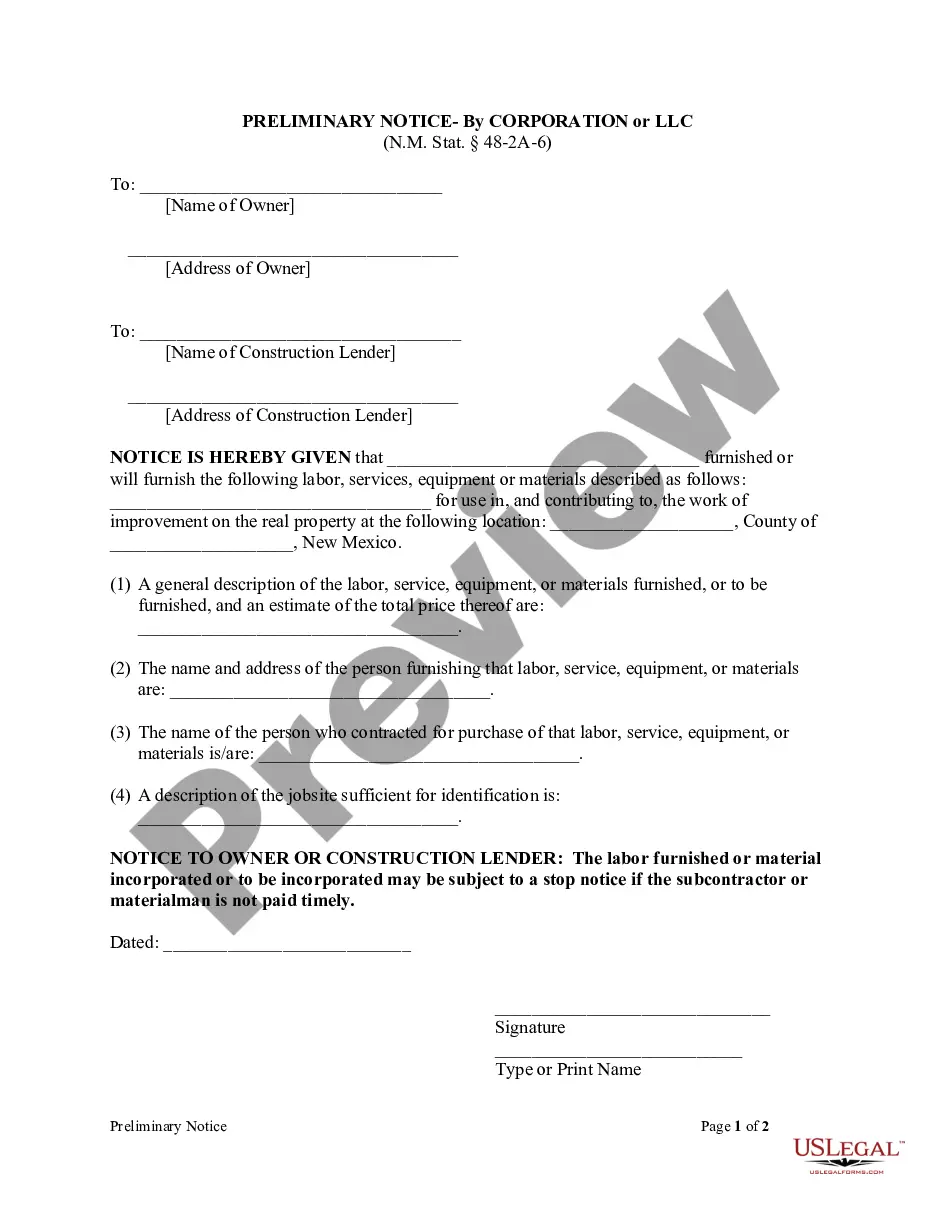

This Preliminary Notice form is for use by a corporation that furnished or will furnish labor, services, equipment or materials for use in, and contributing to, work of improvement on real property to provide notice of a general description of the labor, service, equipment, or materials furnished, or to be furnished, and an estimate of the total price thereof, the name and address of the person furnishing that labor, service, equipment, or materials, the name of the person who contracted for purchase of that labor, service, equipment, or materials, and a description of the jobsite sufficient for identification.

New Mexico Notice Form Pte Instructions 2020

Description

How to fill out New Mexico Notice Form Pte Instructions 2020?

There's no longer a need to waste hours looking for legal documents to meet your local state laws.

US Legal Forms has compiled all of them in one place and made them easier to access.

Our site offers over 85,000 templates for any business and personal legal matters organized by state and purpose.

Select the Buy Now button next to the template title when you identify the right one. Choose the most suitable pricing option and create or Log Into an account. Proceed to pay for your subscription with a credit card or through PayPal. Select the file format for your New Mexico Notice Form Pte Instructions 2020 and download it to your device. Print out your form to fill it out manually or upload the sample if you wish to utilize an online editor. Completing formal paperwork under federal and state regulations is swift and simple with our collection. Experience US Legal Forms today to keep your records organized!

- All forms are correctly drafted and verified for accuracy, so you can trust in acquiring a current New Mexico Notice Form Pte Instructions 2020.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before downloading any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever required by accessing the My documents tab in your profile.

- If you are new to our service, the process will require a few additional steps to finalize.

- Here's how newcomers can locate the New Mexico Notice Form Pte Instructions 2020 in our catalog.

- Carefully examine the page content to confirm it includes the sample you require.

- To assist, use the form description and preview options, if available.

Form popularity

FAQ

In New Mexico, retirement income is generally taxed, but specific exemptions may apply based on the type of income. For example, Social Security benefits and certain retirement accounts may not be taxed or may be partially exempt. To ensure you understand your obligations, review the New Mexico notice form pte instructions 2020, which details how retirement income is treated.

Qualified net income for PTE tax refers to the total income that qualifies for tax calculations according to New Mexico tax law. This income generally excludes certain deductions and non-taxable items. To navigate the specifics, refer to the New Mexico notice form pte instructions 2020, which clearly outlines what qualifies as net income for tax purposes.

The PTE tax in New Mexico is a specific tax assessed on the income of pass-through entities. This includes certain partnerships and S-corporations. By following the New Mexico notice form pte instructions 2020, you can better understand how the rates apply to various income levels and how these taxes are structured.

Determining whether PTE tax is worth it depends on your unique financial situation. Many taxpayers find benefits in reduced rates and potential loopholes that arise from claiming PTE status. The New Mexico notice form pte instructions 2020 can help provide clarity on these advantages, guiding you through the decision-making process.

PTE tax in New Mexico is calculated based on your qualified net income. To determine this amount, you consider your income after certain deductions and exclusions. The New Mexico notice form pte instructions 2020 provides specific guidelines on how to report your income accurately, ensuring you comply with state regulations.

The RPD 41359 form is used in New Mexico for tax reporting specific to certain transactions. This form may be relevant when following the New Mexico notice form PTE instructions 2020, as it pertains to specific tax obligations. By accessing our resources, you can gain clarity on how this form interacts with your tax responsibilities and ensure accurate filing.

You can obtain NM tax forms through the New Mexico Taxation and Revenue Department's website or directly from uslegalforms. By visiting our platform, you can easily find the New Mexico notice form PTE instructions 2020 along with other necessary tax documents. We provide a user-friendly experience to help you navigate your tax filing needs efficiently.

The PTE rate in New Mexico varies based on the income reported by the entity. Generally, the PTE rate has been set to provide tax benefits for qualifying pass-through entities. It's crucial to follow the New Mexico notice form PTE instructions 2020 to calculate your specific rate accurately. If you’re unsure about the calculations, the US Legal Forms platform offers detailed guidance to help you navigate this process smoothly.

No, a CRS number and a tax ID are not the same. A CRS number is specific to New Mexico for reporting gross receipts taxes, while a tax ID, often referred to as an EIN, is used federally. When filling out your New Mexico notice form PTE instructions 2020, it is important to include the correct identification numbers to avoid confusion. Always check with your tax advisor for clarity on these requirements.

To elect PTE in New Mexico, you must complete the New Mexico notice form PTE instructions 2020. This form allows you to declare your intention to be treated as a pass-through entity. You should submit this form with your tax return, ensuring you meet the state’s filing requirements. If you need assistance, consider using the resources available on the US Legal Forms platform.