Tenant Landlord Building For Rent

Description

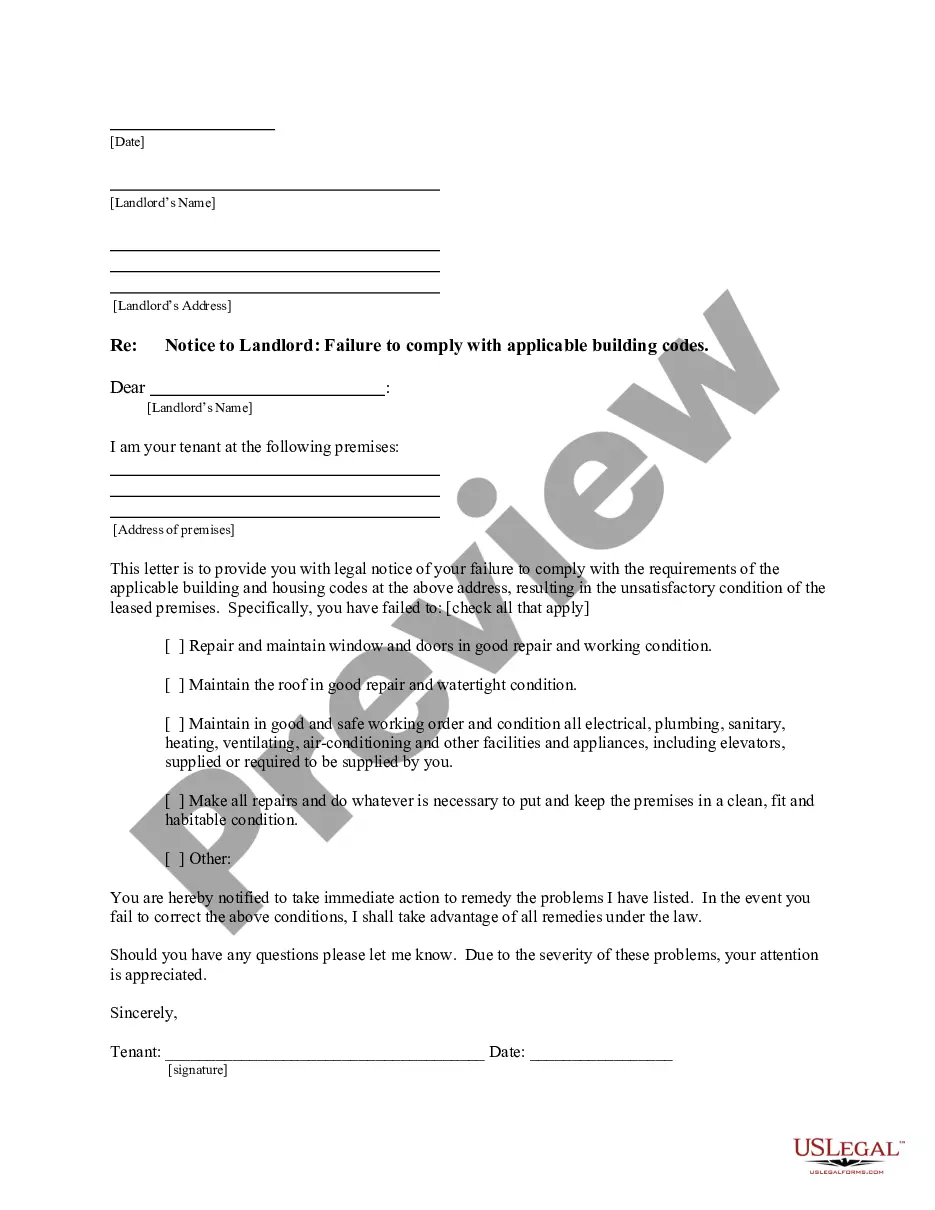

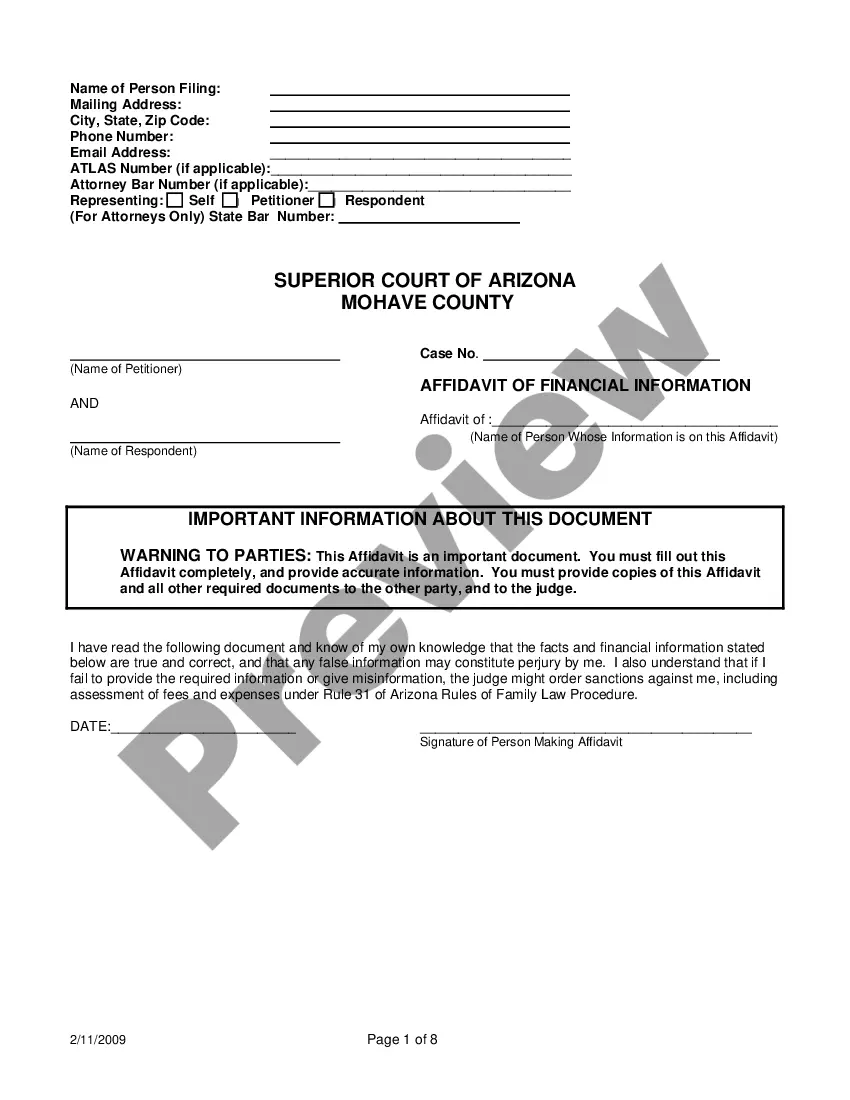

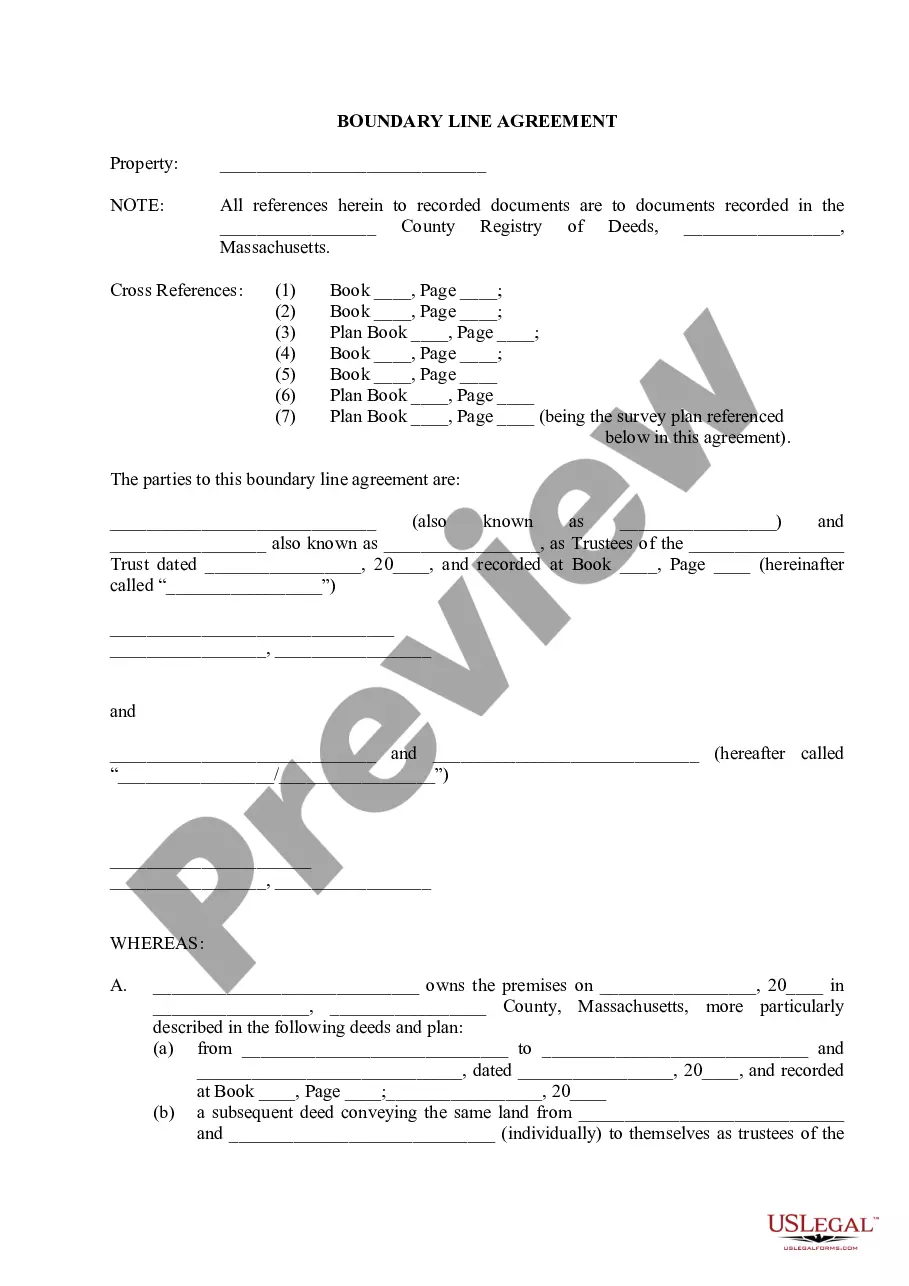

How to fill out New Mexico Letter From Tenant To Landlord For Failure Of Landlord To Comply With Building Codes Affecting Health And Safety Or Resulting In Untenantable Condition - Demand For Remedy?

- If you're returning, log in to your account and navigate to the required form template. Ensure your subscription is active, or renew it if needed.

- For new users, start by exploring the Preview mode to review form descriptions. This step ensures you select a template that aligns with your specific needs and local jurisdiction.

- If necessary, utilize the Search bar to locate a more suitable template. Confirm it meets your criteria before proceeding.

- Finish the purchase by clicking the Buy Now button and selecting your preferred subscription plan. You'll need to create an account for access to the comprehensive legal library.

- Complete your transaction by entering payment details, either through credit card or PayPal to finalize your subscription.

- Download the completed form and save it to your device. You can easily revisit it anytime from the My Forms section of your profile.

By following these straightforward steps, you can secure the legal forms necessary for managing your tenant-landlord relationships effectively. US Legal Forms not only provides a wide selection of documents but also ensures they are easy to complete and legally sound.

Ready to simplify your rental document process? Visit US Legal Forms today.

Form popularity

FAQ

The 50% rule in rental property investment suggests that approximately half of your rental income will go towards property expenses, including maintenance, taxes, and management fees. This guideline helps landlords estimate potential profits accurately. Utilizing it within a tenant landlord building for rent context can provide a clearer financial picture.

Recent laws in Illinois address tenant rights and landlord obligations, emphasizing fair housing practices and security deposit regulations. These changes aim to protect tenants while maintaining fair practices for landlords. Staying informed about these laws is crucial for anyone involved in tenant landlord buildings for rent to ensure compliance.

Yes, a handwritten rental agreement can be legal as long as it includes all essential terms and is signed by both parties. However, clarity and detail matter significantly. It's often advisable to use a standardized format or consult platforms like US Legal Forms to ensure your agreement meets legal requirements for tenants in landlord buildings for rent.

To document a rental property, create a consistent system for recording lease agreements, maintenance records, and communications with tenants. This includes keeping copies of important documents and using digital tools for organization. By doing so, you will streamline operations related to your tenant landlord building for rent, ensuring smoother interactions.

Documenting rental property expenses requires keeping detailed receipts and records of all costs related to property maintenance and management. You can categorize expenses such as repairs, utilities, and property management fees for easier analysis. This practice is essential for accurate tax reporting, especially in a tenant landlord building for rent scenario.

To show proof of rental income, gather documents such as lease agreements, bank statements, and tax returns that reflect rental payments received. These documents offer a clear depiction of your income and can be helpful for tax purposes or when applying for loans. Using a tenant landlord building for rent system simplifies tracking your income details.

In Illinois, a landlord must comply with local housing codes, ensure the rental unit is safe and habitable, and maintain necessary property documents. It's also crucial to provide a written rental agreement that outlines the terms of the lease. This helps establish clear expectations between the tenant and landlord, especially in tenant landlord buildings for rent.

To find someone to rent your property, start by creating an appealing and detailed listing that highlights its features. Utilize online platforms and local resources to reach a wider audience. Additionally, working with uslegalforms can provide you with valuable documents and guidelines to streamline the tenant landlord building for rent process. By taking these steps, you increase your chances of attracting reliable tenants more effectively.

Yes, the government does rent buildings for various purposes, such as office space and community resources. This rental approach allows flexibility for government operations and can sometimes lead to opportunities for private tenants. If you’re exploring the tenant landlord building for rent landscape, consider how government leasing might affect available rental options in your area. Understanding these dynamics can help you make informed decisions.

Federal buildings are funded by taxpayer dollars, including local, state, and federal taxes. This funding supports the construction, leasing, and maintenance of these buildings, ensuring they remain functional and accessible. For individuals interested in tenant landlord buildings for rent, understanding this funding helps clarify how public resources are utilized for various properties. It may also influence your choice in selecting a rental space.