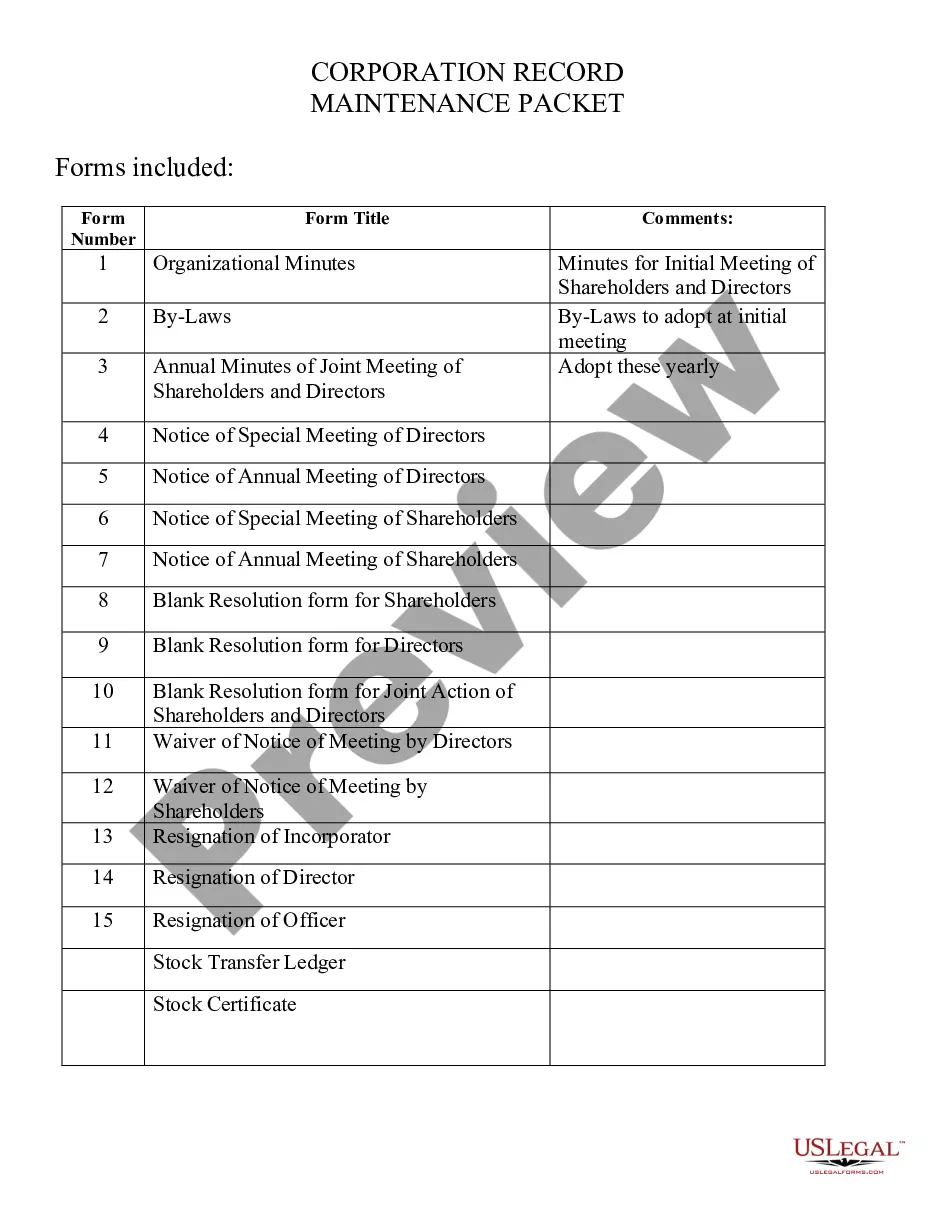

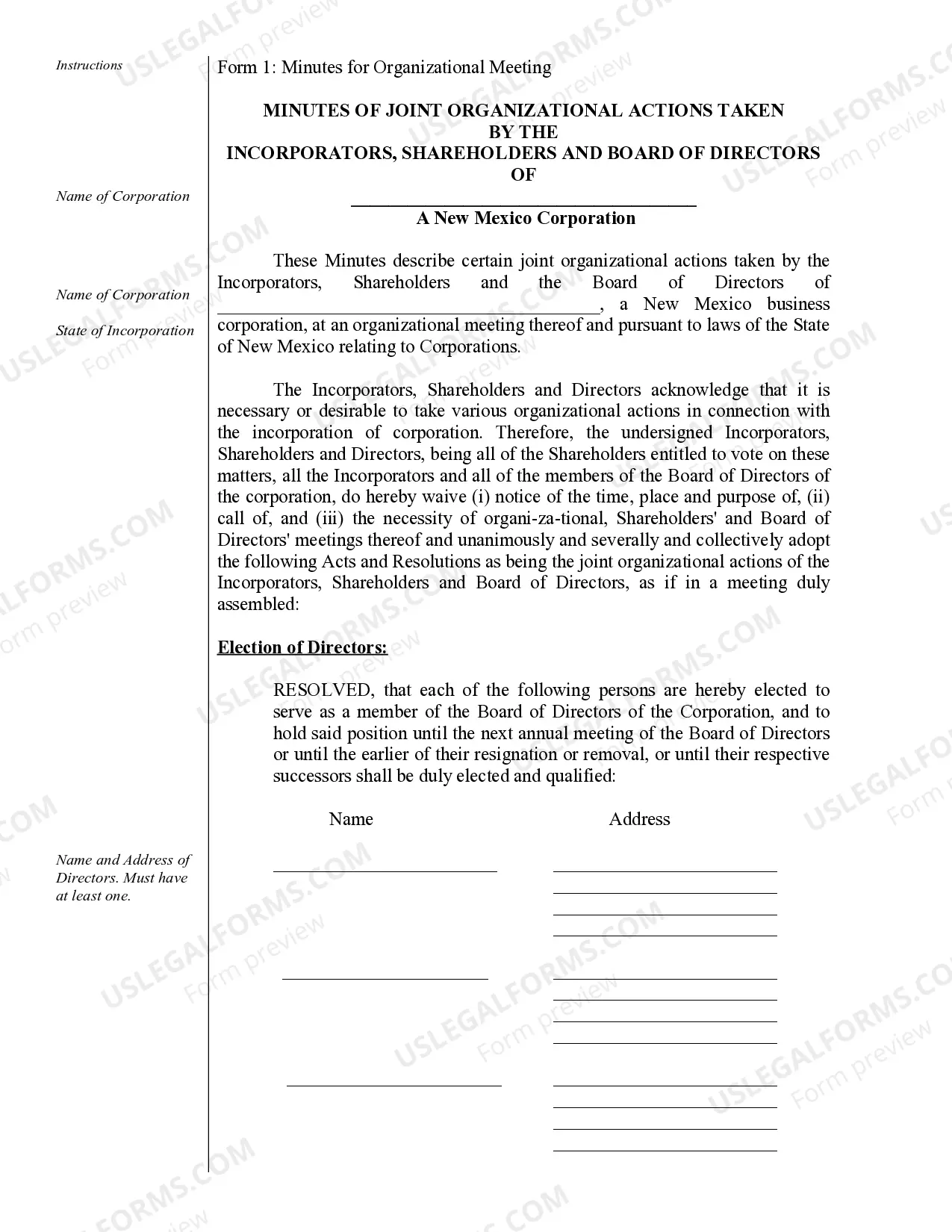

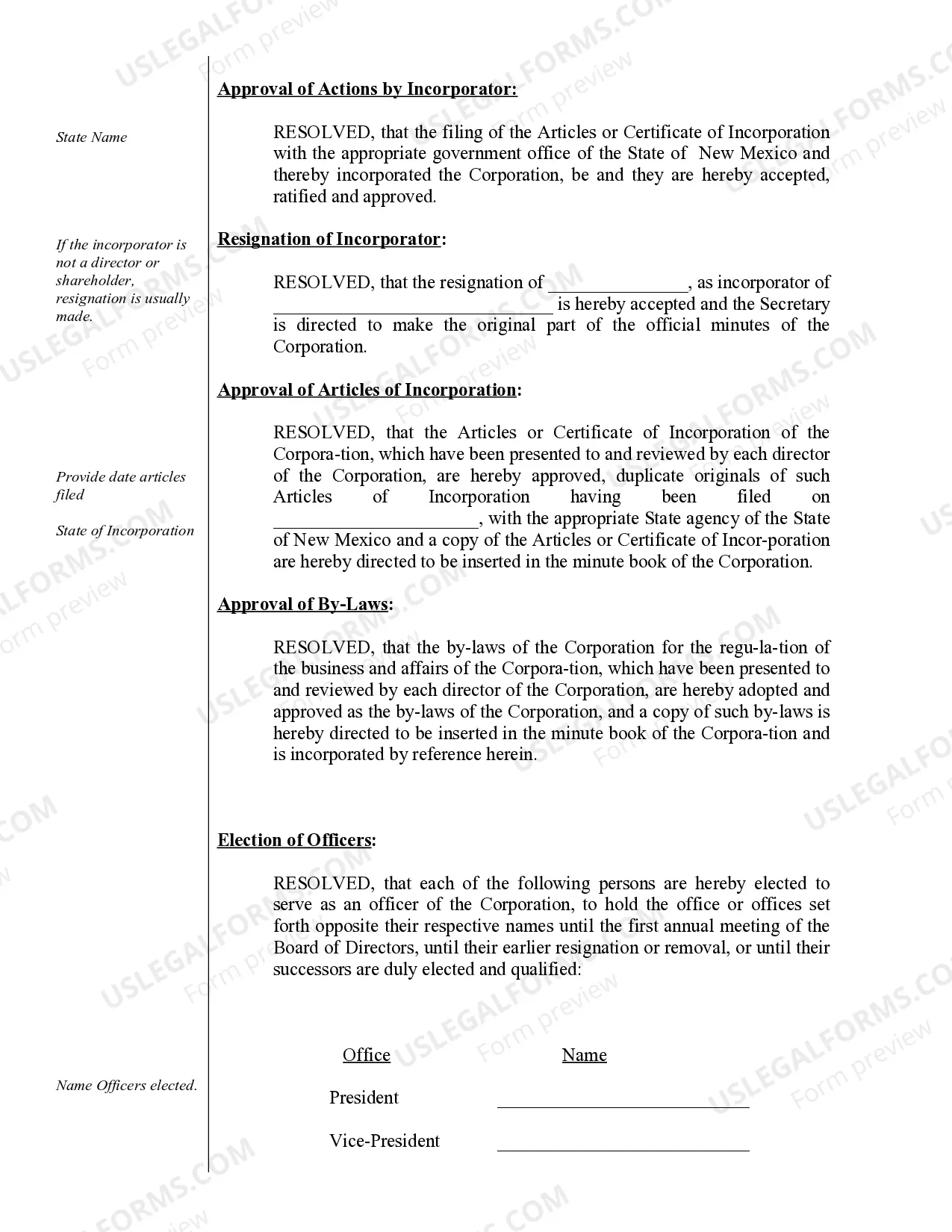

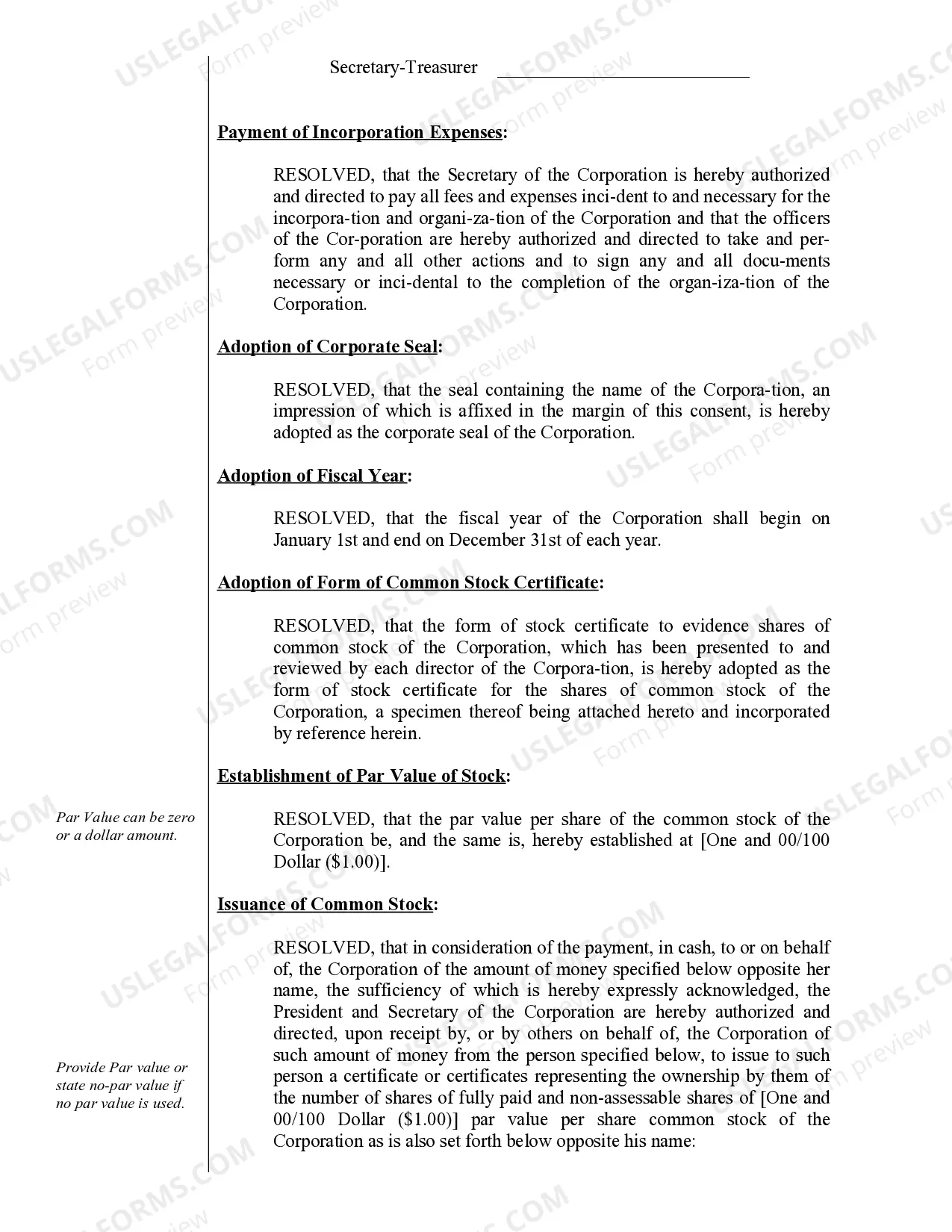

This package includes the following forms: Organizational Minutes, Minutes for Initial Meeting of Shareholders and Directors, By-Laws, Annual Minutes of Joint Meeting of Shareholders and Directors, Notice of Special Meeting of Directors, Notice of Annual Meeting of Directors, Notice of Special Meeting of Shareholders, Notice of Annual Meeting of Shareholders, Blank Resolution form for Shareholders, Blank Resolution form for Directors, Blank Resolution form for Joint Action of Shareholders and Directors, Waiver of Notice of Meeting by Directors, Waiver of Notice of Meeting by Shareholders, Resignation of Incorporator, Resignation of Director, Resignation of Officer, Stock Transfer Ledger and Simple Stock Certificate.

New Mexico Corporations Form Cit-1 Instructions 2020

Description

How to fill out New Mexico Corporations Form Cit-1 Instructions 2020?

There’s no longer a need to invest hours searching for legal documents to satisfy your local state requirements. US Legal Forms has compiled all of them in one location and improved their accessibility.

Our platform provides over 85,000 templates for any business and personal legal situations organized by state and usage area. All forms are properly prepared and validated for legitimacy, so you can confidently acquire the current New Mexico Corporations Form Cit-1 Instructions 2020.

If you are acquainted with our service and already possess an account, ensure your subscription is active before obtaining any templates. Log In to your account, select the document, and click Download. You can also retrieve all previously obtained documents whenever necessary by accessing the My documents section in your profile.

Completing official paperwork in compliance with federal and state regulations is speedy and easy with our library. Give US Legal Forms a try now to keep your documentation organized!

- Read the page content thoroughly to ensure it features the template you require.

- To do so, utilize the form description and preview options if available.

- Use the search bar above to look for another template if the present one does not suit you.

- Click Buy Now next to the name of the template once you locate the right one.

- Select the most appropriate subscription plan and create an account or sign in.

- Make payment for your subscription using a credit card or through PayPal to proceed.

- Select the file format for your New Mexico Corporations Form Cit-1 Instructions 2020 and download it to your device.

- Print your form to fill it out by hand or upload the sample if you prefer to use an online editor.

Form popularity

FAQ

In Mexico, CIT also refers to Corporate Income Tax, which is levied on the profits of companies. Understanding the nuances of CIT in Mexico is necessary for proper financial management, particularly for businesses with cross-border operations. For those engaged in or considering business in the U.S. and Mexico, staying informed on regulations, including the New Mexico corporations form CIT-1 instructions 2020, is crucial.

CIT stands for Corporate Income Tax, which is a tax imposed on the income of corporations. Understanding CIT is essential for all business owners, as it affects net revenue and operational efficiency. For businesses operating in New Mexico, following the New Mexico corporations form CIT-1 instructions 2020 is vital for proper tax reporting and filing.

To file an S Corporation in New Mexico, you must first ensure that you qualify under IRS guidelines. You'll need to file Form 2553 with the IRS and complete the requisite state forms. For easy compliance, refer to the New Mexico corporations form CIT-1 instructions 2020, which can guide you through the necessary steps and forms.

Yes, if you are a resident or have income generated in New Mexico, you must file a state income tax return. All corporations operating in New Mexico should comply with this requirement to avoid potential penalties. Furthermore, utilizing the New Mexico corporations form CIT-1 instructions 2020 will ensure that your filing is accurate and timely.

CUCA stands for 'Capital Contributions Account' in Mexico and relates to the tax implications for businesses and corporations. It tracks the contributions of capital from shareholders and can impact the distribution of profits. For U.S.-based businesses engaged in operations in Mexico, understanding CUCA can be beneficial alongside keeping up with the New Mexico corporations form CIT-1 instructions 2020.

In Mexico, the Corporate Income Tax (CIT) is generally set at 30%. This tax applies to legal entities operating in Mexico, and it is essential for businesses to understand their tax obligations. For individuals or companies dealing with New Mexico corporations, reviewing the New Mexico corporations form CIT-1 instructions 2020 can clarify how international taxes might play a role in your overall strategy.

The Corporate Income Tax (CIT) rate in the United States varies depending on the type of corporation and its taxable income. Generally, the federal CIT rate is 21% after the tax reforms in 2018. However, states like New Mexico may impose additional taxes, so it’s crucial to refer to the New Mexico corporations form CIT-1 instructions 2020 for specific requirements.

In New Mexico, obtaining a seller’s permit involves registering your business with the Taxation and Revenue Department. You will need to fill out the appropriate application and may be asked to provide specific business details. Once approved, your seller's permit allows you to collect sales tax legally. To navigate this process more efficiently, refer to the New mexico corporations form cit-1 instructions 2020, which provides clarity on necessary steps.

To acquire a New Mexico CRS ID number, complete the CRS registration process through the state’s online portal. This requires filling out the necessary forms accurately, providing information about your business, and submitting your application. Once processed, you will receive your CRS ID, which is vital for tax reporting and compliance. Following the New mexico corporations form cit-1 instructions 2020 will help ensure that your application is filled out correctly.

The standard deduction for New Mexico varies based on filing status and is important for your tax calculations. As of 2020, single filers can deduct around $12,400, while married couples filing jointly may deduct approximately $24,800. Always check for the latest updates on deductions, as they can change yearly. Understanding these figures is crucial when completing your taxes, especially following the New mexico corporations form cit-1 instructions 2020.