New Mexico Corporation Dissolution Withholding Tax

Description

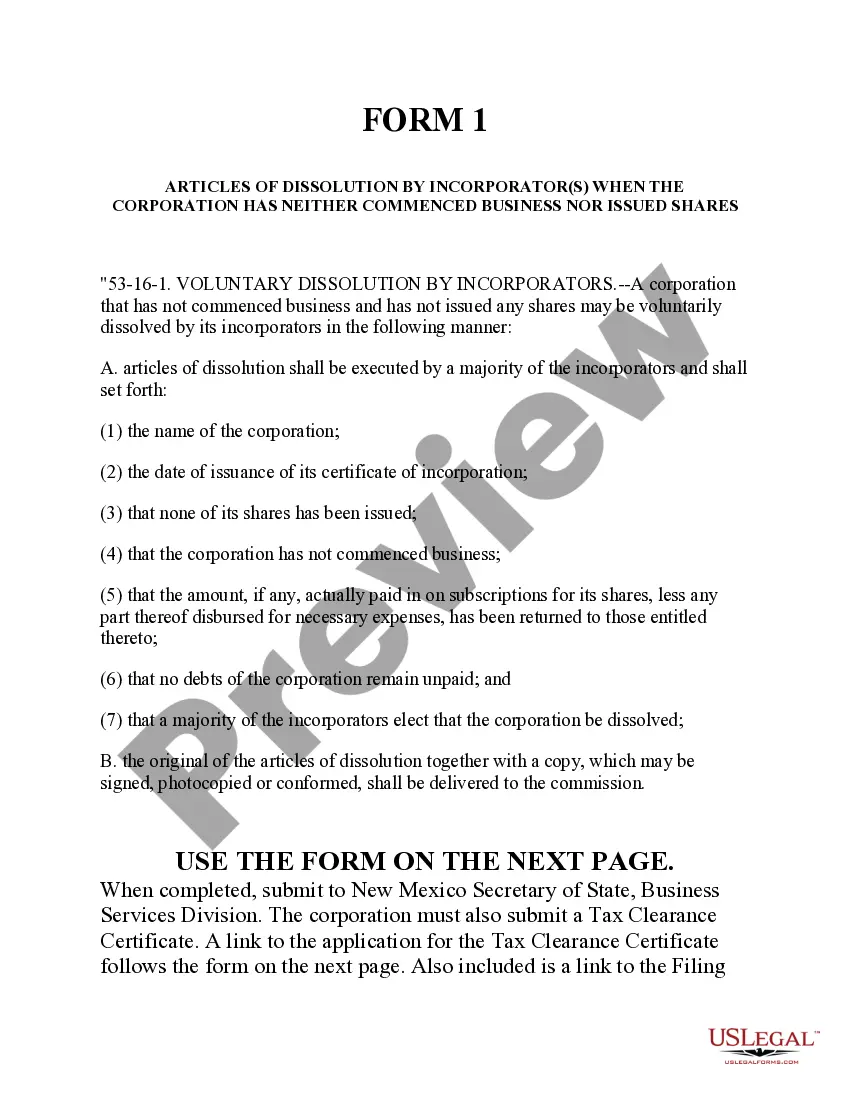

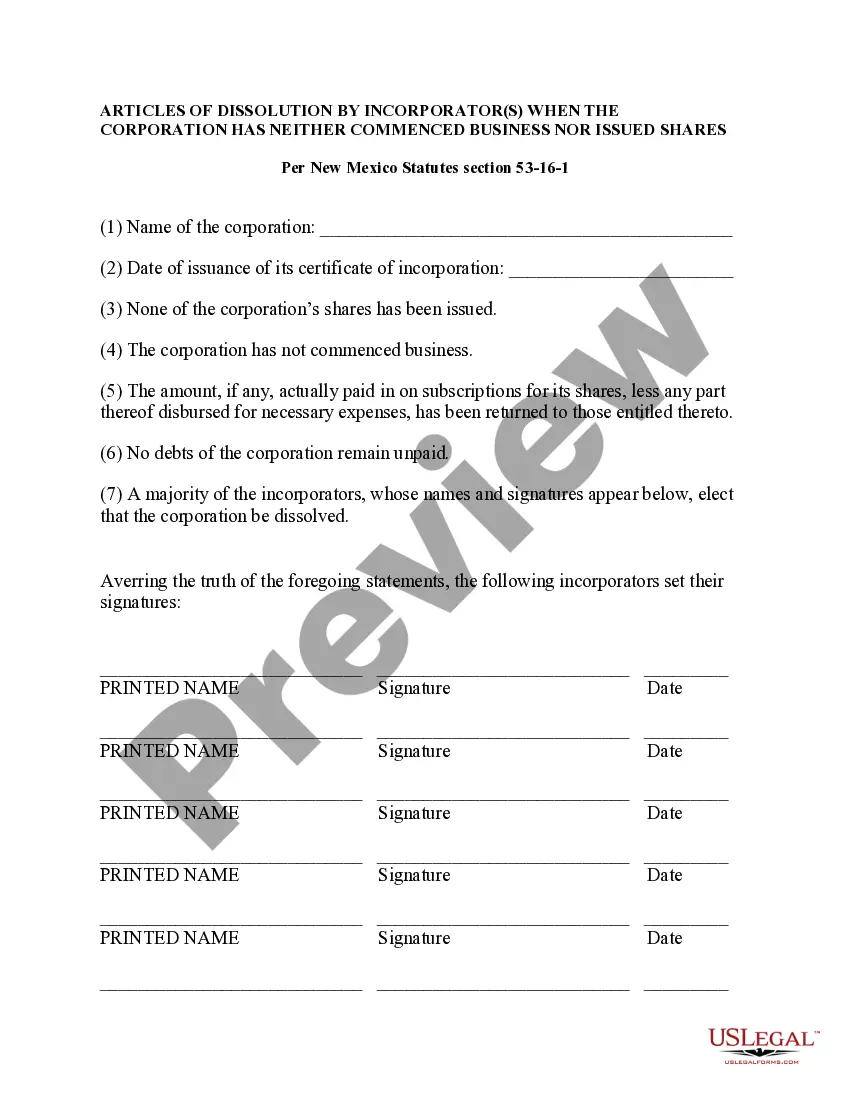

How to fill out New Mexico Dissolution Package To Dissolve Corporation?

Finding a go-to place to access the most recent and relevant legal templates is half the struggle of handling bureaucracy. Finding the right legal papers calls for precision and attention to detail, which is the reason it is important to take samples of New Mexico Corporation Dissolution Withholding Tax only from reliable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and see all the details concerning the document’s use and relevance for the situation and in your state or region.

Consider the listed steps to complete your New Mexico Corporation Dissolution Withholding Tax:

- Make use of the catalog navigation or search field to locate your sample.

- Open the form’s description to check if it matches the requirements of your state and region.

- Open the form preview, if available, to ensure the template is definitely the one you are interested in.

- Go back to the search and look for the correct document if the New Mexico Corporation Dissolution Withholding Tax does not suit your requirements.

- When you are positive regarding the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the template.

- Pick the pricing plan that fits your preferences.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a transaction method (bank card or PayPal).

- Pick the file format for downloading New Mexico Corporation Dissolution Withholding Tax.

- When you have the form on your device, you may alter it using the editor or print it and finish it manually.

Eliminate the inconvenience that comes with your legal documentation. Check out the extensive US Legal Forms library where you can find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

New Mexico withholding taxpayers may file Form RPD- 41072, Annual Summary of Withholding Tax.

To dissolve your New Mexico corporation you must file both the Statement of Intent to Dissolve and the Articles of Dissolution. Each one requires a $50 filing fee. Payment must be made by check or money order. You may expedite processing of your dissolution by the PRC.

Failure to dissolve your business can also leave you open to forms of business fraud, such as business identity theft. Step 1: Get approval of the owners of the corporation or LLC. ... Step 2: File the Certificate of Dissolution with the state. ... Step 3: File federal, state, and local tax forms. ... Step 4: Wind up affairs.

You may pay by mail sending a check or money order to the Taxation and Revenue Department with a payment voucher. Please refer to the Contact Us page to determine the correct mailing address for each type of tax. Make your check or money order payable to New Mexico Taxation and Revenue Department.

New Mexico bases its withholding tax on an estimate of an employee's State income tax liability. The State credits taxes withheld against the employee's actual income tax liability on the New Mexico personal income tax return. State withholding tax is like federal withholding tax.