Tenant Lease Verification Form With 1099

Description

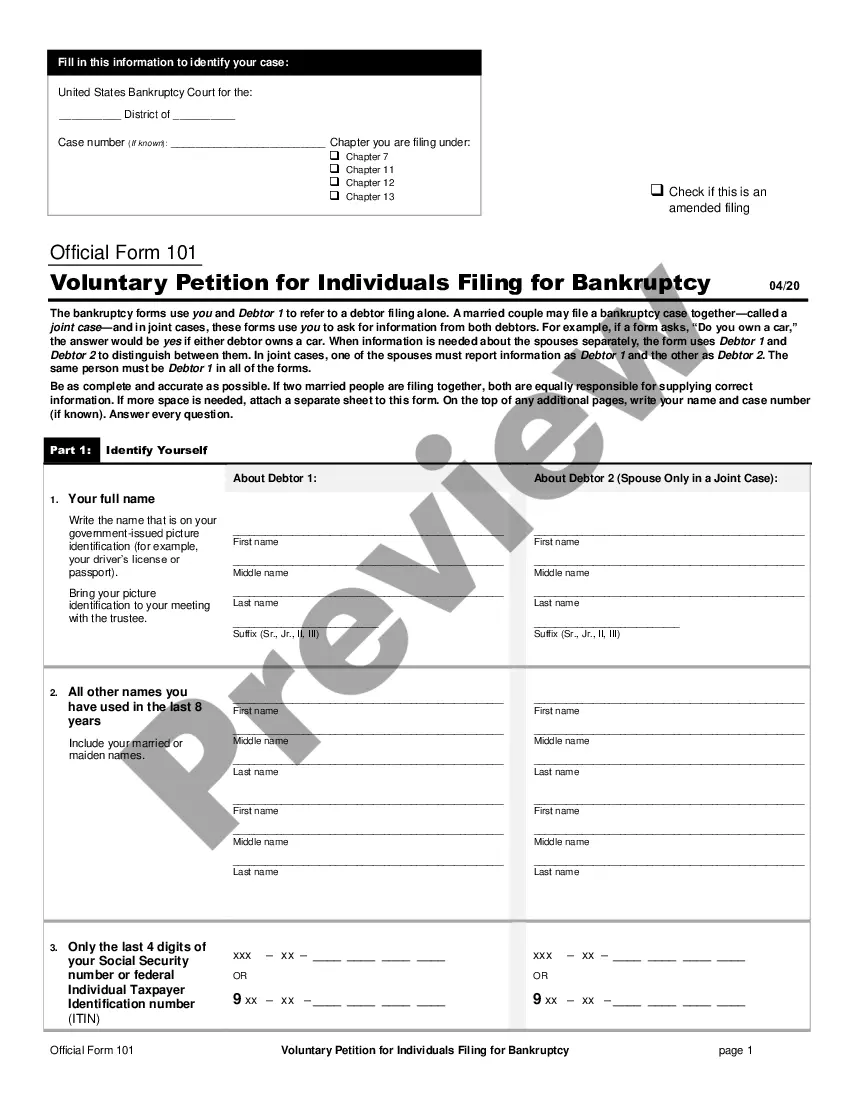

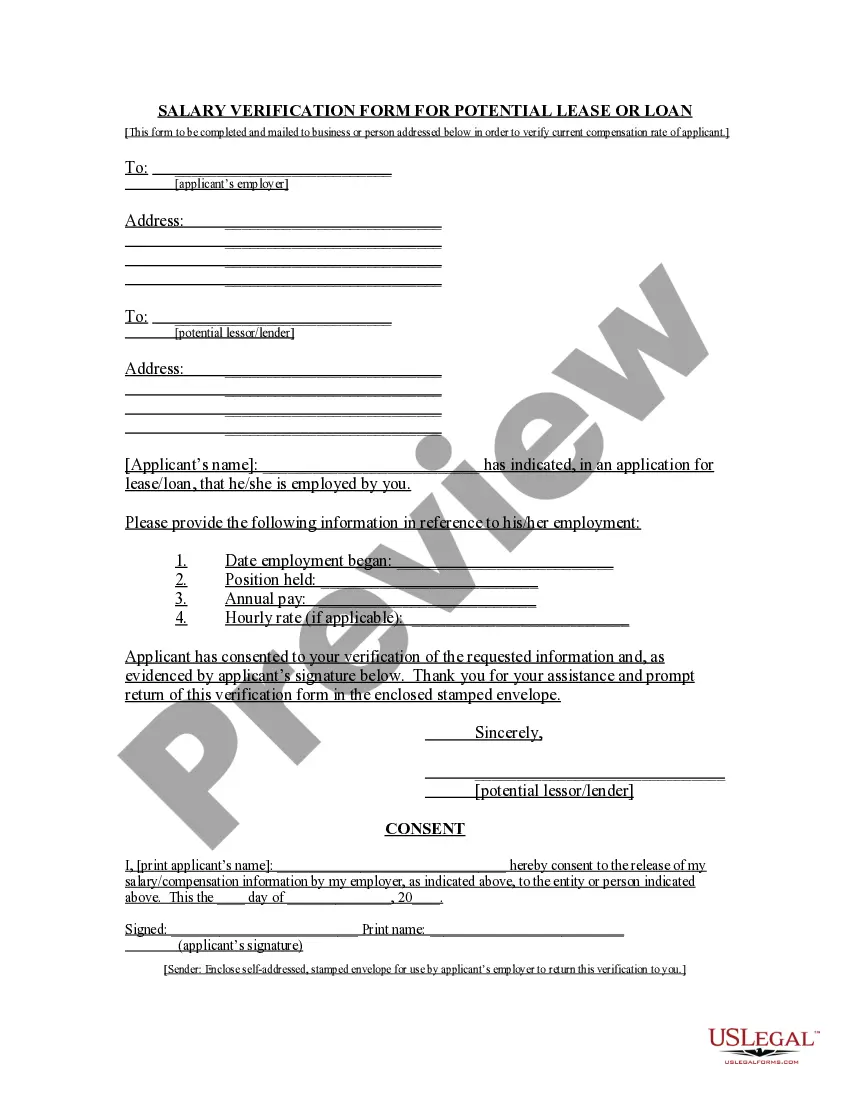

How to fill out New Jersey Salary Verification Form For Potential Lease?

It’s clear that you cannot instantaneously become a legal expert, nor can you comprehend how to swiftly draft a Tenant Lease Verification Form With 1099 without possessing a specific set of expertise.

Producing legal documents is a lengthy procedure necessitating distinct training and abilities. Hence, why not entrust the formulation of the Tenant Lease Verification Form With 1099 to the professionals.

With US Legal Forms, one of the most extensive legal template collections, you can discover anything from court documents to templates for in-office correspondence.

You can re-access your documents from the My documents tab anytime. If you’re an existing customer, you can conveniently Log In and locate and download the template from the same tab.

Regardless of the objective of your paperwork—whether it be financial, legal, or personal—our website has you covered. Experience US Legal Forms today!

- Identify the form you require by utilizing the search bar located at the upper section of the page.

- Examine it (if this feature is available) and review the supporting description to ascertain whether the Tenant Lease Verification Form With 1099 is what you seek.

- Initiate your search again if you require an alternate form.

- Register for a complimentary account and choose a subscription option to acquire the template.

- Select Buy now. Once the payment is processed, you can obtain the Tenant Lease Verification Form With 1099, complete it, print it, and send or mail it to the relevant parties or organizations.

Form popularity

FAQ

Hear this out loud PauseA: The property manager's responsibility is to issue a 1099 to the property owner at the end of the year for rent ONLY. Do not include CAM charges or other monies received other than rent. Read more at IRS.gov or ask your accountant, if you still have questions. Order 1096 forms, 1099 forms, and envelopes NOW and SAVE!

Hear this out loud PauseAny type of rent requires a 1099 form, including machine rentals. The IRS instructions advise that "all real estate rentals paid for office space require a 1099-MISC form." You do not need to report office space rentals if you made payments to a real estate agent.

3. Form 1099-S Instructions - A complete overview In Box 1, the filer must enter the date of closing for the property. In Box 2, enter the gross proceeds, this is the cash amount that the transferor will receive in exchange for the property. In Box 3, enter the address and/or legal description of the property.

If you use a property manager, you will need to file a Form 1099 for their service fees (not including reimbursed expenses). You must also supply a form W-9 to the property manager.

Hear this out loud PauseFile Form 1099-MISC for each person to whom you have paid during the year: At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest. At least $600 in: Rents.