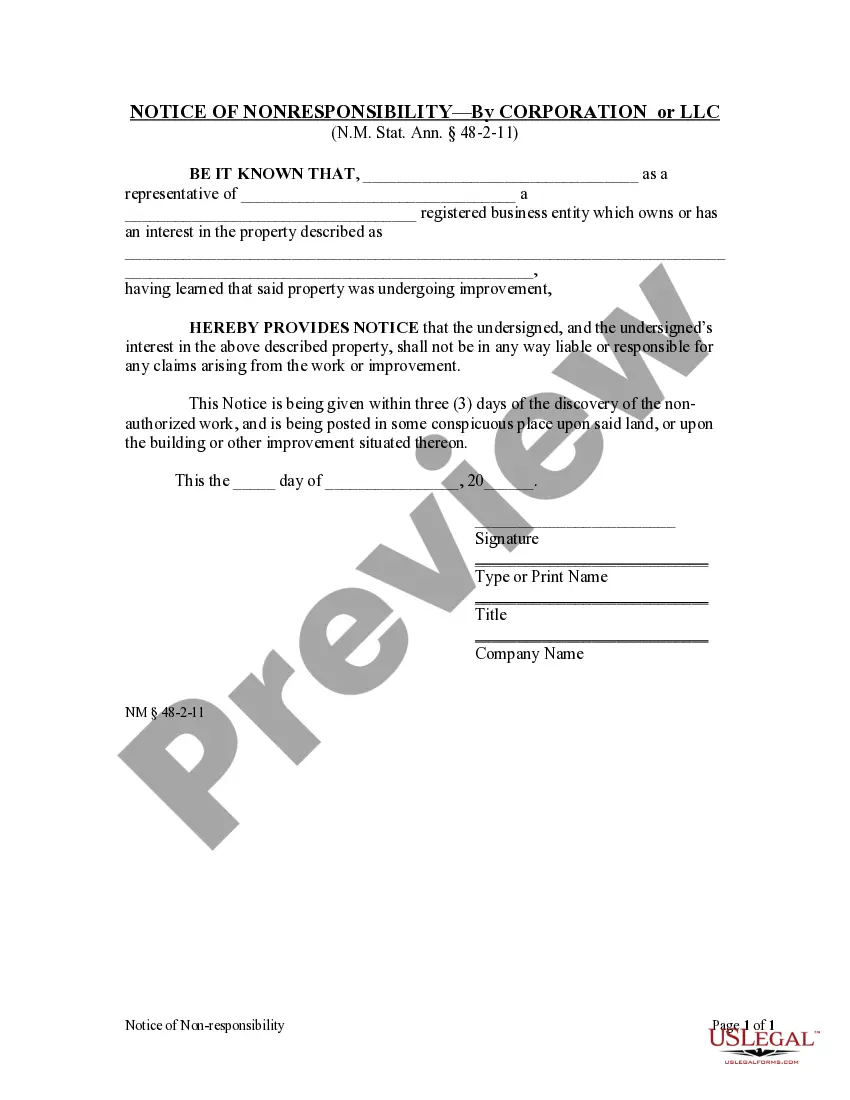

A party providing labor or material for the improvement of property is entitled to a lien against that property, unless the owner or person having or claiming an interest in the property shall, within three days after he shall have obtained knowledge of the construction, alteration or repair, or the intended construction, alteration or repair, give notice that he will not be responsible for the same, by posting a notice in writing to the effect, in some conspicuous place upon said land, or upon the building or other improvement situated thereon.

New Mexico Employee Withholding Form

Description

Form popularity

FAQ

Nonresident withholding tax in the USA applies to income earned by individuals who do not reside in the state they are earning income in. Each state, including New Mexico, has its own rules and forms, such as the New Mexico employee withholding form for state-specific regulations. This tax helps ensure equity between residents and nonresidents regarding state contributions. Familiarizing yourself with these regulations is advisable for smooth tax compliance.

The New Mexico nonresident withholding tax is a tax deducted from income earned by nonresidents working in the state. This tax helps ensure that nonresidents contribute to state revenue for the services they use. Properly completing the New Mexico employee withholding form is vital for accurate reporting. Stay informed about tax rates and regulations to avoid surprises during tax season.

Individuals who earn income in New Mexico but live outside the state must file a nonresident tax return. This requirement includes working, or receiving income from New Mexico sources. The New Mexico employee withholding form can assist in determining the correct amount to report. For clarity, consulting with a tax specialist can further simplify this process.

To register for Withholding Tax in New Mexico, visit the New Mexico Taxation and Revenue Department website. You can complete the registration online or submit a paper application, depending on your preference. Using the New Mexico employee withholding form will allow you to declare your withholding obligations properly. Consider using platforms like uslegalforms for guided help during registration.

Yes, New Mexico requires withholding for nonresidents working within the state. This means that if you are a nonresident earning income in New Mexico, your employers must use the New Mexico employee withholding form to withhold the appropriate state taxes. This requirement helps ensure that all individuals contribute fairly to state revenue. Always check the latest regulations to stay compliant with nonresident tax obligations.

Yes, New Mexico has a designated state withholding form, essential for employers and employees to comply with state tax laws. The New Mexico employee withholding form allows you to report and manage state tax deductions accurately. Make sure to fill it out correctly to avoid issues with your tax returns. Access this form easily through the New Mexico taxation website or platforms like uslegalforms.

To report foreign withholding, you must complete the appropriate sections on your tax return. Ensure that you have proper documentation of the foreign tax withheld. It's crucial to use the New Mexico employee withholding form for any state-specific reporting related to your case. Additionally, consulting with a tax professional can provide personalized guidance on correctly reporting foreign withholding.

To register for withholding tax in New Mexico, you need to complete the New Mexico employee withholding form. This form can be obtained online from the New Mexico Taxation and Revenue Department's website. After filling out the form, submit it to the department along with your business information. By registering, you ensure compliance with state tax regulations and are better prepared to manage employee withholding responsibilities.

New Mexico offers some tax benefits for retirees, including exemptions on certain retirement income. This makes the state relatively tax-friendly, especially for those on fixed incomes. When filling out the New Mexico employee withholding form, retirees can indicate their status to take advantage of these benefits.

NM state tax forms are available online through the New Mexico Taxation and Revenue Department. You can also find a range of these forms, including the New Mexico employee withholding form, on platforms like uslegalforms. Their user-friendly interface makes it easy to locate and download tax documents.