New Mexico Corporation Bylaws With Secretary Of State

Description

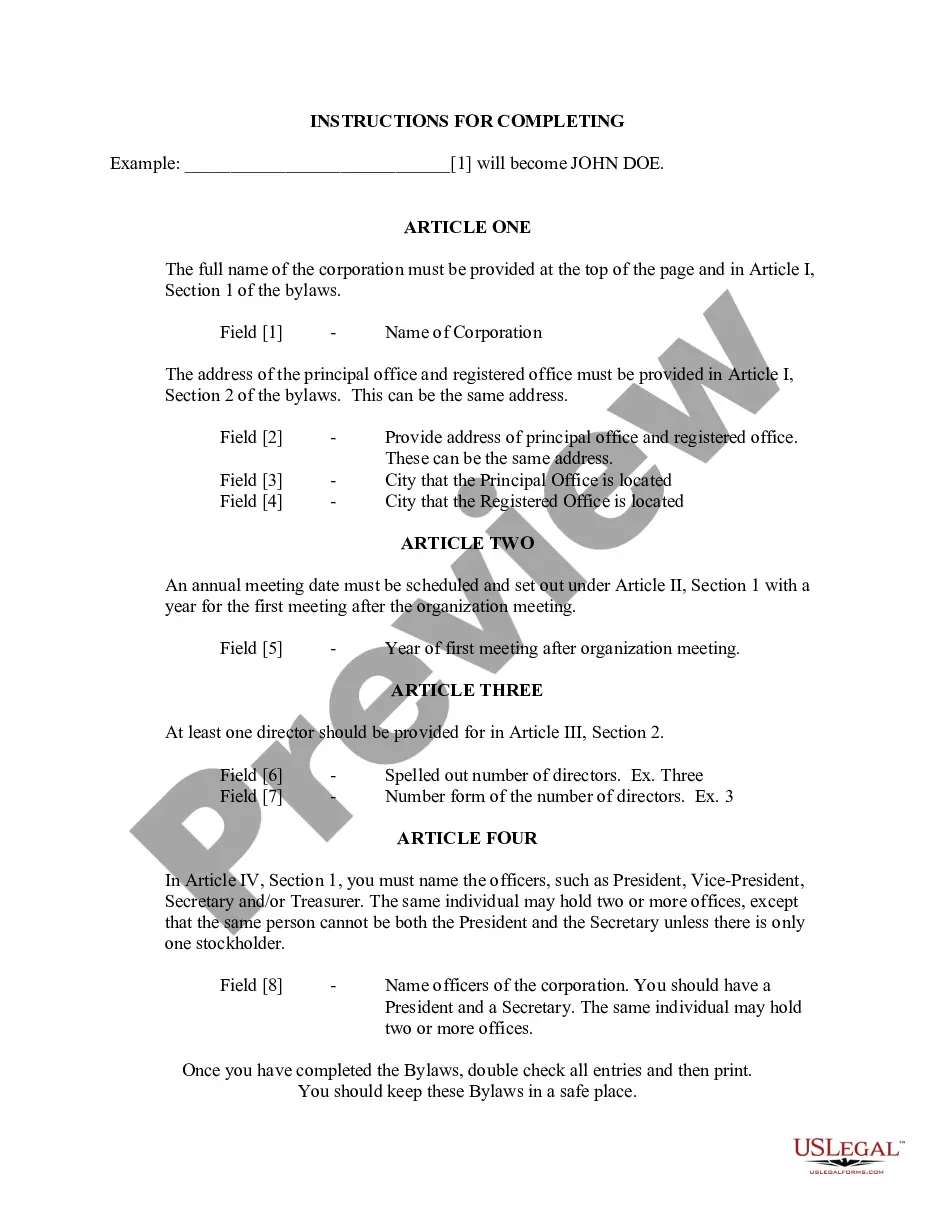

How to fill out New Mexico Bylaws For Corporation?

It’s no secret that you can’t become a legal expert overnight, nor can you figure out how to quickly prepare New Mexico Corporation Bylaws With Secretary Of State without having a specialized set of skills. Creating legal documents is a time-consuming venture requiring a particular training and skills. So why not leave the preparation of the New Mexico Corporation Bylaws With Secretary Of State to the professionals?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court paperwork to templates for in-office communication. We understand how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and obtain the form you need in mere minutes:

- Find the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether New Mexico Corporation Bylaws With Secretary Of State is what you’re searching for.

- Begin your search again if you need any other template.

- Set up a free account and choose a subscription plan to purchase the template.

- Pick Buy now. As soon as the transaction is through, you can download the New Mexico Corporation Bylaws With Secretary Of State, complete it, print it, and send or send it by post to the necessary individuals or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your paperwork-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

As the owner of an LLC, you must pay self-employment tax and federal income tax, both of which are levied as ?pass-through taxation." Federal taxes can be complicated, so speak to your accountant or professional tax preparer to ensure that your New Mexico LLC is paying the correct amount.

The requirements for being a registered agent in New Mexico are fairly simple: you must be over the age of 18, have a physical address in the state the company is registered in (not a PO box), and be physically present during normal business hours.

To dissolve your New Mexico corporation you must file both the Statement of Intent to Dissolve and the Articles of Dissolution. Each one requires a $50 filing fee. Payment must be made by check or money order. You may expedite processing of your dissolution by the PRC.

Any person or business entity in New Mexico can be a registered agent. The only necessary requirements are that they have a physical address in New Mexico and that they understand that their personal information will be made public once the business is formed.

New Mexico doesn't register DBAs, nor does it require DBAs to be listed on any state or local business license or tax forms. However, most state and local forms do feature a section where you can list your DBA alongside your legal business name.