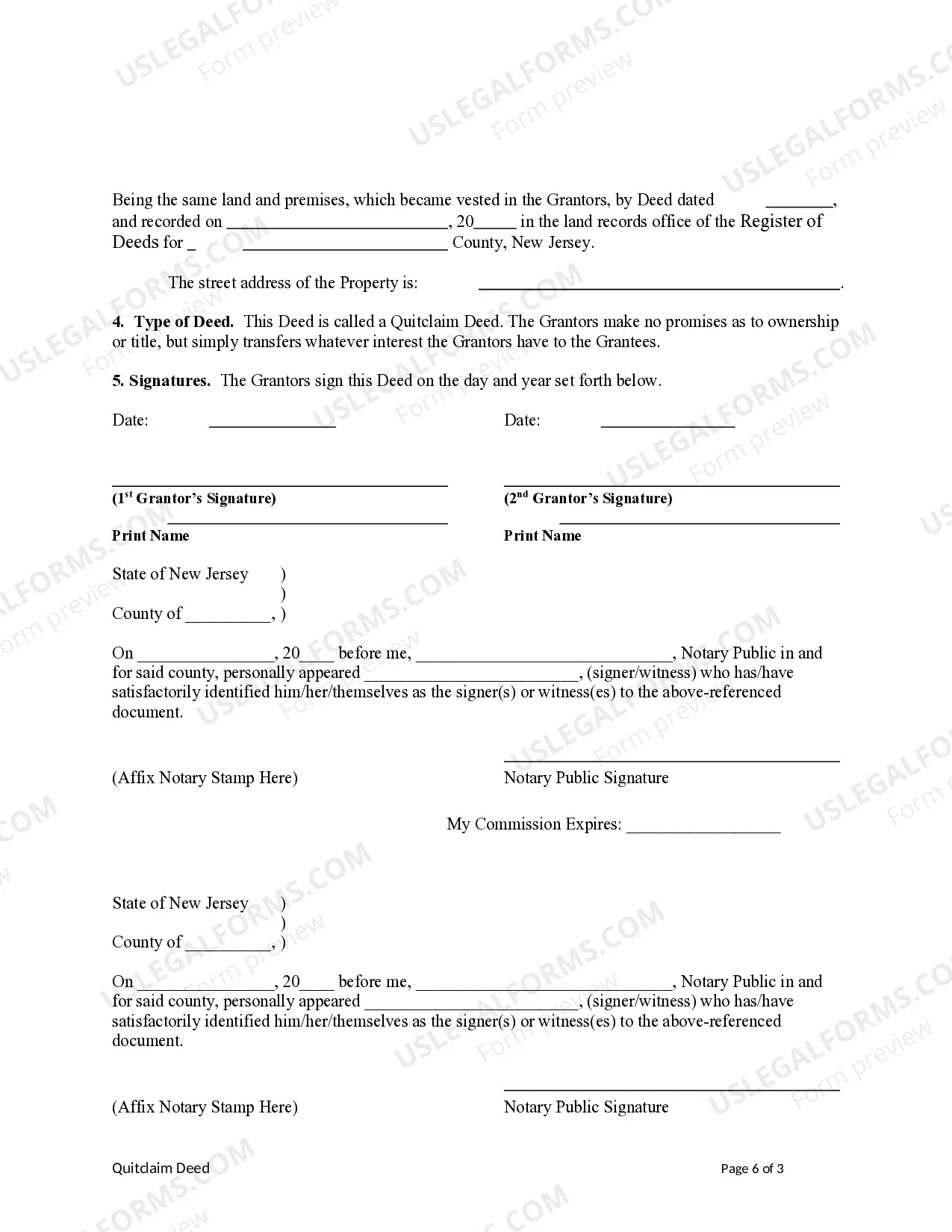

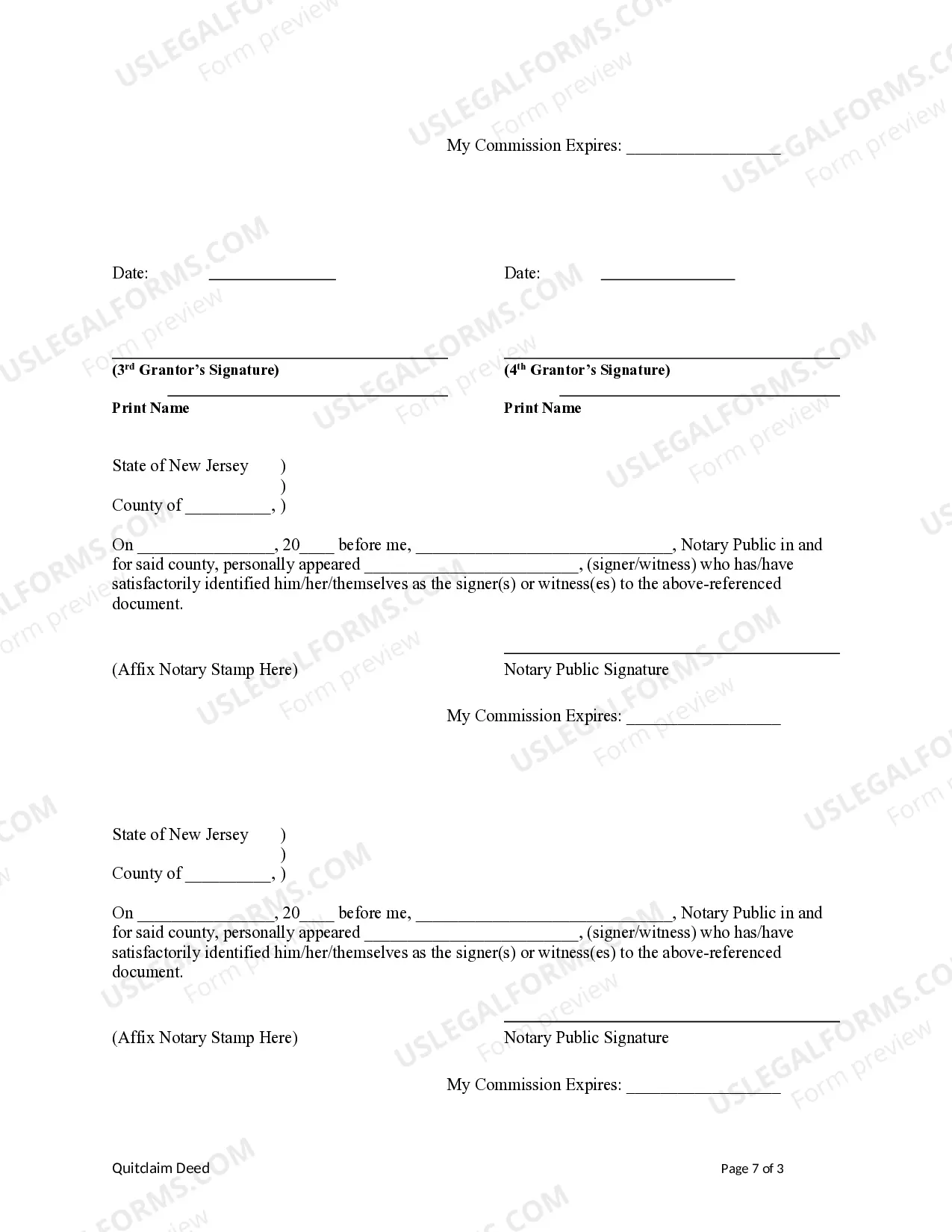

This form is a Quitclaim Deed where the Grantors are Husband and Wife and Husband and Wife and the Grantees are Husband and Wife. Grantors convey and quitclaim the described property to Grantees. This deed complies with all state statutory laws.

A quitclaim deed is a legal document that transfers ownership rights or interest in a real property from one party to another. It is commonly used to transfer property between family members, spouses during divorce, or to clear up title issues. When a quitclaim deed is drafted in conjunction with a mortgage, it serves as a tool to either add or remove an individual's name from the mortgage. Here are some important terms and keywords related to quitclaim deeds with mortgages: 1. Quitclaim Deed: A legal document used to transfer interest or rights in a property from one party (the granter) to another (the grantee). 2. Mortgage: A loan secured by the real property being purchased or refinanced, which acts as collateral for the lender in case of default. 3. Granter: The individual or entity who transfers their interest in the property through the quitclaim deed. 4. Grantee: The individual or entity who receives the interest in the property through the quitclaim deed. 5. Transfer of Ownership: When a quitclaim deed is utilized in conjunction with a mortgage, it enables the transfer of a partial or complete ownership interest. 6. Adding Someone to a Mortgage: In certain situations, a quitclaim deed may be used to add an individual to the mortgage agreement. This means that the new party is now jointly responsible for the mortgage payments and shares ownership of the property. 7. Removing Someone from a Mortgage: Conversely, when a quitclaim deed is used to remove an individual from a mortgage, it means that the party being removed is no longer liable for the mortgage, and their interest in the property is relinquished. There aren't different types of quitclaim deeds specifically related to mortgages, as the concept remains the same. However, different variations of quitclaim deeds exist, such as general quitclaim deeds, special warranty quitclaim deeds, or fiduciary quitclaim deeds, depending on the specific circumstances of the transfer of property. It's crucial to consult with a legal professional or title company to ensure the appropriate type of quitclaim deed is used for specific situations. In conclusion, a quitclaim deed with a mortgage is a legal instrument used to transfer ownership interest in a property while also dealing with the associated mortgage. Whether it is adding or removing someone from a mortgage, the quitclaim deed ensures that the transferring parties' obligations and interests are accurately recorded and legally binding.