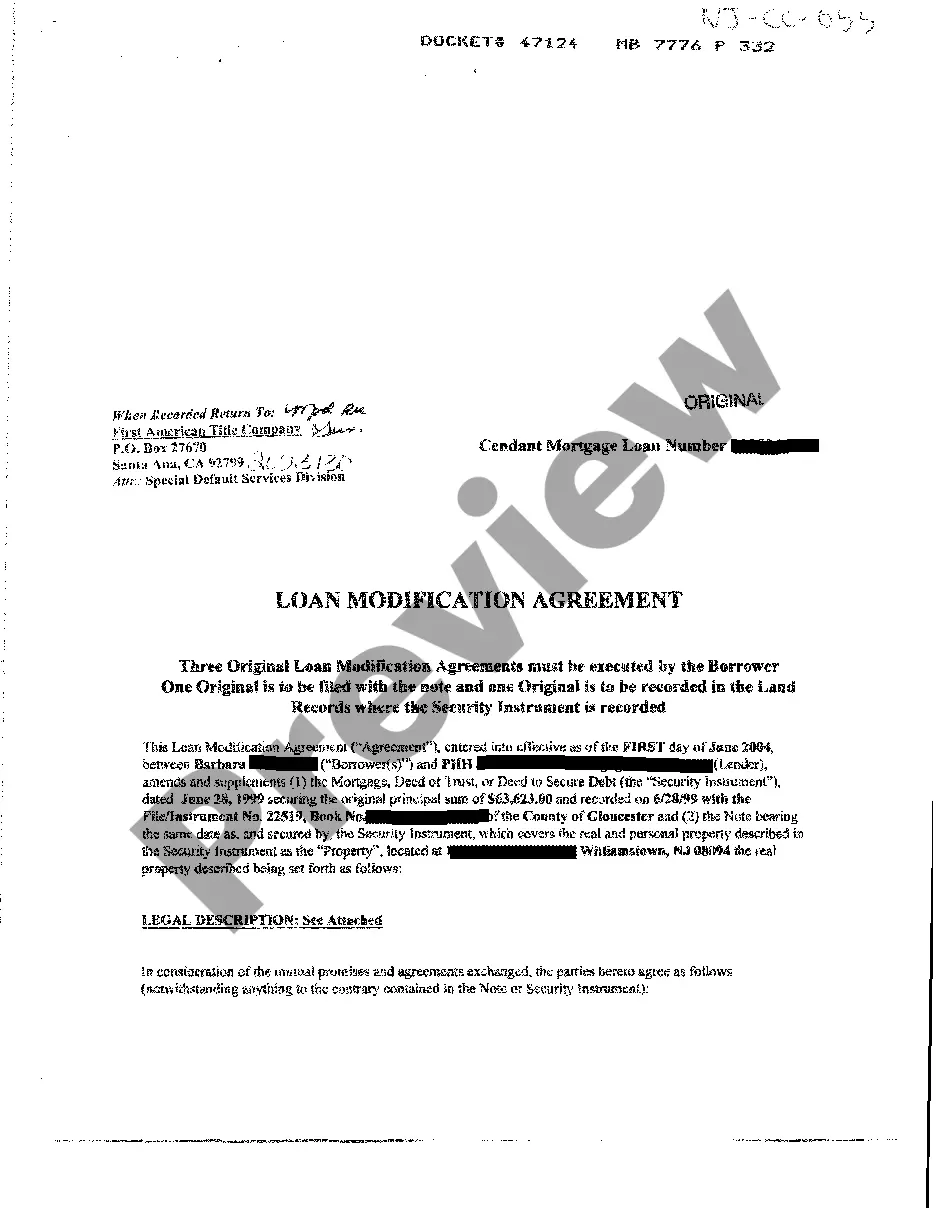

New Jersey Personal Loan Agreement Template With Notary

Description

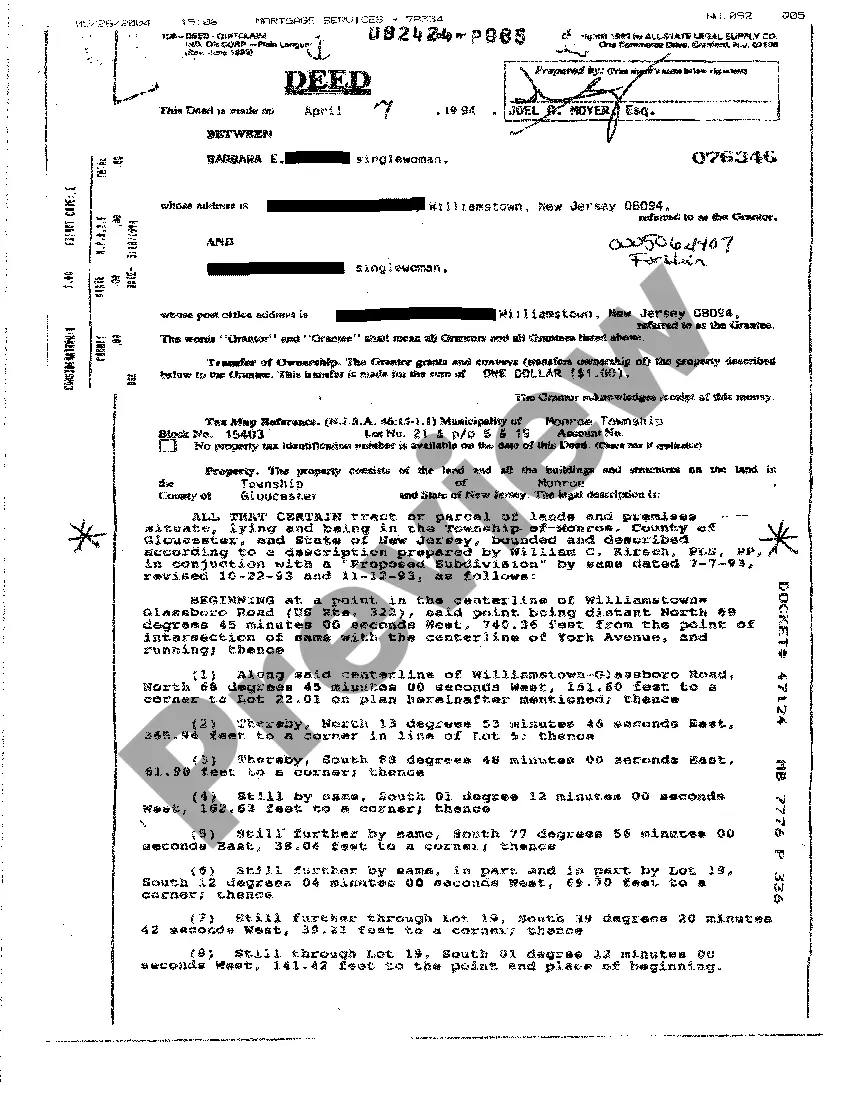

How to fill out New Jersey Loan Modification Agreement?

Individuals commonly link legal documents with complexity that solely an expert can handle.

In a particular sense, this is accurate, as creating a New Jersey Personal Loan Agreement Template With Notary demands considerable expertise regarding relevant criteria, including state and local laws.

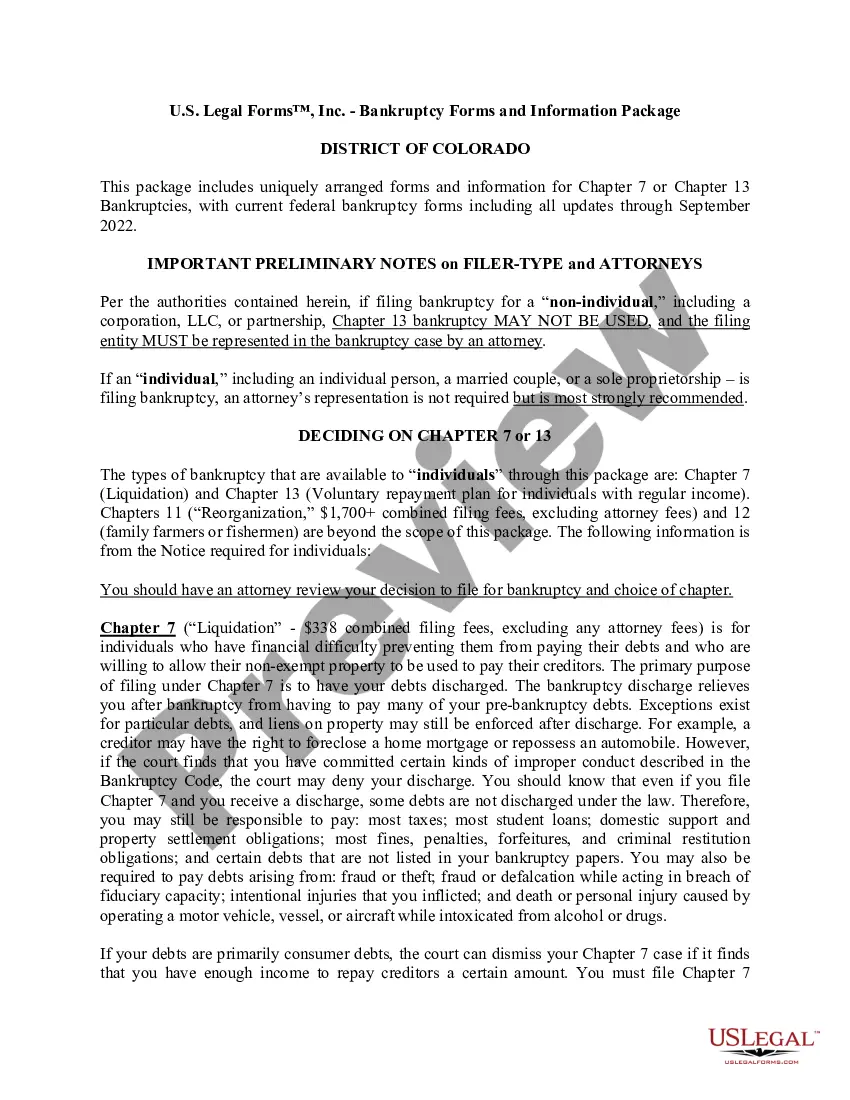

Nonetheless, with US Legal Forms, everything has become simpler: pre-prepared legal documents for every life and business scenario tailored to state regulations are compiled in a singular online repository and are now accessible to all.

Choose your file format and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our library can be reused: once purchased, they remain saved in your profile, ensuring you can access them at any time through the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current documents categorized by state and usage area, making it easy to find the New Jersey Personal Loan Agreement Template With Notary or any other specific template within minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to obtain the form.

- New users must first establish an account and subscribe before being able to download any documents.

- Here are the step-by-step instructions on how to acquire the New Jersey Personal Loan Agreement Template With Notary.

- Review the page content carefully to ensure it meets your requirements.

- Read the form description or inspect it via the Preview option.

- If the previous sample doesn't suit your preferences, search for another using the Search bar above.

- Once you find the appropriate New Jersey Personal Loan Agreement Template With Notary, click Buy Now.

- Select a pricing plan that aligns with your needs and financial situation.

- Sign up for an account or Log In to continue to the payment page.

Form popularity

FAQ

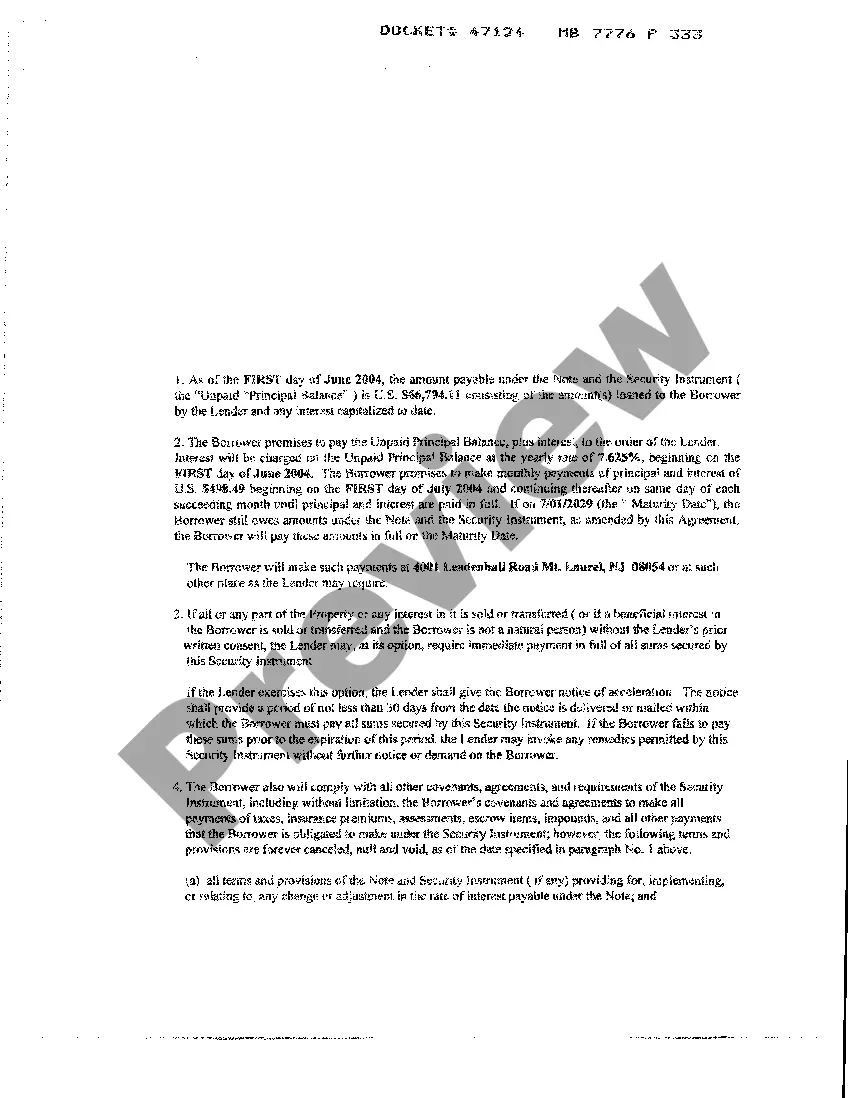

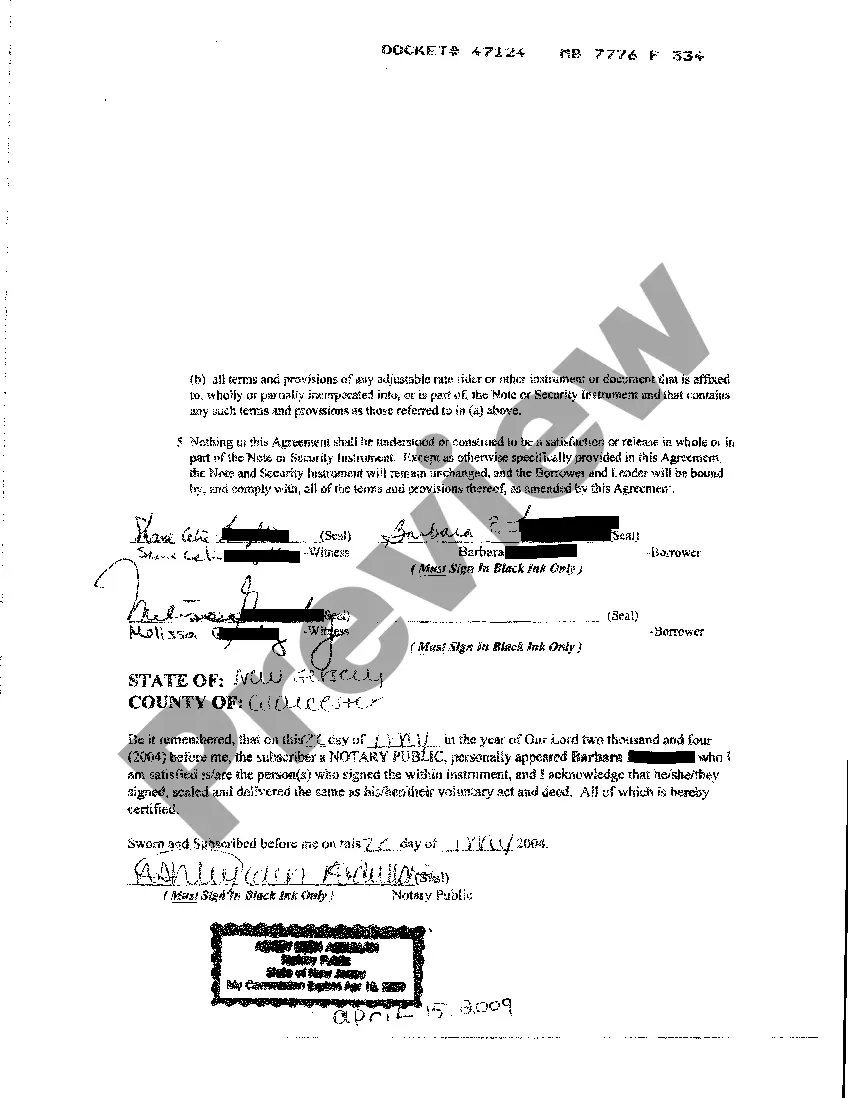

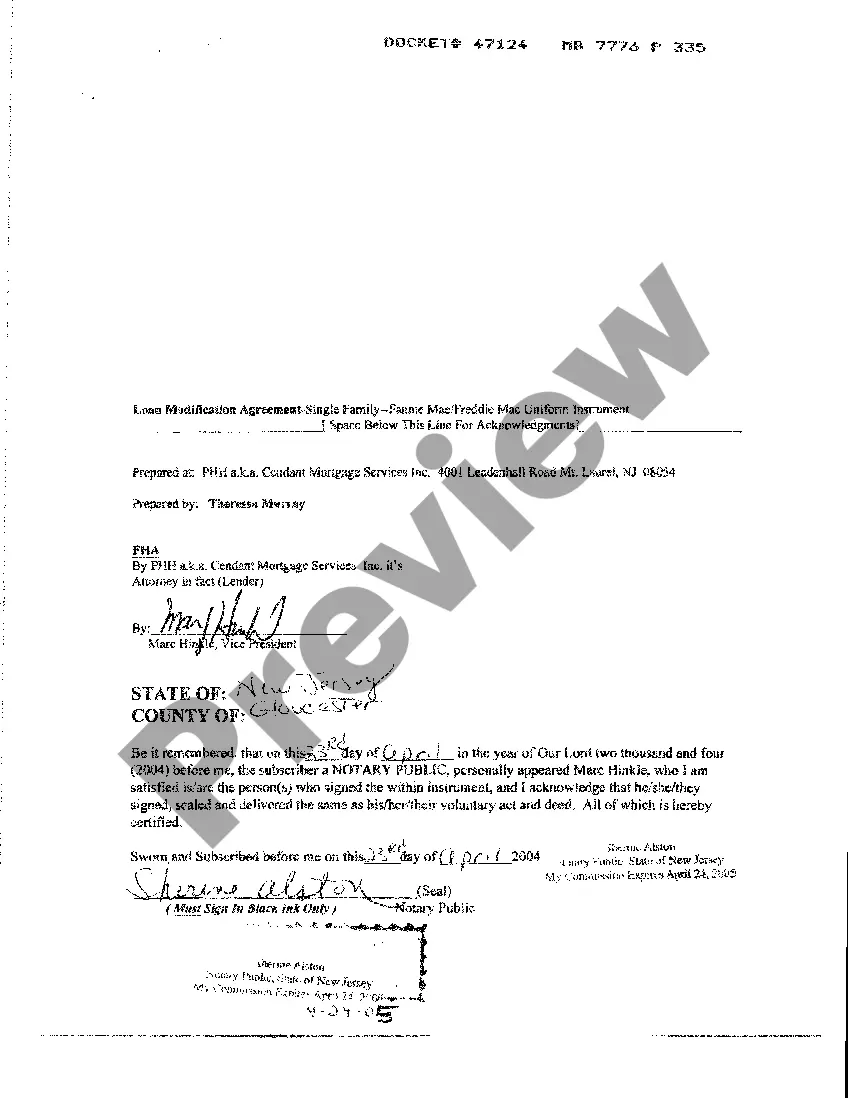

Loan documents, however, have to be drawn on a stamp paper and notarized. They let you put as many clauses as you want, such as on collateral, default, termination and inclusion of legal heirs.

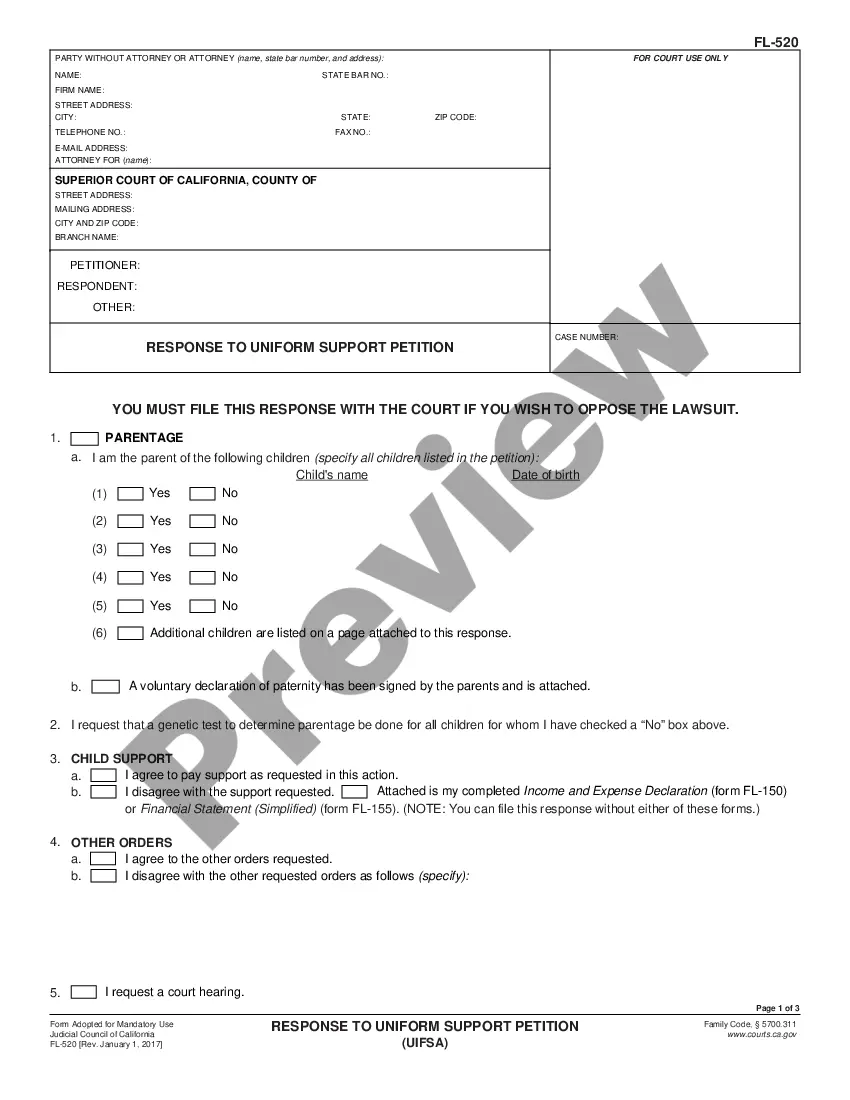

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

(i) Loan agreement requires signature of both lender and borrower. (ii)Loan agreement should mention clearly interest rate, time period for payment and other terms clearly. (iii)Loan agreement should be registered or notarized by the advocate.

Dated Signature: In New Jersey, both unsecured and secured promissory notes must be signed and dated by the borrower and any co-signer; the lender need not sign. There is no legal requirement for promissory notes to be witnessed or notarized in New Jersey.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...