Drainage Contractor New Jersey For Sale

Description

How to fill out New Jersey Drainage Contract For Contractor?

Bureaucracy demands exactness and correctness.

Unless you manage completing documents like Drainage Contractor New Jersey For Sale on a daily basis, it can result in some misunderstanding.

Choosing the appropriate sample from the outset will ensure that your document submission proceeds smoothly and avert any hassles of re-submitting a file or repeating the same task from the beginning.

If you are not a subscribed user, finding the necessary sample will require a few more steps.

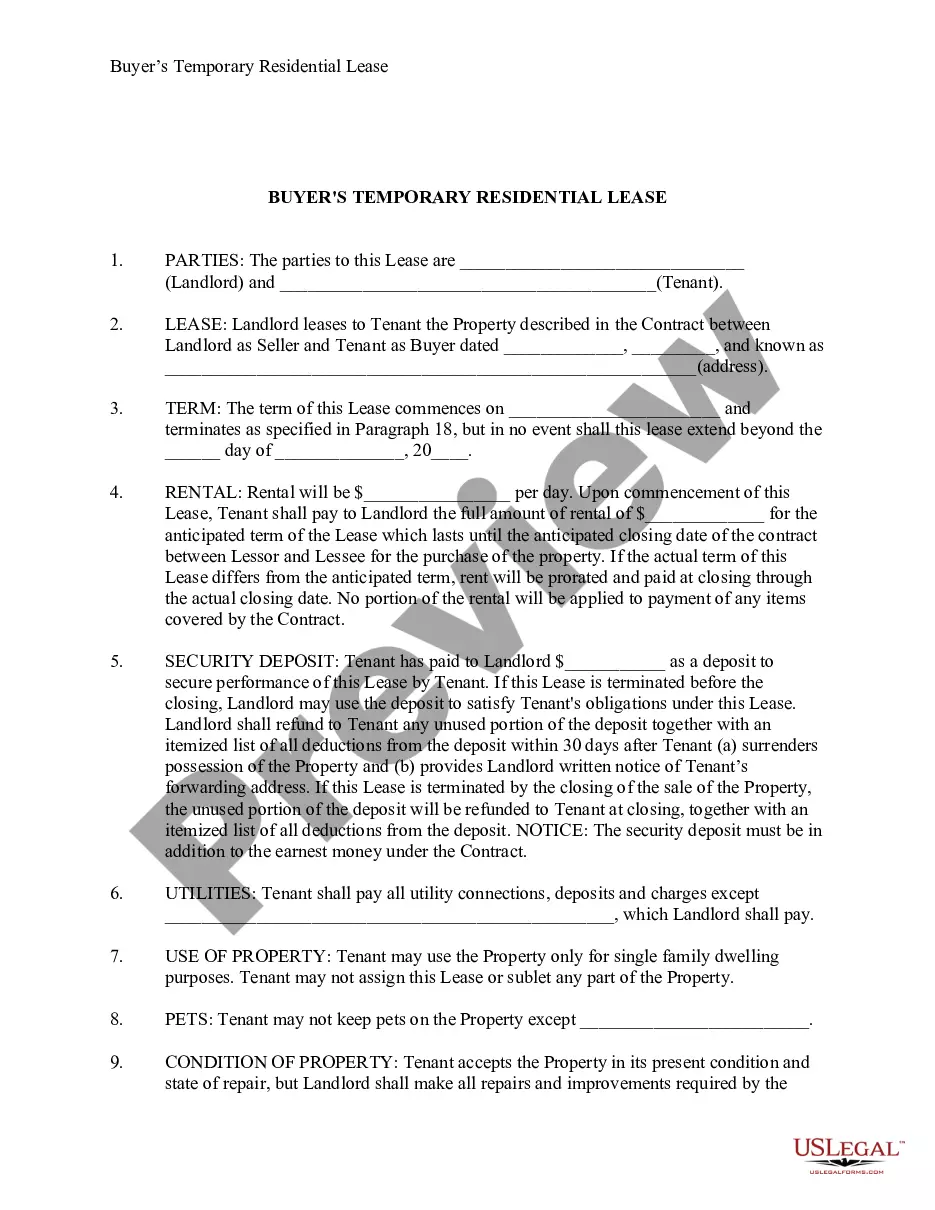

- Discover the accurate sample for your documentation at US Legal Forms.

- US Legal Forms is the biggest online forms repository that provides over 85 thousand templates for various fields.

- You can find the latest and most pertinent version of the Drainage Contractor New Jersey For Sale by merely searching on the platform.

- Find, store, and safeguard templates in your account or refer to the description to confirm that you possess the right one readily available.

- With an account at US Legal Forms, it is uncomplicated to obtain, save in one location, and navigate the templates you save for quick access.

- When on the website, click the Log In button to authenticate.

- Then, move to the My documents page, where the inventory of your documents is kept.

- Review the description of the forms and save the ones you need at any time.

Form popularity

FAQ

Sales of parts purchased for use in performing service under optional maintenance contracts are exempt from the sales tax in New Jersey.

For New Jersey Sales Tax purposes, a contractor is considered the actual consumer of the materials and supplies used in construction or in improving, altering, or repairing the real property of others. Sales of materials and supplies to contractors are considered retail sales and, therefore, taxable.

INSTALLATION AND MAINTENANCE SERVICES AND SERVICE CONTRACTS They are treated as charges for the installation of tangible personal property. N.J.S.A. B-3(b)(2). The sale of a maintenance contract for prewritten software is generally subject to tax.

The contractor charges Sales Tax on the labor portion of the bill only when he/she performs a taxable capital improvement, repair, maintenance, or installation service. (There is no Sales Tax due on the charge for labor when the contractor's work results in an exempt capital improvement.

The following are examples of taxable repair and maintenance services performed by landscapers:Lawn mowing.Lawn reseeding.Lawn fertilizing.Tree maintenance (trimming, pruning, spraying, bracing, cabling, grafting, coppicing, suckering and feeding)Weed/Insect control.Soil aerating, sterilizing and mulching.