New Mexico Corporation Bylaws For Churches

Description

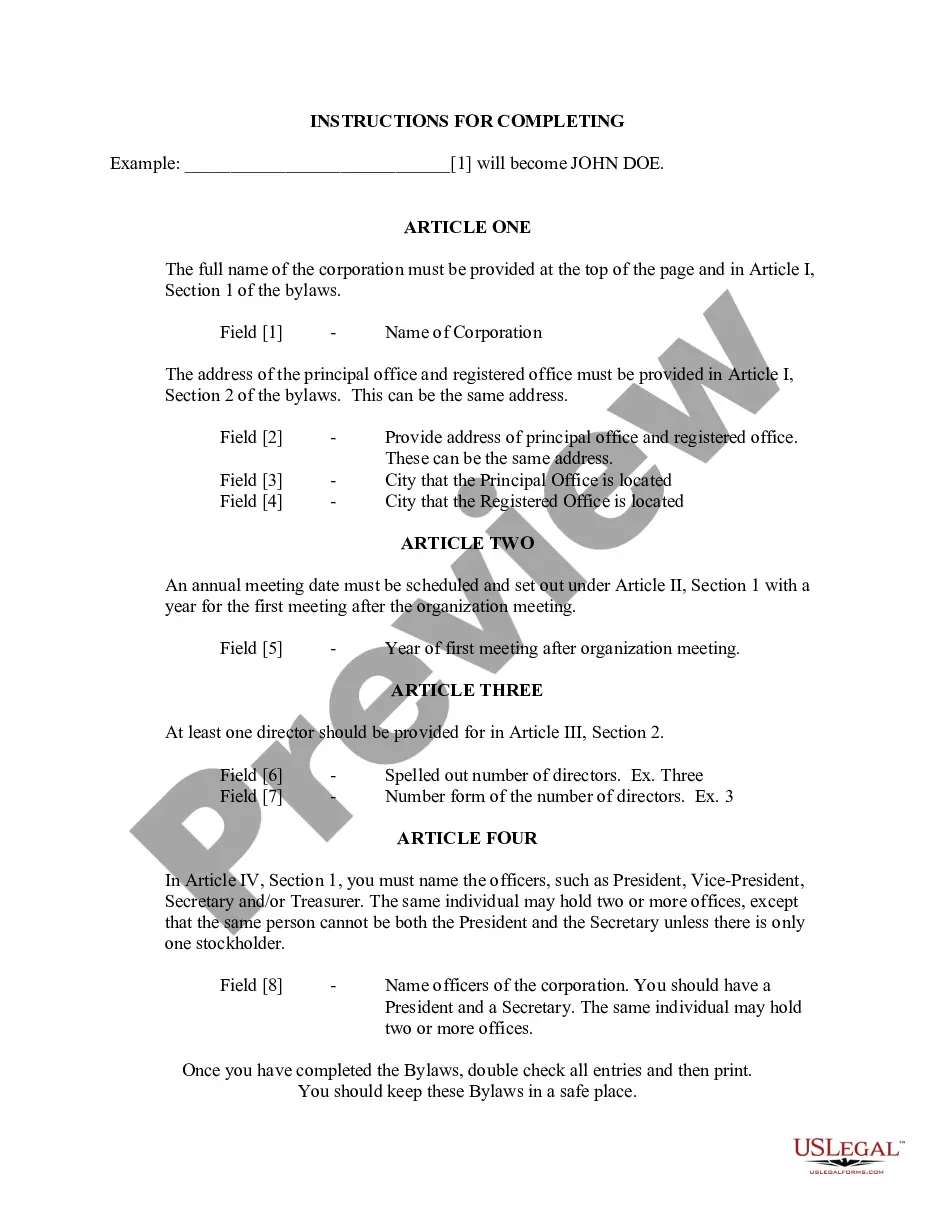

How to fill out New Mexico Bylaws For Corporation?

How to locate professional legal documents that comply with your state laws and draft the New Mexico Corporation Bylaws for Churches without consulting an attorney.

Numerous online services offer templates to address various legal scenarios and requirements. Nonetheless, it can take time to determine which of the available samples fulfill both practical use and legal standards for you.

US Legal Forms is a trustworthy platform that aids you in finding official documents crafted in line with the latest state law amendments, helping you save on legal costs.

In the event that you do not possess an account with US Legal Forms, follow the instructions below: Browse through the webpage you've accessed and confirm if the form meets your requirements. To do this, utilize the form description and preview options if available. If necessary, search for another template in the header corresponding to your state. Click the Buy Now button once you locate the fitting document. Choose the most appropriate pricing plan, then sign in or create an account. Select the payment option (by credit card or PayPal). Choose the file format for your New Mexico Corporation Bylaws for Churches and click Download. The acquired documents remain under your control: you can always revisit them in the My documents section of your profile. Join our platform and create legal documents independently like a seasoned legal expert!

- US Legal Forms is not just a typical online repository.

- It's a compilation of over 85,000 validated templates for diverse business and personal situations.

- All documents are categorized by region and state to streamline your search and minimize inconvenience.

- Furthermore, it incorporates powerful tools for PDF editing and electronic signatures, enabling users with a Premium membership to swiftly complete their paperwork online.

- Acquiring the necessary documents requires minimal time and effort.

- If you already have an account, Log In and verify that your subscription is active.

- Download the New Mexico Corporation Bylaws for Churches using the corresponding button next to the file name.

Form popularity

FAQ

Starting a nonprofit organization in New Mexico involves several key steps. You begin by choosing a name that aligns with state regulations and drafting your articles of incorporation as required by New Mexico corporation bylaws for churches. Next, file your articles with the state and apply for the necessary federal tax exemption. Utilizing a service like USLegalForms can guide you through the process, ensuring all documents are completed correctly for compliance.

Yes, a foreigner can start a nonprofit organization in the United States, including New Mexico. The individual must comply with the respective state laws and regulations, including adhering to New Mexico corporation bylaws for churches. It is essential to have a registered agent, complete the application process, and fulfill all necessary requirements for non-profit status. Engaging with professionals who understand these processes can simplify your journey.

To become a non-profit organization in New Mexico, you need to file the appropriate paperwork with the New Mexico Secretary of State. First, you must choose a unique name for your organization that complies with New Mexico corporation bylaws for churches. Then, draft your articles of incorporation, outline your mission, and include specific provisions that meet state requirements. Once your application is approved, you can apply for tax-exempt status to operate as a non-profit.

New Mexico does not uniformly require a business license at the state level, but local municipalities may have their own licensing requirements. Non-profit organizations, including churches, should check with local authorities to ensure compliance. Keeping up with these requirements is vital to ensure that your New Mexico corporation bylaws for churches align with regulatory expectations.

Yes, churches and non-profit organizations recognized as 501(c)(3) are exempt from federal income tax in New Mexico. This tax-exempt status allows these organizations to focus more resources on their missions. It is essential to comply with both federal and state laws, including maintaining proper New Mexico corporation bylaws for churches, to retain this status.

New Mexico has a variety of lesser-known laws that can surprise residents and visitors alike. For example, certain types of unique hunting regulations exist, as well as laws pertaining to the use of equipment during fishing. Understanding these nuances can help organizations, including churches, navigate the legal landscape more effectively.

To register a non-profit organization in New Mexico, you must first choose a unique name and file a Certificate of Incorporation with the Secretary of State. Following this, you should create bylaws that comply with state requirements and outline your organization’s governance. Resources like US Legal Forms can assist you in drafting these necessary New Mexico corporation bylaws for churches efficiently.

While New Mexico does not legally require nonprofit organizations, including churches, to have bylaws, it is highly recommended. Bylaws serve as the internal governing document, outlining the structure and rules of the organization. Having clear New Mexico corporation bylaws for churches can help prevent conflicts and ensure transparency.

Yes, New Mexico has a comprehensive set of laws that govern various aspects of life, including business, real estate, and personal affairs. Understanding these laws is crucial for anyone, especially organizations like churches, that want to create effective New Mexico corporation bylaws. Being compliant with state laws ensures smooth operations and legal protection.

In New Mexico, a will must be written, signed by the testator, and witnessed by at least two individuals who are not beneficiaries. The testator must be at least 18 years old and of sound mind when creating the will. If you are developing New Mexico corporation bylaws for churches, including provisions for succession planning can be vital.