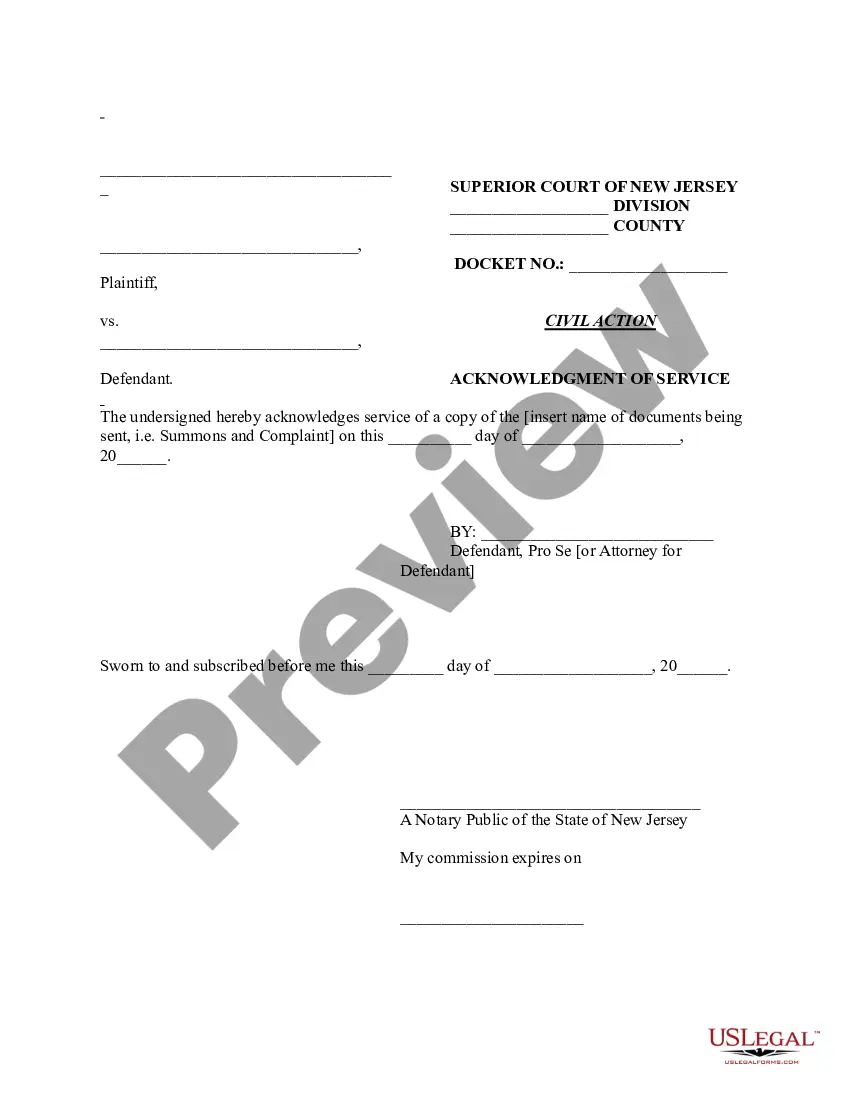

Acknowledgment Of Service Form Nj Withholding

Description

How to fill out New Jersey Acknowledgment Of Service?

Utilizing legal document examples that comply with federal and state laws is essential, and the internet provides numerous alternatives to select from.

However, what’s the benefit of squandering time searching for the correct Acknowledgment Of Service Form Nj Withholding example online if the US Legal Forms digital library already compiles such templates in a single location.

US Legal Forms is the most extensive online legal repository with over 85,000 fillable documents created by lawyers for any business and personal situation. They are simple to navigate with all files organized by state and intended purpose.

Search for another template using the search tool at the top of the page if needed. Click Buy Now when you’ve found the appropriate form and select a subscription option. Create an account or Log In and complete the payment via PayPal or a credit card. Choose the preferred format for your Acknowledgment Of Service Form Nj Withholding and download it. All templates you find through US Legal Forms are reusable. To re-download and fill out previously acquired forms, navigate to the My documents section in your profile. Take advantage of the most comprehensive and user-friendly legal document service!

- Our experts stay updated with legislative changes, ensuring your documentation is current and compliant when acquiring a Acknowledgment Of Service Form Nj Withholding from our site.

- Accessing a Acknowledgment Of Service Form Nj Withholding is straightforward and swift for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document template you need in the desired format.

- If you are a newcomer to our website, follow the steps below.

- Review the template using the Preview feature or via the text outline to confirm it fulfills your specifications.

Form popularity

FAQ

All WR-30 forms must be completed and submitted through the State of New Jersey, Division of Taxation website. To do so, you will need a New Jersey taxpayer identification number and Personal Identification Number (PIN). A PIN can be obtained by registering your business with the Division of Taxation.

Employee's unemployment and workforce development wage base increase to $41,100, maximum withholding $174.68. However, employee's disability insurance and family leave wage base increases to $156,800, maximum withholding $94.08. The base week for 2023 will increase to $260.

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

All employees, except those who file state income taxes with the Commonwealth of Pennsylvania, must file a form NJ-W4. NJ Form W4 must be completed and signed before an employee can be paid.

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.