single person with child universal credit will depend on your overall income and household situation. It's wise to check with a relevant advisor to understand how these two benefits can interact.

Universal Credit may check your bank account as part of the assessment process to verify your income and savings. This is part of their effort to ensure that the Form single person with child universal credit is filled out correctly and that you are receiving the right amount. Being transparent about your finances can make the process smoother and increase your chances of approval.

Yes, you can receive the child element of Universal Credit even if you do not claim child benefit. When you submit the Form single person with child universal credit, it’s critical to provide accurate information about your circumstances. However, certain criteria must be met, so reviewing your eligibility thoroughly is essential to maximize your support.

As of the latest updates, the child element of Universal Credit typically includes a standard rate as well as additional amounts based on specific circumstances, such as children with disabilities. When you fill out the Form single person with child universal credit, you can understand how much you can expect to receive, which may enhance your financial situation. It’s a useful component of your overall benefits package.

The maximum income to qualify for Universal Credit can vary based on your circumstances, including your location and the number of children you have. Generally, those who complete the Form single person with child universal credit should be aware of the income threshold, which is subject to change. This information helps you better assess your eligibility for financial support.

You should stop claiming your child as a dependent around the age of 19, or if they start supporting themselves financially. If they marry, work full-time, or no longer reside with you, it may be time to change your claim status. Understanding the implications of claiming is essential to make informed choices about receiving the Form single person with child universal credit.

As a single parent with one child, you may be eligible for various tax credits designed to support your financial needs. The specific amounts can vary based on income and filing status. Consulting resources that explain the Form single person with child universal credit can provide clarity on the benefits available to you.

You should stop allowing your parents to claim you as a dependent when you become financially independent or start earning a substantial income. Generally, reaching the age of 19 or transitioning to living on your own can signal that it’s time to claim yourself. Consider how this transition may affect benefits like the Form single person with child universal credit.

Deciding not to claim your child as a dependent can have significant financial implications. While it may seem easier to let them claim themselves, you could miss out on benefits such as the Form single person with child universal credit. Analyzing the overall tax and benefits impact is crucial to making an informed decision.

Yes, you can make a single universal credit claim if you meet the eligibility requirements. This allows you to request financial assistance tailored to single individuals, including those with dependents. To apply, visit the appropriate resource or platform that helps you fill out the Form single person with child universal credit.