Form A Limited Liability Company With The Ability To Establish Series

Description

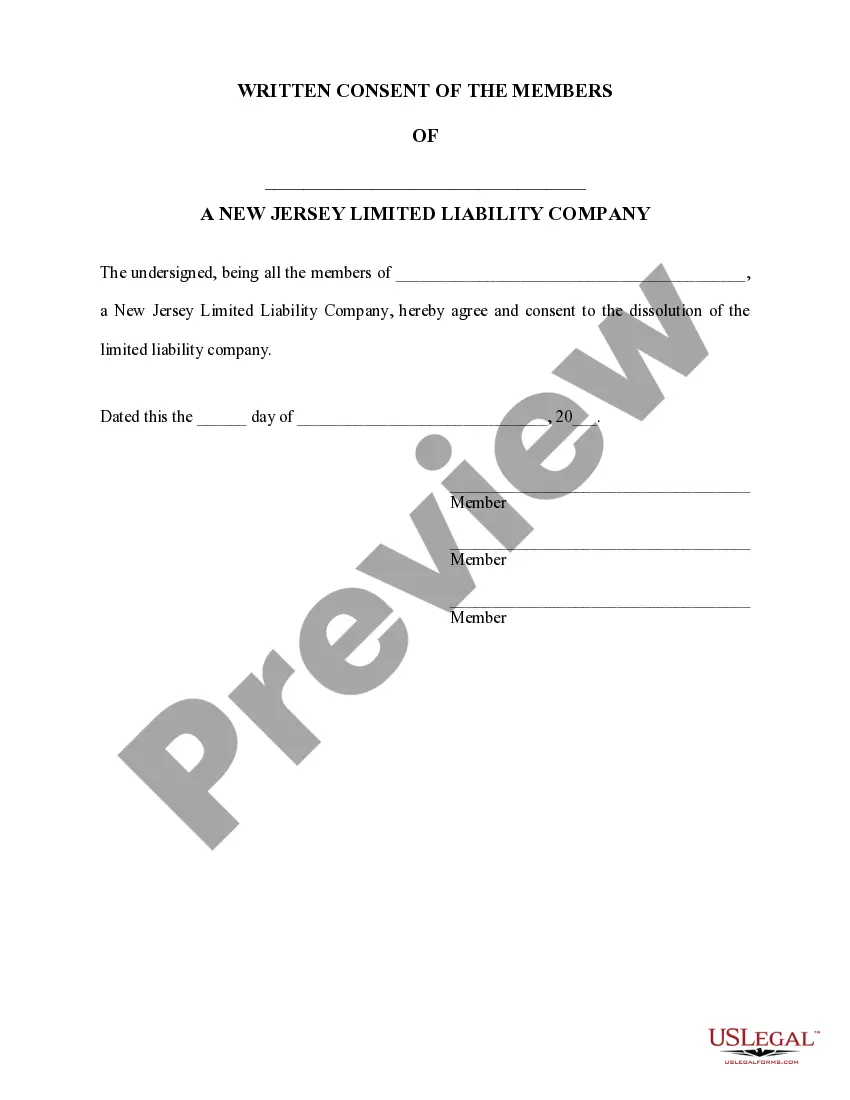

How to fill out New Jersey Dissolution Package To Dissolve Limited Liability Company LLC?

- If you're an existing user, log in to your account and select the desired form template for download. Ensure your subscription is active; if not, renew it based on your payment plan.

- If you're a new user, begin by browsing the available forms. Utilize the Preview mode and form descriptions to ensure it meets your specific requirements and complies with local jurisdiction.

- If the form does not match your needs, use the Search tab to find an alternative template that is suitable.

- Once you've found the correct document, click the Buy Now button. Choose your preferred subscription plan and create an account for full access to the library.

- Complete your purchase using your credit card or PayPal. This subscription grants you access to the entire collection of legal forms.

- Once your payment is processed, download your selected form. You can access it anytime through the My Forms section in your profile.

By following these steps, you'll have the necessary form to establish a limited liability company with series capabilities, ensuring that your business is organized correctly.

Don't hesitate to leverage US Legal Forms’ extensive resources for more assistance! Start your legal journey today.

Form popularity

FAQ

You can use the same EIN for multiple 'doing business as' (DBA) names under the same LLC, which simplifies tax reporting. However, if you form a limited liability company with the ability to establish series and operate them as distinct entities, it may be beneficial to obtain separate EINs for clarity. It's always a good practice to consult with a financial advisor to ensure you meet all regulatory requirements.

An LLC with the ability to establish series is a unique structure that allows a single limited liability company to create multiple series, each with its own assets, liabilities, and operations. This setup offers significant advantages, including reduced paperwork and protection from cross-liability. When you form a limited liability company with the ability to establish series, you can enjoy streamlined management while protecting different aspects of your business.

Each series within a series LLC may not necessarily need its own EIN, depending on how you plan to manage taxes. Generally, if each series conducts distinct business activities or has separate bank accounts, obtaining an EIN for each can simplify financial management. Forming a limited liability company with the ability to establish series gives you the flexibility to decide based on your operational needs.

To convert your existing LLC into a series LLC, you typically need to file a document with your state that includes a plan for how the series will be structured. Forming a limited liability company with the ability to establish series can offer significant benefits, such as liability protection across different series. It is important to review your state’s regulations regarding the conversion process to ensure compliance.

In general, a series LLC does not need to file separate tax returns for each series unless you choose to treat them as distinct entities. Forming a limited liability company with the ability to establish series allows for streamlined management of tax filings. Yet, you should consult a tax advisor to understand the implications based on your unique circumstances, as tax laws can vary significantly by state.

When you form a limited liability company with the ability to establish series, you typically do not need a separate Employer Identification Number (EIN) for each LLC if each series operates as part of the same legal entity. However, if you decide to treat each series as a separate entity for tax purposes, obtaining a unique EIN for each is advisable. Consulting with a tax professional can provide clarity on your specific situation.

For multiple member LLCs, taxation typically follows a partnership model unless you choose to be taxed as a corporation. Members will report their share of profits and losses on their personal tax returns. When you form a limited liability company with the ability to establish series, each series may have its own tax reporting obligations. Always seek professional advice to ensure compliance and optimize your tax strategy.

The primary disadvantage of a series LLC is the complexity of managing multiple series. While forming a limited liability company with the ability to establish series provides liability protection, it can lead to confusion in operations and tax filings. Additionally, not all states recognize series LLCs, which may pose challenges for businesses operating across state lines. It's wise to carefully weigh these points before proceeding.

Filing taxes for a Series LLC differs depending on the state laws and structure chosen. Each series under the LLC may have its own tax identification number and specific tax requirements. If you form a limited liability company with the ability to establish series, understanding these nuances is crucial. Consulting with tax experts will help you navigate these filings efficiently.

Typically, you do not file LLC taxes with your personal taxes as they are separate entities. However, if you have a single-member LLC, the IRS treats you as a sole proprietor, allowing you to report business income on your personal tax return. When you form a limited liability company with the ability to establish series, it may have its own tax requirements. Consulting a tax professional may provide clarity on your specific situation.