New Jersey Attorney Nj Form Nj-cbt

Description

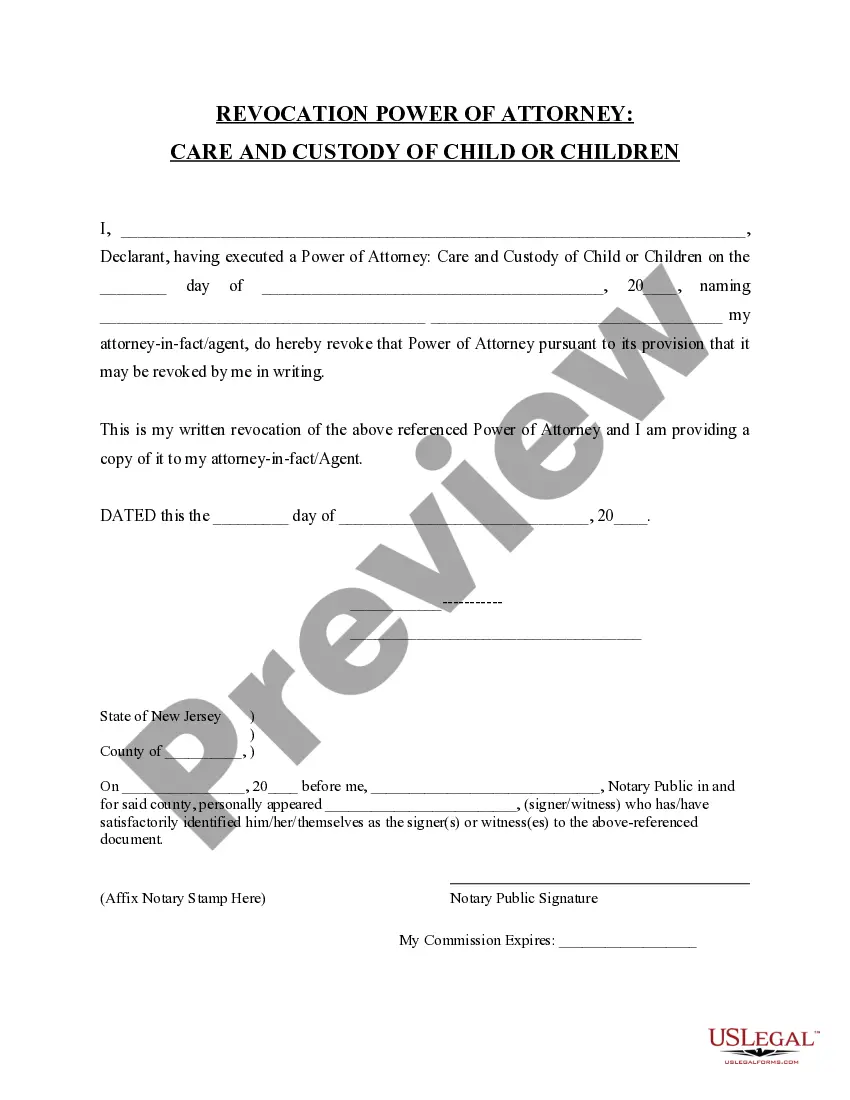

How to fill out New Jersey Revocation Of Power Of Attorney For Care Of Child Or Children?

Finding a go-to place to access the most current and appropriate legal templates is half the struggle of dealing with bureaucracy. Finding the right legal files needs precision and attention to detail, which is why it is important to take samples of New Jersey Attorney Nj Form Nj-cbt only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and check all the information about the document’s use and relevance for your circumstances and in your state or county.

Take the listed steps to finish your New Jersey Attorney Nj Form Nj-cbt:

- Use the catalog navigation or search field to locate your sample.

- Open the form’s information to check if it fits the requirements of your state and area.

- Open the form preview, if there is one, to make sure the form is definitely the one you are looking for.

- Return to the search and look for the appropriate template if the New Jersey Attorney Nj Form Nj-cbt does not fit your requirements.

- When you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Choose the pricing plan that fits your preferences.

- Go on to the registration to complete your purchase.

- Complete your purchase by picking a transaction method (credit card or PayPal).

- Choose the file format for downloading New Jersey Attorney Nj Form Nj-cbt.

- Once you have the form on your gadget, you may modify it using the editor or print it and finish it manually.

Eliminate the hassle that accompanies your legal paperwork. Check out the comprehensive US Legal Forms collection where you can find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Electronic Filing Mandate Visit the Division's website or check with your software provider to see if they support any or all of these filings. To file and pay the annual report electronically, visit the Division of Revenue and Enterprise Services website.

Every corporate entity, including certain limited liability companies (LLCs) and partnerships, that operates in New Jersey is required to file a Corporate Tax Return (Form CBT 100).

You must pay your New Jersey estimated corporation business taxes electronically by e-check or electronic funds transfer (EFT) or by credit card. Go to the Division of Taxation's website at .njtaxation.org.

Be sure to provide the location of the corporate books as well as a contact person and telephone number. (d) Send the completed return to: State of New Jersey, Division of Taxation, Corporation Tax, PO Box 666, Trenton, NJ 08646- 0666.

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. Form NJ-CBT-1065 must be filed when the entity is re- quired to calculate a tax on its nonresident partner(s).